Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out New York Renunciation And Disclaimer Of Property Received By Intestate Succession?

Capitalize on the US Legal Forms and gain instantaneous access to any template you desire.

Our user-friendly platform, featuring a vast array of documents, simplifies the process of locating and acquiring nearly any document sample you need.

You can save, fill out, and authenticate the Syracuse New York Renunciation And Disclaimer of Property resulting from Intestate Succession within minutes, rather than spending hours scouring the internet for a suitable template.

Leveraging our collection is an excellent way to enhance the security of your form submissions.

Locate the template you need. Confirm that it is the document you were seeking: review its title and description, and utilize the Preview function when accessible. Alternatively, use the Search bar to find the required item.

Initiate the download process. Choose Buy Now and select the pricing plan that best fits your needs. Then, set up an account and complete your payment with a credit card or PayPal.

- Our qualified attorneys consistently review all documents to ensure that the forms are pertinent to a specific region and comply with current laws and regulations.

- How can you obtain the Syracuse New York Renunciation And Disclaimer of Property received via Intestate Succession.

- If you have an existing account, simply Log In to your profile. The Download option will be available for all samples you examine.

- Moreover, all your previously saved documents can be accessed from the My documents section.

- If you do not yet have an account, follow the instructions provided below.

Form popularity

FAQ

A person who inherits property through intestate succession typically receives the decedent's property according to New York’s intestacy laws. This can include real estate, personal belongings, and financial assets, which are distributed to heirs based on their relationship to the deceased. The specifics often depend on familial ties, as spouses and children usually hold priority. If there are any uncertainties about your rights, UsLegalForms can offer clarity and comprehensive guidance regarding the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

