Clark Nevada Sole Proprietor Coverage is a specific insurance policy designed exclusively for sole proprietors operating in Clark County, Nevada. This coverage protects the business owner from potential financial losses and liabilities that may arise during the course of operating as a sole proprietor. Sole proprietorship is the most common and simplest form of business ownership, where an individual operates a business as an individual. However, unlike other business entities, sole proprietors do not have separate legal personalities and are personally liable for all business debts, liabilities, and damages incurred. This is where Clark Nevada Sole Proprietor Coverage comes into play, as it helps safeguard the business and personal assets of the sole proprietor against unexpected events. There are different types of coverage that Clark Nevada Sole Proprietor Insurance offers to cater to the unique needs of sole proprietors. These may include: 1. General Liability Insurance: This coverage protects the sole proprietor from legal claims arising due to bodily injury, property damage, or personal injury caused by the business operations. It covers legal defense costs, settlements, and judgments awarded against the business. 2. Professional Liability Insurance: Also known as errors and omissions insurance, this coverage is essential for sole proprietors who provide professional services or advice. It protects against professional negligence claims, errors, or omissions that may result in financial losses for clients. 3. Commercial Property Insurance: This coverage safeguards the physical assets of the business, including buildings, equipment, inventory, and furniture, against damages caused by fire, theft, vandalism, or natural disasters like floods or earthquakes. 4. Business Interruption Insurance: In case of a covered event that leads to the temporary closure of the business, this insurance helps cover the lost income and ongoing expenses like rent, utilities, and employee salaries during the period of interruption. 5. Workers' Compensation Insurance: If the sole proprietor has employees, this coverage provides benefits for medical expenses and lost wages in the event of work-related injuries or illnesses to employees. 6. Commercial Auto Insurance: For sole proprietors who use vehicles for business purposes, commercial auto insurance provides coverage for accidents, damages, and liabilities arising from the use of owned or leased vehicles. 7. Cyber Liability Insurance: In the digital age, sole proprietors may be vulnerable to cyber risks and data breaches. This coverage helps cover the financial losses and liabilities when sensitive customer data is compromised. By obtaining Clark Nevada Sole Proprietor Coverage, sole proprietors can have peace of mind knowing that their personal and business assets are protected against unforeseen events. It is important to consult with an insurance professional to assess individual business needs and tailor the coverage accordingly.

