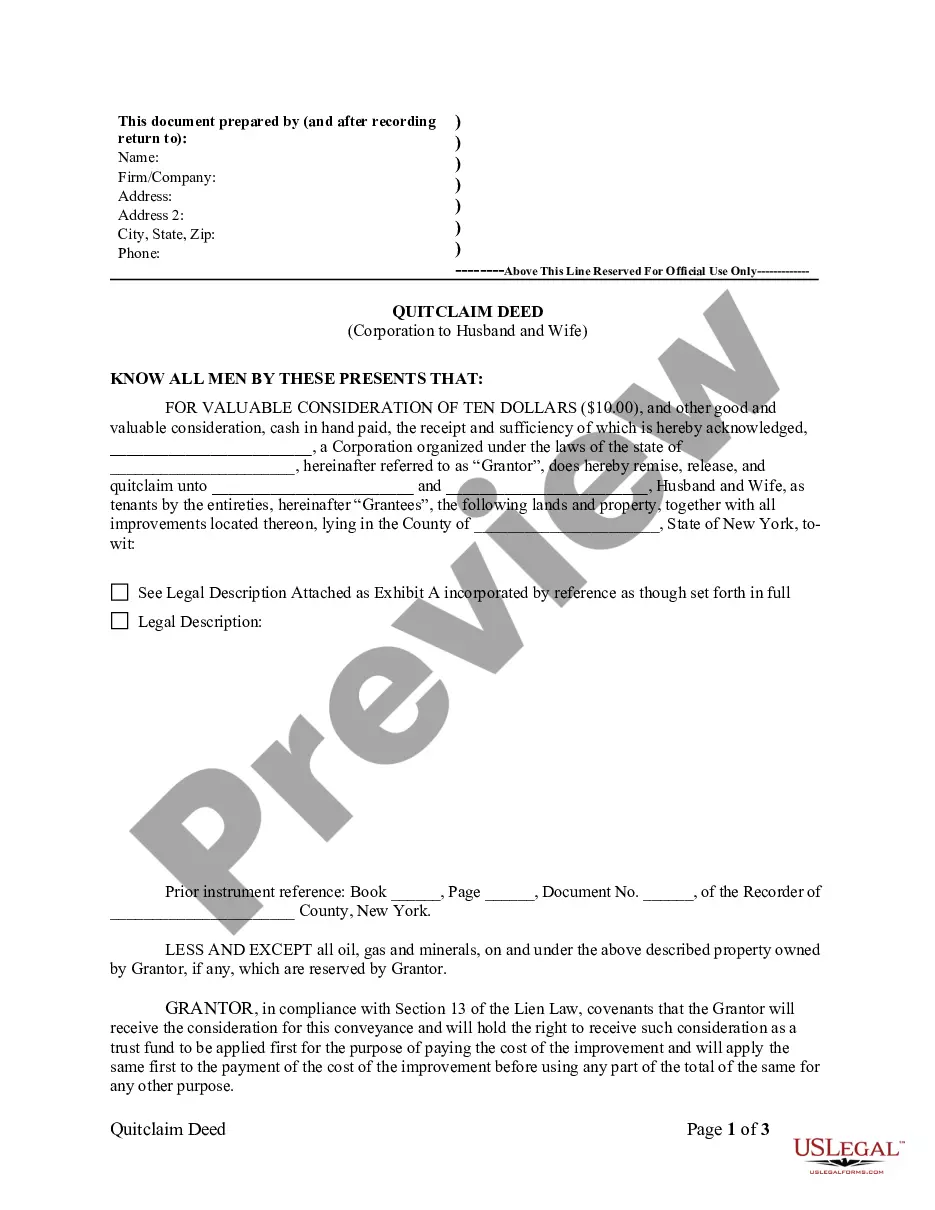

Kings New York Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out New York Quitclaim Deed From Corporation To Husband And Wife?

If you are looking for a legitimate form template, it’s incredibly challenging to select a superior service than the US Legal Forms site – arguably the most extensive libraries available online.

With this repository, you can obtain a vast array of document samples for business and personal purposes categorized by types and states, or keywords.

With the sophisticated search feature, locating the latest Kings New York Quitclaim Deed from Corporation to Husband and Wife is as simple as 1-2-3.

Execute the payment process. Use your credit card or PayPal account to finalize the registration procedure.

Receive the template. Choose the format and download it to your device.

- Furthermore, the validity of each document is confirmed by a group of expert attorneys who continually assess the templates on our platform and modify them according to the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to access the Kings New York Quitclaim Deed from Corporation to Husband and Wife is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the steps outlined below.

- Ensure that you have located the form you require. Read its description and utilize the Preview option (if available) to review its contents. If it doesn’t satisfy your requirements, employ the Search feature at the top of the screen to find the appropriate document.

