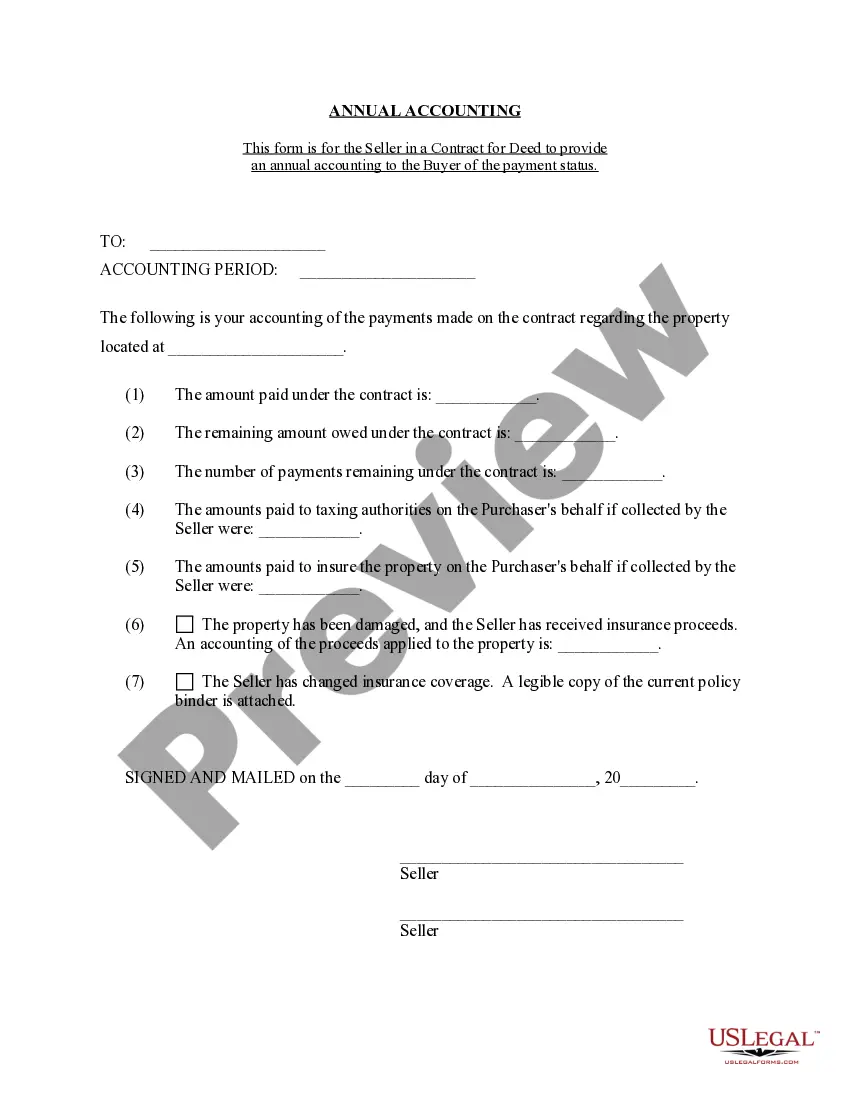

Queens New York Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out New York Contract For Deed Seller's Annual Accounting Statement?

Finding validated templates tailored to your local laws can be difficult unless you utilize the US Legal Forms repository.

It's an online resource containing over 85,000 legal documents for both personal and professional purposes as well as various real-life scenarios.

All the forms are systematically organized by usage area and jurisdictional domains, making it straightforward to find the Queens New York Contract for Deed Seller's Annual Accounting Statement.

Keep your paperwork organized and in compliance with legal standards. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirements!

