Clark Nevada Certificate of Trust by Individual

Description

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

How to fill out Nevada Certificate Of Trust By Individual?

If you have previously used our service, sign in to your account and download the Clark Nevada Certificate of Trust by Individual to your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to use them again. Use the US Legal Forms service to efficiently find and save any template for your personal or professional requirements!

- Make sure you’ve identified the correct document. Review the description and utilize the Preview option, if available, to verify if it meets your needs. If it doesn't meet your criteria, use the Search tab above to find the suitable one.

- Purchase the form. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and complete the payment. Enter your credit card information or opt for the PayPal option to finish the transaction.

- Obtain your Clark Nevada Certificate of Trust by Individual. Select the file format for your document and store it on your device.

- Complete your form. Print it out or use online professional editors to fill it in and sign it digitally.

Form popularity

FAQ

No, a certificate of trust is not required to be recorded in Nevada. However, it is often recommended to provide a certificate when dealing with third parties, such as banks or real estate brokers. Using the Clark Nevada Certificate of Trust by Individual helps streamline transactions and proves the trust's existence, making it easier for trustees to manage assets effectively.

In Nevada, typically, the individuals who can obtain a copy of a trust include the trust creator, also known as the grantor, and the current trustees. If you are a beneficiary of the trust, you also have the right to request a copy. Having access to the Clark Nevada Certificate of Trust by Individual allows these parties to understand the trust’s term and their rights within it.

Yes, you can create your own certificate of trust. However, it is important to ensure it meets all legal requirements in your state. The Clark Nevada Certificate of Trust by Individual should accurately reflect your intentions and comply with local laws. Utilizing resources like uslegalforms can help you draft a legally sound document with less hassle.