- Verify your choice. Click the Buy now button. Then, select the desired subscription plan and provide information to create an account.

Form popularity

FAQ

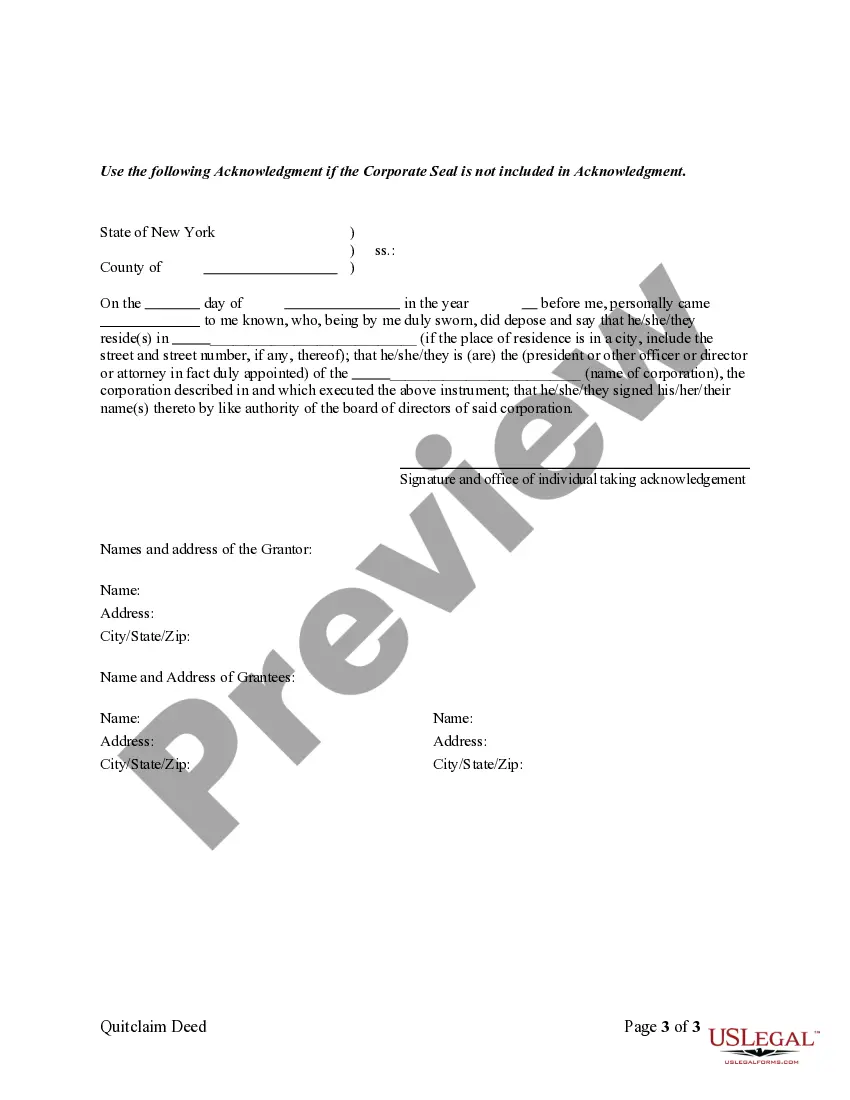

To file a quitclaim deed in New York, first, properly complete the document ensuring all required information is included. Once the Kings New York Quitclaim Deed from Corporation to Husband and Wife is filled out and notarized, submit it to the local county clerk's office. This step finalizes the transfer and makes it part of the public record, providing security for all parties involved.

The best way to transfer property to a family member is typically through a quitclaim deed. This method is straightforward and efficient, especially with the Kings New York Quitclaim Deed from Corporation to Husband and Wife. Properly filling out the deed and filing it with local authorities ensures that the transfer is legally recognized and executed without complications.

To add your spouse to your deed in NY, you will need to complete a quitclaim deed. Use the Kings New York Quitclaim Deed from Corporation to Husband and Wife to ensure all information is clear and relevant. After filling it out and having it notarized, file it with your county clerk's office to officially include your spouse on the property title.

To quickly and effectively transfer property to a family member in New York, using a quitclaim deed is often the best approach. The Kings New York Quitclaim Deed from Corporation to Husband and Wife simplifies this process by allowing for an easy transfer without extensive legal requirements. Just ensure all necessary details are accurately filled out, and file the deed with the local authorities for a smooth transaction.

Filling out a quitclaim deed to add a spouse involves providing specific details such as the names of both spouses, the property's address, and the legal description of the property. You will want to utilize the Kings New York Quitclaim Deed from Corporation to Husband and Wife for clarity. After completing the document, sign it in front of a notary and submit it to the appropriate office to make the addition official.

