Clark Nevada Renunciation And Disclaimer Property - Intestate Succession

Description

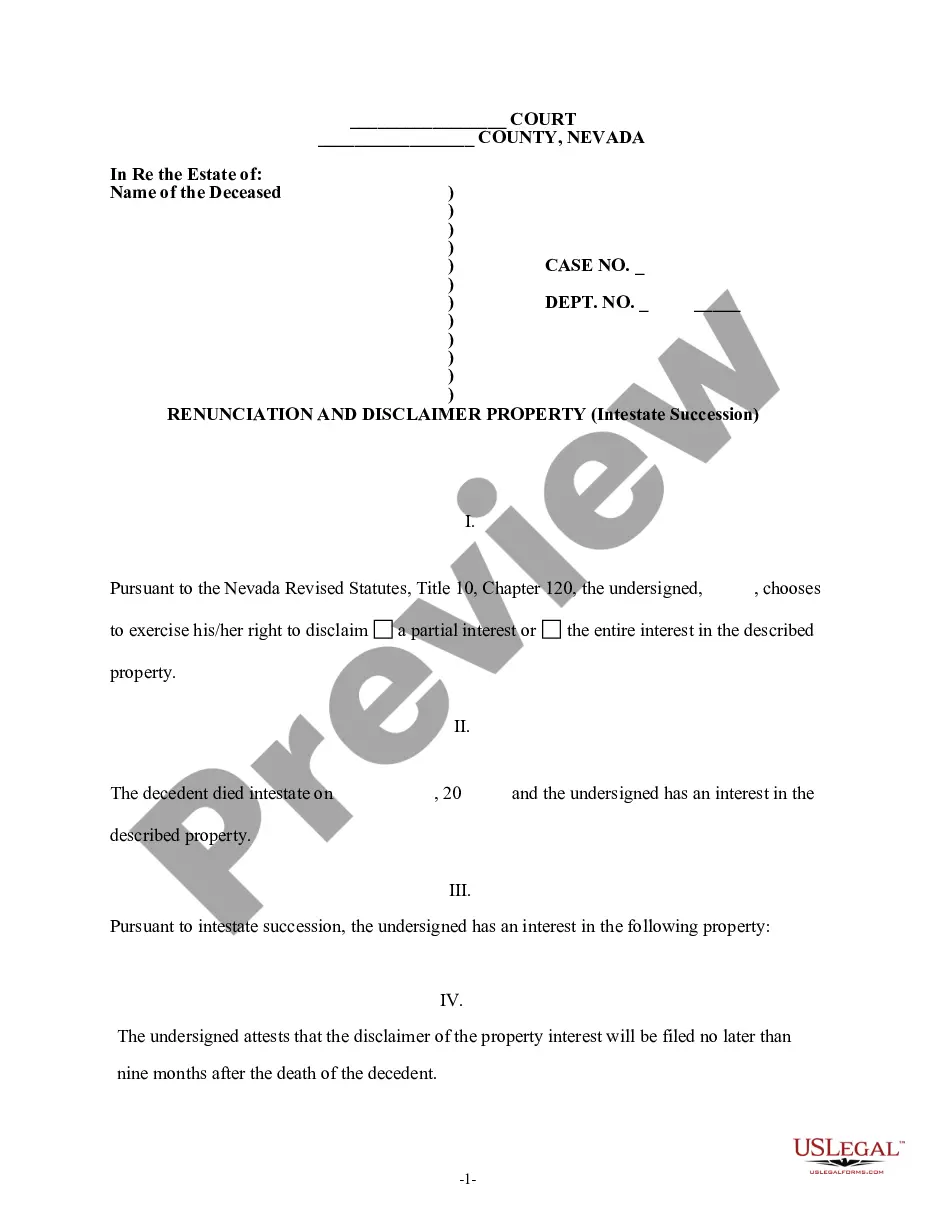

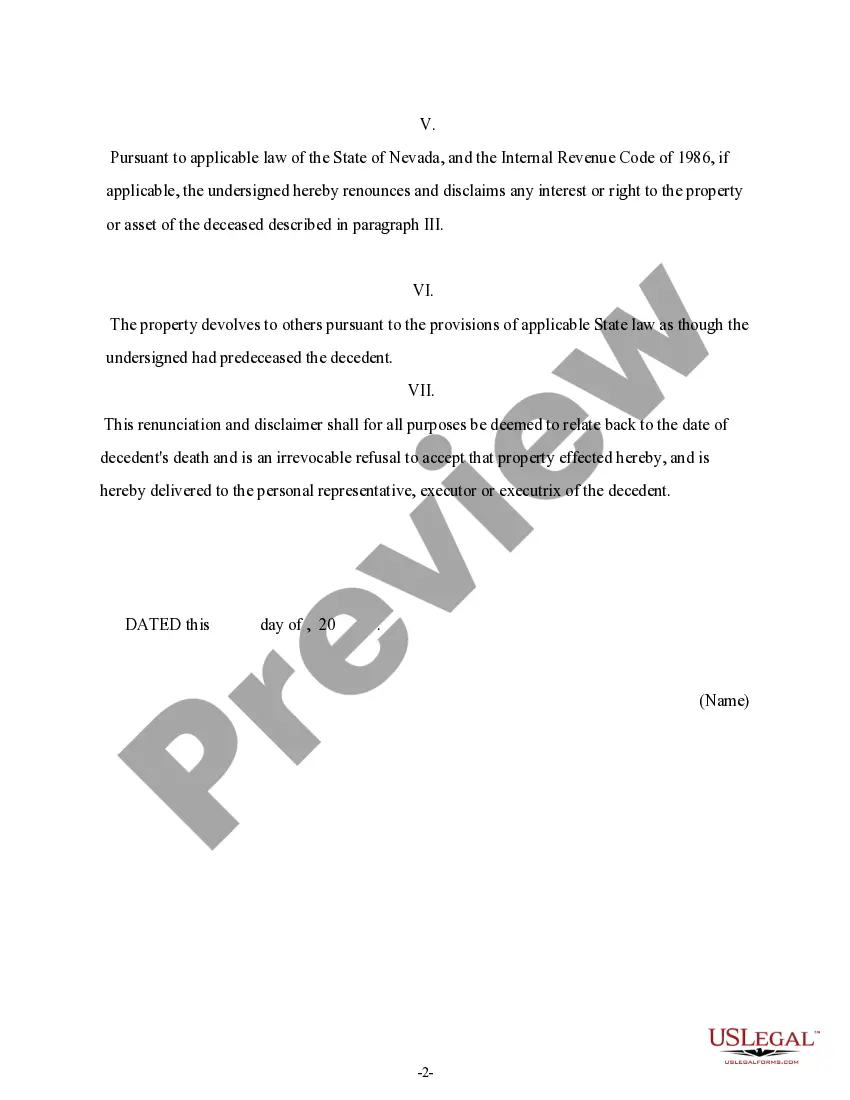

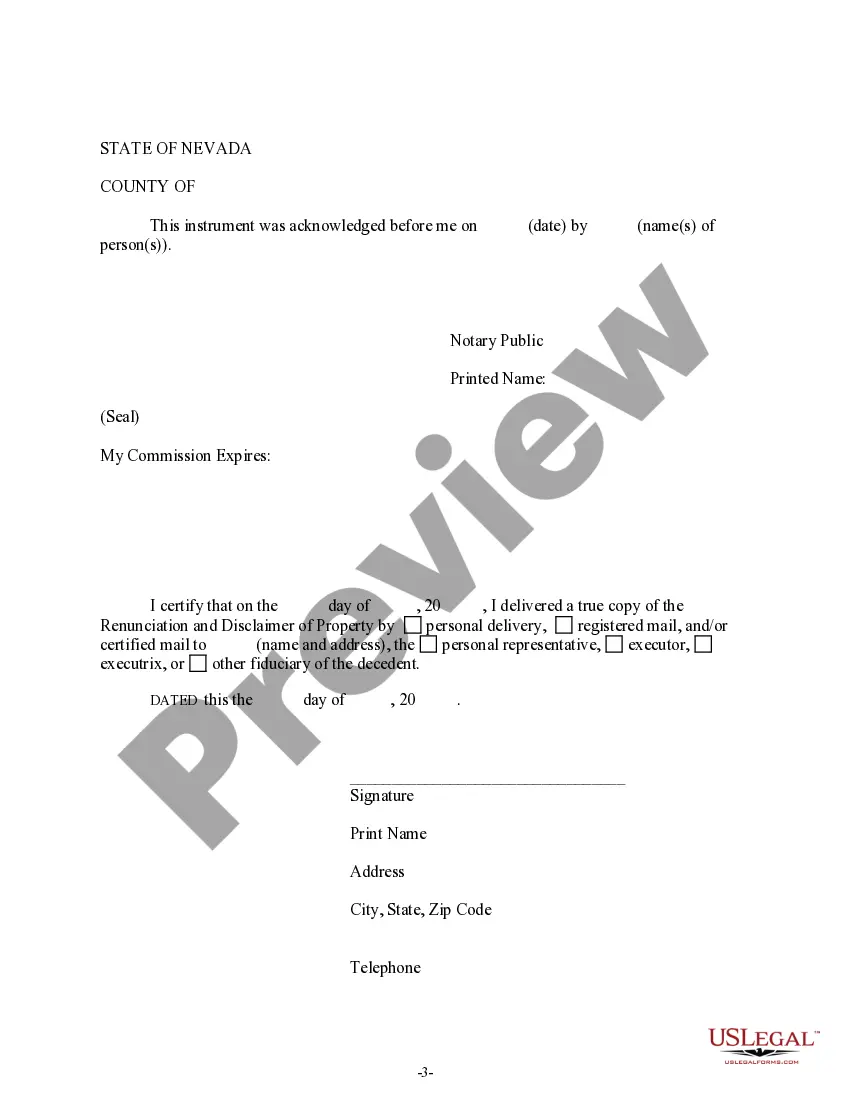

How to fill out Nevada Renunciation And Disclaimer Property - Intestate Succession?

If you’ve previously utilized our service, Log In to your account and acquire the Clark Nevada Renunciation And Disclaimer Property - Intestate Succession onto your device by selecting the Download button. Verify that your subscription is active. If not, refresh it per your payment arrangement.

If this is your initial encounter with our service, adhere to these straightforward steps to obtain your document.

You have lifetime access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you’ve found a suitable document. Review the details and use the Preview option, if accessible, to ascertain if it fulfills your needs. If it’s not appropriate, utilize the Search tab above to find the correct one.

- Purchase the template. Select the Buy Now button and opt for a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Clark Nevada Renunciation And Disclaimer Property - Intestate Succession. Choose the file format for your document and store it onto your device.

