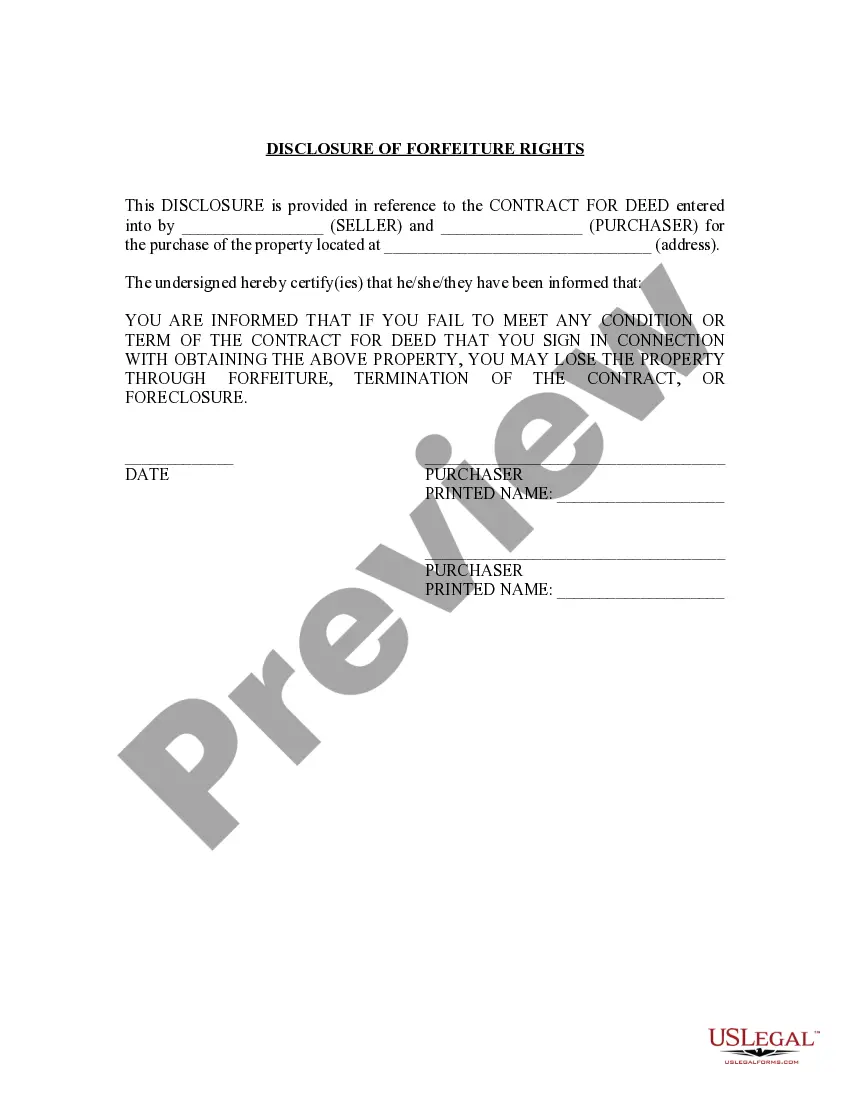

Syracuse New York Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

How to fill out New York Seller's Disclosure Of Forfeiture Rights For Contract For Deed?

If you are seeking a legitimate document, it’s impossible to find a superior service than the US Legal Forms website – likely the most extensive collections on the internet.

With this collection, you can discover a vast array of templates for business and personal uses by categories and regions, or keywords.

Utilizing our enhanced search feature, acquiring the most current Syracuse New York Seller's Disclosure of Forfeiture Rights for Contract for Deed is as simple as 1-2-3.

Obtain the document. Specify the format and store it on your device.

