Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

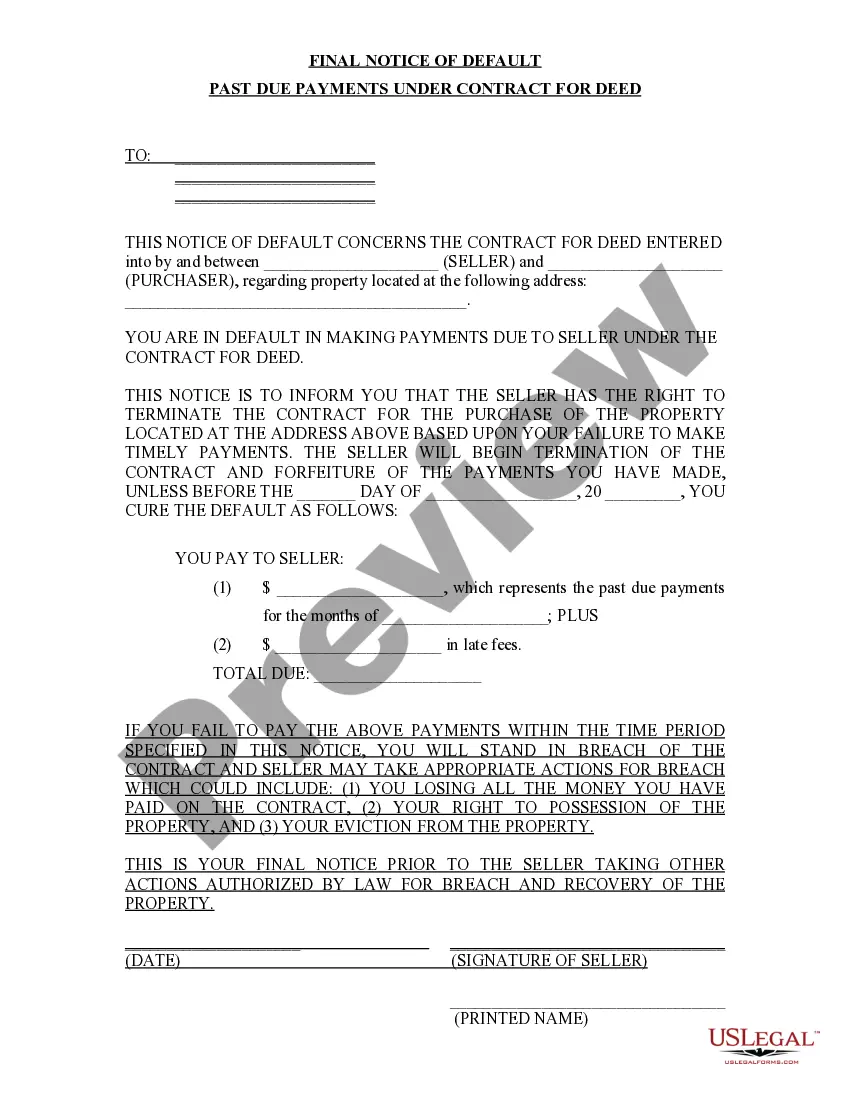

How to fill out New York Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you have previously used our service, Log In to your account and preserve the Rochester New York Final Notice of Default for Past Due Payments related to the Contract for Deed on your device by clicking the Download button. Verify that your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have consistent access to all documents you have purchased: you can find it in your profile under the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to easily find and keep any template for your personal or professional requirements!

- Confirm you’ve located the correct document. Review the description and use the Preview option, if available, to determine if it fits your requirements. If it does not suit you, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Rochester New York Final Notice of Default for Past Due Payments regarding the Contract for Deed. Select the file format for your document and save it to your device.

- Finalize your sample. Print it out or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

The length of the foreclosure process in New York can vary significantly, often taking several months to more than a year. Factors influencing this duration include court schedules and the specific circumstances surrounding each case. Homeowners receiving a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed should be aware that timely intervention can potentially shorten this timeline, so seeking help sooner rather than later is advisable.

New York has enacted several laws aimed at reforming the foreclosure process, making it more transparent and accessible. Recent changes may affect how a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed is handled. It is crucial for homeowners and lenders to stay updated on these legislative changes to ensure compliance and protect their interests.

To initiate a foreclosure in New York, certain requirements must be met. This typically includes issuing a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed and providing proper notice to the borrower. Understanding these requirements is essential for lenders and borrowers alike, as they establish the groundwork for how the process unfolds.

A foreclosure referee plays a crucial role in the foreclosure process in New York. They supervise and facilitate the sale of the property, ensuring that the process adheres to legal requirements. This is especially important when dealing with a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed. Their expertise helps to streamline the proceedings and protect the interests of all parties involved.

Yes, you can stop a foreclosure in New York under certain circumstances. Filing for bankruptcy is one way to pause the process temporarily, offering some breathing room. You can also negotiate a repayment plan or seek assistance through agencies focused on housing stability. Remember, the Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed emphasizes the need for swift action.

In New York, there is typically a redemption period during the foreclosure process. This allows homeowners to reclaim their property by paying off the total amount due. Specifically, under the Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, you may need to act promptly to take advantage of this period. Understanding these timelines is critical for anyone facing foreclosure.

Foreclosure refers to the legal process a lender uses to reclaim property when the borrower fails to make payments as agreed. In Rochester, New York, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed often signals the start of this process. It's essential for homeowners to understand that foreclosure can lead to losing their home if not addressed promptly. By seeking assistance, homeowners can explore options to avoid foreclosure and protect their rights.

New York has specific rules governing the foreclosure process, including mandatory pre-foreclosure notices and court involvement. A lender must file a lawsuit to start foreclosure and prove the borrower's default. If you receive a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, understanding these rules can empower your next steps.

A bank can initiate foreclosure proceedings as soon as a homeowner fails to make payments, but the entire process can take longer due to legal requirements. In New York, the minimum timeline can be several months before the court finalizes the foreclosure. If you face a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed, it's vital to consult with a legal expert as soon as possible.

Typically, you need to miss three consecutive payments before your lender initiates foreclosure proceedings in New York. However, it's important to communicate with your lender as they may offer alternatives that could help prevent this situation. Receiving a Rochester New York Final Notice of Default for Past Due Payments in connection with Contract for Deed is a serious matter, and seeking assistance can help you navigate your options.