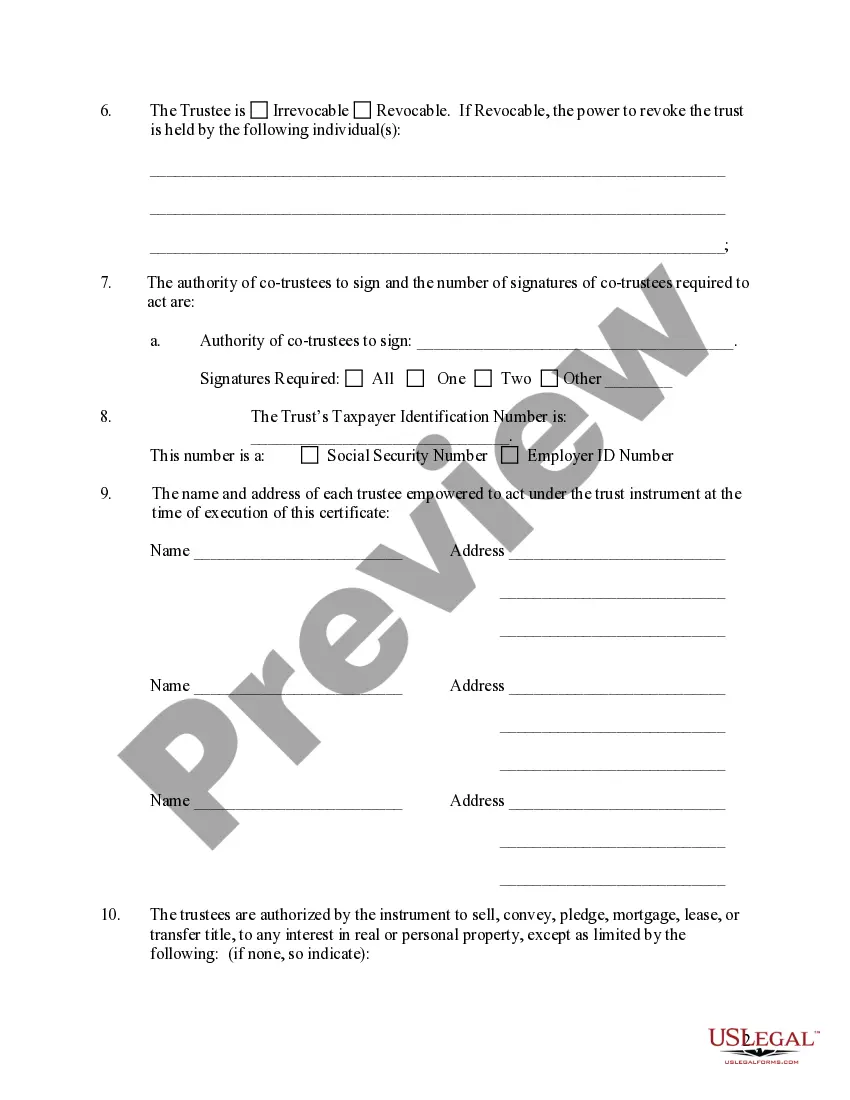

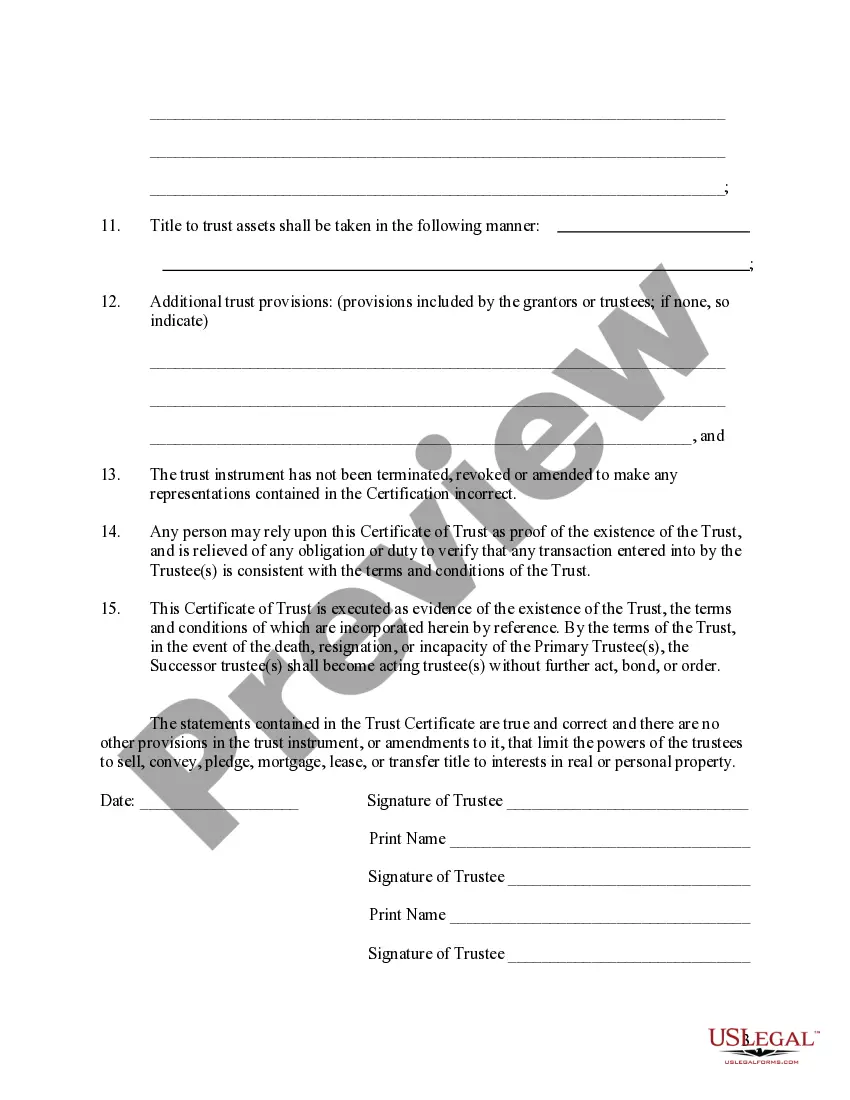

To fill out a certification of trust form, start by providing the trust's name, date of creation, and the names of the trustees. You will also need to include information about the beneficiaries and their rights. A well-prepared Clark Nevada Certificate of Trust by Individual ensures clarity. Using uslegalforms makes filling out this form more straightforward, offering guidance along the way.

Filling out a trust certification involves gathering all necessary details about the trust and its assets. You should include the trust's name, the trustee information, and the specific assets you wish to include in the Clark Nevada Certificate of Trust by Individual. Make sure to follow any state-specific requirements. Using a platform like uslegalforms can simplify this process with easy-to-follow templates.

One of the biggest mistakes parents make is failing to clearly outline their intentions in the Clark Nevada Certificate of Trust by Individual. Without clear guidelines, misunderstandings can arise among heirs. It's crucial to specify how assets will be managed and distributed. Consider seeking professional advice to ensure your trust fund meets your family's needs.

In most cases, a trust does not need to be filed in Nevada to be enforceable. The Clark Nevada Certificate of Trust by Individual functions independently from state filing requirements. However, if your trust holds real estate or engages in certain financial activities, relevant documents may need to be filed. Always stay informed about specific requirements for your situation to maintain compliance.

To obtain a Clark Nevada Certificate of Trust by Individual, you should prepare the trust document that outlines its terms and conditions. You can then fill out appropriate forms provided by platforms such as uSlegalforms, which simplify the creation and management of trust documents. Once you complete the required paperwork, you can request a certificate from the relevant institution, ensuring you have the documentation needed for your financial transactions.

In Nevada, trusts typically do not need to be recorded with a government office. However, certain documents related to the Clark Nevada Certificate of Trust by Individual may need to be filed with the county recorder if they involve real property. It's important to keep your trust documents organized and accessible, even if they are not officially recorded. This practice can ease management and execution of the trust.

Nevada does not impose a state income tax, making it favorable for trust holders. The Clark Nevada Certificate of Trust by Individual can help you manage income generated from your trust efficiently. Federal taxes may still apply, but the lack of state tax burden can provide substantial savings for individuals. Consult with a tax professional to ensure compliance with federal tax obligations.