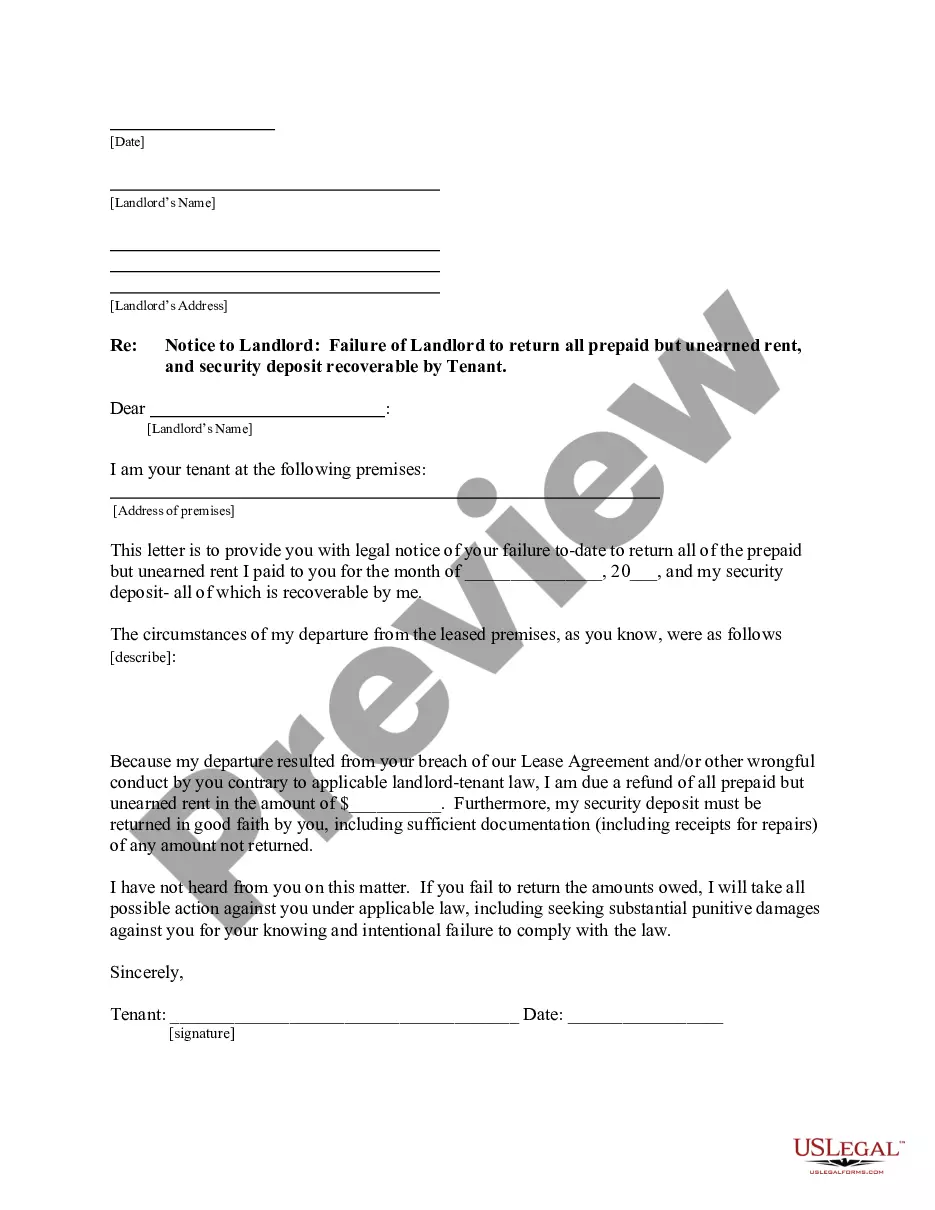

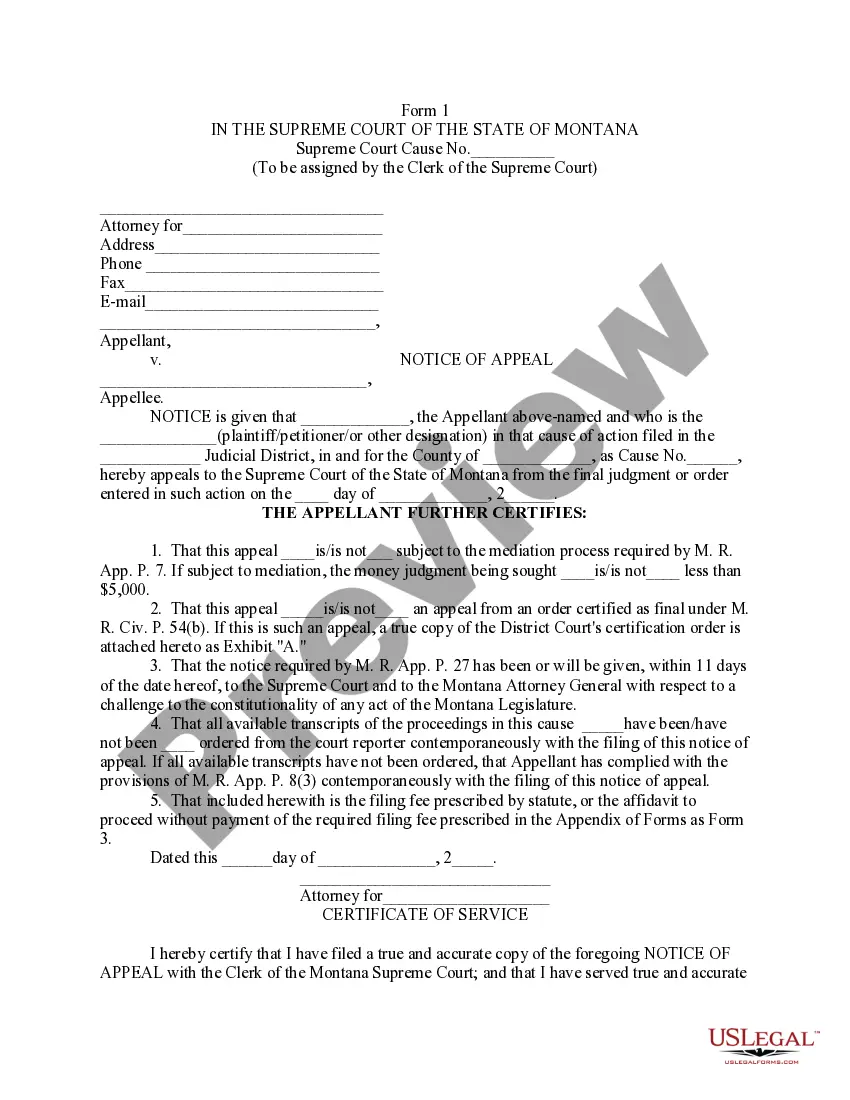

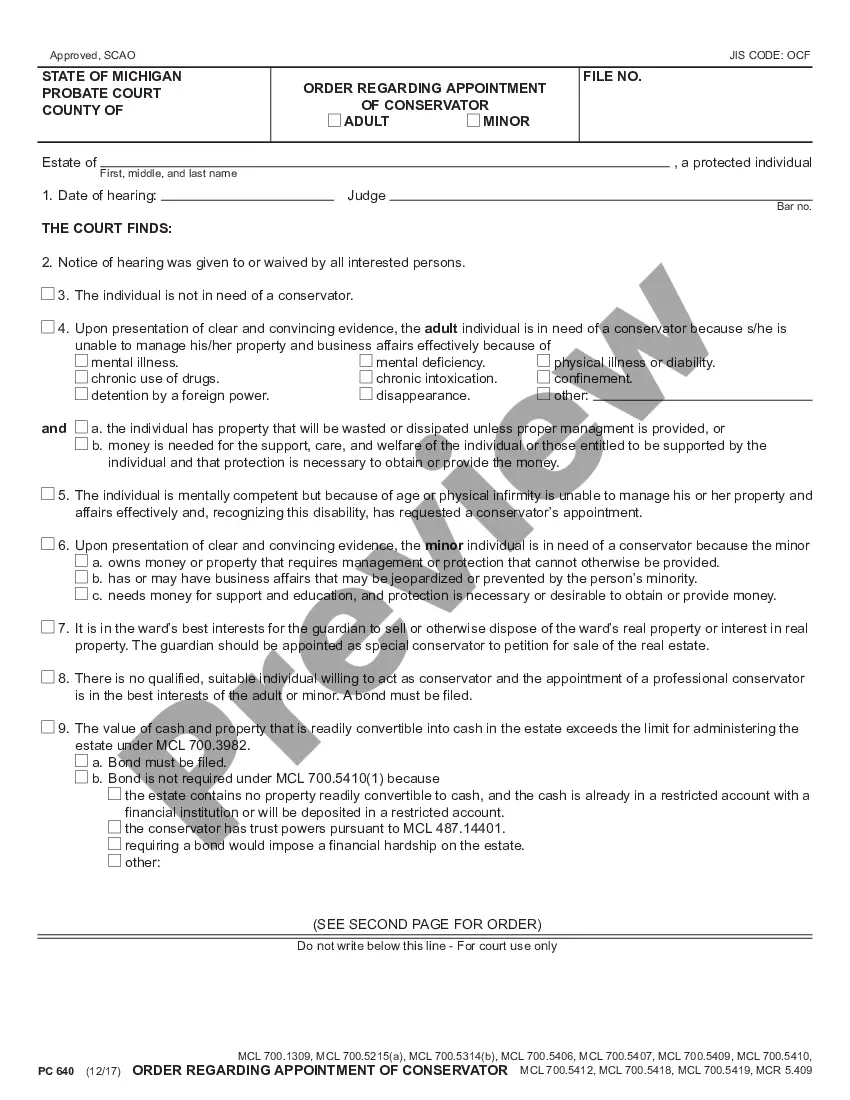

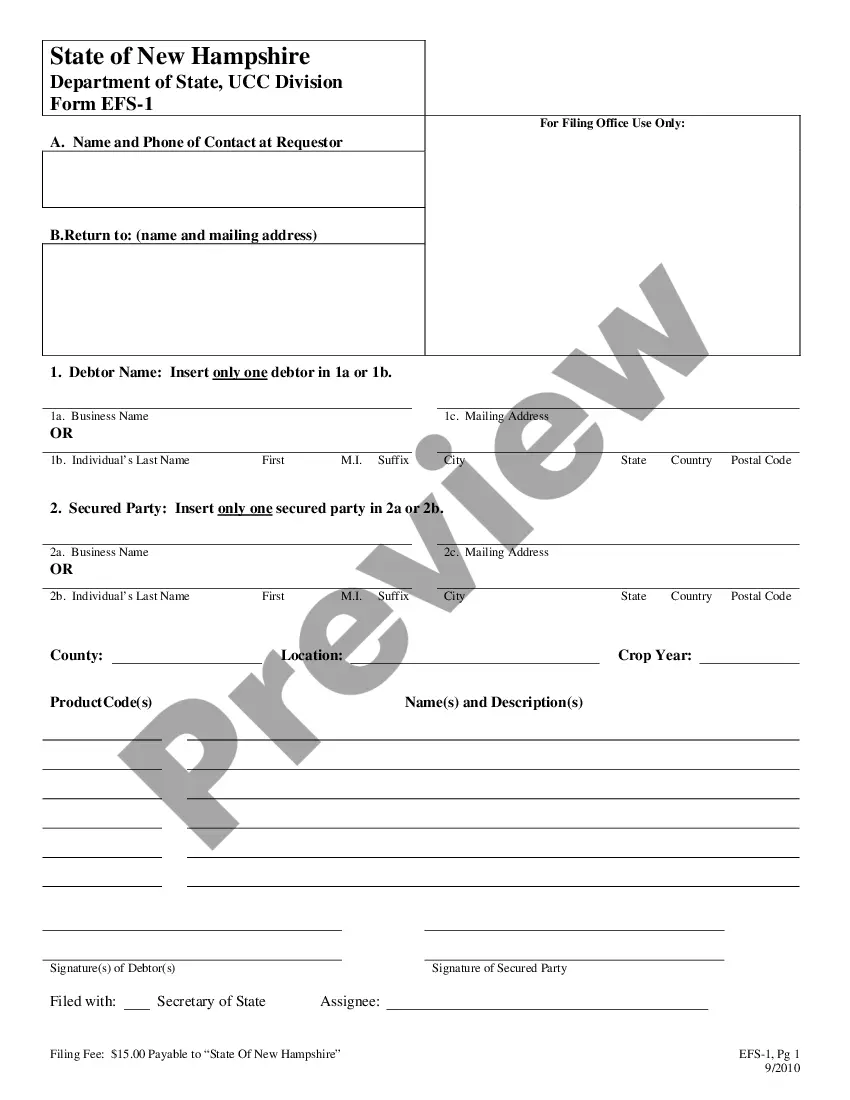

Make modifications. Complete, revise, print, and sign the obtained Syracuse New York Seller's Disclosure of Forfeiture Rights for Contract for Deed. Each template you save in your account has no expiration and belongs to you indefinitely. You can easily access them through the My documents section, so if you need an additional copy for further use or printing, you can return and download it again anytime you wish. Take advantage of the US Legal Forms extensive collection to access the Syracuse New York Seller's Disclosure of Forfeiture Rights for Contract for Deed you were searching for along with a plethora of other specialized and state-specific templates all in one location!

