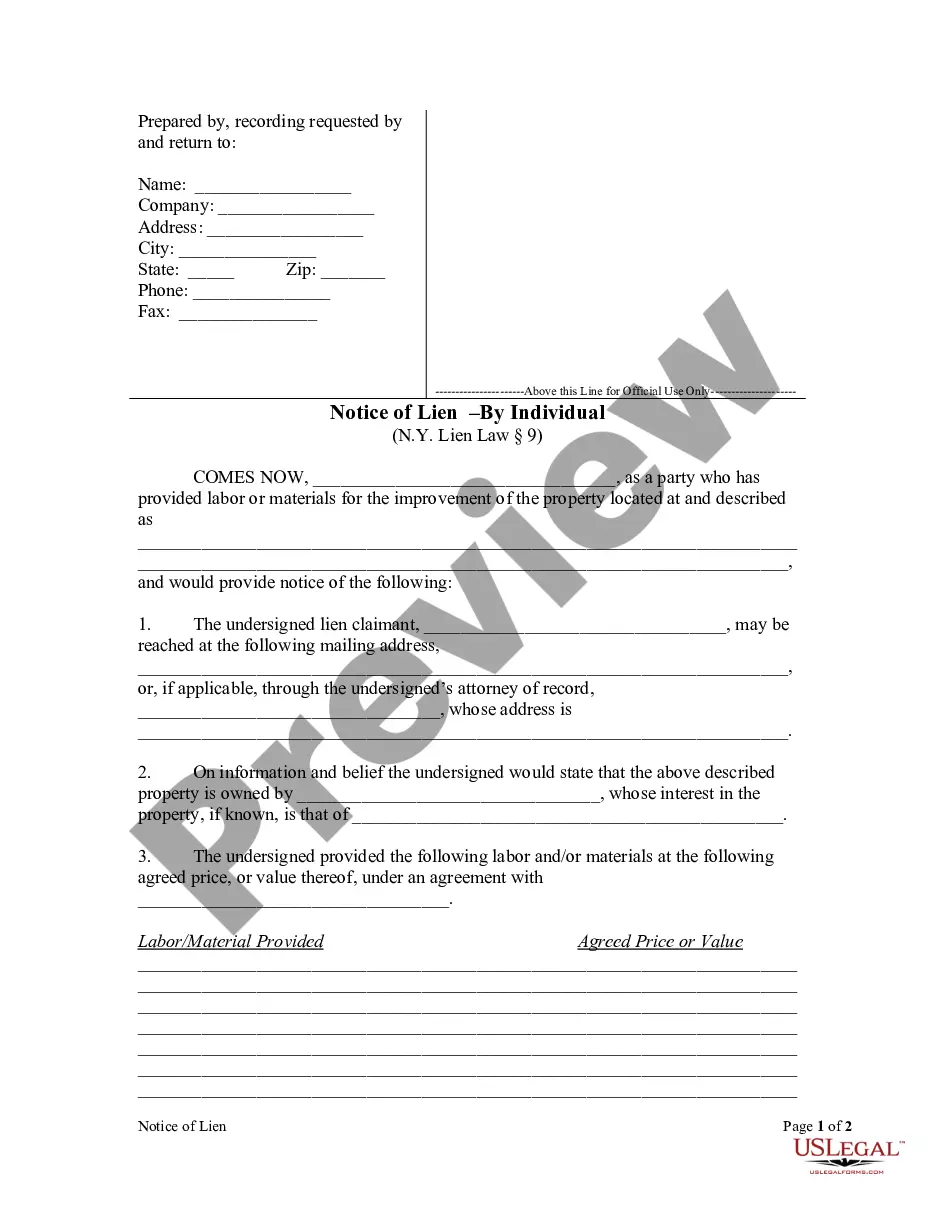

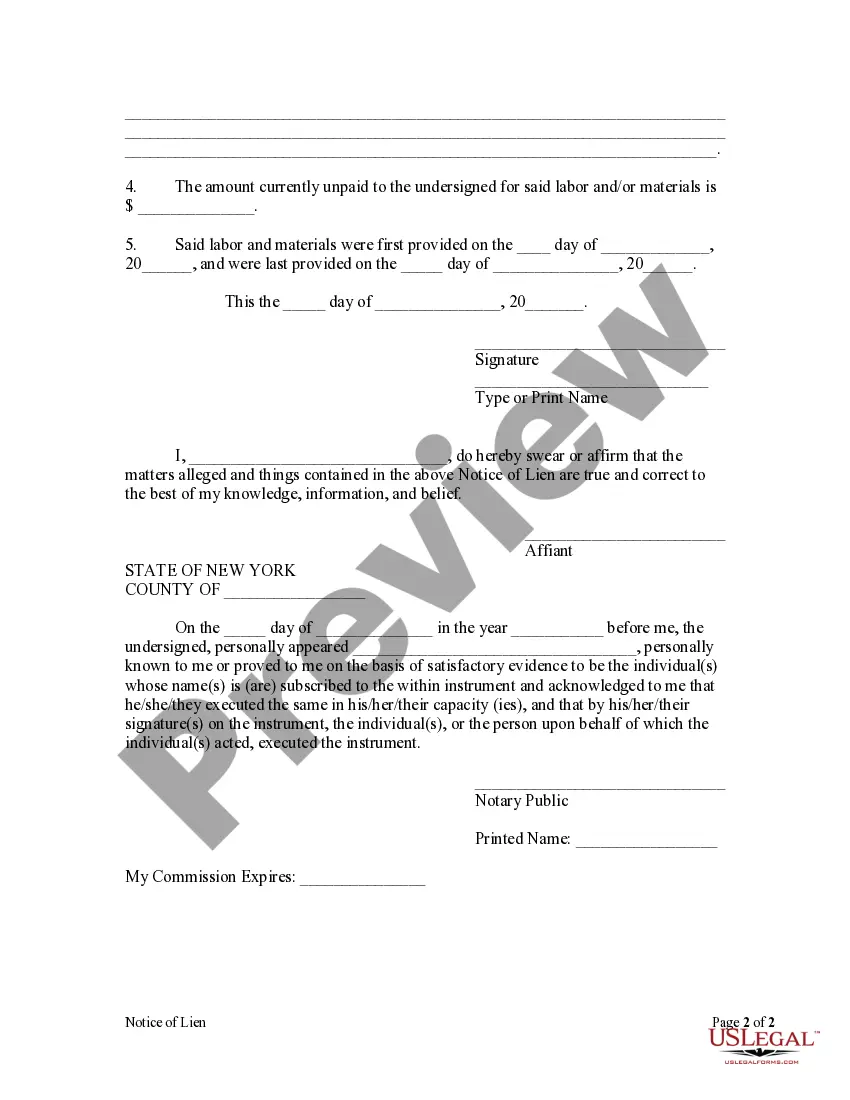

New York law requires a party desiring to claim a lien to file a Notice of Lien form in the office of the clerk of the county where the property is situated. The notice may be filed at any time during the progress of the work and the furnishing of the materials, or, within eight months after the completion of the contract, or the final performance of the work, or the final furnishing of the materials.

Queens New York Notice of Lien by Individual

Description

How to fill out New York Notice Of Lien By Individual?

Regardless of social or professional standing, completing law-related documents is a regrettable necessity in today's employment landscape.

Often, it's nearly impossible for individuals without legal training to generate this type of paperwork from scratch, primarily due to the complex language and legal nuances involved.

This is where US Legal Forms proves valuable. Our platform offers an extensive collection of over 85,000 ready-to-use state-specific forms applicable for nearly any legal circumstance.

If the form you selected does not satisfy your needs, you can restart and find the appropriate document.

Click 'Buy now' and select the subscription plan that best fits your requirements.

- If you seek the Queens New York Notice of Lien by Individual or any other paperwork valid in your state or locality, with US Legal Forms, everything is accessible.

- Here’s how to quickly obtain the Queens New York Notice of Lien by Individual using our reliable platform.

- If you are already a customer, Log In to your account to download the required form.

- However, if you are new to our platform, follow these steps before downloading the Queens New York Notice of Lien by Individual.

- Ensure that the template you have selected is appropriate for your area since the laws of one location may not apply to another.

- Review the form and read a brief description (if available) of the cases for which the document can be utilized.

Form popularity

FAQ

To file a lien in New York State, start by preparing the necessary paperwork, including the lien notice. You must file your lien at the county clerk’s office where the property is located. A Queens New York Notice of Lien by Individual can help clarify your claim. For convenience, consider using US Legal Forms to streamline the filing process.

Filing a lien in New York State requires you to complete specific forms and submit them to the county clerk's office. First, gather all necessary documentation to support your claim. A Queens New York Notice of Lien by Individual is an essential part of this process. You may want to consult US Legal Forms for step-by-step guidance on filing.

The timeline for receiving a lien release in New York can vary, usually ranging from a few days to several weeks, depending on the agency involved. Factors such as proper documentation and the efficiency of the processing office will affect the duration. Being aware of the timeline associated with a Queens New York Notice of Lien by Individual can assist in planning your next steps effectively.

