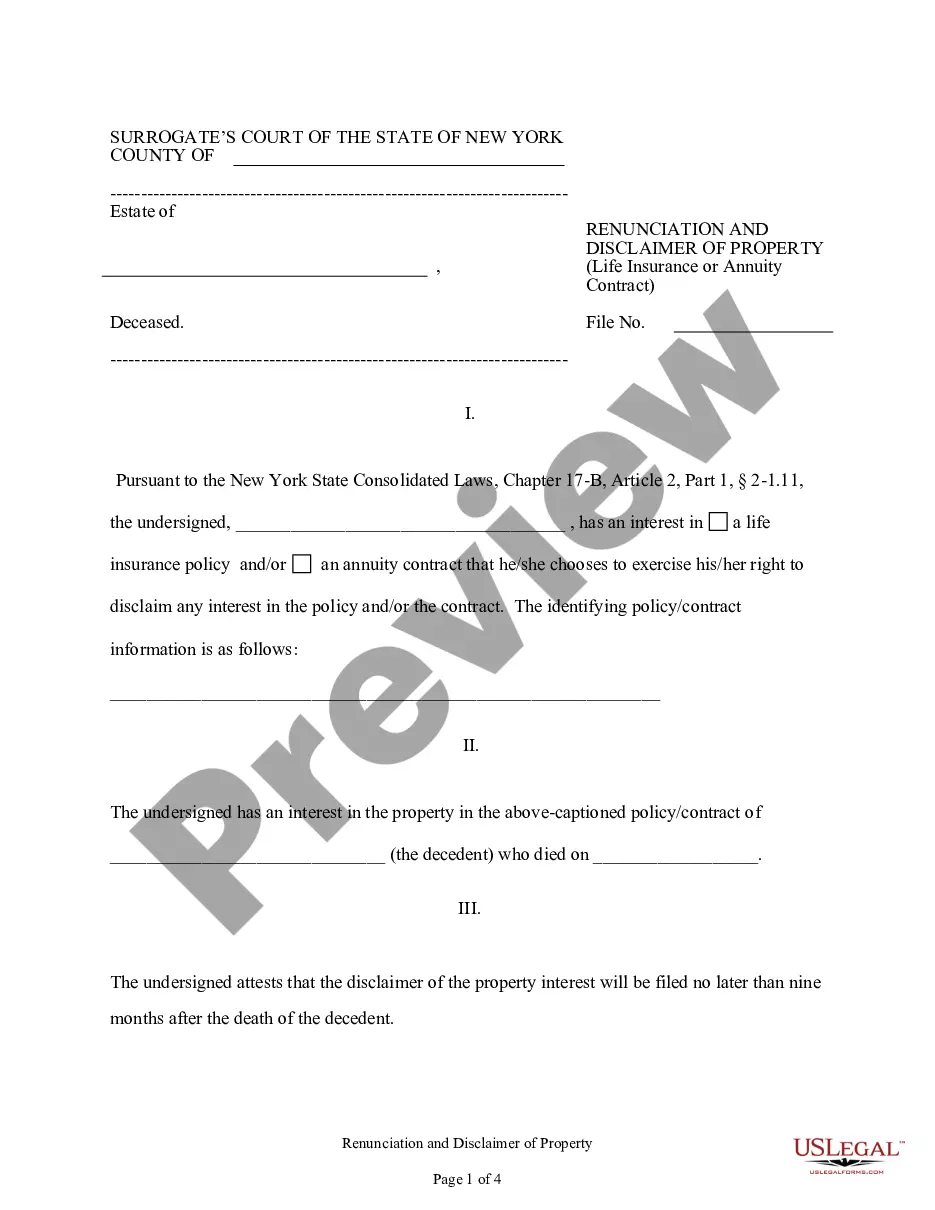

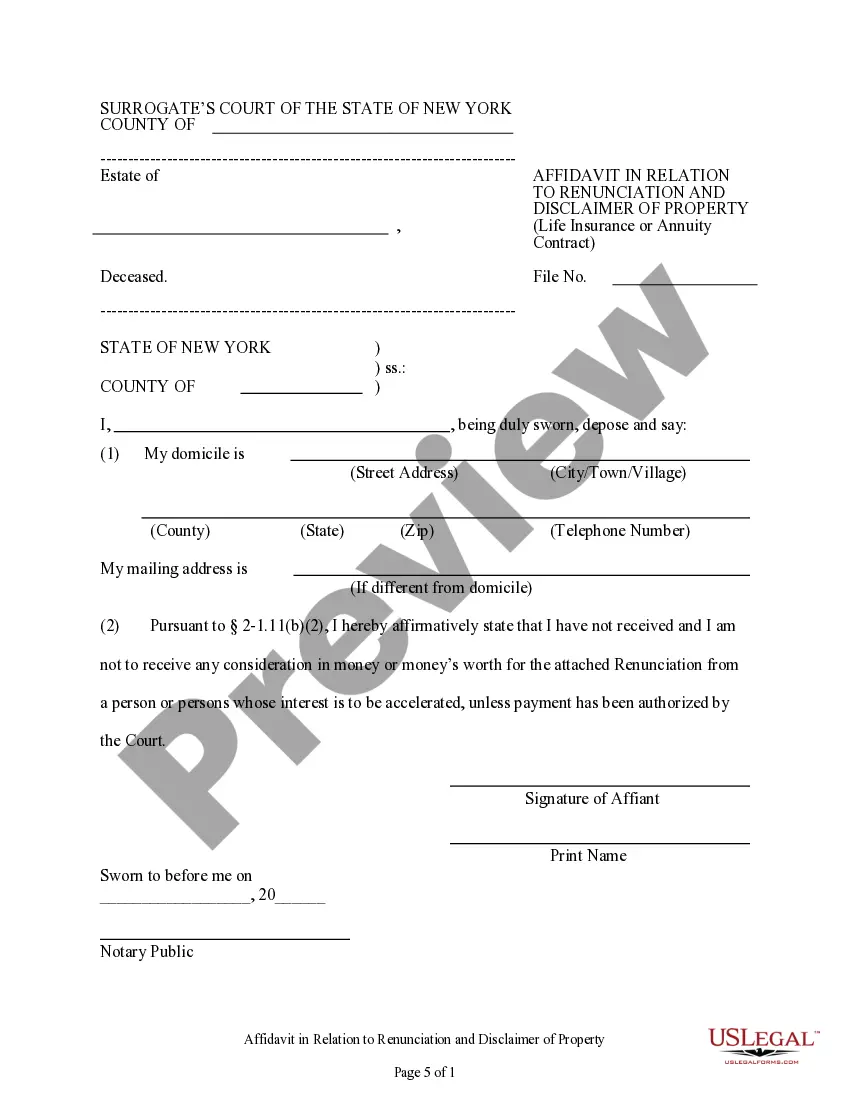

Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out New York Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you are looking for an appropriate form template, it’s challenging to discover a superior platform than the US Legal Forms site – likely the most extensive online collections.

With this collection, you can locate countless form examples for organizational and personal purposes by categories and areas, or keywords.

With our enhanced search option, obtaining the latest Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and save it on your device.Make changes. Complete, modify, print, and sign the obtained Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

- Moreover, the significance of every document is verified by a team of qualified lawyers who routinely review the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to procure the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have opened the form you need. Review its description and employ the Preview feature to examine its content. If it does not satisfy your needs, use the Search option at the top of the screen to find the correct document.

- Confirm your selection. Click the Buy now button. After that, select the preferred subscription plan and provide details to create an account.

Form popularity

FAQ

The New York Trust rule against perpetuities limits the duration of trust interests to ensure property is not tied up indefinitely. Essentially, it prevents the control of property for generations beyond a certain period, which aims to promote property circulation. Understanding this rule is essential for anyone dealing with trusts or inheritances, including those involving life insurance or annuity contracts. For clarity and practical advice, consulting the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can be invaluable.

The statute of limitations on inheritance in New York typically varies depending on the nature of the claim but is generally established at seven years for will contests and five years for cases related to intestacy. Understanding these timeframes is crucial to ensuring that heirs or potential claimants take appropriate action within the legal window. Delaying could result in losing the opportunity to claim property or assets, especially concerning life insurance and annuary contracts. Seeking information on the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can help clarify legal time constraints.

