Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

NEVADA STATUTES

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 111 ESTATES IN PROPERTY; CONVEYANCING AND RECORDING GENERAL PROVISIONS

NRS 111.010 Definitions.

As used in this chapter:

1. Conveyance shall be construed to embrace every instrument in writing, except a last will and testament, whatever may be its form, and by whatever name it may be known in law, by which any estate or interest in lands is created, aliened, assigned or surrendered.

2. Estate and interest in lands shall be construed and embrace every estate and interest, present and future, vested and contingent, in lands as defined in subsection 3.

3. Lands shall be construed as coextensive in meaning with lands, tenements and hereditaments, and shall include in its meaning all possessory right to the soil for mining and other purposes.

[74:9:1861; B 302; BH 2643; C 2713; RL 1088; NCL 1545] + [75:9:1861; B 303; BH 2644; C 2714; RL 1089; NCL 1546]

111.015 Power of court to compel specific performance not abridged.

Nothing contained in this chapter shall be construed to abridge the powers of courts to compel the specific performance of agreements in cases of part performance of such agreements.

[59:9:1861; B 287; BH 2628; C 2698; RL 1073; NCL 1531]

111.020 Instruments may be subscribed by lawful agents.

Every instrument required by any of the provisions of this chapter to be subscribed by any party, may be subscribed by the lawful agent of such party.

[68:9:1861; B 296; BH 2637; C 2707; RL 1082; NCL 1539]

111.025 Conveyances void against purchasers are void against their heirs or assigns.

Every conveyance, charge, instrument or proceeding declared to be void by the provisions of this chapter, as against purchasers, shall be equally void as against the heirs, successors, personal representatives or assigns of such purchasers.

[71:9:1861; B 299; BH 2640; C 2710; RL 1085; NCL 1542] (NRS A 1959, 418)

111.040 Validity of conveyances made before December 2, 1861.

All conveyances of real property made, acknowledged or proved prior to December 2, 1861, according to the laws in force at the time of the making, acknowledgment or proof, shall have the same force as evidence, and be recorded in the same manner and with like effect as conveyances executed and acknowledged in pursuance of this chapter.

[39:9:1861; B 267; BH 2608; C 2678; RL 1053; NCL 1511]

111.045 Legality of conveyances executed before December 2, 1861, depends on laws and customs of mining and agricultural districts.

The legality of the execution, acknowledgment, proof, form or record of any conveyance, or other instrument made, executed, acknowledged, proved or recorded prior to December 2, 1861, shall not be affected by anything contained in this chapter, but shall depend for its validity or legality upon the laws and customs then in existence and in force in the mining and agricultural districts.

[40:9:1861; B 268; BH 2609; C 2679; RL 1054; NCL 1512]

111.050 Chapter not to be construed to conflict with lawful mining rules, regulations and customs.

This chapter shall not be so construed as to interfere or conflict with the lawful mining rules, regulations or customs in regard to the locating, holding or forfeiture of claims, but, in all cases of mortgages of mining interests under this chapter, the mortgagee shall have the right to perform the same acts that the mortgagor might have performed for the purpose of preventing a forfeiture of the same under the rules, regulations or customs of mines, and shall be allowed such compensation therefor as shall be deemed just and equitable by the court ordering the sale upon a foreclosure. Compensation shall, in no case, exceed the amount realized from the claim by a foreclosure and sale.

[77:9:1861; B 305; BH 2646; C 2716; RL 1091; NCL 1548]

NEVADA STATUTES

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 111 ESTATES IN PROPERTY; CONVEYANCING AND RECORDING CONVEYANCING; STATUTE OF FRAUDS

NRS 111.105 Conveyances by deed.

Conveyances of lands, or of any estate or interest therein, may be made by deed, signed by the person from whom the estate or interest is intended to pass, being of lawful age, or by the person's lawful agent or attorney, and acknowledged or proved, and recorded, as directed in this chapter.

[1:9:1861; B 228; BH 2569; C 2639; RL 1017; NCL 1475]

NRS 111.109 Conveyance by deed which becomes effective upon death of grantor.

1. The owner of an interest in real property may create a deed that conveys his or her interest in real property to a grantee which becomes effective upon the death of the owner. Such a conveyance is subject to liens on the property in existence on the date of the death of the owner.

2. The owner of an interest in real property who creates a deed pursuant to subsection 1 may designate in the deed:

(a) Multiple grantees who will take title to the property upon the death of the owner as joint tenants with right of survivorship, tenants in common, husband and wife as community property, community property with right of survivorship or any other tenancy that is recognized in this State.

(b) A grantee or multiple grantees who will take title to the property upon the death of the owner as the sole and separate property of the grantee or grantees without the necessity of the filing of a quitclaim deed or disclaimer by the spouse of any grantee.

3. If the owner of the real property which is the subject of a deed created pursuant to subsection 1 holds the interest in the property as a joint tenant with right of survivorship or as community property with the right of survivorship and:

(a) The deed includes a conveyance of the interest from each of the other owners, the deed becomes effective on the date of the death of the last surviving owner; or

(b) The deed does not include a conveyance of the interest from each of the other owners, the deed becomes effective on the date of the death of the owner who created the deed only if the owner who conveyed his or her interest in real property to the grantee is the last surviving owner.

4. If an owner of an interest in real property who creates a deed pursuant to subsection 1 transfers his or her interest in the real property to another person during his or her lifetime, the deed created pursuant to subsection 1 is void.

5. If an owner of an interest in real property who creates a deed pursuant to subsection 1 executes and records more than one deed concerning the same real property, the deed that is last recorded before the death of the owner is the effective deed.