To get a copy of a lien release in New York, visit the County Clerk's office where the lien was recorded. You may also be able to access this information online, depending on the county's resources. Understanding the process surrounding a Queens New York Notice of Lien by Individual can help you navigate the necessary steps for obtaining your lien release efficiently.

You can request your lien release letter from the entity that filed the lien against you. This is usually a creditor or a government agency that has recorded the lien. When dealing with a Queens New York Notice of Lien by Individual, ensure you follow up promptly to secure your release letter, as it is essential for clearing your title.

To obtain a copy of a lien release from the IRS, you need to file Form 4506, which is a request for a copy of your tax return. You may also call the IRS directly for guidance. Having a clear understanding of the process related to a Queens New York Notice of Lien by Individual can assist you in these proceedings, ensuring you handle your affairs effectively.

Finding an old lien release typically involves checking with the County Clerk or Recorder’s office where the original lien was filed. They maintain public records, including lien releases, and can provide access to historical documents. Utilizing resources available through a Queens New York Notice of Lien by Individual can streamline your search for past lien releases.

To find a lien on a property in New York, you can search public records through the County Clerk's office or local court. Additionally, online databases and title companies offer services to identify existing liens. Knowing how to search for a Queens New York Notice of Lien by Individual can help you protect your investments and ensure informed decisions.

In New York, a notice of intent to lien serves as a formal notification that an individual plans to place a lien on a property due to unpaid debts. This notice provides information about the outstanding obligation and warns the property owner of potential actions. Understanding the implications of a Queens New York Notice of Lien by Individual is crucial, as it can impact the property owner’s credit and future financial dealings.

To find out if a lien has been filed on your property, you can start by checking your local county clerk's office or online databases that track property records. In Queens, New York, these records will include any Notices of Lien by Individual that may have been filed against your property. Additionally, using services like US Legal Forms can simplify the process, allowing you to easily search for liens and understand your property status. Regularly reviewing these records helps you stay informed and protect your assets.