Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out New York Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both individual and professional purposes and various real-world scenarios.

All the paperwork is properly organized by category of use and jurisdiction areas, making it as swift and simple as ABC to search for the Queens New York Financial Statements solely related to Prenuptial Premarital Agreement.

Enter your credit card information or use your PayPal account to complete the payment for the subscription.

- Review the Preview mode and form details.

- Ensure you've selected the correct document that fulfills your needs and aligns with your local jurisdiction stipulations.

- Search for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Yes, you can write your own prenup in New York, but there are specific legal requirements to ensure it is valid. It’s important to include clear financial statements, especially in terms of assets and debts that relate to the Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement. It is recommended to consult a legal professional to review or assist you in drafting your agreement. This helps avoid potential disputes and ensures your agreement is enforceable.

In New York, premarital assets generally remain protected during a divorce, provided they are clearly outlined in a prenuptial agreement. It’s crucial to establish and document the financial statements relating to these assets as they relate to the Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement. Having a solid prenup can safeguard your individual property and financial interests. Consulting a legal professional can ensure your financial statements are properly incorporated.

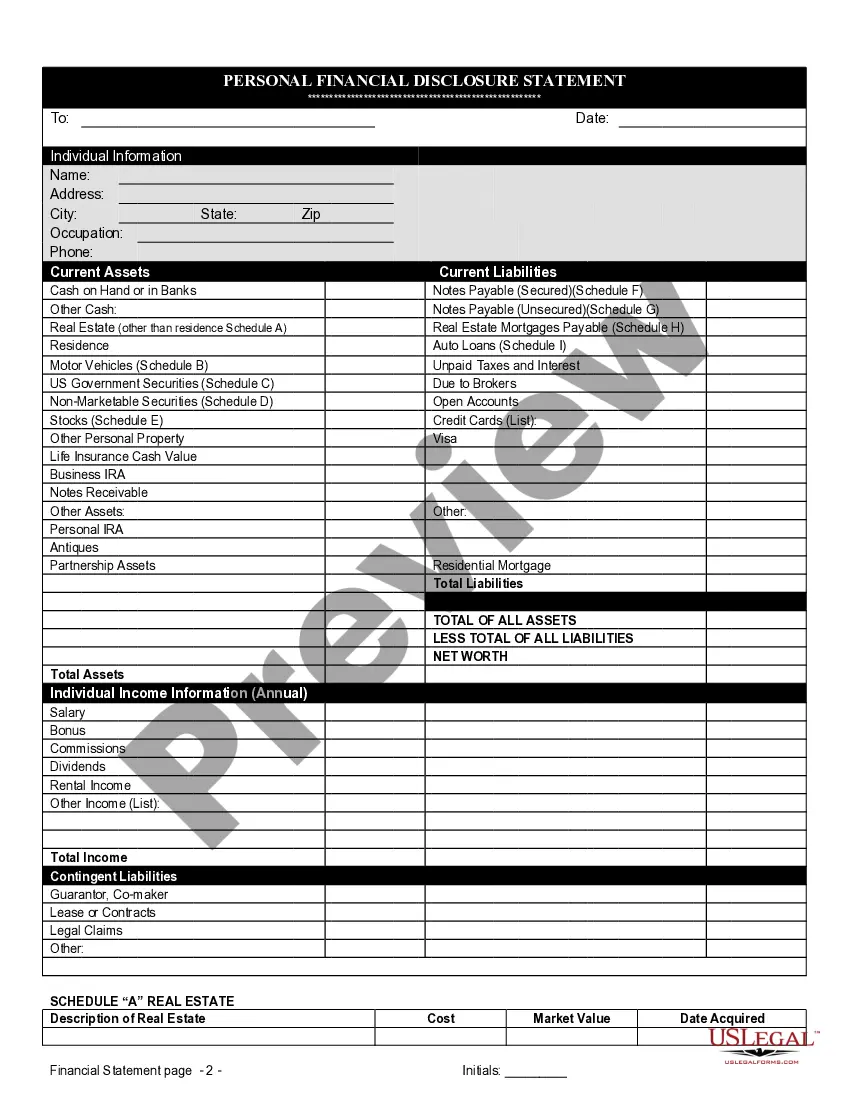

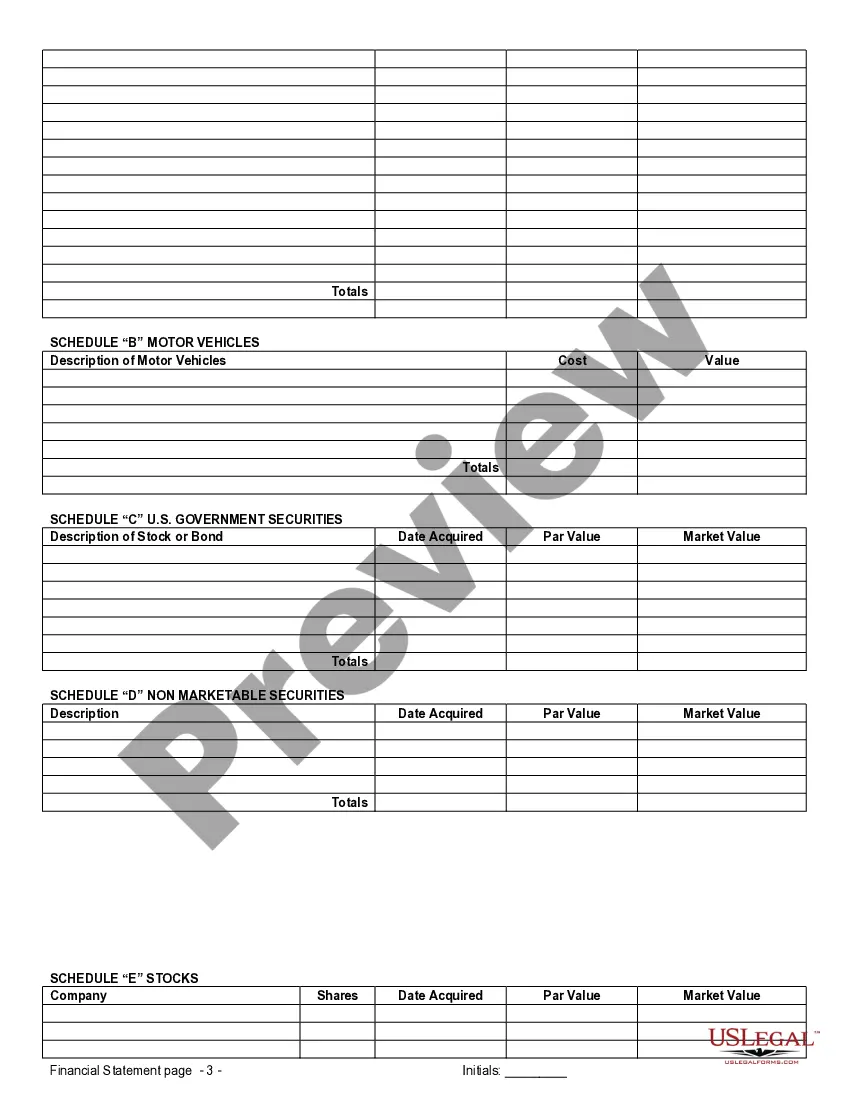

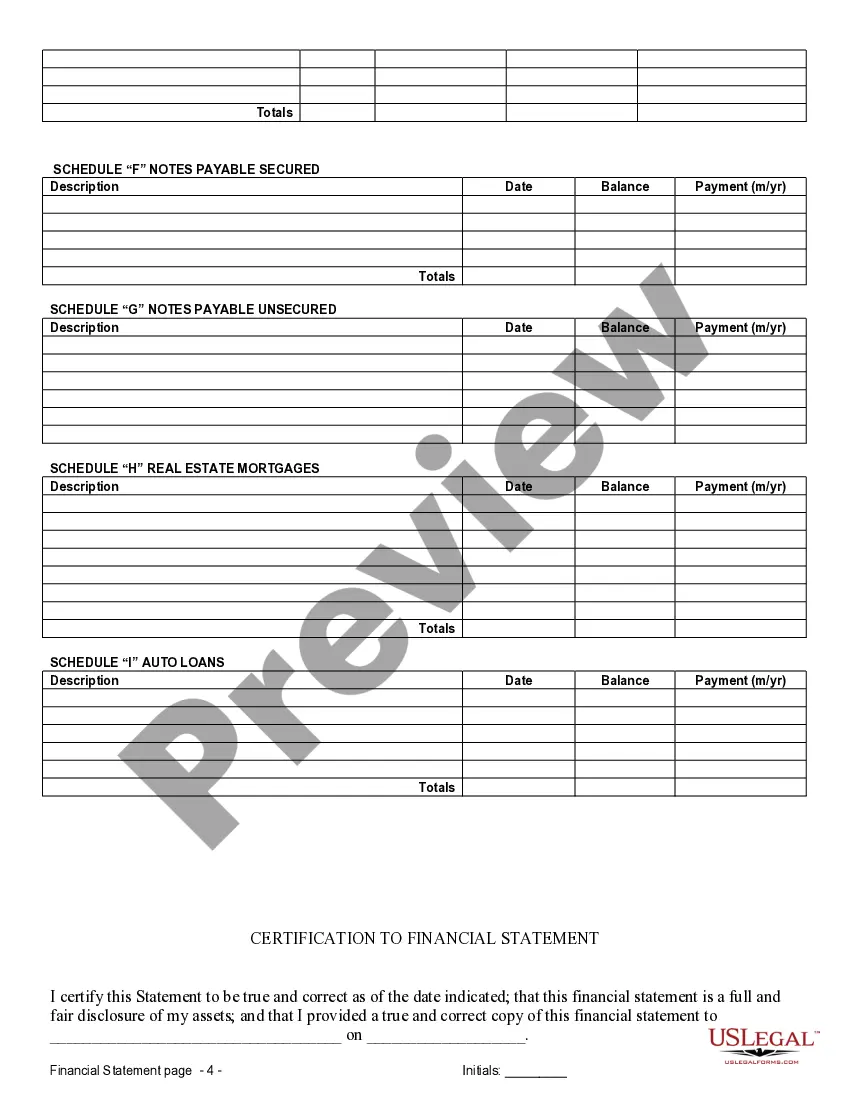

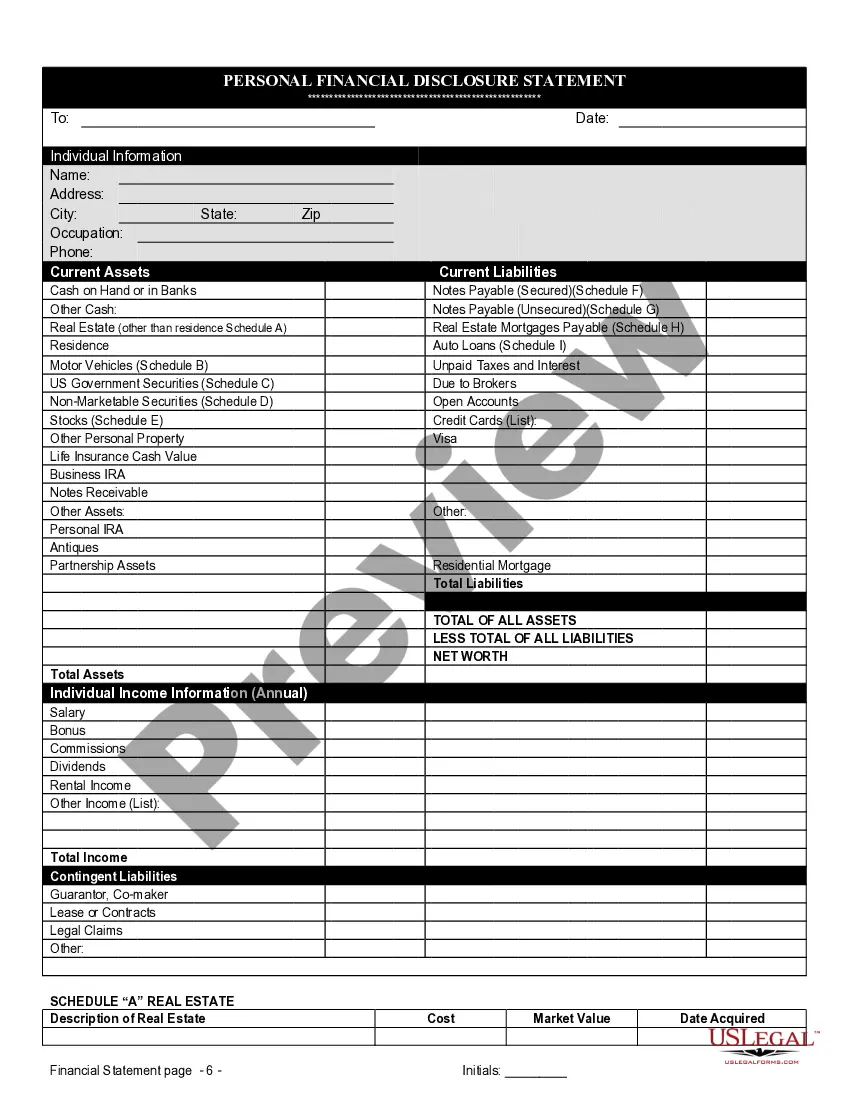

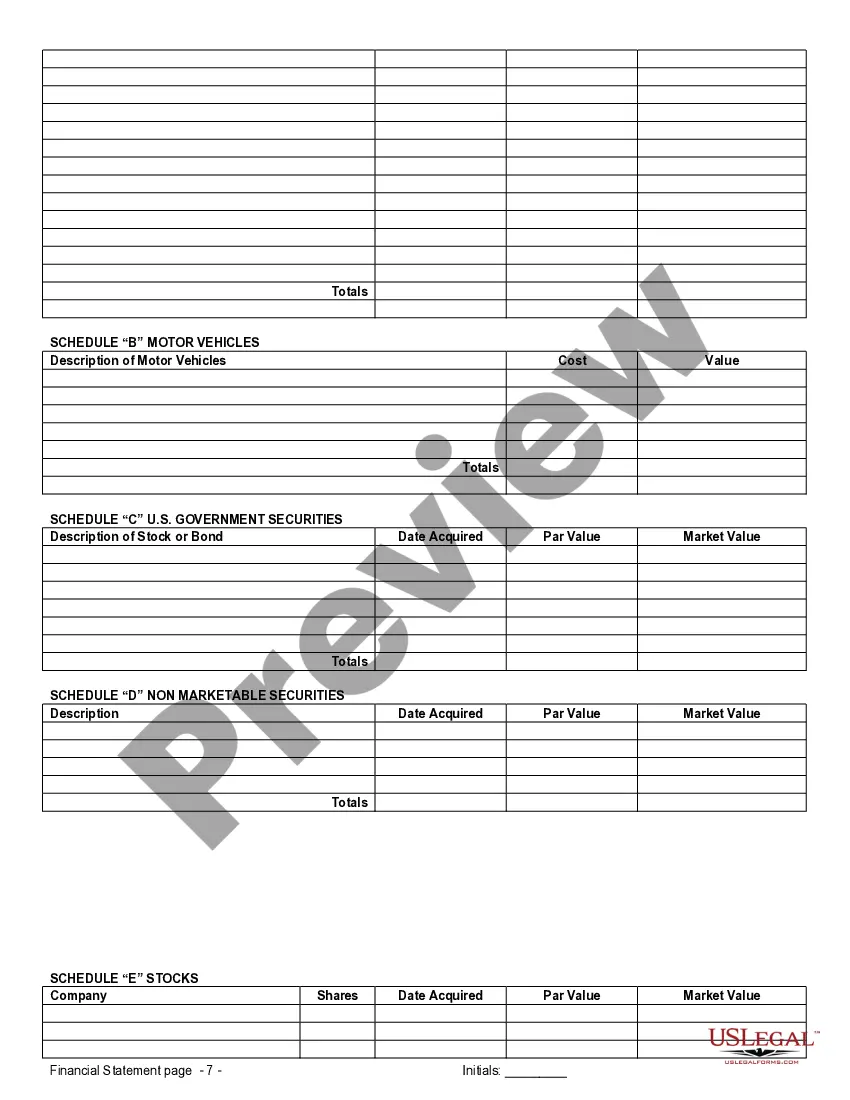

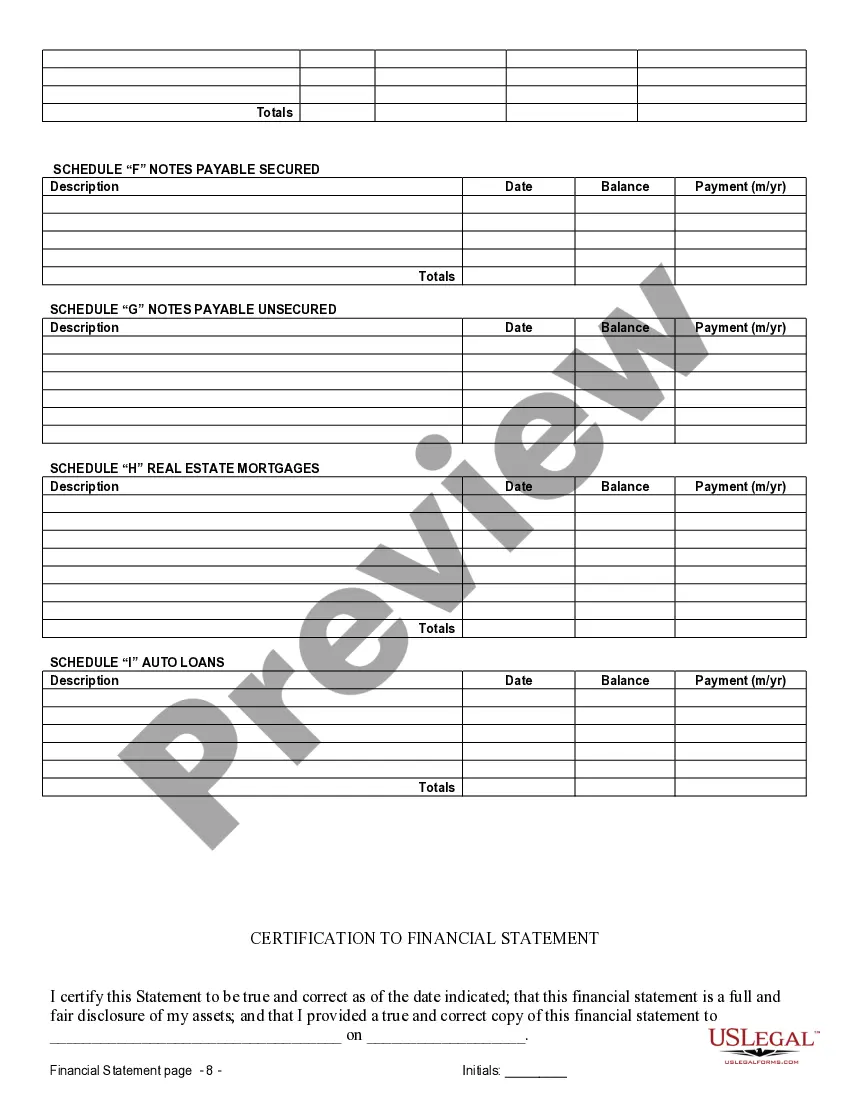