Clark Nevada Sole Proprietor Coverage

Description

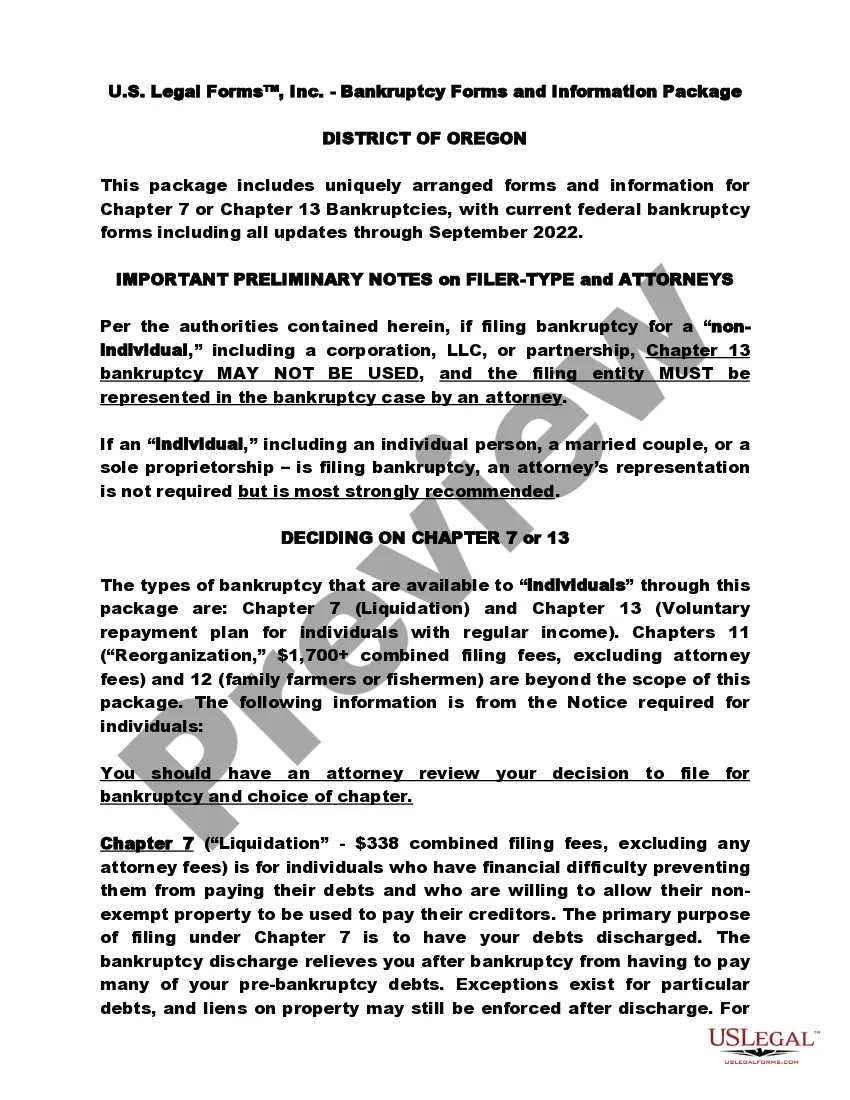

How to fill out Clark Nevada Sole Proprietor Coverage?

Are you looking for a reliable and affordable legal forms provider to buy the Clark Nevada Sole Proprietor Coverage? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of particular state and area.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Clark Nevada Sole Proprietor Coverage conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is good for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is done, download the Clark Nevada Sole Proprietor Coverage in any available format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal papers online once and for all.

Form popularity

FAQ

State law requires that every person or entity doing business in the state of Nevada obtain a business license annually. A business that meets the criteria shall not do business in the state of Nevada without the State Business License. Certain businesses may be exempt from the State Business License requirement.

Advantages of sole trading include that: you're the boss. you keep all the profits. start-up costs are low. you have maximum privacy. establishing and operating your business is simple. it's easy to change your legal structure later if circumstances change you can easily wind up your business.

Risk and reward ? A sole proprietor has complete ownership over the profits or losses from their firm's operations. Control ? The rights and responsibilities of a sole proprietorship lies solely with its owner. No other person can interfere in the business activities of a sole proprietor without prior permission.

What is the cost of a State Business License, and when is it due? The State Business License Fee is $500 for Corporations, and $200 for all other business types. The State Business License must be renewed annually.

How to Establish a Sole Proprietorship in Nevada Choose a business name. File a Fictitious Firm Name Certificate with county clerk. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

SOLE PROPRIETORSHIP Sole Proprietorships are not required to file formation documents with the Secretary of State's office. However, a Nevada State Business License or Notice of Exemption is required before conducting business in the state of Nevada.

Nevada law requires business owners with one or more employees in the State of Nevada to obtain and maintain workers' compensation coverage.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

Nevada nonprofit entities formed pursuant to NRS Chapter 82 and corporations sole formed pursuant to NRS Chapter 84 are specifically exempted from the requirements of the State Business License and are not required to maintain a state business license nor are they required to claim an exemption.

Minimal paperwork and low set-up costs are two major benefits of having a sole proprietorship. In addition, there is the ease of maintaining it. In fact, according to the SBA, it's the simplest and least expensive business type you can establish.

Interesting Questions

More info

Net. You may also want to check our directory of local and national agents. Will the Nevada State Contractors Board acknowledge receipt of my application? 15. Before I start a business, I need to know about insurance! Are all workers' compensation plans accepted for my company? □ Yes. Your employees (including independent contractors) must carry workers' compensation coverage. Is it cheaper to get workers' compensation? □ No. Workers' compensation premiums are typically between and 3% of your gross revenue every year. What if I'm a franchisee? □ Yes. You may use your franchise agreement if you want. The agreement is your contract that contains details of your liability insurance policy. Is there a minimum age to work in Nevada? □ Yes. You must be 18 years old to register with the Nevada Department of Labor. Workplace safety is my highest priority. How do I ensure my job is safe? □ Get an annual safety awareness training.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.