Las Vegas Nevada Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Nevada Dissolution Package To Dissolve Limited Liability Company LLC?

We consistently aim to reduce or evade legal repercussions when navigating complex legal or financial matters.

To achieve this, we subscribe to legal services that are typically quite expensive.

However, not every legal issue is as intricate.

Many can be addressed independently.

Utilize US Legal Forms whenever you need to find and obtain the Las Vegas Nevada Dissolution Package to Dissolve Limited Liability Company LLC or any other document swiftly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering a range of topics, from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your matters independently without consulting a lawyer.

- We provide access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly streamlines the search process.

Form popularity

FAQ

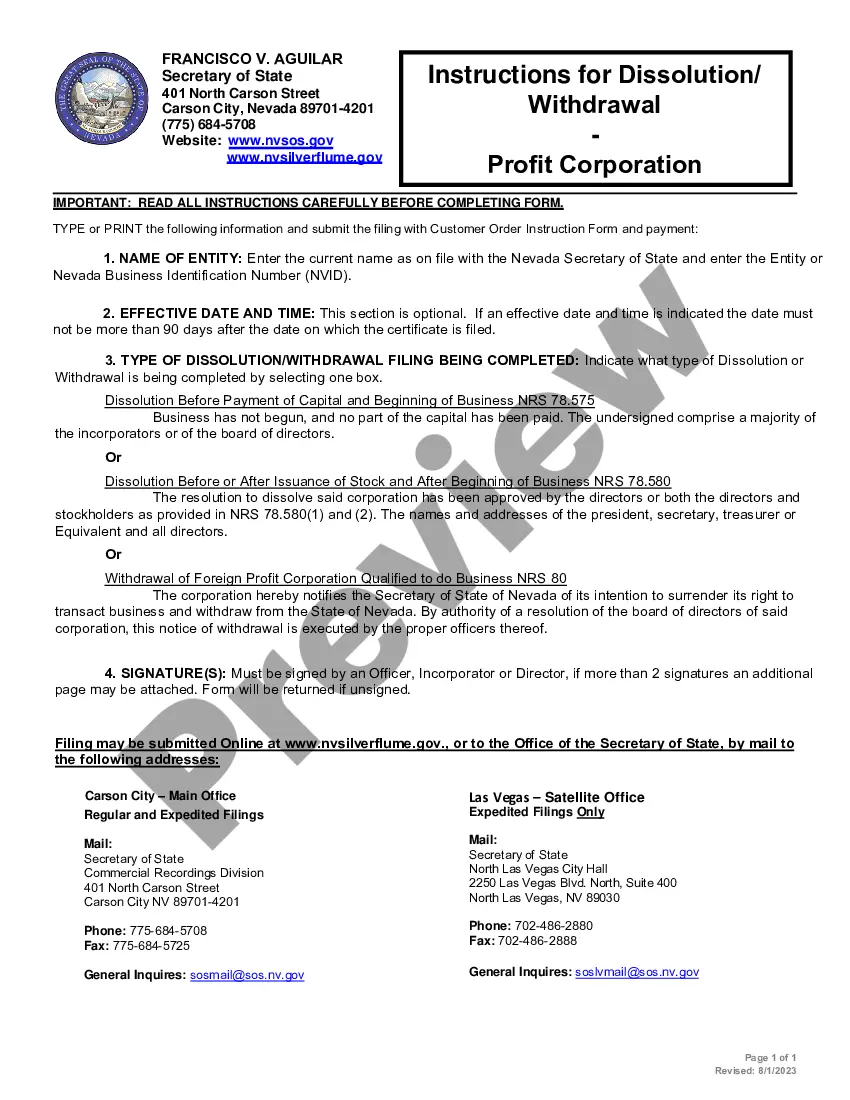

To dissolve your domestic LLC in Nevada, you must provide the completed Articles of Dissolution For a Nevada limited liability company and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

There is a $100 fee to file the articles of dissolution. The document should be processed within about one week. You can pay additional fees for expedited processing. Nevada does not require you to obtain tax clearance from the Department of Texation in order to dissolve your LLC.

To dissolve your domestic LLC in Nevada, you must provide the completed Articles of Dissolution For a Nevada limited liability company and Customer Order Instructions forms to the Secretary of State by mail, fax, email or in person, along with the filing fee.

The process to close Nevada LLC involves filing of dissolution documents with the secretary of state along with liquidating your business assets and settling any liabilities. The process for dissolving Nevada LLC will take 7-10 business days from the day you file the proper documents.

Nevada LLC Processing Time Normally, it takes five days to get the new LLC set up. Expect an additional 2-3 days for mailing of documents. The Nevada Secretary of State does offer expedited service for filings, but it will cost you. It takes $125 to expedite processing time to 24 hours.

There is a $100 fee to file the articles of dissolution. The document should be processed within about one week. You can pay additional fees for expedited processing. Nevada does not require you to obtain tax clearance from the Department of Texation in order to dissolve your LLC.

Three Required Steps to Closing a Business in Nevada Voter Approval. Before you begin the process of dissolving your business, you must get an approval by vote from your shareholders, directors, or managers.IRS Forms.Certificate of Dissolution.

To dissolve a corporation or LLC in Nevada, there is a $100 filing fee required. Expedited service within 24 working hours is available for an additional $125 fee. Expedited service within two hours is available for an additional $500 fee.