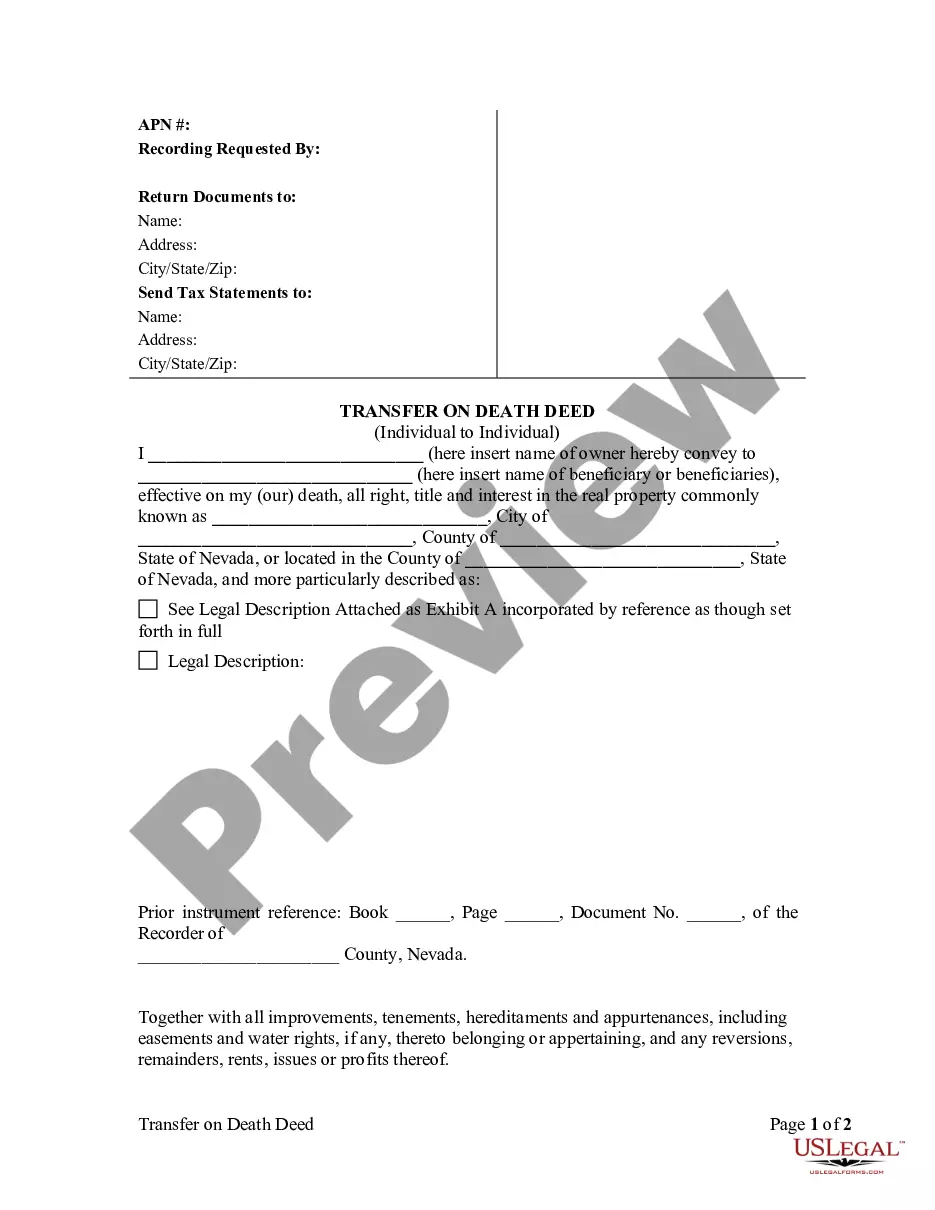

6. A deed created pursuant to subsection 1 is valid only if executed and recorded as provided by law in the office of the county recorder of the county in which the property is located before the death of the owner or the death of the last surviving owner. The deed must be in substantially the following form:

DEED

I (We) . (owner) hereby convey to .. (grantee), effective on my (our) death, the following described real property:

(Legal Description)

