Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Nevada Dissolution Package To Dissolve Limited Liability Company LLC?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents for both personal and business requirements as well as any real-world situations.

All the files are appropriately categorized by usage area and legal jurisdictions, making it straightforward to find the Clark Nevada Dissolution Package to dissolve Limited Liability Company LLC.

Maintaining organized paperwork that complies with legal standards is of utmost significance. Leverage the US Legal Forms archive to consistently have crucial document templates available for any needs right at your fingertips!

- If you are already accustomed to our collection and have navigated it before, acquiring the Clark Nevada Dissolution Package to dissolve Limited Liability Company LLC takes merely a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- This procedure will require just a few extra steps to finalize for first-time users.

- Follow the instructions below to initiate the process with the largest online form compilation.

- Examine the Preview mode and document description. Ensure you’ve chosen the right one that fulfills your needs and aligns with your local jurisdiction regulations.

Form popularity

FAQ

After you dissolve your LLC, you need to manage certain final tasks. This may include settling debts, distributing remaining assets, and notifying any stakeholders. The Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC guides you through these steps, ensuring you meet all requirements. By handling these appropriately, you can finalize your LLC's affairs with confidence and certainty.

Dissolution of a limited liability corporation (LLC) refers to the formal process of shutting down your business. This process involves filing specific paperwork and settling any outstanding obligations. By using the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC, you simplify this process significantly. It helps ensure that your dissolution complies with state laws and that all necessary steps are completed efficiently.

If your LLC gets dissolved, it loses its legal status and cannot conduct business or enter contracts. However, you can use the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC to navigate the reinstatement process effectively. It's essential to address any outstanding obligations, as personal liability might arise in certain cases. By acting quickly, you can protect your interests and restore your LLC's functionality.

Dissolving an LLC in South Dakota involves submitting a Certificate of Dissolution to the state. You should also complete your tax obligations and notify all creditors and members about the dissolution. While this process differs from Nevada, using services like the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC can provide valuable insights on how to handle the dissolution effectively. This guidance ensures that you comply with all necessary regulations, regardless of the state.

Yes, you can close your LLC yourself if you follow the proper steps outlined by the state of Nevada. This includes filing the necessary paperwork and ensuring all obligations are met. The Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC streamlines this process for you, providing clear instructions and essential forms. Opting for this package saves you time and reduces the chances of overlooking critical steps.

Dissolving an LLC can lead to various cons, such as losing limited liability protection and the ability to conduct business under your LLC's name. It may also result in the inability to recover some of your investments, as assets may need to be liquidated. Understanding these drawbacks becomes easier with the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC, which clarifies the implications of dissolution. Knowing all the facts helps you make informed decisions.

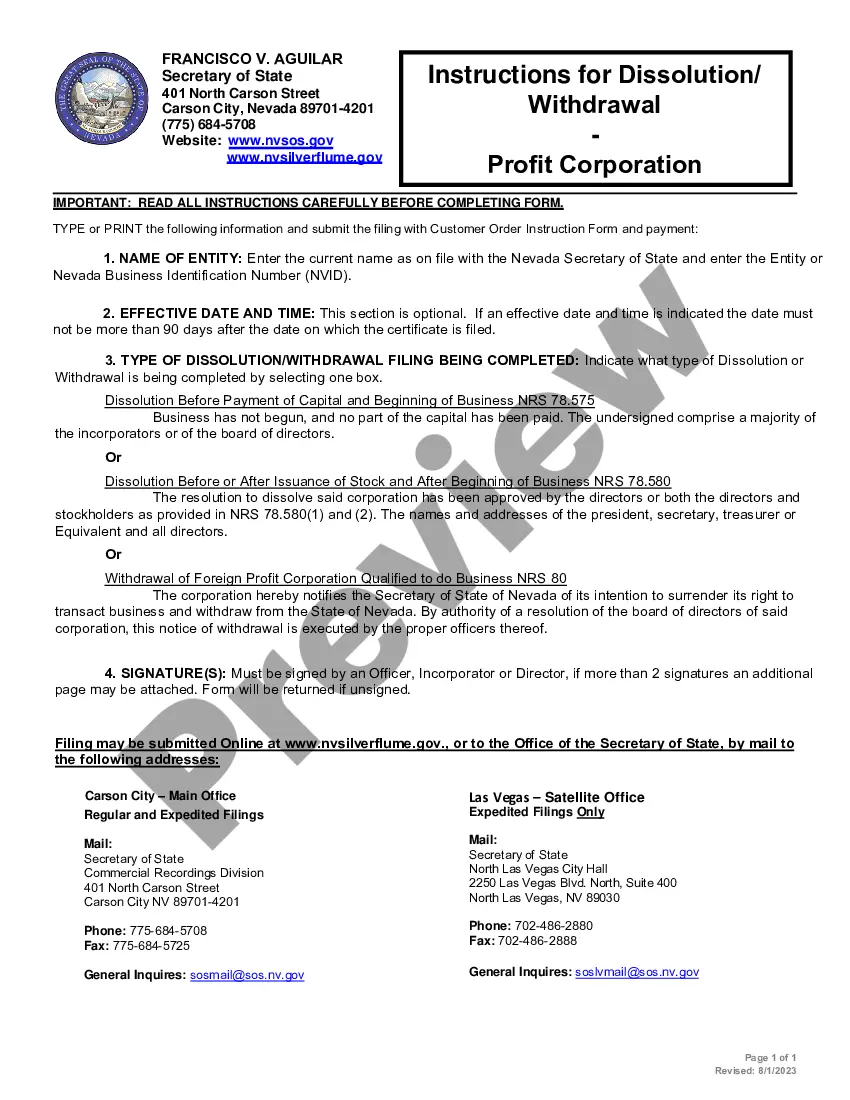

To dissolve an LLC in Nevada, you must first hold a meeting with the members to approve the dissolution. Next, you need to file the Articles of Dissolution with the Nevada Secretary of State, ensuring that all tax obligations are settled. Utilizing the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC simplifies this process, providing you with essential forms and guidance. By following these steps, you can successfully close your LLC.

Upon dissolution, an LLC stops conducting business and needs to handle its outstanding debts and obligations. The members may also need to distribute any remaining assets. Our Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC provides a straightforward way to navigate through this process, ensuring that you address all legal requirements and protect your interests.

Yes, notifying the IRS is necessary when you close your LLC, as they need to be aware of your business status for tax purposes. You must file the final tax return and indicate that it is the last return for your LLC. Using the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC can help ensure that you meet all IRS requirements efficiently.

Resolving a dissolved LLC involves taking specific steps to restore its good standing. You generally need to follow the reactivation process set by your state’s Secretary of State, which may include filing required paperwork and paying any outstanding fees. Utilizing the Clark Nevada Dissolution Package to Dissolve Limited Liability Company LLC can make this process smoother and more efficient.