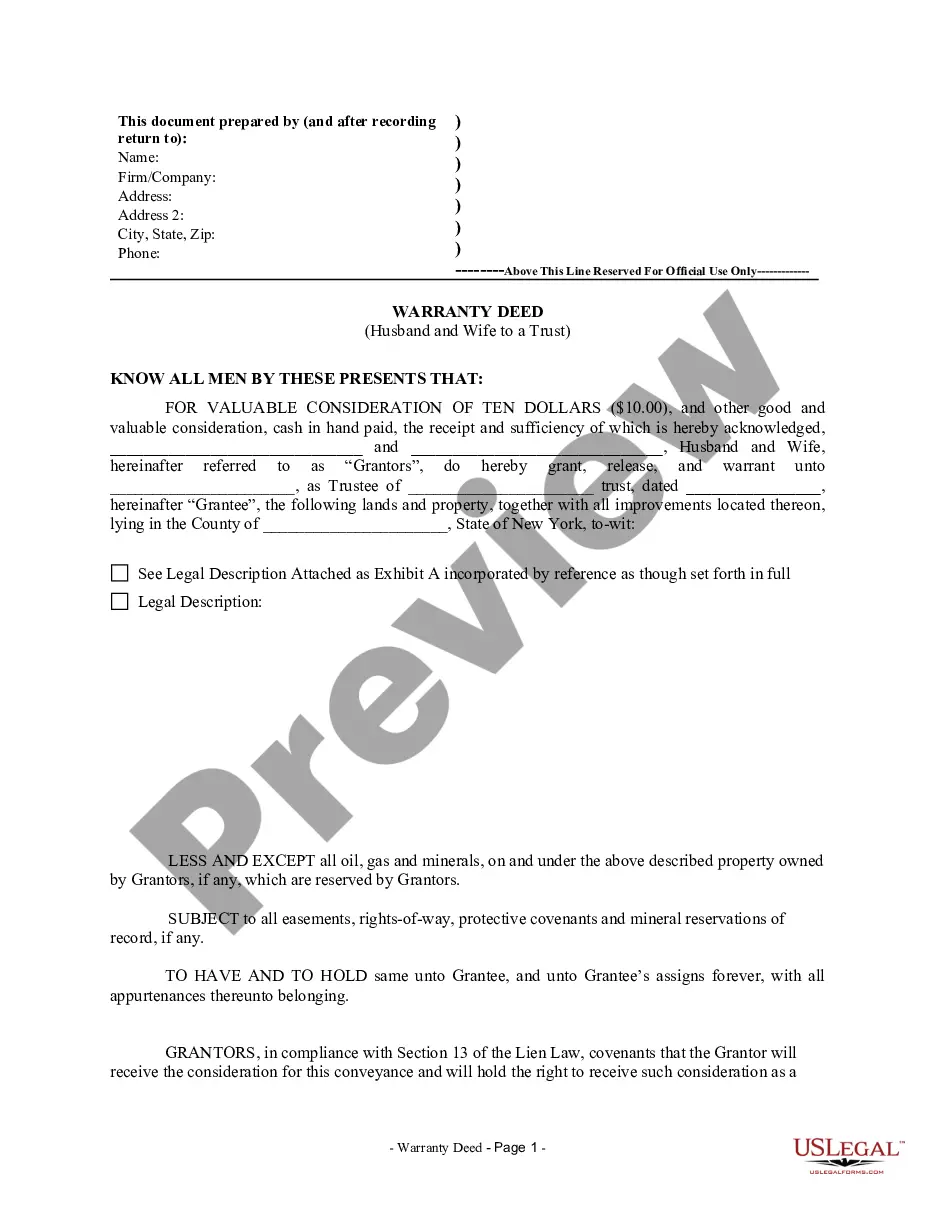

Kings New York Warranty Deed from Husband and Wife to a Trust

Description

How to fill out New York Warranty Deed From Husband And Wife To A Trust?