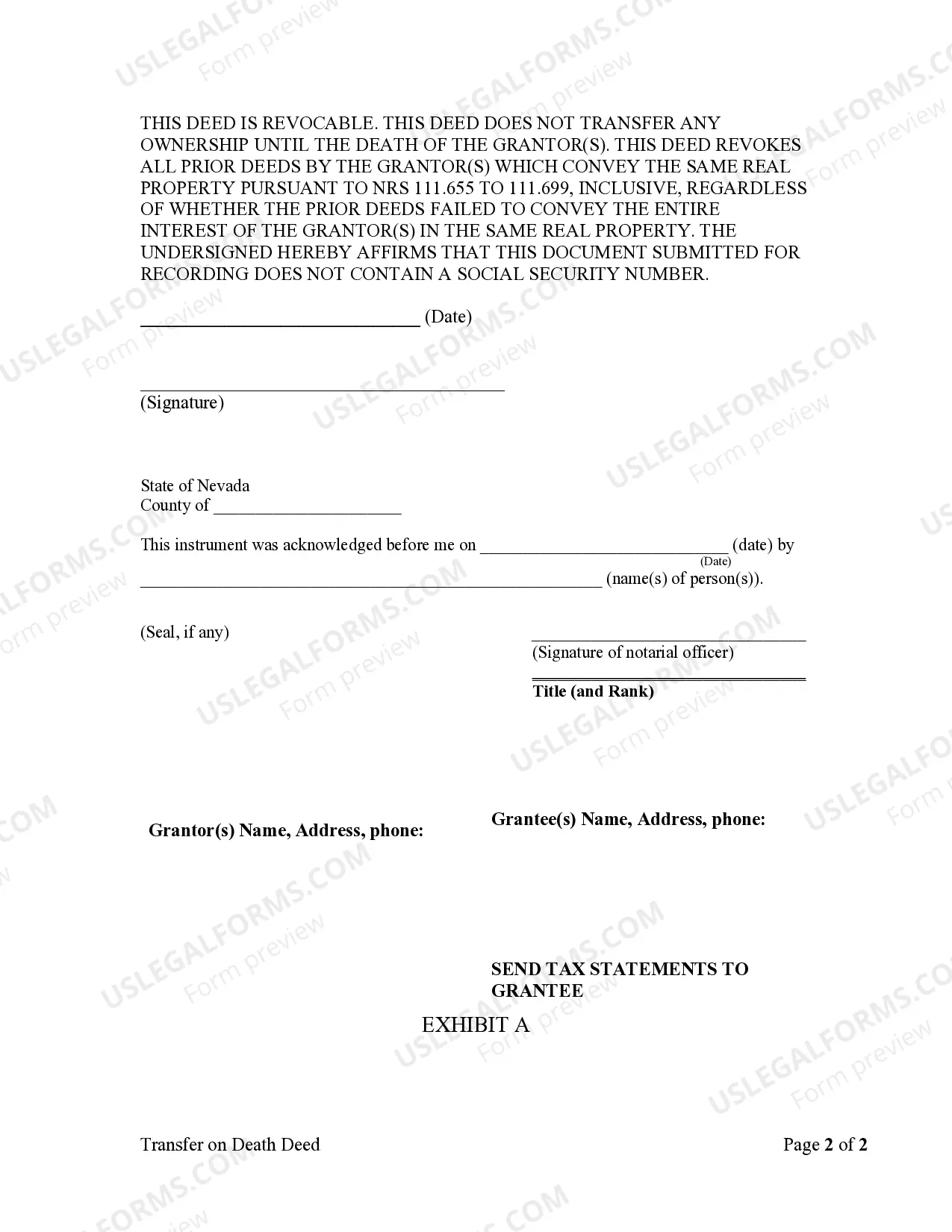

THIS DEED IS REVOCABLE. THIS DEED DOES NOT TRANSFER ANY OWNERSHIP UNTIL THE DEATH OF THE GRANTOR. THIS DEED REVOKES ALL PRIOR DEEDS BY THE GRANTOR WHICH CONVEY THE SAME REAL PROPERTY PURSUANT TO SUBSECTION 1 OF NRS 111.109 REGARDLESS OF WHETHER THE PRIOR DEEDS FAILED TO CONVEY THE GRANTOR'S ENTIRE INTEREST IN THE SAME REAL PROPERTY.

(Signature of Grantor)

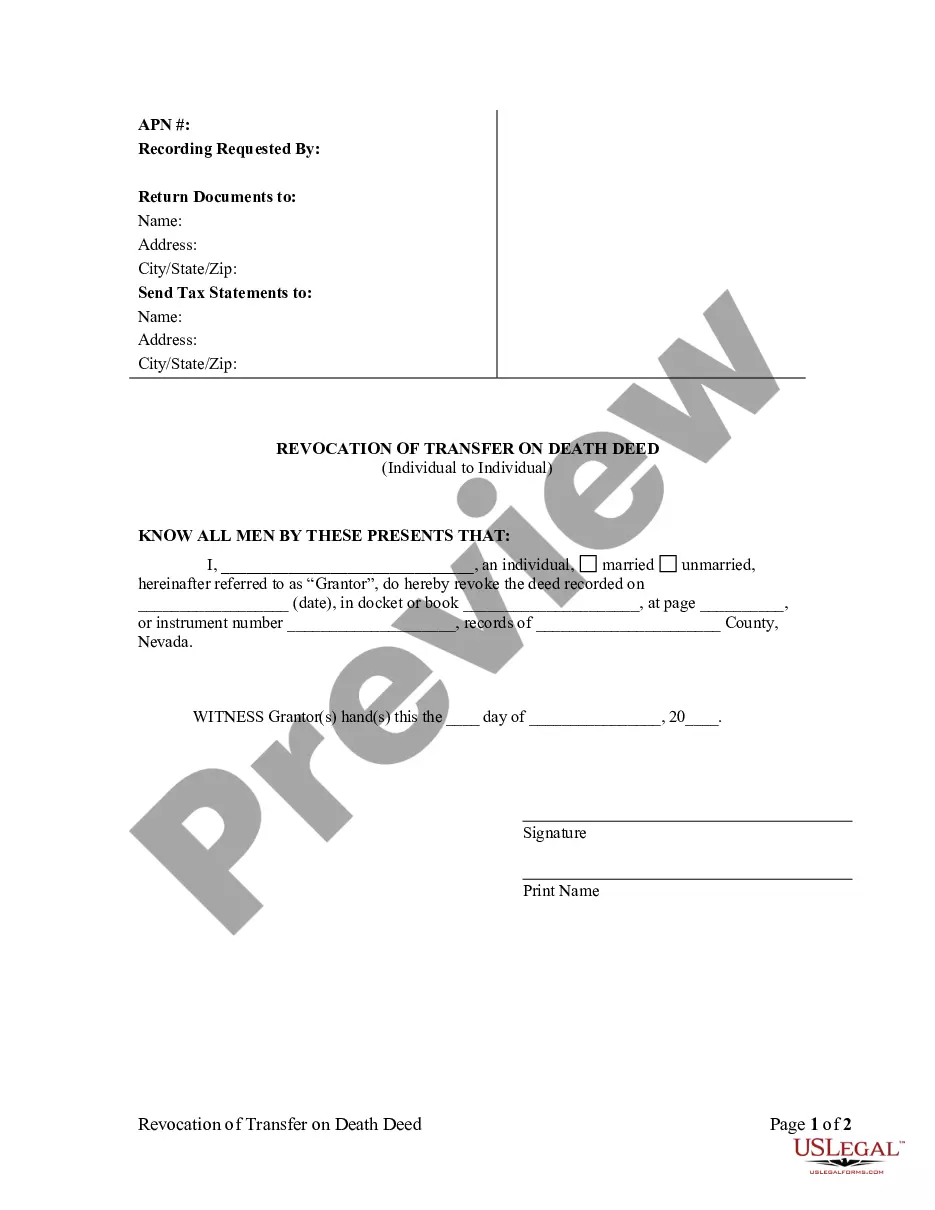

7. A deed created pursuant to subsection 1 may be revoked at any time by the owner or, if there is more than one owner, by any of the owners who created the deed. The revocation is valid only if executed and recorded as provided by law in the office of the county recorder of the county in which the property is located before the death of the owner who executes the revocation. If the property is held as joint tenants with right of survivorship or as community property with the right of survivorship and the revocation is not executed by all of the owners, the revocation does not become effective unless the revocation is executed and recorded by the last surviving owner. The revocation of deed must be in substantially the following form:

REVOCATION OF DEED

The undersigned hereby revokes the deed recorded on (date), in docket or book at page or instrument number .., records of County, Nevada.

(Date) (Signature)

8. Upon the death of the last grantor of a deed created pursuant to subsection 1, a declaration of value of real property pursuant to NRS 375.060 and a copy of the death certificate of each grantor must be attached to a Death of Grantor Affidavit and recorded in the office of the county recorder where the deed was recorded. The Death of Grantor Affidavit must be in substantially the following form:

DEATH OF GRANTOR AFFIDAVIT

(affiant name), being duly sworn, deposes and says that (name of deceased), the decedent mentioned in the attached certified copy of the Certificate of Death, is the same person as (name of grantor), named as the grantor or as one of the grantors in the deed recorded on (date), in docket or book ., at page or instrument number ., records of County, Nevada, covering the following described property:

(Legal Description)

(affiant name) is the grantee or at least one of the grantees to whom the real property is conveyed upon the death of the grantor . (name of deceased) or is the authorized representative of the grantee or at least one of the grantees.