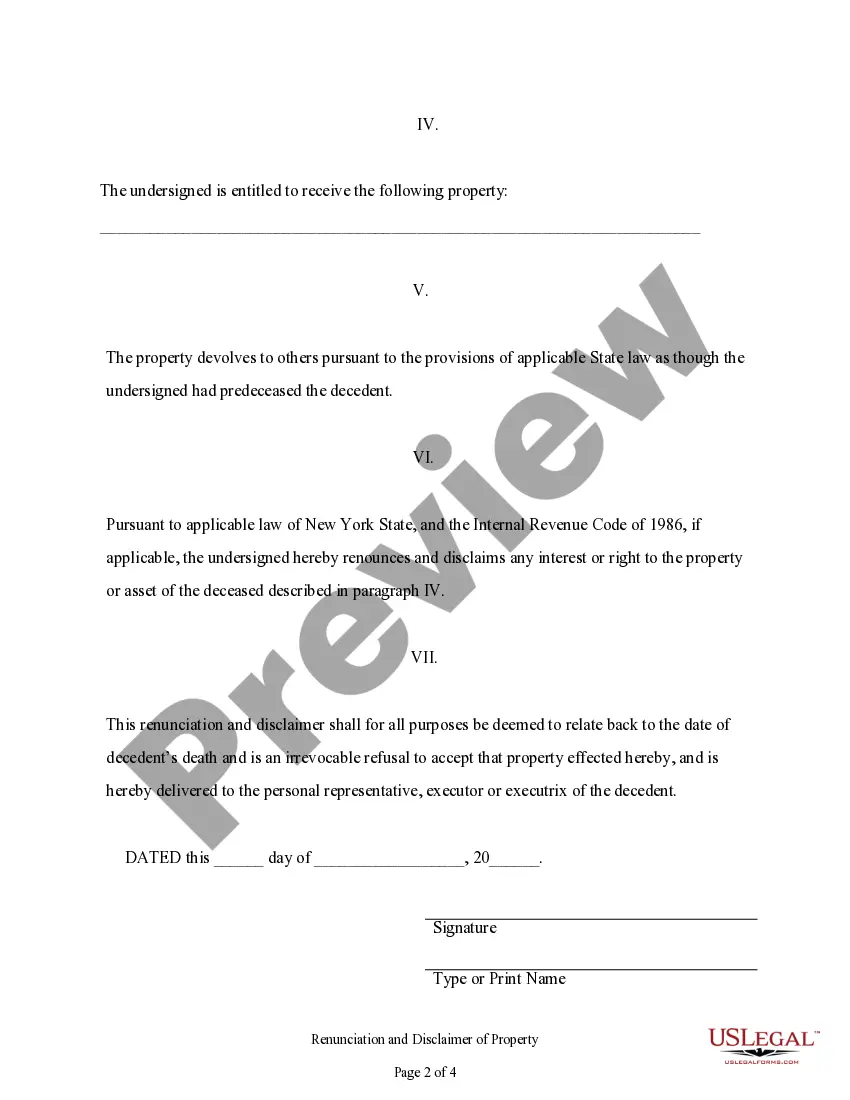

In New York, renunciation is not classified as an affirmative defense; rather, it is a legal option that individuals can pursue to reject an inheritance. This process allows individuals to step back voluntarily, which can simplify estate matters, especially those surrounding life insurance and annuity contracts. Understanding this distinction can clarify available options during estate administration. The Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract outlines how to navigate these situations effectively.