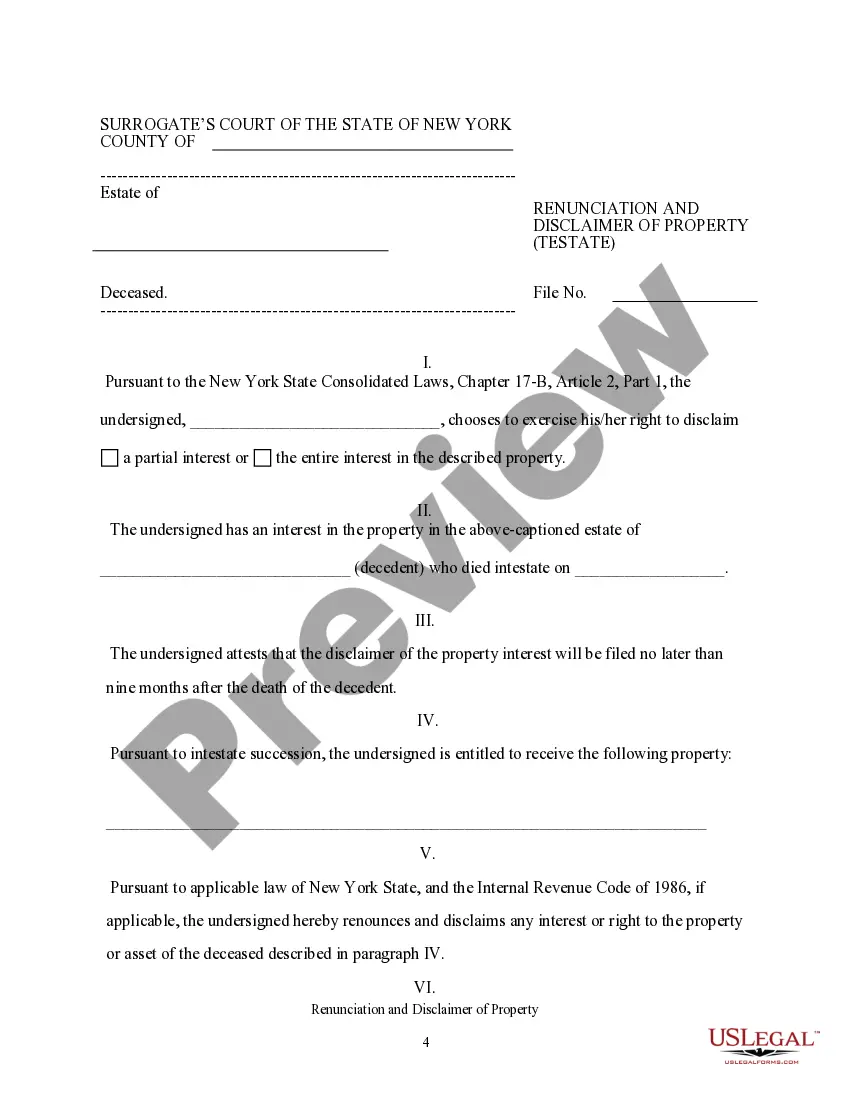

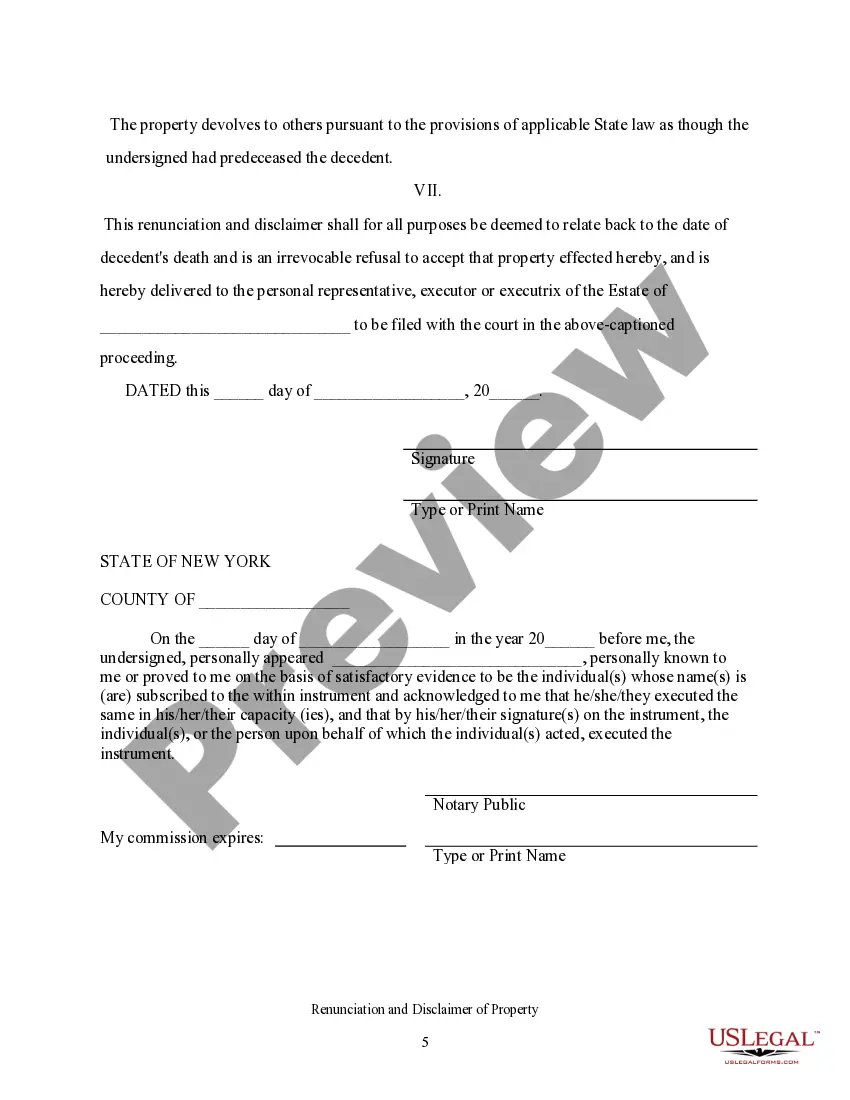

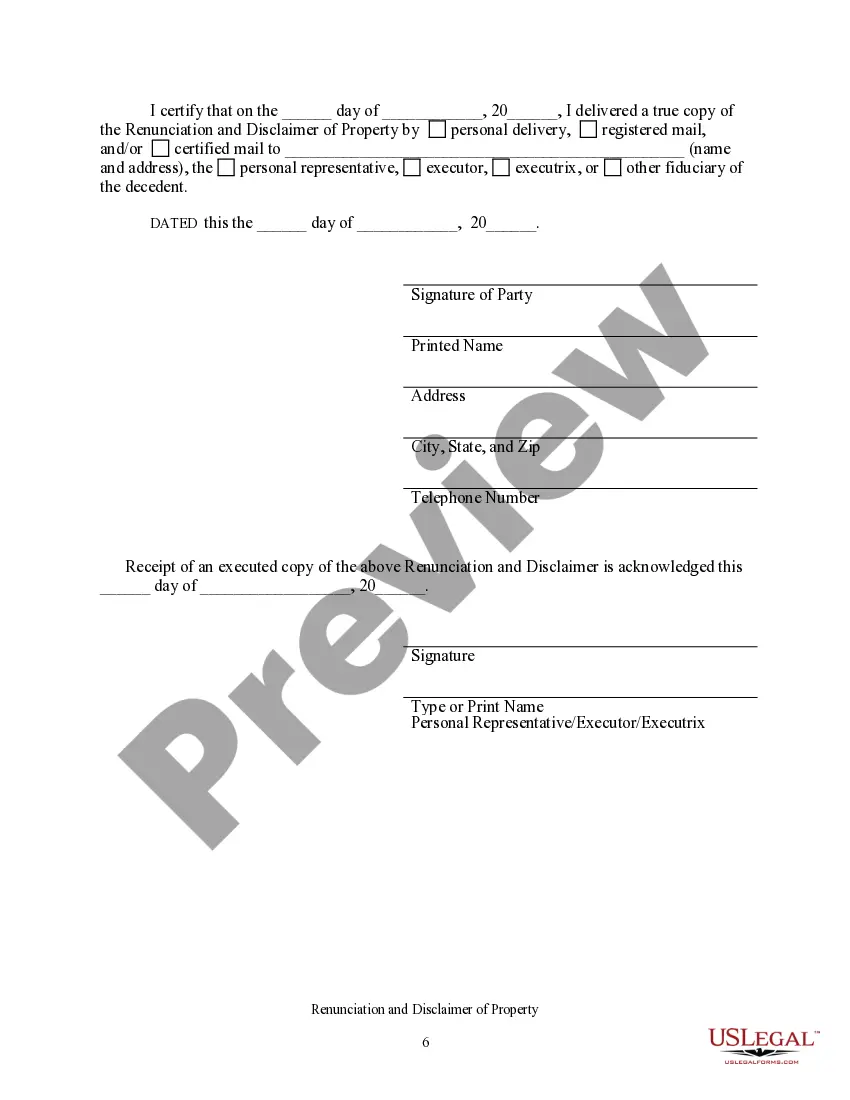

To disclaim an inheritance in New York, you must submit a written disclaimer to the executor of the estate within nine months of when you become aware of your inheritance. The disclaimer must be clear and express your desire to not accept the property, adhering to the format required by the state. Remember to avoid any actions that could imply acceptance of the inheritance while the disclaimer is pending. Utilize platforms like UsLegalForms for straightforward access to information and documentation for your Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

To write a letter to disclaim an inheritance, start by including your name, address, and the date at the top of the letter. Clearly state your intention to disclaim the inheritance, referencing the specific property received from intestate succession. It is vital to sign the letter and deliver it to the executor of the estate or relevant court. UsLegalForms offers guidance and templates to simplify the process for crafting an effective Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession letter.

In Syracuse, New York, the rules for disclaiming an inheritance require the beneficiary to file a written disclaimer with the executor of the estate or the court. The disclaimer must not be accepted by the beneficiary and must be in writing, signed, and delivered before the beneficiary takes any possession of the inheritance. It is essential to act promptly upon discovering the inheritance, as any delay may impact your eligibility to disclaim. Consulting resources like UsLegalForms can provide helpful templates for the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