(Date) (Signature)

9. The provisions of this section must not be construed to limit the recovery of benefits paid for Medicaid.

(Added to NRS by 2003, 2507; A 2005, 960)

111.115 Proof of execution of conveyance.

The proof of the execution of any conveyance, whereby any real property is conveyed, or may be affected, shall be:

1. By the testimony of a subscribing witness; or

2. When all the subscribing witnesses are dead, or cannot be had, by evidence of the handwriting of the party, and of at least one subscribing witness, given by a credible witness to each signature.

[10:9:1861; B 238; BH 2579; C 2649; RL 1027; NCL 1485]

111.120 Conditions necessary before proof by subscribing witness can be taken.

No proof by a subscribing witness shall be taken unless the witness shall be personally known to the person taking the proof to be the person whose name is subscribed to the conveyance as witness thereto, or shall be proved to be such by the oath or affirmation of a credible witness.

[11:9:1861; B 239; BH 2580; C 2650; RL 1028; NCL 1486]

111.125 Proof required from subscribing witnesses.

No certificate of proof shall be granted unless subscribing witnesses shall prove:

1. That the person whose name is subscribed thereto as a party is the person described in, and who executed the same.

2. That such person executed the conveyance.

3. That such witness subscribed his or her name thereto as a witness thereof.

[12:9:1861; B 240; BH 2581; C 2651; RL 1029; NCL 1487]

111.130 Contents of certificate of proof.

The certificate of proof shall set forth the following matters:

1. The fact that the subscribing witness was personally known to the person granting the certificate to be the person whose name is subscribed to such conveyance as a witness thereto, or was proved to be such by oath or affirmation of a witness, whose name shall be inserted in the certificate.

2. The proof given by such witness of the execution of such conveyance, and of the fact that the person whose name is subscribed to such conveyance as a party thereto is the person who executed the same, and that such witness subscribed his or her name to such conveyance as a witness thereof.

[13:9:1861; B 241; BH 2582; C 2652; RL 1030; NCL 1488]

111.135 When proof by evidence of handwriting may be taken.

No proof by evidence of the handwriting of the party, and of a subscribing witness, shall be taken, unless the person taking the same shall be satisfied that all the subscribing witnesses to the conveyance are dead, or cannot be had to prove the execution thereof.

[14:9:1861; B 242; BH 2583; C 2653; RL 1031; NCL 1489]

111.140 Statements of witnesses under oath before certificate granted.

No certificate of any such proof shall be granted unless:

1. A competent and credible witness shall state, on oath or affirmation, that the witness personally knew the person whose name is subscribed thereto as a party, well knew the person's signature (stating his or her means of knowledge), and believes the name of the person subscribed thereto as a party was subscribed by such person.

2. A competent and credible witness shall, in like manner, state that the witness personally knew the person whose name is subscribed to such conveyance as a witness, well knew the person's signature (stating his or her means of knowledge), and believes the name subscribed thereto as a witness was thereto subscribed by such person.

[15:9:1861; B 243; BH 2584; C 2654; RL 1032; NCL 1490]

111.145 Witnesses to conveyance may be subpoenaed.

Upon the application of any grantee in any conveyance required by this chapter to be recorded, or by any person claiming under such grantee, verified under the oath of the applicant, that any witness to such conveyance, residing in the county where such application is made, refuses to appear and testify touching the execution thereof, and that such conveyance cannot be proved without the evidence of the witness, any person authorized to take the acknowledgment or proof of such conveyance may issue a subpoena requiring such witness to appear before such person and testify touching the execution thereof.

[16:9:1861; B 244; BH 2585; C 2655; RL 1033; NCL 1491]

111.155 Conveyance acknowledged or proved may be read in evidence.

Every conveyance, or other instrument, conveying or affecting real property, which shall be acknowledged, or proved and certified, as prescribed in this chapter, may, together with the certificate of acknowledgment, or proof, be read in evidence without further proof.

[29:9:1861; B 257; BH 2598; C 2668; RL 1043; NCL 1501]

111.160 After-acquired title passes to grantee.

If any person shall convey any real property, by conveyance purporting to convey the same in fee simple absolute, and shall not at the time of such conveyance have the legal estate in such real property but shall afterward acquire the same, the legal estate subsequently acquired shall immediately pass to the grantee, and such conveyance shall be valid as if such legal estate had been in the grantor at the time of the conveyance.

[33:9:1861; B 261; BH 2602; C 2672; RL 1047; NCL 1505]

111.165 Adverse possession does not prevent sale and conveyance.

Any person claiming title to any real property may, notwithstanding there may be an adverse possession thereof, sell and convey his or her interest therein in the same manner and with the same effect as if the person was in actual possession thereof.

[34:9:1861; B 262; BH 2603; C 2673; RL 1048; NCL 1506]

111.167 Presumption of conveyance with land: Water rights, permits, certificates and applications appurtenant to land.

Unless the deed conveying land specifically provides otherwise, all:

1. Applications and permits to appropriate any of the public waters;

2. Certificates of appropriation;

3. Adjudicated or unadjudicated water rights; and

4. Applications or permits to change the place of diversion, manner of use or place of use of water, which are appurtenant to the land are presumed to be conveyed with the land.

(Added to NRS by 1995, 438)

111.170 Construction of words grant, bargain and sell in conveyances; suit upon covenants.

1. The words grant, bargain and sell in all conveyances made after December 2, 1861, in and by which any estate of inheritance or fee simple is to be passed, shall, unless restrained by express terms contained in such conveyances, be construed to be the following express covenants, and none other, on the part of the grantor, for the grantor and the heirs of the grantor to the grantee, the heirs of the grantee, and assigns:

(a) That previous to the time of the execution of the conveyance the grantor has not conveyed the same real property, or any right, title, or interest therein, to any person other than the grantee.

(b) That the real property is, at the time of the execution of the conveyance, free from encumbrances, done, made or suffered by the grantor, or any person claiming under the grantor.

