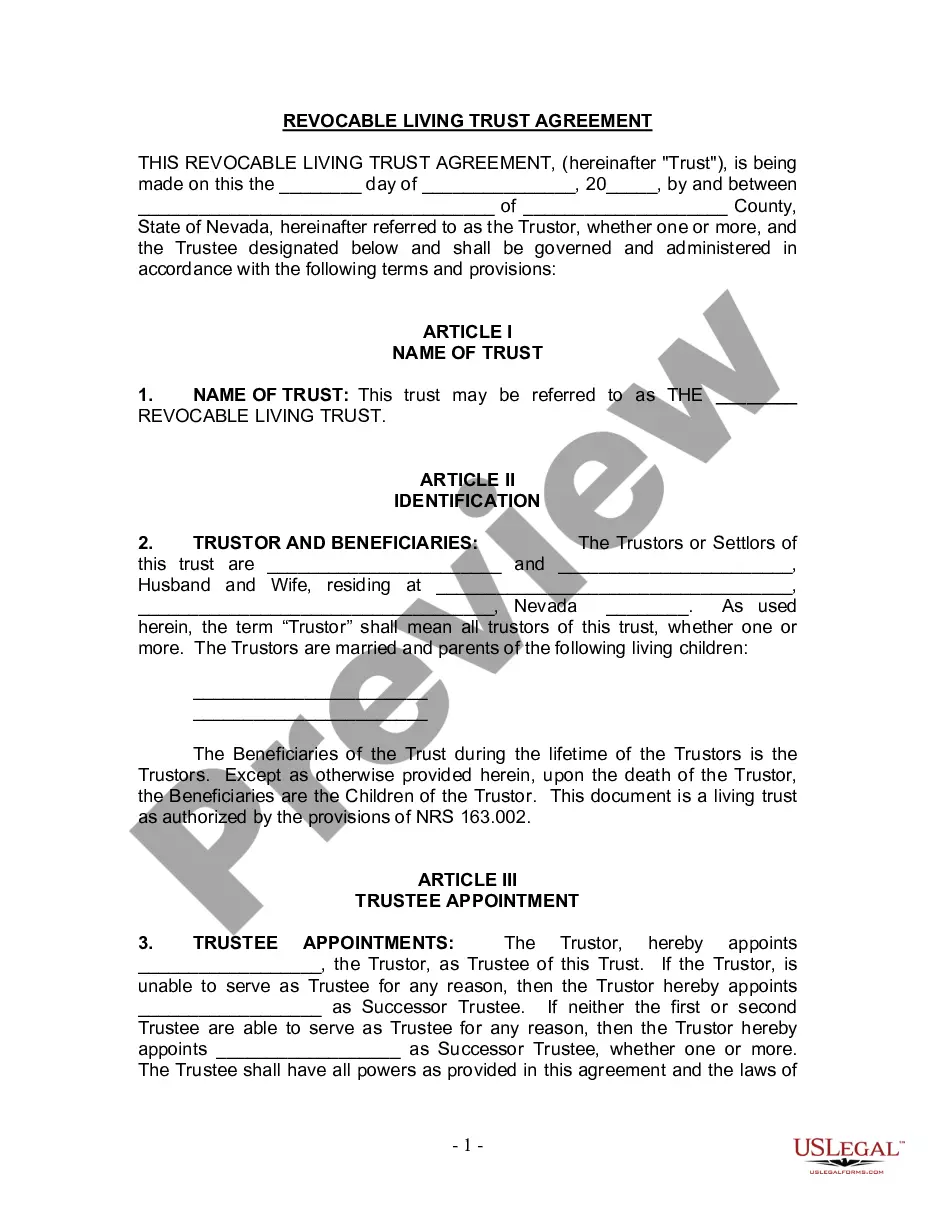

Las Vegas Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of social or professional standing, completing legal-related documents is an unfortunate requirement in today's business landscape.

Frequently, it’s nearly impossible for an individual without a legal background to draft such documents from scratch, primarily due to the intricate vocabulary and legal intricacies they encompass.

This is where US Legal Forms steps in to help.

Confirm that the document you selected is valid for your jurisdiction, as regulations in one state or county may not apply to another.

Review the document and read through a brief overview (if available) outlining the situations for which the document can be utilized.

- Our platform offers a vast repository containing over 85,000 ready-to-use state-specific documents that are suitable for nearly any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to save time by using our DIY forms.

- Whether you need the Las Vegas Nevada Living Trust for Husband and Wife with Minor and/or Adult Children or any other documentation that is appropriate in your state or county, US Legal Forms has everything you need.

- Here’s a guide on how to obtain the Las Vegas Nevada Living Trust for Husband and Wife with Minor and/or Adult Children in moments using our reliable service.

- If you’re already a member, simply Log In to your account to retrieve the required form.

- If you’re not familiar with our collection, be sure to follow these steps before downloading the Las Vegas Nevada Living Trust for Husband and Wife with Minor and/or Adult Children.

Form popularity

FAQ

The cost of a Nevada trust formation typically runs $2995 to $3995. In addition, the trustee fees start at about $2500 per year. Alternatively, some trustees charge based on a percent of assets the trust holds.

Nevada Asset Protection Trust The Nevada Spendthrift Trust Act allows for the provision of self-settled spendthrift trusts. The cost of a Nevada trust formation typically runs $2995 to $3995.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

A married couple has many reasons to establish a living trust. A living trust can help their estate survive onerous estate taxes, avoid probate if they both die, and side step the need for a conservatorship if either one (or both) become incapacitated.

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

A joint revocable trust is probably the easiest form of living revocable trusts for a married couple to use. A joint revocable trust merges the estate planning of a couple using a single trust document. Joint trusts and individual trusts each have advantages and disadvantages.

A Nevada Revocable Living Trust prevents your estate from having to be submitted to the probate process primarily because the Revocable Living Trust is a separate legal entity created during your life to hold your estate assets. However, you still control everything (unless you become incapacitated/pass away).

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

?When it comes to cost, a basic trust plan may run anywhere from $1,600 to $3,000, possibly more depending on the complexity of the trust,? states the editors of Money magazine. At Cassady Law Offices, we offer our clients a basic revocable living trust plan for only $995. There are no hidden costs or fees.