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Syracuse New York Seller's Disclosure of Forfeiture Rights for Contract for Deed is to Log In to your account and click the Download button.

- If you are accessing US Legal Forms for the first time, simply follow the steps below.

- Ensure you have selected the document you need. Review its description and use the Preview option to examine its details. If it doesn’t satisfy your requirements, utilize the Search option located near the top of the page to locate the appropriate file.

- Verify your selection. Click the Buy now button. Then, choose your desired subscription plan and provide details to set up an account.

- Complete the payment process. Use your credit card or PayPal account to finalize the registration steps.

Form popularity

FAQ

The Property Condition Disclosure Act requires the seller of residential real property to cause this disclosure statement or a copy thereof to be delivered to a buyer or buyer's agent prior to the signing by the buyer of a binding contract of sale.

New York law requires you to disclose known home defects to the buyer. Under today's law, you?as a New York home seller?could be found liable to a buyer for having failed to disclose certain property conditions, or defects, in the course of the sale.

Transfers made by court order, default, divorce, and by government entities are exempt from the disclosure requirement. Sellers with exempt property should fill out an exemption certificate provided by the Delaware real estate commission.

A seller is required to provide the TDS even when selling property without an agent, such as in a ?for sale by owner? transaction. The TDS also must be provided for sales of a new residential property that is not part of a subdivision, such as a new home or a new four-unit building being built on a lot.

Which of these transactions in California is exempt from agency disclosure requirements? Agency disclosure is not required for transactions involving residential properties with five or more units, as these are exempt from this disclosure requirement.

The Transfer Disclosure Statement (TDS) is required in the state of California unless the seller (or transferor) meets one of the following conditions: Court-ordered sales such as probate sales, foreclosure sales, sale by bankruptcy trustee, eminent domain.

If a property is transferred from one spouse to another during a divorce, no disclosure is required. Similarly, if the property is being transferred along close family lines (even without a divorce), then no disclosure is required. 4. Dwelling.

New York state law Section 462 requires all sellers to disclose known material defects to buyers, including: Material defects in electrical and other systems. Termite and asbestos conditions. Homeowners' association rules.