2. Such covenants may be sued upon in the same manner as if they had been expressly inserted in the conveyance.

[49:9:1861; B 277; BH 2618; C 2688; RL 1063; NCL 1521]

111.175 Conveyances made to defraud prior or subsequent purchasers are void.

Every conveyance of any estate, or interest in lands, or the rents and profits of lands, and every charge upon lands, or upon the rents and profits thereof, made and created with the intent to defraud prior or subsequent purchasers for a valuable consideration of the same lands, rents or profits, as against such purchasers, shall be void.

[50:9:1861; B 278; BH 2619; C 2689; RL 1064; NCL 1522] — (NRS R 1959, 418; reenacted 1960, 324)

111.180 Bona fide purchaser: Conveyance not deemed fraudulent in favor of bona fide purchaser unless subsequent purchaser had actual knowledge, constructive notice or reasonable cause to know of fraud.

1. Any purchaser who purchases an estate or interest in any real property in good faith and for valuable consideration and who does not have actual knowledge, constructive notice of, or reasonable cause to know that there exists a defect in, or adverse rights, title or interest to, the real property is a bona fide purchaser.

2. No conveyance of an estate or interest in real property, or charge upon real property, shall be deemed fraudulent in favor of a bona fide purchaser unless it appears that the subsequent purchaser in such conveyance, or person to be benefited by such charge, had actual knowledge, constructive notice or reasonable cause to know of the fraud intended.

[51:9:1861; B 279; BH 2620; C 2690; RL 1065; NCL 1523] NRS R 1959, 418; reenacted 1960, 324; A 2013, 2173)

111.185 Power of revocation at will.

Every conveyance or charge of or upon any estate or interest in lands, containing any provision for the revocation, determination or alteration of such estate or interest, or any part thereof, at the will of the grantor, shall be void, as against subsequent purchasers from the grantor for a valuable consideration, of any estate or interest, so liable to be revoked or determined, although the same be not directly revoked, determined or altered by the grantor, by virtue of the power reserved, or expressed in such prior conveyance or charge.

[52:9:1861; B 280; BH 2621; C 2691; RL 1066; NCL 1524]

111.190 Revocation and reconveyance.

Where a power to revoke a conveyance of lands, or the rents and profits thereof, and to reconvey the same, shall be given to any person other than the grantor in such conveyance, and such person shall thereafter convey the same lands, rents or profits to a purchaser for a valuable consideration, such subsequent conveyance shall be valid in the same manner, and to the same extent, as if the power of revocation were recited therein, and the intent to revoke the former conveyance expressly declared.

[53:9:1861; B 281; BH 2622; C 2692; RL 1067; NCL 1525]

111.195 Effect of conveyance made before power of revocation can be exercised.

If a conveyance to a purchaser, under either NRS 111.185 or 111.190, shall be made before the person making the same shall be entitled to execute his or her power of revocation, it shall, nevertheless, be valid from the time the power of revocation shall actually vest in such person, in the same manner, and to the same extent, as if then made.

[54:9:1861; B 282; BH 2623; C 2693; RL 1068; NCL 1526]

111.200 Limitations on terms of leases.

1. No agricultural or grazing lands within the state shall hereafter be conveyed for agricultural or grazing purposes by lease or otherwise, except in fee and perpetual succession, for a longer period than 25 years.

2. No other lands or real property shall be so conveyed for a longer period than 99 years.

3. All leases hereafter made contrary to the provisions of this chapter shall be void as to any periods of time in excess of those enumerated in subsections 1 and 2.

[78:9:1861; A 1923, 314; 1929, 364; 1951, 237] — (NRS A 1959, 96; 1963, 60)

111.205 No estate created in land unless by operation of law or written conveyance; leases for terms not exceeding 1 year.

1. No estate or interest in lands, other than for leases for a term not exceeding 1 year, nor any trust or power over or concerning lands, or in any manner relating thereto, shall be created, granted, assigned, surrendered or declared after December 2, 1861, unless by act or operation of law, or by deed or conveyance, in writing, subscribed by the party creating, granting, assigning, surrendering or declaring the same, or by the party's lawful agent thereunto authorized in writing.

2. Subsection 1 shall not be construed to affect in any manner the power of a testator in the disposition of the testator's real property by a last will and testament, nor to prevent any trust from arising or being extinguished by implication or operation of law.

[55:9:1861; B 283; BH 2624; C 2694; RL 1069; NCL 1527] + [56:9:1861; B 284; BH 2625; C 2695; RL 1070; NCL 1528]

111.210 Contracts for sale or lease of land for periods in excess of 1 year void unless in writing.

1. Every contract for the leasing for a longer period than 1 year, or for the sale of any lands, or any interest in lands, shall be void unless the contract, or some note or memorandum thereof, expressing the consideration, be in writing, and be subscribed by the party by whom the lease or sale is to be made.

2. Every instrument required to be subscribed by any person under subsection 1 may be subscribed by the agent of the party lawfully authorized.

[57:9:1861; B 285; BH 2626; C 2696; RL 1071; NCL 1529] + [58:9:1861; B 286; BH 2627; C 2697; RL 1072; NCL 1530]

111.220 Agreements not in writing: When void.

In the following cases every agreement is void, unless the agreement, or some note or memorandum thereof expressing the consideration, is in writing, and subscribed by the person charged therewith:

1. Every agreement that, by the terms, is not to be performed within 1 year from the making thereof.

2. Every special promise to answer for the debt, default or miscarriage of another.

3. Every promise or undertaking made upon consideration of marriage, except mutual promises to marry.

4. Every promise or commitment to loan money or to grant or extend credit in an original principal amount of at least $100,000 made by a person engaged in the business of lending money or extending credit.

5. Every promise or commitment to pay a fee for obtaining a loan of money or an extension of credit for another person if the fee is $1,000 or more.

[61:9:1861; B 289; BH 2630; C 2700; RL 1075; NCL 1533] — (NRS A 1989, 285)

111.235 Grants and assignments of existing trusts to be in writing or are void.

Every grant or assignment of any existing trust in lands, goods or things in action, unless the same shall be in writing, subscribed by the person making the same, or by his or her agent lawfully authorized, shall be void.

[70:9:1861; B 298; BH 2639; C 2709; RL 1084; NCL 1541]

NEVADA STATUTES

TITLE 10 — PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 111 ESTATES IN PROPERTY; CONVEYANCING AND RECORDING ACKNOWLEDGMENT OF INSTRUMENTS

NRS 111.240 Acknowledgment of conveyances.