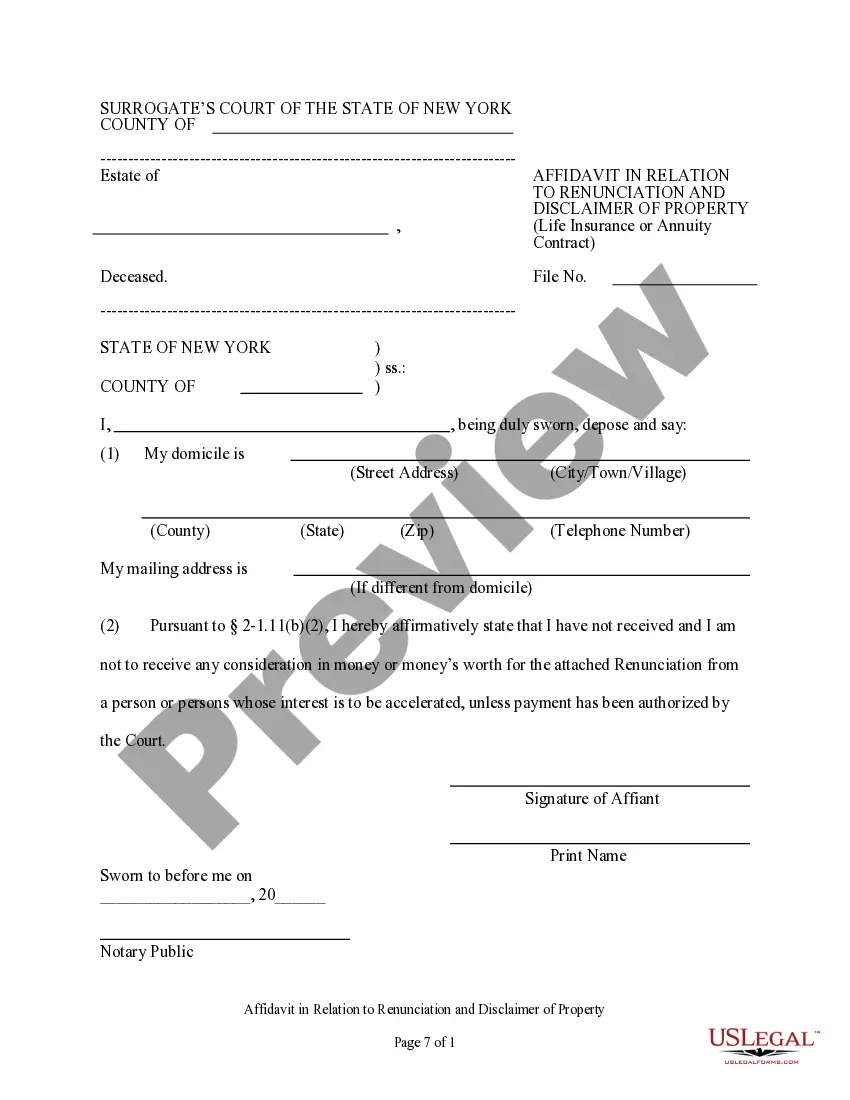

Yes, a disclaimer of inheritance in New York must adhere to specific formatting requirements to be legally valid. The document should clearly state the disclaimed property and be submitted to the appropriate court to formalize the process. To simplify preparation and ensure accuracy, you can utilize resources provided by USLegalForms tailored for the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

Generally, a Disclaimer of inheritance does not need to be notarized in New York, but having it notarized can lend additional credibility and ensure that your intentions are clear. This practice can protect you in the event of any disputes or misunderstandings. For more assistance in handling your disclaimer correctly, consider using USLegalForms for guidance and the necessary paperwork.

When dealing with the IRS, disclaiming an inheritance requires filing a disclaimer that meets the federal tax guidelines. You must also ensure that this disclaimer is in line with state laws, such as those in Syracuse, New York. By renouncing the property legally, you avoid tax liabilities that come from accepting the inheritance, thus aligning your actions with the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

In New York State, to disclaim an inheritance, you must file a formal disclaimer document with the court handling the estate. This document should be filed within nine months of the decedent’s death and must include specific information about the inherited property. By following these procedures, you ensure compliance with the laws governing the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

Disclaiming inherited property involves submitting a written disclaimer that meets New York State legal requirements. This document should describe your relationship to the decedent and clearly indicate the property you wish to renounce. For those navigating this process, USLegalForms offers resources and templates to help you effectively complete your disclaimer in accordance with the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession.

When writing a disclaimer of inheritance sample in Syracuse, you should begin with a clear title, such as 'Disclaimer of Inheritance.' Include your full name, the decedent’s name, and a statement declaring your intention to renounce the inherited property. It’s important to specify the property being disclaimed, and to affirm that you have not accepted any property interests, ensuring compliance with the Syracuse New York Renunciation And Disclaimer of Property received by Intestate Succession guidelines.