Regardless of social or professional rank, filling out legal documents is a regrettable requirement in today’s work landscape.

Frequently, it becomes nearly impossible for an individual without legal training to create these types of documents from the ground up, primarily due to the intricate language and legal nuances they incorporate.

This is where US Legal Forms steps in to provide assistance.

Verify that the document you selected is appropriate for your region, as the regulations of one state or jurisdiction are not applicable to another.

Examine the document and peruse a brief summary (if accessible) of scenarios where the document is applicable.

- Our platform features an extensive catalog with more than 85,000 ready-to-use state-specific forms applicable to nearly any legal situation.

- US Legal Forms also serves as a fantastic resource for paralegals or legal advisors aiming to enhance their efficiency by using our DYI templates.

- Regardless of whether you require the Kings New York Warranty Deed from Husband and Wife to a Trust or any other documentation appropriate for your jurisdiction, US Legal Forms has everything readily available.

- Here's a step-by-step guide on how to acquire the Kings New York Warranty Deed from Husband and Wife to a Trust within minutes using our reliable platform.

- If you are an existing user, simply Log In to your account to download the needed form.

- However, if you are not familiar with our collection, ensure to adhere to these procedures before obtaining the Kings New York Warranty Deed from Husband and Wife to a Trust.

Form popularity

FAQ

The declaration of trust between husband and wife is a document that outlines how property is owned within a marital trust. It serves to assign ownership rights and responsibilities, detailing the allocation of assets. Often, this involves a Kings New York Warranty Deed from Husband and Wife to a Trust, which formalizes the agreement. This declaration ensures both spouses have clear legal standings regarding their joint property.