Every conveyance in writing whereby any real property is conveyed or may be affected must be acknowledged or proved and certified in the manner provided in this chapter and in NRS 240.161 to 240.169, inclusive.

[3:9:1861; B 230; BH 2571; C 2641; RL 1019; NCL 1477] (NRS A 1993, 204)

111.265 Persons authorized to take acknowledgment or proof within State.

The proof or acknowledgment of every conveyance affecting any real property, if acknowledged or proved within this State, must be taken by one of the following persons:

1. A judge or a clerk of a court having a seal.

2. A notary public.

3. A justice of the peace.

[Part 4:9:1861; A 1867, 103; B 231; BH 2572; C 2642; RL 1020; NCL 1478] — (NRS A 1985, 1209; 1987, 123)

NEVADA STATUTES

TITLE 10 PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 111 ESTATES IN PROPERTY; CONVEYANCING AND RECORDING RECORDING

NRS 111.310 Instruments entitled to recordation; patents need not be acknowledged.

1. Except as otherwise provided in NRS 111.312, a certificate of the acknowledgment of any conveyance or other instrument in any way affecting the title to real or personal property, or the proof of the execution thereof, as provided in this chapter, signed by the person taking the same, and under the seal or stamp of that person, if the person is required by law to have a seal or stamp, entitles the conveyance or instrument, with the certificate or certificates, to be recorded in the office of the recorder of any county in this state.

2. Any state or United States contract or patent for land may be recorded without any acknowledgment or proof.

[18:9:1861; A 1909, 270; RL 1035; NCL 1493] (NRS A 1969, 491; 1989, 1645)

111.312 Requirements for recording certain documents relating to real property.

1. The county recorder shall not record with respect to real property, a notice of completion, a declaration of homestead, a lien or notice of lien, an affidavit of death, a mortgage or deed of trust, or any conveyance of real property or instrument in writing setting forth an agreement to convey real property unless the document being recorded contains:

(a) The mailing address of the grantee or, if there is no grantee, the mailing address of the person who is requesting the recording of the document; and

(b) Except as otherwise provided in subsection 2, the assessor's parcel number of the property at the top left corner of the first page of the document, if the county assessor has assigned a parcel number to the property. The parcel number must comply with the current system for numbering parcels used by the county assessor's office. The county recorder is not required to verify that the assessor's parcel number is correct.

2. Any document relating exclusively to the transfer of water rights may be recorded without containing the assessor's parcel number of the property.

3. The county recorder shall not record with respect to real property any deed, including, without limitation:

(a) A grant, bargain or deed of sale;

(b) Quitclaim deed;

(c) Warranty deed; or

(d) Trustee's deed upon sale,

unless the document being recorded contains the name and address of the person to whom a statement of the taxes assessed on the real property is to be mailed.

4. The assessor's parcel number shall not be deemed to be a complete legal description of the real property conveyed.

5. Except as otherwise provided in subsection 6, if a document that is being recorded includes a legal description of real property that is provided in metes and bounds, the document must include the name and mailing address of the person who prepared the legal description. The county recorder is not required to verify the accuracy of the name and mailing address of such a person.

6. If a document including the same legal description described in subsection 5 previously has been recorded, the document must include all information necessary to identify and locate the previous recording, but the name and mailing address of the person who prepared the legal description is not required for the document to be recorded. The county recorder is not required to verify the accuracy of the information concerning the previous recording.

(Added to NRS by 1989, 1645; A 1999, 885; 2001, 478, 1558, 1754; 2003, 53, 55, 2781, 3190)

111.315 Recording of conveyances and instruments: Notice to third persons.

Every conveyance of real property, and every instrument of writing setting forth an agreement to convey any real property, or whereby any real property may be affected, proved, acknowledged and certified in the manner prescribed in this chapter, to operate as notice to third persons, shall be recorded in the office of the recorder of the county in which the real property is situated or to the extent permitted by NRS 105.010 to 105.080, inclusive, in the Office of the Secretary of State, but shall be valid and binding between the parties thereto without such record.

[24:9:1861; B 252; BH 2593; C 2663; RL 1038; NCL 1496] — (NRS A 1995, 891)

111.320 Filing of conveyances or other instruments is notice to all persons: Effect on subsequent purchasers and mortgagees.

Every such conveyance or instrument of writing, acknowledged or proved and certified, and recorded in the manner prescribed in this chapter or in NRS 105.010 to 105.080, inclusive, must from the time of filing the same with the Secretary of State or recorder for record, impart notice to all persons of the contents thereof; and subsequent purchasers and mortgagees shall be deemed to purchase and take with notice.

[25:9:1861; B 253; BH 2594; C 2664; RL 1039; NCL 1497] — (NRS A 1995, 891)

111.325 Unrecorded conveyances void as against subsequent bona fide purchaser for value when conveyance recorded.

Every conveyance of real property within this State hereafter made, which shall not be recorded as provided in this chapter, shall be void as against any subsequent purchaser, in good faith and for a valuable consideration, of the same real property, or any portion thereof, where his or her own conveyance shall be first duly recorded.

[26:9:1861; A 1935, 34; 1931 NCL 1498]

111.340 Certificate of acknowledgment and record may be rebutted.

Neither the certificate of the acknowledgment nor of the proof of any conveyance or instrument, nor the record, nor the transcript of the record, of such conveyance or instrument, shall be conclusive, but the same may be rebutted.

[31:9:1861; B 259; BH 2600; C 2670; RL 1045; NCL 1503]

111.345 Proof taken upon oath of incompetent witness: Instrument not admissible until established by competent proof.

If the party contesting the proof of any conveyance or instrument shall make it appear that any such proof was taken upon the oath of an incompetent witness, neither such conveyance or instrument, nor the record thereof, shall be received in evidence, until established by other competent proof.

[32:9:1861; B 260; BH 2601; C 2671; RL 1046; NCL 1504]

111.347 Recording defective instrument: Notice to subsequent purchasers; admissibility in evidence.

Any instrument affecting the title to real property, 3 years after the instrument has been copied into the proper book of record kept in the office of any county recorder, imparts notice of its contents to subsequent purchasers and encumbrancers, notwithstanding any defect, omission or informality in the execution of the instrument, or in the certificate of acknowledgment thereof, or the absence of any such certificate; but nothing herein affects the rights of purchasers or encumbrancers previous to March 27, 1935. When such copying in the proper book of record occurred within 5 years prior to the trial of an action, the instrument is not admissible in evidence unless it is first shown that the original instrument was genuine.

