Clark Nevada Assignment to Living Trust

Description

How to fill out Nevada Assignment To Living Trust?

If you have previously used our service, Log In to your account and download the Clark Nevada Assignment to Living Trust onto your device by clicking the Download button. Ensure your subscription is current. If it isn't, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have uninterrupted access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to quickly locate and save any template for your personal or business needs!

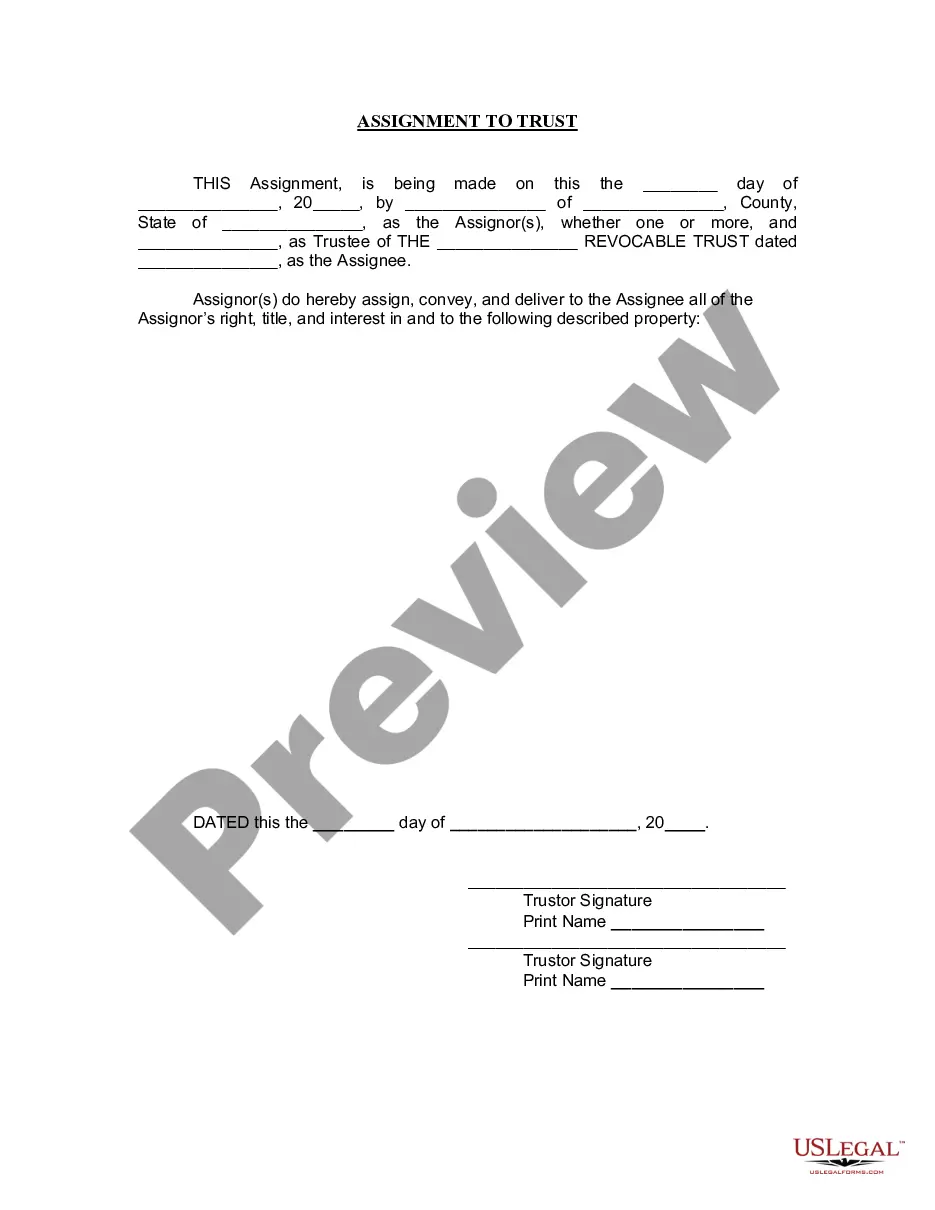

- Confirm you’ve located the right document. Read the description and utilize the Preview option, if accessible, to verify if it satisfies your requirements. If it doesn’t suit you, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Clark Nevada Assignment to Living Trust. Select the file format for your document and store it on your device.

- Complete your example. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The downside of a living trust, particularly concerning the Clark Nevada Assignment to Living Trust, is that it may not provide the same level of court protection as a will. In some cases, if you do not fund your trust correctly, your assets may not bypass probate. Additionally, creating a living trust can involve initial setup costs and ongoing maintenance. While they offer many benefits, understanding these potential drawbacks is crucial for effective estate planning.

To get a living trust in Nevada, you can create the trust document yourself using tools from platforms like US Legal Forms, or you can consult an attorney. The Clark Nevada Assignment to Living Trust allows you to specify how your assets will be managed during your lifetime and distributed after your passing. Begin by outlining your wishes, and then ensure the trust is properly executed to validate it.

Transferring property into a trust in Nevada involves executing a new deed that names the trust as the owner. This process is crucial for maximizing the benefits of your Clark Nevada Assignment to Living Trust. It is recommended to consult with a legal professional to ensure that all documentation is correct and compliant with state laws.

No, trusts are not public record in Nevada. This means that details regarding your Clark Nevada Assignment to Living Trust remain private. Only interested parties, such as beneficiaries, can access this information, ensuring your estate plan stays confidential.

In Nevada, a trust does not need to be filed with any state agency. However, it is essential to maintain proper documentation to support the Clark Nevada Assignment to Living Trust. You will want to keep your trust documents in a safe place and provide copies to relevant parties, such as beneficiaries or financial institutions.

A deed is a legal document that transfers ownership of real property, while an assignment refers to transferring assets or interests into a trust. When you create a Clark Nevada Assignment to Living Trust, you utilize both documents—deeds for property and assignments for other assets. Understanding this distinction helps ensure your estate plan is comprehensive and properly executed.

An assignment to a trust is the process of transferring ownership of assets to the trust. This step is crucial for ensuring that your assets are managed according to your wishes. By completing a Clark Nevada Assignment to Living Trust, you help streamline the distribution of your assets, reduce potential probate issues, and maintain privacy for your estate.

In Nevada, a living trust does not need to be recorded with the county. Instead, it is a private document held by the trustee. However, if your trust holds real estate, it is advisable to prepare a deed to formally transfer ownership. This process, known as Clark Nevada Assignment to Living Trust, ensures your assets are effectively managed.

Yes, you can write your own trust in Nevada. While many people feel confident in drafting their own documents, it is essential to be aware of the specific requirements for a valid Clark Nevada Assignment to Living Trust. Using templates or services provided by platforms like USLegalForms can help ensure that your trust meets all state regulations and reflects your intentions clearly.

One significant mistake parents often make is failing to fund the trust adequately. Without proper funding, a Clark Nevada Assignment to Living Trust does not serve its purpose, which can lead to complications in the future. Parents should carefully consider which assets to include and ensure they regularly review and update the trust as needed to keep it effective.