Financial disclosure in a prenuptial agreement involves fully revealing your assets, debts, and income before marriage. This transparency allows both parties to make informed decisions and protects against future disputes. In the context of Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring complete financial disclosure is vital for a fair and enforceable agreement.

To keep finances separate in marriage, you can create a prenuptial agreement that specifies ownership of all assets and debts. By detailing the financial arrangements in this document, each spouse understands their financial rights. In Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement, this clarity minimizes conflicts and fosters a positive financial relationship.

Prenups primarily serve to keep finances separate by defining ownership of assets and debts. They establish a legal framework that protects both partners' interests. Utilizing Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can navigate financial planning with greater confidence and clarity.

Yes, a well-crafted prenup can ensure that specific marital assets remain separate. By explicitly listing each partner's property and designating which items are non-marital, both individuals can protect their investments. This aspect is critical for Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement to outline asset ownership clearly.

A prenuptial agreement can effectively keep debt separated between partners. If one party has significant debt, this can be defined in the prenup to avoid the other party being held liable. With Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement, you can clearly document existing debts and prevent misunderstandings down the road.

Yes, a prenup can help you keep finances separate during marriage. By outlining your individual assets and liabilities in advance, you establish clear boundaries. This is particularly important in Queens New York Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring that both partners understand their financial responsibilities.

An example of financial disclosure could be presenting a list of bank accounts, properties, investments, and any outstanding debts. Each partner must honestly declare their financial status to promote transparency and fairness. In a prenup context, detailed financial disclosure ensures that both parties are fully informed about each other’s financial capabilities. Tools from US Legal Forms can help in preparing these disclosures clearly.

To protect future earnings in a prenuptial agreement, you should specify in the document how such earnings will be treated. In Queens, New York, including these provisions ensures that your income and professional advancements remain your property if you wish. This approach allows both partners to maintain their financial independence while enjoying the benefits of marriage. Consulting with legal experts can aid in crafting these terms effectively.