(Added to NRS by 1971, 803)

111.350 Conveyances or other instruments recorded before December 17, 1862: Notice to subsequent purchasers; certified copies as evidence.

1. All instruments of writing copied into the proper books of record of the offices of the county recorders of the several counties of the Territory of Nevada prior to December 17, 1862, shall, after December 17, 1862, be deemed to impart to subsequent purchasers and encumbrancers, and all other persons whomsoever, notice of all deeds, mortgages, powers of attorney, contracts, conveyances or other instruments, notwithstanding any defect, omission or informality existing in the execution, acknowledgment or certificate of recording the same.

2. Nothing contained in this section shall be construed to affect any rights acquired prior to December 17, 1862, in the hands of subsequent grantees or assignees.

3. Certified copies of such instruments as are embraced in subsection 1 may be read in evidence under the same circumstances and rules as are now or may hereafter be provided by law for using copies of instruments duly executed and recorded. Proof shall be first made that the instruments, copies of which it is proposed to use, were genuine instruments and were in truth executed by the grantor or grantors therein named.

[1:32:1862; B 311; BH 2648; C 2718; RL 1093; NCL 1551] + [2:32:1862; B 312; BH 2649; C 2719; RL 1094; NCL 1552]

111.353 Recording of master form mortgages and deeds of trust; incorporation of provisions by reference in subsequently recorded instruments.

A mortgage or deed of trust of real property may be recorded and be constructive notice of such mortgage or deed of trust and the contents thereof in the following manner:

1. Any person may record in the office of the county recorder of any county master form mortgages and deeds of trust of real property, which:

(a) Need not be acknowledged or proved or certified to be recorded or entitled to record.

(b) Shall have noted upon the face thereof that they are master forms.

(c) Shall be indexed and recorded by the county recorder in the same manner as other mortgages and deeds of trust are recorded, and the county recorder shall note on all indexes and records of such documents that they are master forms.

2. Thereafter, any of the provisions of any such recorded master form mortgage or deed of trust may be included for any and all purposes in any mortgage or deed of trust by reference therein to any such provisions, without setting them forth in full, if such master form mortgage or deed of trust is of record in the county in which the mortgage or deed of trust adopting or including by reference any of the provisions of such master form mortgage or deed of trust is recorded.

3. Such reference shall contain a statement as to the following:

(a) Each county in which the mortgage or deed of trust containing such a reference is recorded;

(b) The date such master form mortgage or deed of trust was recorded;

(c) The county recorder's office where the master form mortgage or deed of trust is recorded, and the book or volume and the first page of the records in the recorder's office wherein and at which any such master form mortgage or deed of trust was recorded; and

(d) By paragraph numbers or any other method that will definitely identify such provisions, the specific provisions of any such master form mortgage or deed of trust that are being so adopted and included therein.

4. The recording of any such mortgage or deed of trust which has included therein any such provisions by reference as provided in this section shall operate as constructive notice of the whole of such mortgage or deed of trust, including the terms, as a part of the written contents of any such mortgage or deed of trust, of any such provisions so included by reference as though such provisions were written in full therein.

5. The parties bound or to be bound by provisions so adopted and included by reference shall be bound thereby in the same manner and with like effect for all purposes as though such provisions had been and were set forth in full in any such mortgage or deed of trust.

(Added to NRS by 1967, 766)

111.355 Recordation of only part of instrument under certain conditions.

A document or paper may be presented for the recordation of only a part of its contents if:

1. The part to be recorded is a mortgage or deed of trust, entitled to recordation, which refers to and incorporates:

(a) Provisions of a master form mortgage or deed of trust as authorized by NRS 111.353; or

(b) Provisions of some other instrument previously recorded in the office of any county recorder; and

2. The part not to be recorded is separated from the part to be recorded and clearly marked do not record or not to be recorded or the like.

The county recorder shall record only the mortgage or deed of trust set forth on such document or paper.

(Added to NRS by 1967, 767)

NEVADA STATUTES

TITLE 10 — PROPERTY RIGHTS AND TRANSACTIONS

CHAPTER 113 SALES OF REAL PROPERTY

REQUIRED DISCLOSURES

CONDITION OF RESIDENTIAL PROPERTY OFFERED FOR SALE

NRS 113.100 Definitions.

As used in NRS 113.100 to 113.150, inclusive, unless the context otherwise requires:

1. Defect means a condition that materially affects the value or use of residential property in an adverse manner.

2. Disclosure form means a form that complies with the regulations adopted pursuant to NRS 113.120.

3. Dwelling unit means any building, structure or portion thereof which is occupied as, or designed or intended for occupancy as, a residence by one person who maintains a household or by two or more persons who maintain a common household.

4. Residential property means any land in this state to which is affixed not less than one nor more than four dwelling units.

5. Seller means a person who sells or intends to sell any residential property.

(Added to NRS by 1995, 842; A 1999, 1446)

113.110 Conditions required for conveyance of property and to complete service of document.

For the purposes of NRS 113.100 to 113.150, inclusive:

1. A conveyance of property occurs:

(a) Upon the closure of any escrow opened for the conveyance; or

(b) If an escrow has not been opened for the conveyance, when the purchaser of the property receives the deed of conveyance.

2. Service of a document is complete:

(a) Upon personal delivery of the document to the person being served; or

(b) Three days after the document is mailed, postage prepaid, to the person being served at the person's last known address.

(Added to NRS by 1995, 844)

113.120 Regulations prescribing format and contents of form for disclosing condition of property.

The Real Estate Division of the Department of Business and Industry shall adopt regulations prescribing the format and contents of a form for disclosing the condition of residential property offered for sale. The regulations must ensure that the form:

1. Provides for an evaluation of the condition of any electrical, heating, cooling, plumbing and sewer systems on the property, and of the condition of any other aspects of the property which affect its use or value, and allows the seller of the property to indicate whether or not each of those systems and other aspects of the property has a defect of which the seller is aware.

2. Provides notice:

(a) Of the provisions of NRS 113.140 and subsection 5 of NRS 113.150.