To transfer property to family members in New York, you can use a quitclaim deed. This type of deed does not guarantee the property’s title, but it allows for a straightforward transfer from one party to another. The Kings New York Quitclaim Deed from Corporation to Husband and Wife is an effective option for such transactions. Simply complete the deed with the necessary information and file it with your local county clerk's office.

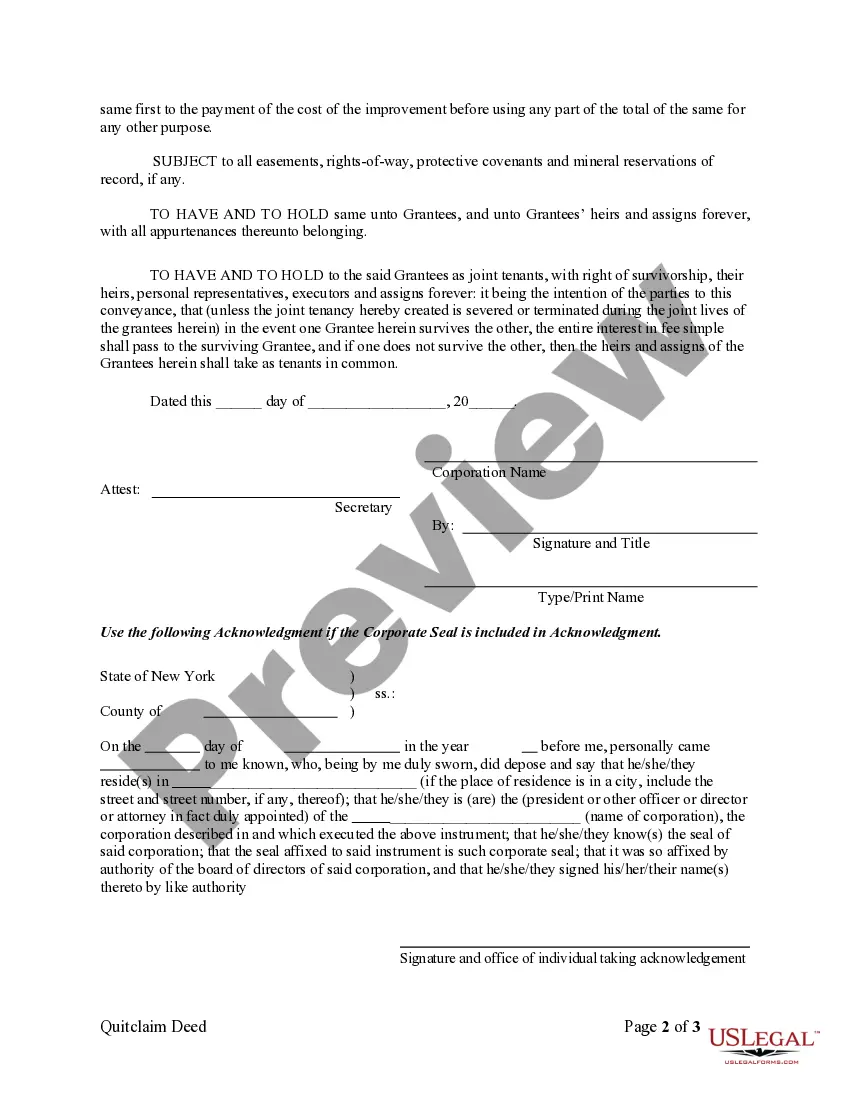

Typically, both spouses benefit from a quitclaim deed in terms of clarity and security in property ownership. The spouse receiving the interest or ownership gains official recognition of their rights, while the transferring spouse simplifies legal aspects of asset ownership. In scenarios involving a Kings New York Quitclaim Deed from Corporation to Husband and Wife, both parties ensure that their rights are protected and defined, making it a beneficial transaction for couples.

There are several reasons a spouse might execute a quitclaim deed, including clarifying ownership, transferring interest in property, or otherwise addressing changes in marital status. For instance, if one spouse acquires property before marriage and wants to add their partner's name, a quitclaim deed can simplify this process. In the case of a Kings New York Quitclaim Deed from Corporation to Husband and Wife, this deed is a straightforward way to address property ownership smoothly and legally.

A quitclaim deed for a married couple is a legal document that transfers property ownership from one spouse to both spouses or from both spouses to one spouse. This type of deed is commonly used in situations such as transferring assets after marriage or simplifying property division during a divorce. In the context of a Kings New York Quitclaim Deed from Corporation to Husband and Wife, it helps in formalizing the property ownership arrangement, ensuring both parties have legal rights to the property.

Filling out a quitclaim deed form involves several straightforward steps. Start by entering the names and addresses of both parties, followed by a clear description of the property. Finally, sign and date the Kings New York Quitclaim Deed from Corporation to Husband and Wife before a notary public to finalize the process. Platforms like uslegalforms can provide all the necessary resources and templates to guide you through this process effortlessly.