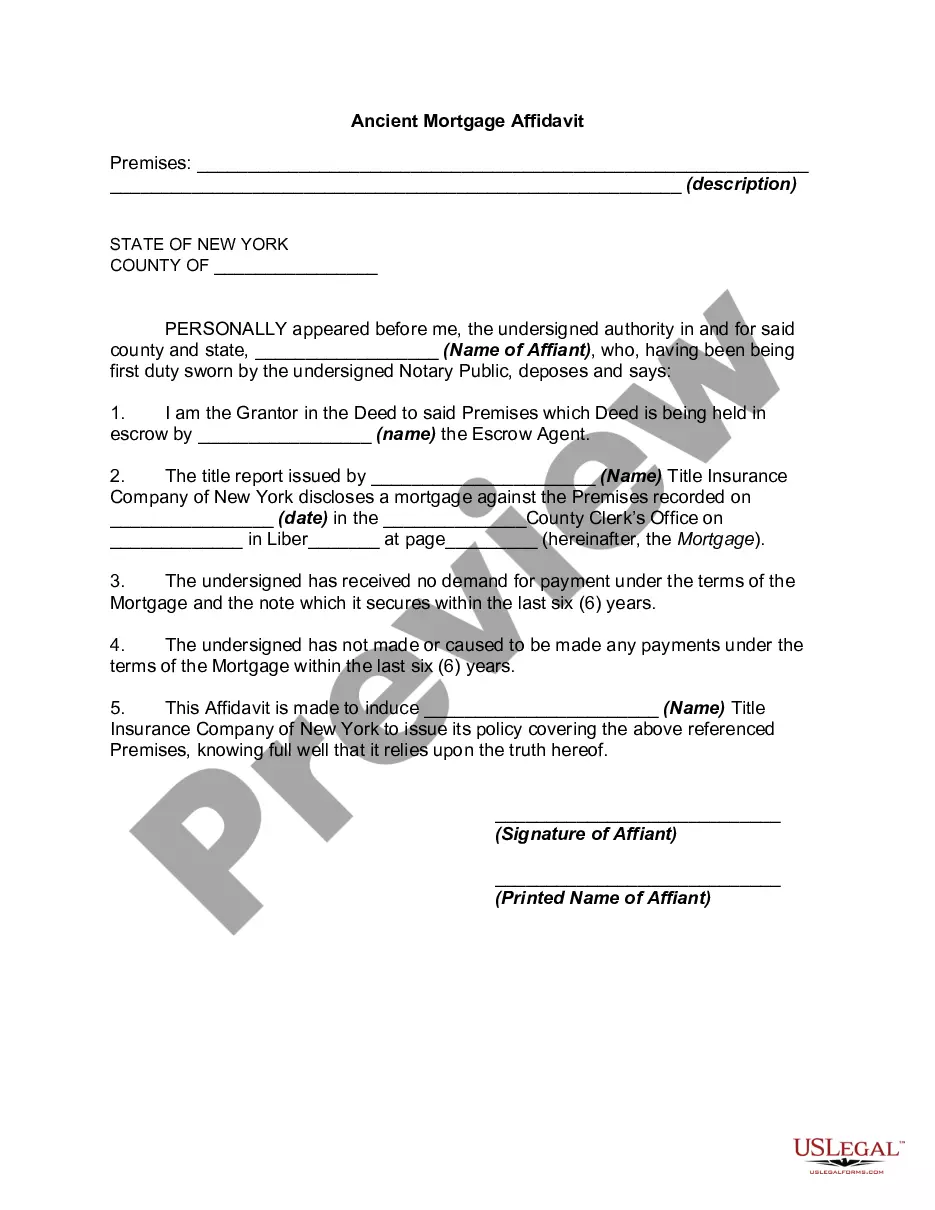

An ancient mortgage is one that has obviously been satisfied but not cancelled off record.

Suffolk New York Ancient Mortgage Affidavit

Description

How to fill out New York Ancient Mortgage Affidavit?

Locating authenticated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms database.

It’s a digital repository of over 85,000 legal documents catering to both personal and business requirements and various real-world situations.

All the papers are appropriately categorized by field of application and legal jurisdictions, making the discovery of the Suffolk New York Ancient Mortgage Affidavit as straightforward as one-two-three.

Maintaining documentation organized and in compliance with legal regulations is crucial. Take advantage of the US Legal Forms database to always have vital document templates readily available for any needs!

- Review the Preview mode and document details.

- Ensure you’ve selected the correct one that satisfies your requirements and fully aligns with your local legal stipulations.

- Look for an alternative template if necessary.

- If you encounter any discrepancies, use the Search tab above to locate the accurate one.

- Proceed to the next step if it fits your needs.

Form popularity

FAQ

An affidavit of mortgage is a legal document that provides a sworn statement regarding the status of a mortgage. This document often includes details about the mortgage amount, the property, and the parties involved. If you're working with a Suffolk New York Ancient Mortgage Affidavit, having a clear understanding of affidavits can simplify the process. Our platform, USLegalForms, offers valuable resources to help you create or obtain necessary affidavits efficiently.

A gap mortgage in New York refers to a financial instrument that bridges the period between the payoff of an existing mortgage and the acquisition of a new mortgage. It is designed to help homeowners manage their finances during the transition between loans. If you're dealing with a Suffolk New York Ancient Mortgage Affidavit, this type of mortgage may offer a solution to maintain your financial stability. Consider consulting professionals who can help you explore the right options for your situation.

In New York, the statute of limitations on a mortgage is six years from the last payment made or from the date of acceleration. This means that if a mortgagee does not take any action within this period, the mortgage may become unenforceable. If you find yourself in a situation related to a Suffolk New York Ancient Mortgage Affidavit, understanding these timelines becomes crucial for your legal standing. It’s best to seek expert guidance to navigate your options effectively.

Typically, the borrower is responsible for the costs associated with the satisfaction of a mortgage. This includes the filing fees charged by the county clerk's office. However, the terms may vary based on agreements made at the mortgage's inception. It’s wise to review your mortgage agreements or consult with a legal expert for clarification; resources like US Legal Forms can provide helpful insights.

To file a satisfaction of mortgage in New York City, you must first secure the signed satisfaction document from your lender. Next, visit the county clerk’s office to submit this document along with any required forms and fees. Proper filing is essential to officially clear the mortgage from public records. For streamlined assistance, consider using platforms like US Legal Forms to ensure all your documents are correctly completed.

An ancient mortgage in New York refers to a mortgage that has not been enforced or serviced for a substantial period, generally over 20 years. This term often creates special legal considerations, especially regarding foreclosure and validity. If you are dealing with an ancient mortgage, it's critical to understand your rights and responsibilities. Resources like US Legal Forms can guide you through the implications and necessary steps.

The satisfaction of judgment in New York is typically filed by the creditor who obtained the judgment. Once the debt has been settled, this party completes the necessary paperwork to officially record the satisfaction. This step is vital to clear the debtor’s record of the judgment. Utilizing services such as US Legal Forms can help you efficiently manage the filing process and ensure the documents are correctly prepared.