Las Vegas Nevada Revocation of Living Trust

Description

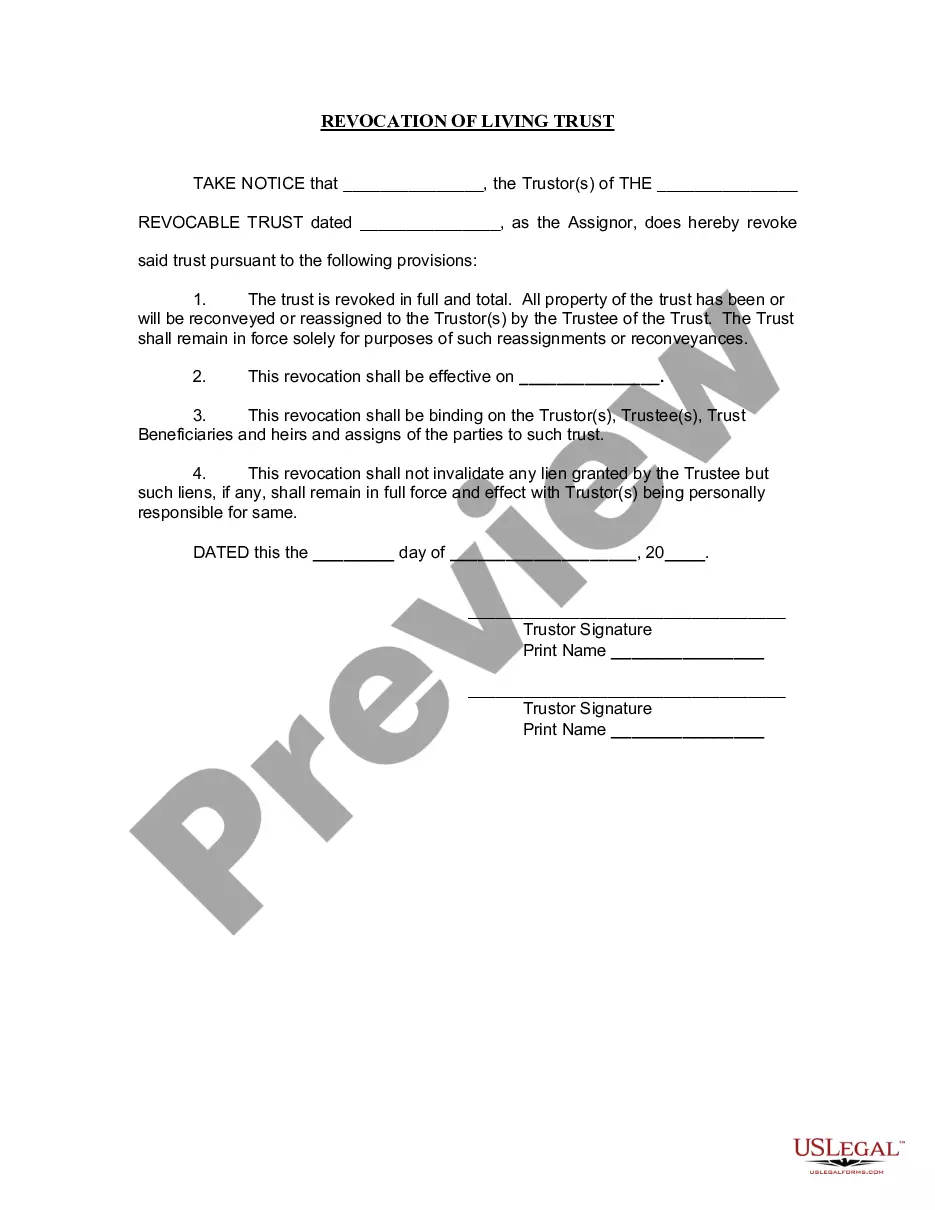

How to fill out Las Vegas Nevada Revocation Of Living Trust?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is an online collection comprising over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the paperwork is effectively categorized by usage area and jurisdictional types, making it as simple as ABC to find the Las Vegas Nevada Revocation of Living Trust.

Maintaining organized paperwork that complies with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates for any situation readily available!

- Review the Preview mode and document description.

- Ensure you’ve chosen the accurate one that aligns with your needs and fully meets your local jurisdiction prerequisites.

- Seek an alternative template if necessary.

- Should you detect any discrepancies, utilize the Search tab above to locate the appropriate one.

- If it fits your needs, proceed to the subsequent step.

Form popularity

FAQ

Should I Record My Trust? The Clark County, Nevada, Recorder's Office (which serves Las Vegas, Henderson, Boulder City, North Las Vegas, Mesquite among other towns) will accept your trust for filing if you want. It's your choice whether to record the trust or not.

The trust is fully valid. It only comes to an end when the settlor fully revokes it.

Challenges to a Trust or Will in Nevada. A sibling, or another beneficiary of the trust, can challenge a trust or will in multiple ways. One way is to question whether the trust or will actually states what the decedent intended. A second way is to question the trust's administration.

You can completely undo the trust if you decide the arrangement isn't working for you after all. But all a revocable trust can do for you is avoid probate of the property it holds when you die. You can name a successor trustee to take over management of the trust for you if you should become incompetent.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

(a) A noncharitable irrevocable trust may be terminated upon consent of all of the beneficiaries if the court concludes that continuance of the trust is not necessary to achieve any material purpose of the trust.

An irrevocable trust cannot be revoked or changed. But the difference goes far beyond that fact. Revocable trusts and irrevocable trusts serve very different purposes in estate planning.

A Nevada Revocable Living Trust prevents your estate from having to be submitted to the probate process primarily because the Revocable Living Trust is a separate legal entity created during your life to hold your estate assets. However, you still control everything (unless you become incapacitated/pass away).

Privacy is one of the key benefits of a living trust Nevada. A will becomes public record when it goes through probate. A trust does not become public record. Your assets, beneficiaries, and the terms of the trust remain private.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.