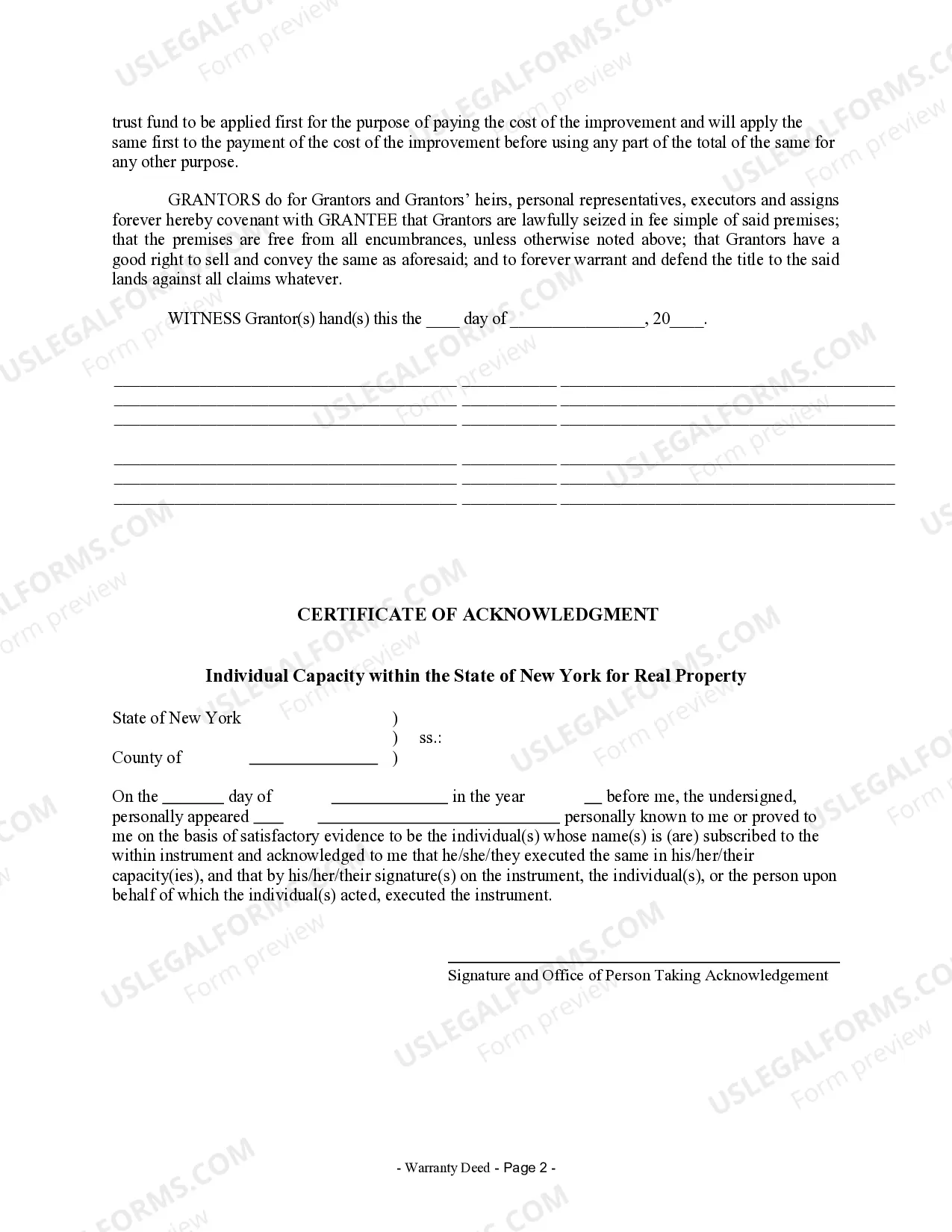

To add your spouse to your warranty deed in New York, you will create a new Kings New York Warranty Deed from Husband and Wife to a Trust. This new deed should clearly list both of your names as joint owners. Once the deed is prepared, sign it and submit the updated document to your local county clerk's office for recording. This will legally recognize both of you as owners of the property.

