Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out Nevada Assignment Of Deed Of Trust By Corporate Mortgage Holder?

Finding verified templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and business requirements and any real-world circumstances.

All the files are systematically categorized by area of application and jurisdiction, making it simple and swift to find the Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder.

Utilize the US Legal Forms library to maintain orderly documentation that complies with legal standards, ensuring you always have vital document templates readily available!

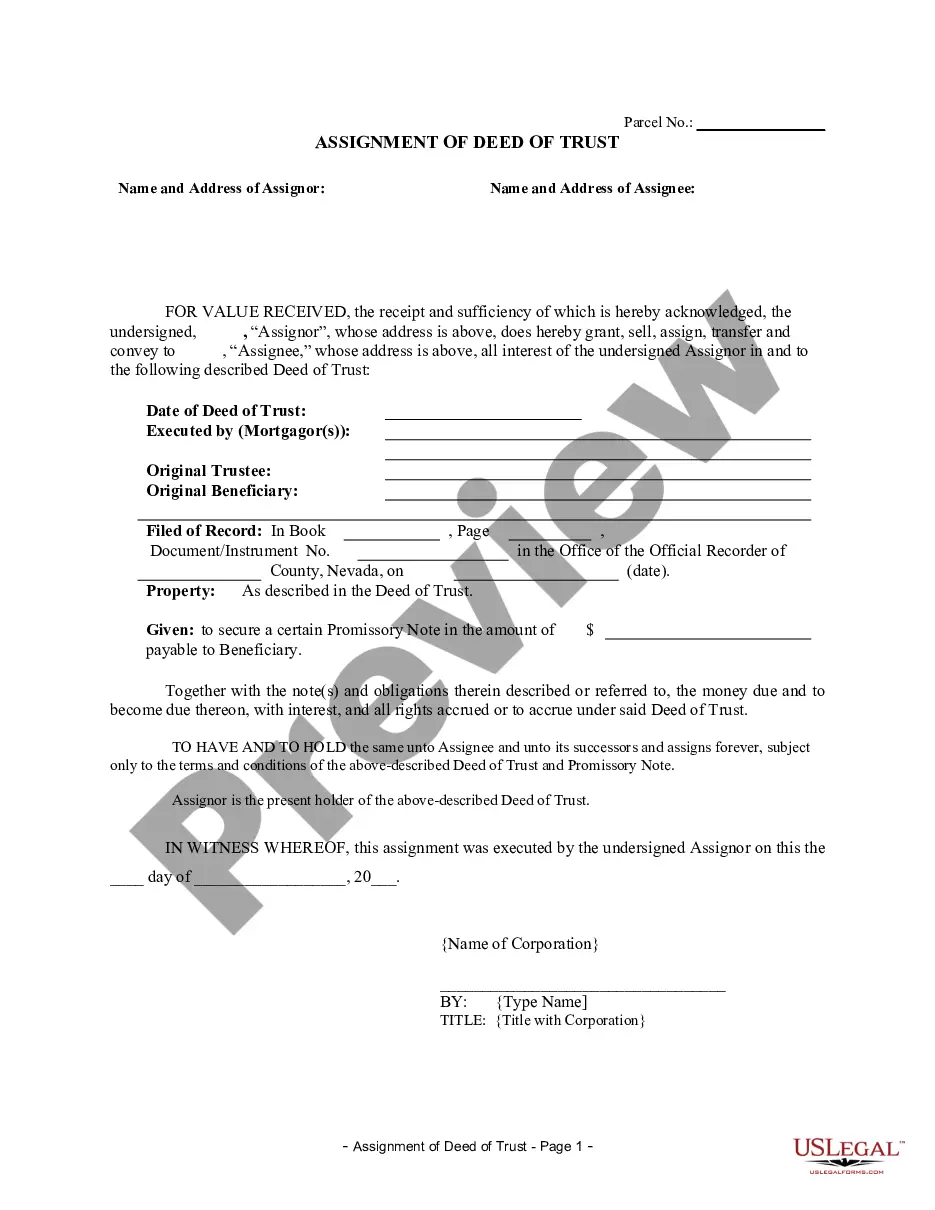

- Examine the Preview mode and document description.

- Ensure you’ve selected the right one that fulfills your needs and fully aligns with your local jurisdiction criteria.

- Search for an alternative template if necessary.

- If you encounter any discrepancies, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

Generally, your mortgage company has a copy of your deed of trust. They retain this document as long as your mortgage is active. If you have concerns or need specific details about how this relates to a Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder, reach out to your mortgage company for clarification. Their support can help you understand your obligations and rights.