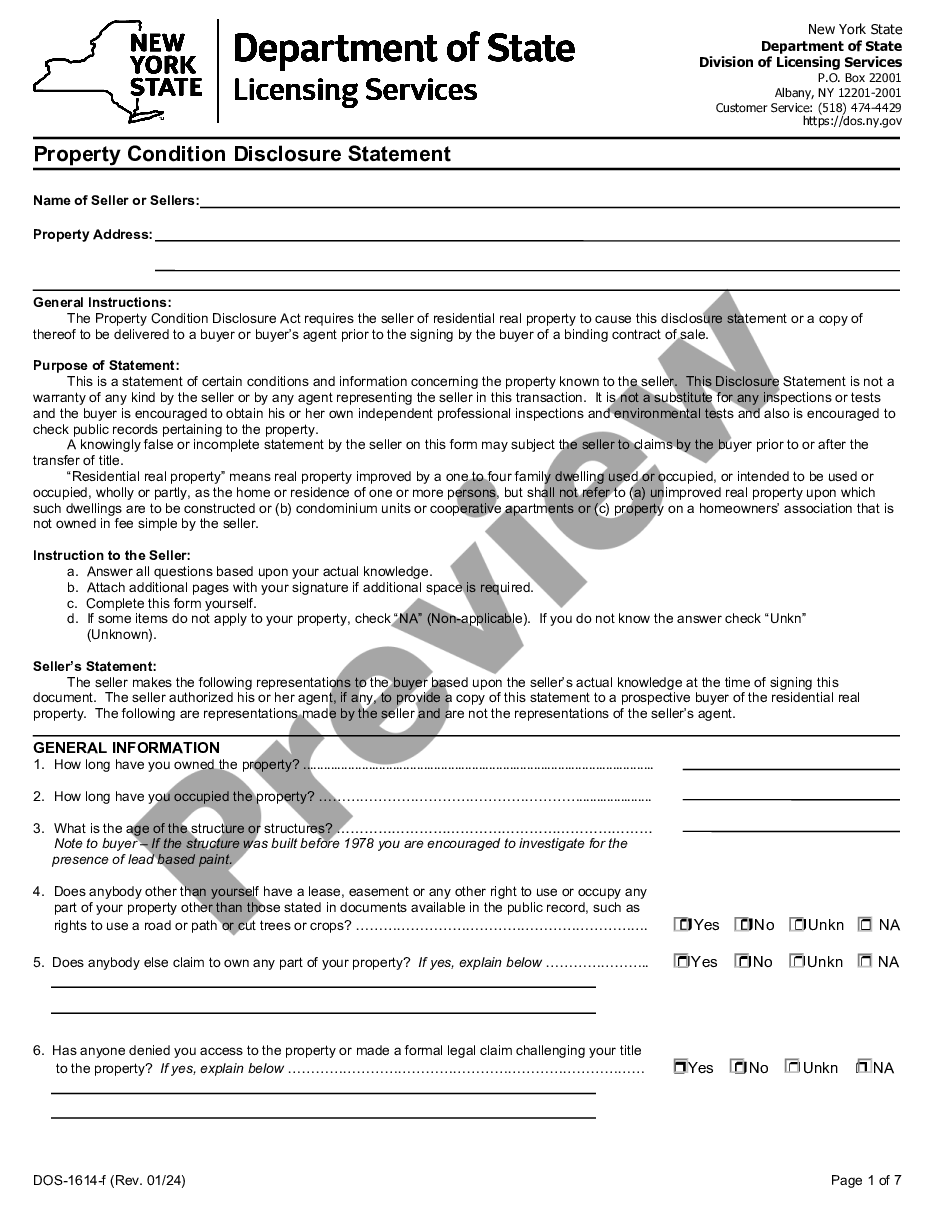

- Check the Preview mode and form description.

- Ensure you’ve chosen the right one that aligns with your needs and fully matches your local jurisdiction criteria.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your requirements, proceed to the next step.

- Click on the Buy Now button and choose your desired subscription plan. You must register for an account to access the library’s offerings.

