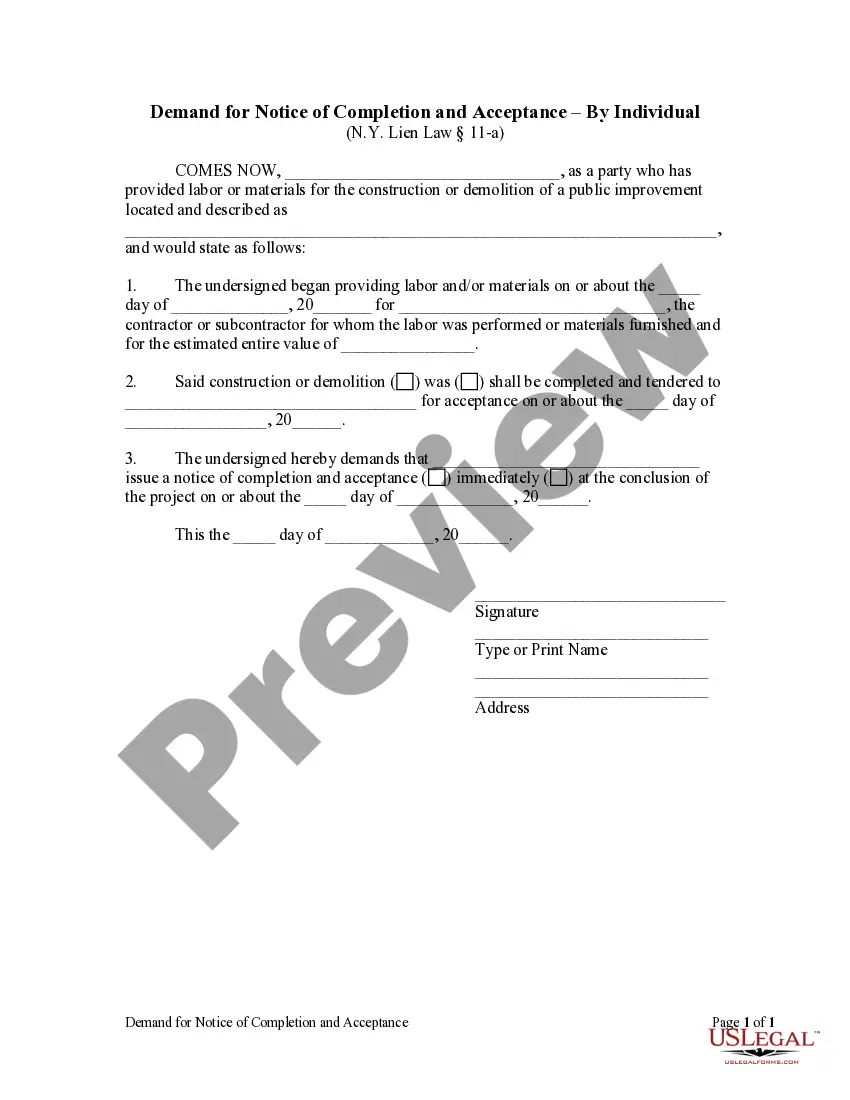

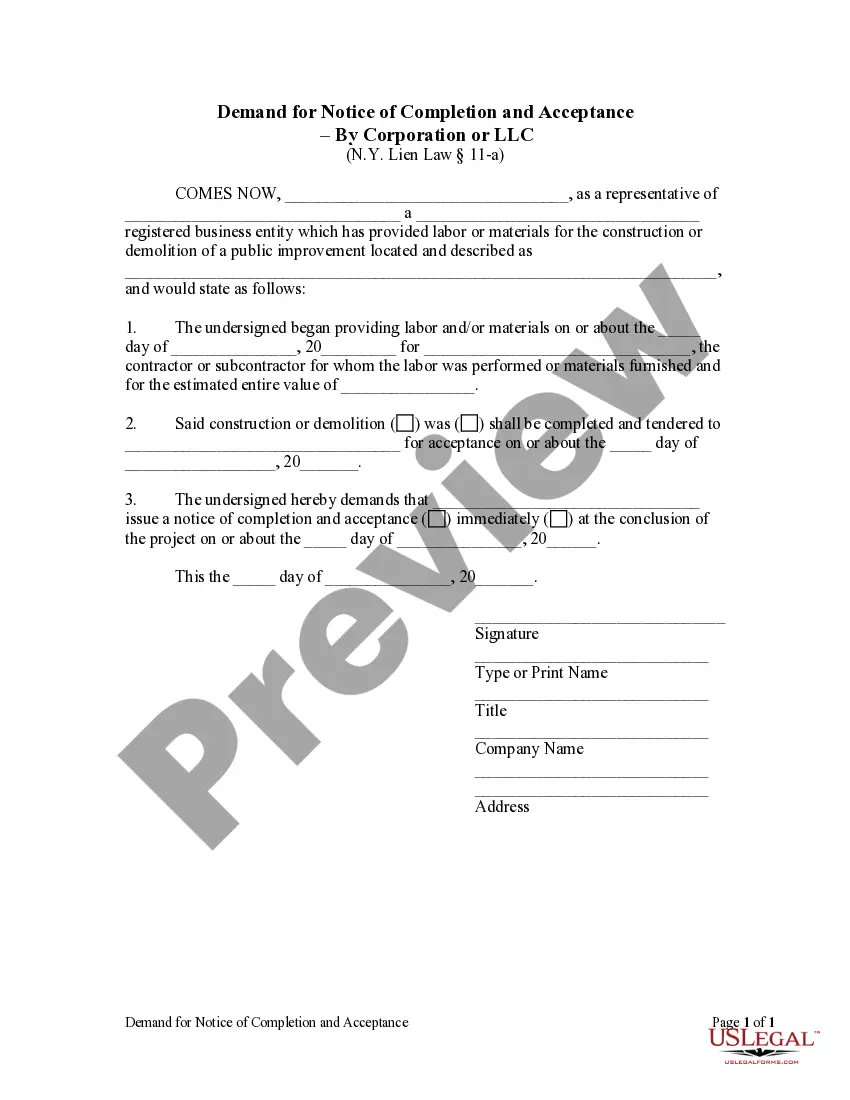

A contractor or other person providing labor or materials for the construction and demolition of a public improvement may use this form to demand that the state agency overseeing the improvement tender a notice of completion and acceptance upon the completion of work.

Rochester New York Demand for Notice of Completion and Acceptance by Corporation

Description

How to fill out New York Demand For Notice Of Completion And Acceptance By Corporation?

If you are seeking a pertinent document, it’s impossible to select a superior service than the US Legal Forms website – likely the most extensive collections on the web.

Here you can obtain a vast number of document samples for commercial and personal uses categorized by types and regions, or keywords.

Utilizing our premium search feature, acquiring the most current Rochester New York Demand for Notice of Completion and Acceptance by Corporation or LLC is as simple as 1-2-3.

Complete the purchase. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and save it on your device. Make adjustments. Fill out, modify, print, and sign the obtained Rochester New York Demand for Notice of Completion and Acceptance by Corporation or LLC.

- Moreover, the significance of each document is validated by a group of qualified lawyers who routinely review the templates on our platform and revise them according to the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Rochester New York Demand for Notice of Completion and Acceptance by Corporation or LLC is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have located the form you desire. Review its details and use the Preview function to examine its contents. If it doesn’t satisfy your needs, employ the Search option at the top of the screen to find the necessary document.

- Verify your choice. Click the Buy now button. Then, select the desired subscription plan and supply credentials to create an account.

Form popularity

FAQ

It's strongly recommended. Even though single-member LLCs can be relatively simple entities, operating agreements help the business with credibility and help ensure LLC status.

The members of an LLC are required to adopt a written Operating Agreement. See Section 417 of the Limited Liability Company Law. The Operating Agreement may be entered into before, at the time of, or within 90 days after the filing of the Articles of Organization.

(See Section 23.03 of the Arts and Cultural Affairs Law). Limited liability companies that fail to comply with the publication requirements within 120 days after their formation or qualification will have their authority to carry on, conduct or transact any business suspended.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

Since you aren't required to file this document with the state, there is no filing fee associated with it. However, your Operating Agreement needs to be adopted around the time you file your Articles of Organization, which costs $200 in New York.

Service of a Notice of Claim on the New York Secretary of State as agent of a public corporation may be accomplished by serving an authorized person at the New York Department of State's office at One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231.

No, your Operating Agreement doesn't need to be notarized. Each Member just needs to sign it. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

Operating agreements do not cost money, since no state requires you to file an official copy. Instead, it's recommended that you hire a lawyer to help you craft this complex and crucial legal document.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.