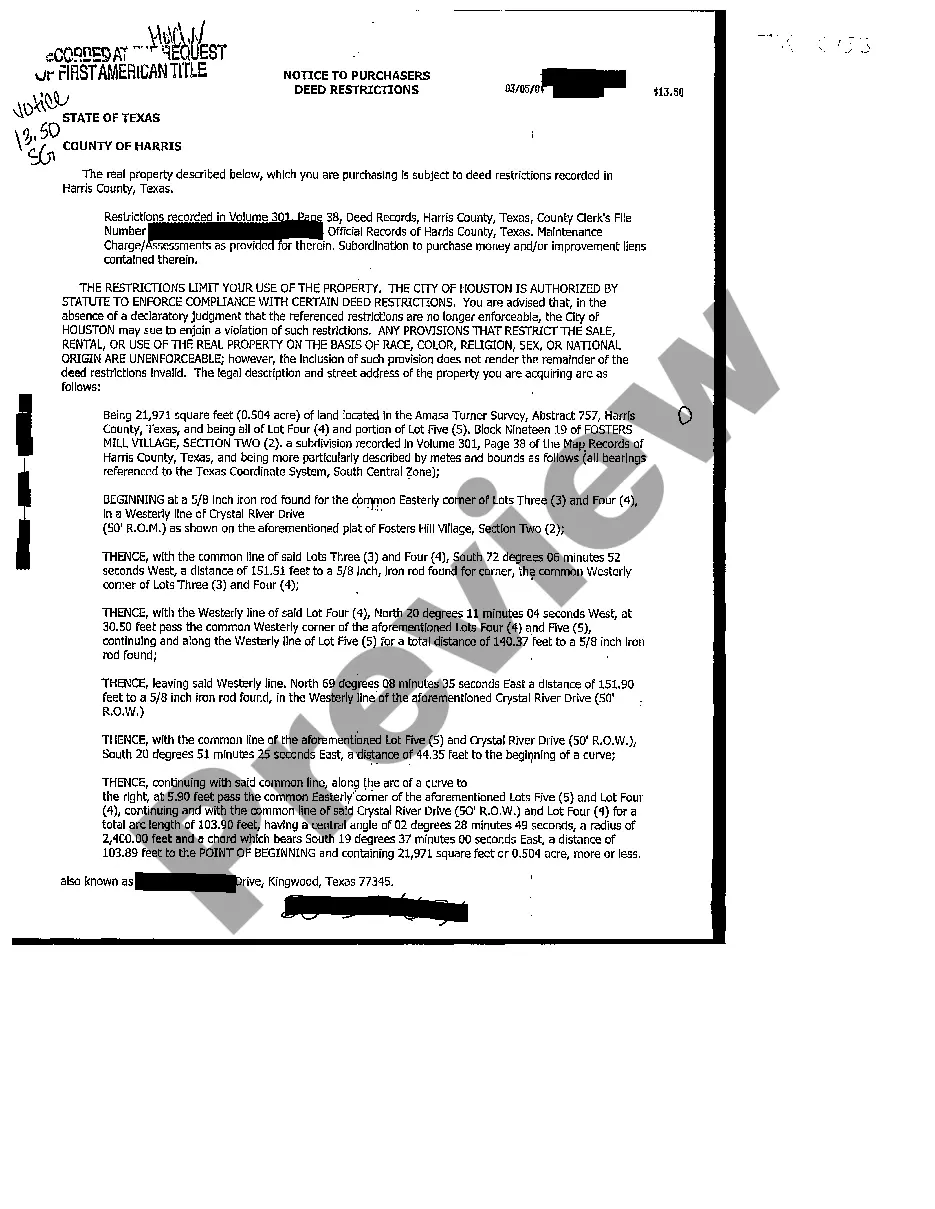

To obtain a copy of your mortgage deed, you can contact your local county recorder's office. They keep records of all land transactions, including deeds. If you need specific guidance with retrieving these documents, consider using resources like uslegalforms, which can assist you in navigating the process seamlessly. This ensures you have the correct information related to your Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder.

Nevada is primarily a deed of trust state. This means that in Sparks, Nevada, lending practices generally involve a deed of trust rather than a typical mortgage. This arrangement allows lenders to initiate a non-judicial foreclosure process, helping streamline property recovery if necessary. Understanding this distinction is crucial when dealing with a Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder.

In general, the lender or the beneficiary of the deed of trust files it with the local county recorder's office. This is vital for establishing a public record of the lien against the property. For those involved in a Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder, it is important to follow the appropriate procedures to ensure the filing is done correctly.

Yes, the mortgage company often holds the deed until you have fully repaid the mortgage. This provides them with a legal claim to the property should you fail to meet your payment obligations. However, it’s important to remember that you are still the rightful owner of the home. Familiarizing yourself with the nuances of a Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder can enhance your understanding of this process.

A corporation Assignment of deed of trust mortgage refers to the transfer of interest in a deed of trust from one corporate holder to another. This transaction typically involves financial institutions or corporate entities that manage multiple properties. Understanding this assignment is crucial, as it can affect your mortgage terms and obligations. Consulting a legal expert familiar with Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder can provide clarity.

The Assignment of a deed of trust generally requires the signature of the current beneficiary or mortgage holder. This individual or entity must sign the document to indicate their consent to transfer rights under the deed of trust. If the beneficiary is a corporation, an authorized representative must sign to ensure the assignment is legally binding. Make sure to follow standard procedures for the Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder to secure a valid transfer.

In an assignment of a mortgage, typically the original mortgage holder or their authorized representative will sign the document. This signature is essential to validate the transfer of rights and responsibilities. If the new mortgage holder is a corporation, an authorized officer should sign on behalf of the corporation. As you navigate the Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder, ensure that all parties understand their roles to avoid future complications.

To release an assignment of a mortgage, you must create a release document that states the assignment is no longer in effect. This document should include information about the original assignment, such as names and property details. After preparing the release, sign it and have it notarized, then submit the release to the appropriate local authority in Sparks, Nevada. This ensures that the public record reflects the termination of the assignment, providing clarity for all parties involved.

A corporate Assignment of deed of trust is a legal process where a corporation transfers its rights under a deed of trust to another entity. This type of assignment is common in commercial lending, as it allows corporations to manage their mortgages efficiently. When dealing with the Sparks Nevada Assignment of Deed of Trust by Corporate Mortgage Holder, ensure you follow state guidelines to maintain compliance and protect all parties involved. It is essential to document this process properly to uphold your legal rights.