Form popularity

FAQ

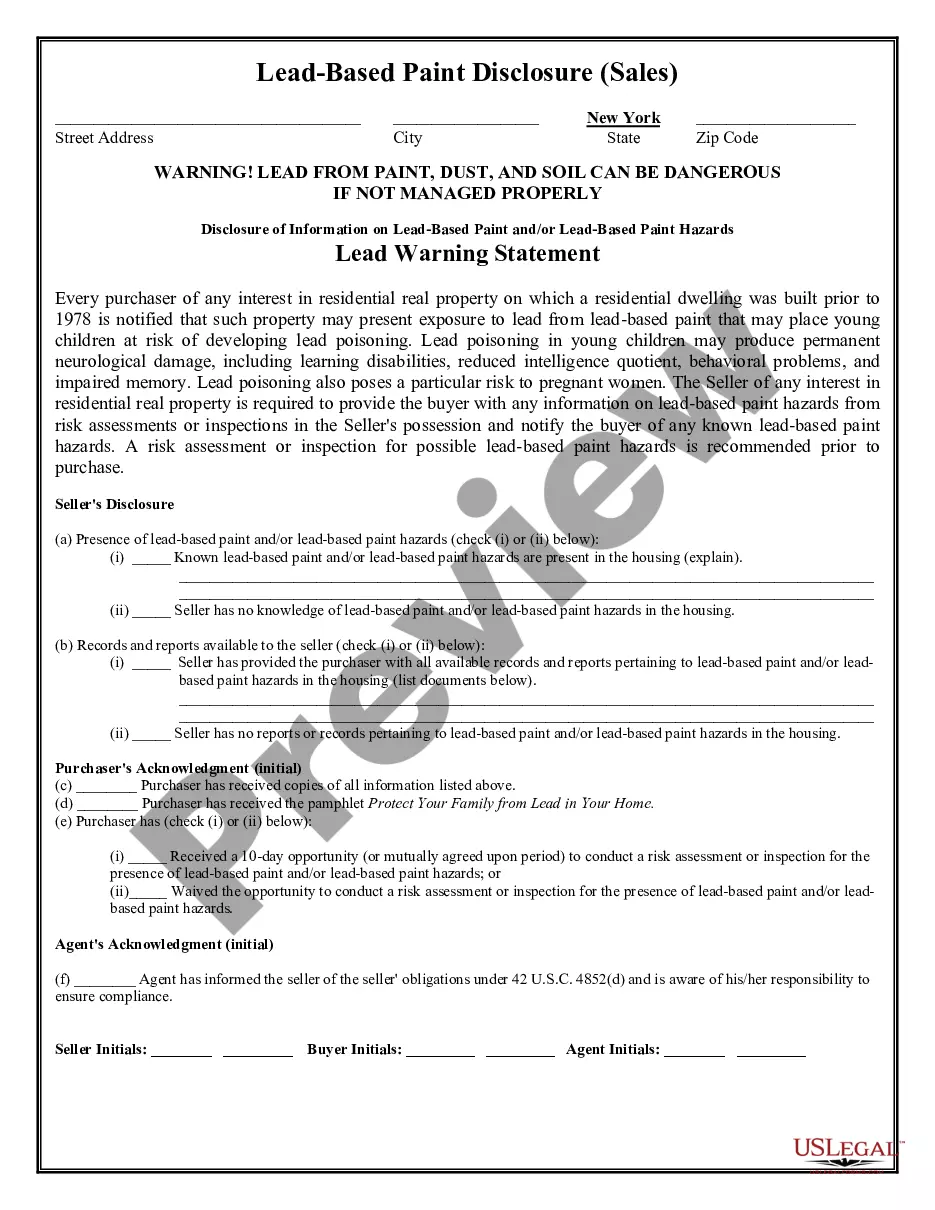

The deed. This document transfers the property from the seller to the buyer. State law dictates its form and language, but you can choose the form of ownership in which you take title: individually, in trust, in joint tenancy or in other tenancies.

In order to fully protect the buyer's interest, the deed must be recorded at the office of the clerk of the county where the land is located. Recording the deed puts everyone on notice of the deed.

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

In order to fully protect the buyer's interest, the deed must be recorded at the office of the clerk of the county where the land is located. Recording the deed puts everyone on notice of the deed.

The recorder is an official appointed to the county and serves the role of preparing, recording, and submitting documents. There is one recorder per county, and the buyer must record the deed at the recorder's office in the county in which the purchased property is situated.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

You can record property-related documents in person or online. To register a document, you must create a cover page in ACRIS, and submit document, supporting documents, and pay fees and taxes (if necessary). Learn more about recording documents, including required documentation and fees online.

The Office of the City Register records and maintains all property-related documents including deeds, mortgages and leases for every borough except for Staten Island.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.