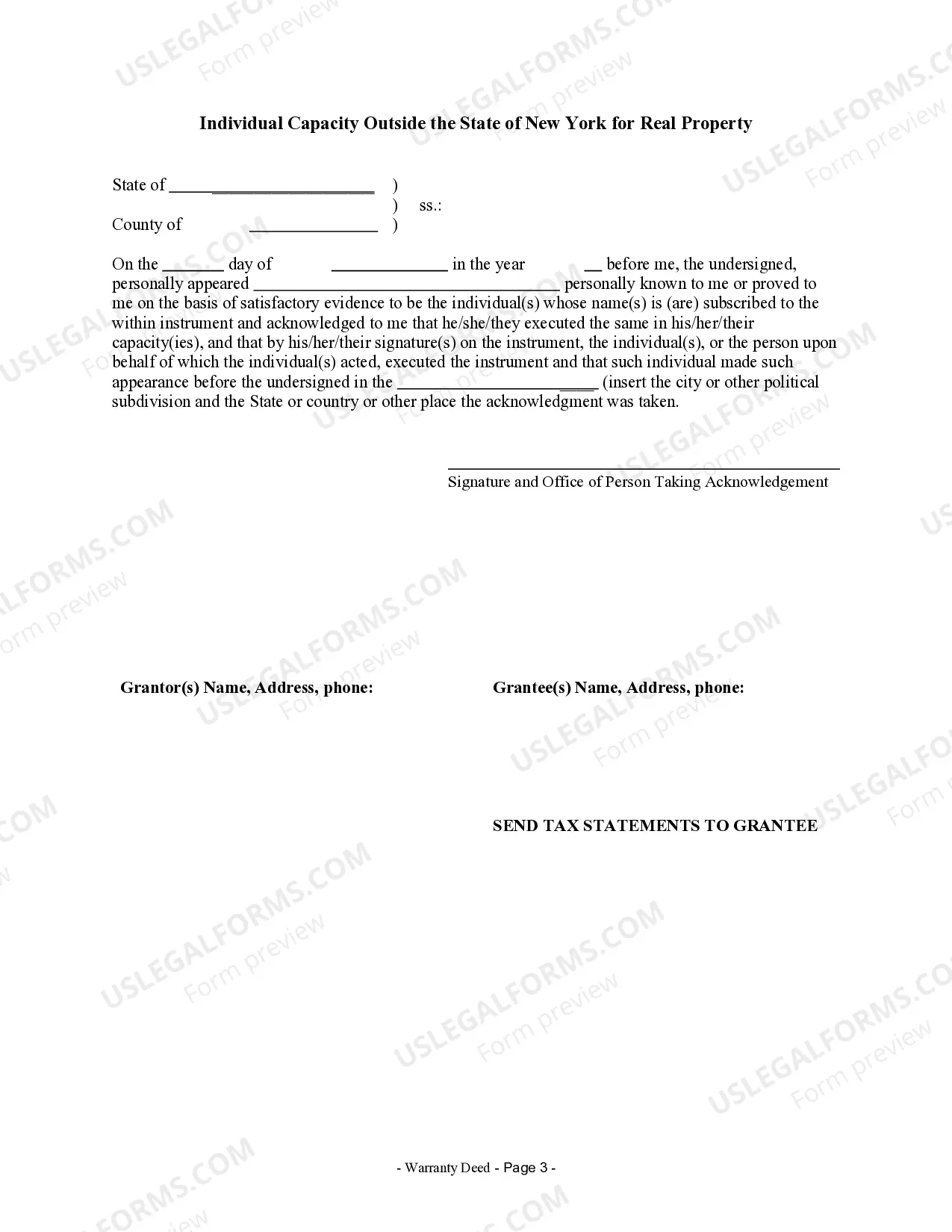

To transfer property to a trust in New York, you will need to execute a Kings New York Warranty Deed from Husband and Wife to a Trust. Start by preparing the deed, which must include essential information like the property description and the names of the trust. After signing the deed, you must file it with the county clerk's office where the property is located. This process ensures that the property is officially owned by the trust.

Although a warranty deed provides a strong guarantee of title, the primary disadvantage lies in the seller's obligation to defend the title against any claims. If issues arise after the transfer, the seller may be held responsible, potentially leading to costly legal disputes. It is crucial to understand these risks when using the Kings New York Warranty Deed from Husband and Wife to a Trust as part of your property transaction.

While putting your house in a trust, like the Kings New York Warranty Deed from Husband and Wife to a Trust, offers many benefits, there are also potential drawbacks. You may face ongoing administrative costs and legal fees, and you may lose some control over the asset. Additionally, transferring property into a trust could impact eligibility for certain government benefits. It's important to weigh these considerations with a professional advisor.

A warranty deed guarantees that the property owner has the right to transfer the property and protects the buyer from any future claims against the title. In contrast, a trust deed is part of the arrangement that transfers property into a trust. The Kings New York Warranty Deed from Husband and Wife to a Trust serves as a legal instrument to execute this transfer, ensuring both security and clarity about ownership. Understanding these differences is key to effective property management in estate planning.

To transfer a deed to a trust in New York, prepare a Kings New York Warranty Deed from Husband and Wife to a Trust that clearly names the trust as the new owner. Next, sign and date the deed, and have it notarized to validate the transfer. Finally, record the deed with your county clerk’s office to officially update the public record. This process helps to establish the trust as the rightful owner of the property.

To transfer your property into a trust in New York, you should first draft a trust agreement that specifies the terms of the trust. Then, execute a Kings New York Warranty Deed from Husband and Wife to a Trust to legally change the ownership of the property. It is also recommended to file the deed with your local county clerk to ensure proper documentation. For convenience, you can access the necessary forms through US Legal Forms.

Transferring property to a trust offers several benefits, such as avoiding probate and ensuring a smooth transition of assets to your beneficiaries. A trust can provide privacy and flexibility in managing your property after your death. Additionally, using a Kings New York Warranty Deed from Husband and Wife to a Trust can simplify the transfer process. This strategic move can ultimately protect your loved ones and enhance your estate planning efforts.