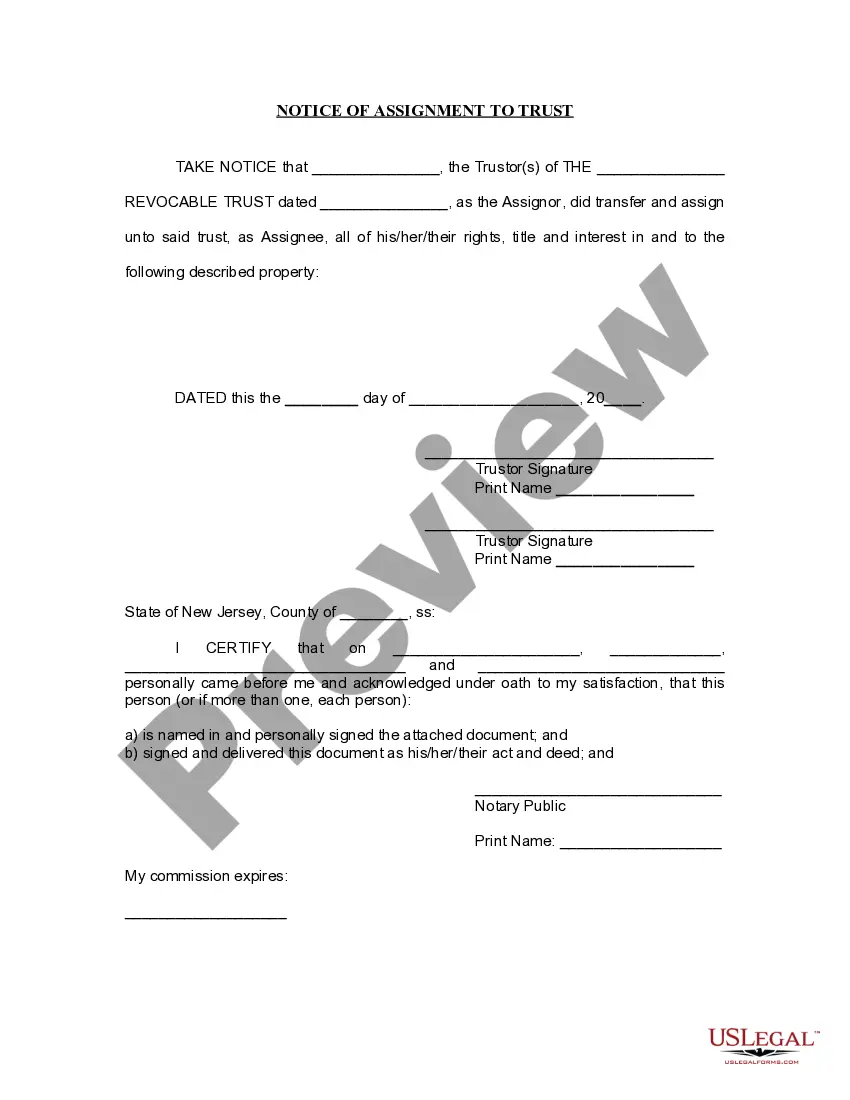

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Las Vegas, Nevada Notice of Assignment to Living Trust is a legal document that serves as an official notice of transferring ownership or assignment of assets to a living trust. This process ensures that individuals' assets are protected and managed according to their preferences, even during their lifetime or in the event of incapacitation. By creating a living trust, individuals can safeguard their estates and ensure a smooth transition of assets to chosen beneficiaries without the need for probate court proceedings. The Las Vegas, Nevada Notice of Assignment to Living Trust outlines the specific details of asset transfer, including property, financial accounts, investments, and personal belongings, to be held within the trust. When it comes to different types of Las Vegas, Nevada Notice of Assignment to Living Trust, the document may vary based on the nature and complexity of the assets being transferred. Some common variations include: 1. Real Estate Notice of Assignment to Living Trust: This type of notice specifically focuses on transferring ownership of real property, such as residential homes, vacation properties, or commercial buildings, into a living trust. 2. Financial Account Assignment Notice: In this case, the notice emphasizes the transfer of financial accounts, such as bank accounts, retirement plans, stocks, bonds, or mutual funds, into the living trust. 3. Personal Property Assignment Notice: This type of notice pertains to assets like vehicles, artwork, collectibles, jewelry, and any other personal belongings that the granter wishes to include within the living trust. 4. Business Assets Assignment Notice: If a business owner wants to transfer their business ownership interests, intellectual property rights, or other business assets into the living trust, this specific notice is utilized. Regardless of the type of Las Vegas, Nevada Notice of Assignment to Living Trust, the document typically includes essential information such as the granter's name, address, and identification details, the appointed trustee(s), a comprehensive list of assets being assigned, and any specific instructions or restrictions concerning the management of the assets within the living trust. It is important to consult with an experienced estate planning attorney in Las Vegas, Nevada, to ensure that the Notice of Assignment to Living Trust accurately reflects an individual's estate planning goals and complies with the state's legal requirements. Professional guidance will help guarantee that all relevant keywords and legal terminologies are appropriately included within the document for its utmost effectiveness.