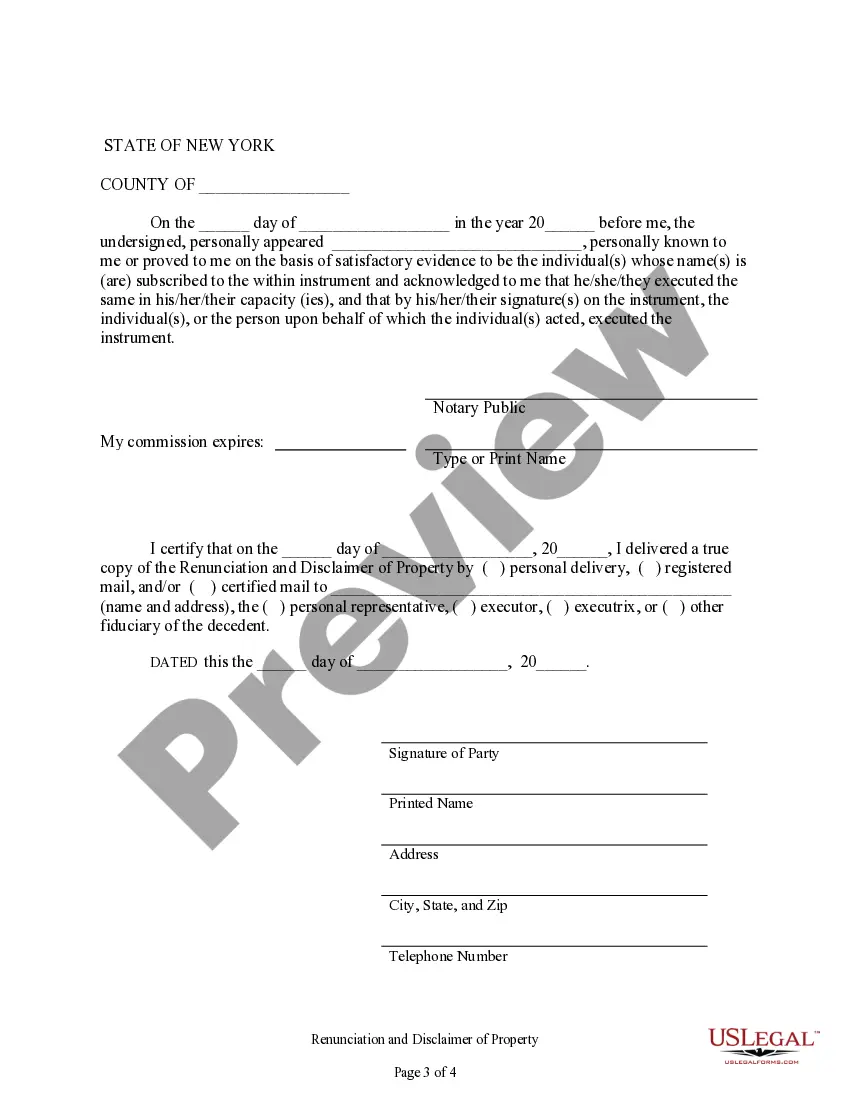

An affidavit of renunciation of inheritance is a formal document in which an individual declares their intention to renounce their rights to inherit property or assets. This affidavit is typically necessary in legal proceedings to document the renunciation effectively. For cases involving life insurance and annuity contracts, this document plays a crucial role in clarifying the intent of the renouncing party. When dealing with such matters, using the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract ensures proper legal compliance.

The law of renunciation is a legal principle that enables individuals to decline an inheritance, ensuring that assets are transferred as if they had never been entitled to them. This concept is particularly significant in the context of life insurance and annuity contracts, as it influences how benefits are distributed. Understanding the law of renunciation can help individuals navigate complex family dynamics and financial obligations. For more guidance, the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract is essential.

The statute of renunciation in New York State allows individuals to refuse an inheritance or property from a deceased person's estate. This can be particularly relevant in cases involving life insurance or annuity contracts. By renouncing their rights, individuals can ensure that the property passes directly to other beneficiaries. If you're considering this option, the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract provides the framework for making informed decisions.

Yes, you can disclaim a life estate in New York by filing a formal disclaimer. This action may affect the distribution of the property after your passing. Understanding the complexities of the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract will aid in ensuring your decision aligns with all legal requirements.

Disclaiming an inheritance in New York involves drafting a written disclaimer and submitting it to the probate court. You must act within nine months of the decedent’s death to ensure your disclaimer is effective. For assistance, the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract provides clear guidelines on fulfilling this legal requirement.

A letter to renounce inheritance should clearly state your intent to decline the inherited property. Include your name, the deceased’s name, and details about the property you are renouncing. For precise writing, consider using US Legal Forms to access templates that ensure compliance with the Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Inheritance laws in New York state dictate how property is distributed after a person's death. These laws provide guidelines for wills, intestate succession, and the disclaiming of property. Understanding these laws can clarify the process of making a Queens New York Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.