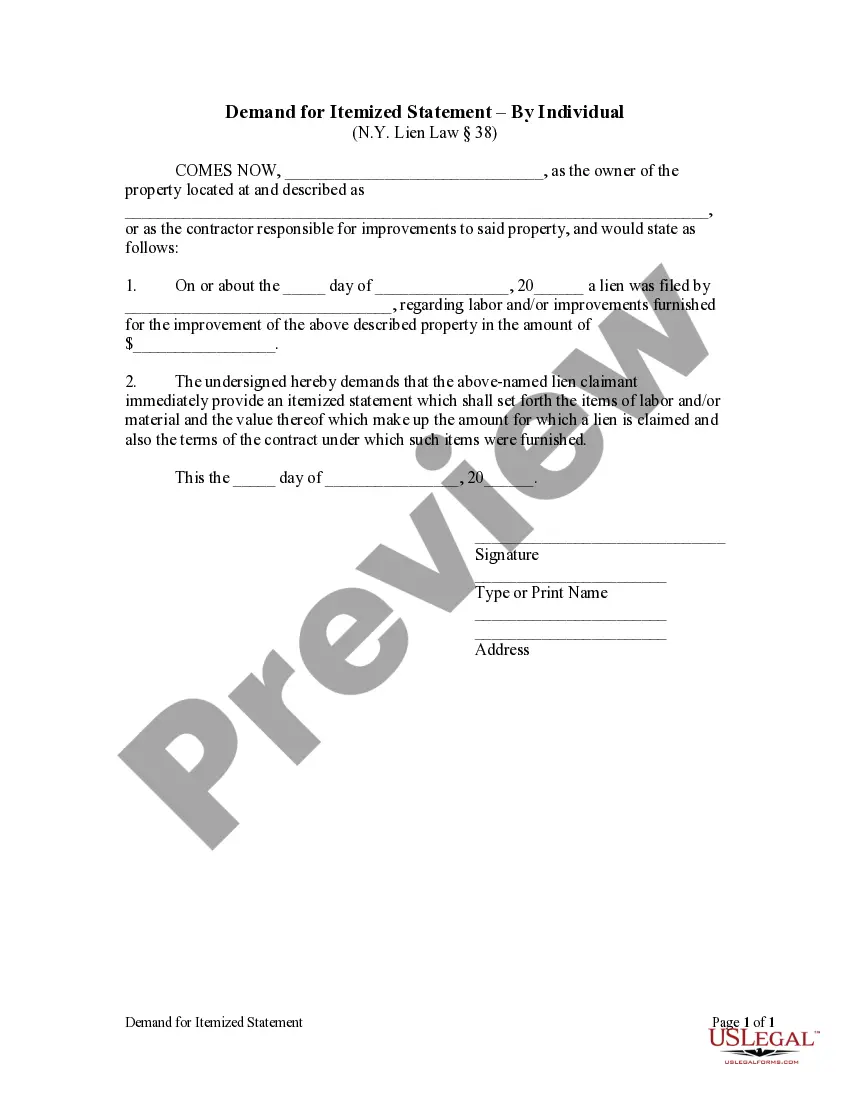

A property owner or contractor may issue a written demand using this form that the party who filed a notice of lien statement provide an itemized statement of labor and/or material provided, including the value or cost of said labor and materials. The lien holder is required to respond with an itemized statement within five (5) days, or the owner or contractor may petition the court to order such a statement to be produced. Failure to respond to the order of the court may result in the nullification of the lien.

Suffolk New York Demand for Itemized Statement by Corporation

Description

How to fill out New York Demand For Itemized Statement By Corporation?

Take advantage of the US Legal Forms and gain instant access to any form sample you desire.

Our helpful platform with a vast array of documents streamlines the process of finding and acquiring nearly any document template you need.

You can save, complete, and sign the Suffolk New York Demand for Itemized Statement by Corporation or LLC in just a few minutes rather than spending hours online searching for the appropriate template.

Utilizing our catalog is an excellent way to enhance the security of your form submissions.

US Legal Forms ranks among the largest and most reliable template libraries available online.

Our team is always eager to assist you with any legal process, even if it is simply downloading the Suffolk New York Demand for Itemized Statement by Corporation or LLC.

- Our experienced attorneys routinely review all the documents to ensure that the forms are suitable for a specific area and adhere to the latest laws and regulations.

- How can you obtain the Suffolk New York Demand for Itemized Statement by Corporation or LLC.

- If you are already a subscriber, simply Log In to your account. The Download option will become visible on all the documents you access.

- Moreover, you can retrieve all your previously saved documents from the My documents section.

- If you do not yet have a profile, follow the instructions outlined below.

- Access the page with the template you need. Ensure that it is the form you were looking for: confirm its title and description, and utilize the Preview feature when available. Alternatively, use the Search function to locate the necessary one.

- Initiate the saving process. Click Buy Now and choose the pricing plan that fits you best. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Select the format to obtain the Suffolk New York Demand for Itemized Statement by Corporation or LLC and modify and complete, or sign it as per your needs.

Form popularity

FAQ

A demand for a bill of particulars in New York is a formal request for detailed information about the claims made in a lawsuit. This request helps clarify the specifics of the case, promoting transparency between parties. When filing a Suffolk New York Demand for Itemized Statement by Corporation, understanding this demand can enhance your case by ensuring all details are adequately addressed.

In Suffolk County, the limit for Small Claims Court is typically $5,000. This amount may vary depending on the type of claim, so it’s essential to check current regulations before proceeding. Properly filing a Suffolk New York Demand for Itemized Statement by Corporation will help ensure your claim remains within this limit and that your case is structured effectively.

You do not need a lawyer to represent you in Small Claims Court in New York, as the process is designed for individuals to navigate easily. However, consulting a legal professional can provide valuable guidance, especially in complex cases. Using tools like a Suffolk New York Demand for Itemized Statement by Corporation can aid in your understanding of the claims process and requirements.

Taking someone to Small Claims Court can be worthwhile if you believe you have a valid claim and can prove your case. In many instances, defendants may settle to avoid court, making the process beneficial for claimants. Moreover, a Suffolk New York Demand for Itemized Statement by Corporation can clarify your position, potentially encouraging a resolution before escalation.

Taking someone to Small Claims Court can be a valuable step if you seek resolution over a monetary dispute. If you have a valid Suffolk New York Demand for Itemized Statement by Corporation, the court can help you recover your funds. Assess your situation carefully, weigh the potential outcomes, and understand that court involvement can bring closure and accountability.

Starting a small claims case in NY requires you to first determine the correct jurisdiction. In Suffolk County, you can file your Suffolk New York Demand for Itemized Statement by Corporation at the appropriate small claims court. Ensure you have the necessary documentation and your claim clearly articulated. This preparation will enhance your chances of a favorable outcome.

Mail your return to: STATE PROCESSING CENTER, PO BOX 15198, ALBANY NY 12212-5198.

Form IT-204-LL, Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form.

But every partnership having either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York State sources, must file a return on Form IT-204, regardless of the amount of its income (see Specific instructions on page

Form IT-201 can be used only by resident New York taxpayers who want to file their New York income tax returns. If you are a part-year resident or a nonresident, you may use Form IT-203 instead to file your income tax return.