(b) That the disclosures set forth in the form are made by the seller and not by the seller's agent.

(c) That the seller's agent, and the agent of the purchaser or potential purchaser of the residential property, may reveal the completed form and its contents to any purchaser or potential purchaser of the residential property.

(Added to NRS by 1995, 842)

113.130 Completion and service of disclosure form before conveyance of property; discovery or worsening of defect after service of form; exceptions; waiver.

1. Except as otherwise provided in subsection 2:

(a) At least 10 days before residential property is conveyed to a purchaser:

(1) The seller shall complete a disclosure form regarding the residential property; and

(2) The seller or the seller's agent shall serve the purchaser or the purchaser's agent with the completed disclosure form.

(b) If, after service of the completed disclosure form but before conveyance of the property to the purchaser, a seller or the seller's agent discovers a new defect in the residential property that was not identified on the completed disclosure form or discovers that a defect identified on the completed disclosure form has become worse than was indicated on the form, the seller or the seller's agent shall inform the purchaser or the purchaser's agent of that fact, in writing, as soon as practicable after the discovery of that fact but in no event later than the conveyance of the property to the purchaser. If the seller does not agree to repair or replace the defect, the purchaser may:

(1) Rescind the agreement to purchase the property; or

(2) Close escrow and accept the property with the defect as revealed by the seller or the seller's agent without further recourse.

2. Subsection 1 does not apply to a sale or intended sale of residential property:

(a) By foreclosure pursuant to chapter 107 of NRS.

(b) Between any co-owners of the property, spouses or persons related within the third degree of consanguinity.

(c) Which is the first sale of a residence that was constructed by a licensed contractor.

(d) By a person who takes temporary possession or control of or title to the property solely to facilitate the sale of the property on behalf of a person who relocates to another county, state or country before title to the property is transferred to a purchaser.

3. A purchaser of residential property may not waive any of the requirements of subsection 1. A seller of residential property may not require a purchaser to waive any of the requirements of subsection 1 as a condition of sale or for any other purpose.

4. If a sale or intended sale of residential property is exempted from the requirements of subsection 1 pursuant to paragraph (a) of subsection 2, the trustee and the beneficiary of the deed of trust shall, not later than at the time of the conveyance of the property to the purchaser of the residential property, or upon the request of the purchaser of the residential property, provide:

(a) Written notice to the purchaser of any defects in the property of which the trustee or beneficiary, respectively, is aware; and

(b) If any defects are repaired or replaced or attempted to be repaired or replaced, the contact information of any asset management company who provided asset management services for the property. The asset management company shall provide a service report to the purchaser upon request.

5. As used in this section:

(a) Seller includes, without limitation, a client as defined in NRS 645H.060.

(b) Service report has the meaning ascribed to it in NRS 645H.150.

(Added to NRS by 1995, 842; A 1997, 349; 2003, 1339; 2005, 598; 2011, 2832)

113.135 Certain sellers to provide copies of certain provisions of Nrs and give notice of certain soil reports; initial purchaser entitled to rescind sales agreement in certain circumstances; waiver of right to rescind.

1. Upon signing a sales agreement with the initial purchaser of residential property that was not occupied by the purchaser for more than 120 days after substantial completion of the construction of the residential property, the seller shall:

(a) Provide to the initial purchaser a copy of NRS 11.202, 11.2055 and 40.600 to 40.695, inclusive;

(b) Notify the initial purchaser of any soil report prepared for the residential property or for the subdivision in which the residential property is located; and

(c) If requested in writing by the initial purchaser not later than 5 days after signing the sales agreement, provide to the purchaser without cost each report described in paragraph (b) not later than 5 days after the seller receives the written request.

2. Not later than 20 days after receipt of all reports pursuant to paragraph (c) of subsection 1, the initial purchaser may rescind the sales agreement.

3. The initial purchaser may waive his or her right to rescind the sales agreement pursuant to subsection 2. Such a waiver is effective only if it is made in a written document that is signed by the purchaser.

(Added to NRS by 1999, 1446; A 2015, 18)

113.140 Disclosure of unknown defect not required; form does not constitute warranty; duty of buyer and prospective buyer to exercise reasonable care.

1. NRS 113.130 does not require a seller to disclose a defect in residential property of which the seller is not aware.

2. A completed disclosure form does not constitute an express or implied warranty regarding any condition of residential property.

3. Neither this chapter nor chapter 645 of NRS relieves a buyer or prospective buyer of the duty to exercise reasonable care to protect himself or herself.

(Added to NRS by 1995, 843; A 2001, 2896)

113.150 Remedies for seller's delayed disclosure or nondisclosure of defects in property; waiver.

1. If a seller or the seller's agent fails to serve a completed disclosure form in accordance with the requirements of NRS 113.130, the purchaser may, at any time before the conveyance of the property to the purchaser, rescind the agreement to purchase the property without any penalties.

2. If, before the conveyance of the property to the purchaser, a seller or the seller's agent informs the purchaser or the purchaser's agent, through the disclosure form or another written notice, of a defect in the property of which the cost of repair or replacement was not limited by provisions in the agreement to purchase the property, the purchaser may:

(a) Rescind the agreement to purchase the property at any time before the conveyance of the property to the purchaser; or

(b) Close escrow and accept the property with the defect as revealed by the seller or the seller's agent without further recourse.

3. Rescission of an agreement pursuant to subsection 2 is effective only if made in writing, notarized and served not later than 4 working days after the date on which the purchaser is informed of the defect:

(a) On the holder of any escrow opened for the conveyance; or

(b) If an escrow has not been opened for the conveyance, on the seller or the seller's agent.

4. Except as otherwise provided in subsection 5, if a seller conveys residential property to a purchaser without complying with the requirements of NRS 113.130 or otherwise providing the purchaser or the purchaser's agent with written notice of all defects in the property of which the seller is aware, and there is a defect in the property of which the seller was aware before the property was conveyed to the purchaser and of which the cost of repair or replacement was not limited by provisions in the agreement to purchase the property, the purchaser is entitled to recover from the seller treble the amount necessary to repair or replace the defective part of the property, together with court costs and reasonable attorney's fees. An action to enforce the provisions of this subsection must be commenced not later than 1 year after the purchaser discovers or reasonably should have discovered the defect or 2 years after the conveyance of the property to the purchaser, whichever occurs later.