- Complete your template. Print it or employ professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

In Nevada, intestate succession laws determine how property is distributed when a person dies without a will. The laws prioritize spouses, children, and parents, in that order. If no immediate relatives exist, the estate may go to more distant relatives. Understanding the implications of the Clark Nevada Renunciation and Disclaimer Property - Intestate Succession can help navigate these laws effectively.

A disclaimer of interest in Nevada is a legal tool that allows an heir to refuse their inheritance from an estate. This process can be beneficial if accepting the property would lead to financial burdens like debts or taxes. By filing a disclaimer, you can ensure that your share is redistributed according to intestate laws. For guidance with Clark Nevada Renunciation And Disclaimer Property - Intestate Succession, US Legal Forms offers valuable resources.

To get heir property in your name, you must first establish a legal claim based on your relationship to the deceased. This often involves gathering necessary documents and potentially filing for a probate process to validate the claim. Utilizing platforms like US Legal Forms can simplify this process, particularly concerning Clark Nevada Renunciation And Disclaimer Property - Intestate Succession.

In Nevada, when someone dies without a will, the deceased’s bank accounts typically freeze until the estate is resolved. The funds in these accounts will be distributed according to the state's intestate succession laws. Heirs may need to provide documentation proving their relationship to the deceased to access these funds. For clarity on processes related to Clark Nevada Renunciation And Disclaimer Property - Intestate Succession, consider using US Legal Forms.

Obtaining heir property without a will involves navigating through the intestate succession laws of your state. This usually means identifying and proving your relationship to the deceased. Once established, you may need to petition the court for an order transferring the property to your name. Leveraging tools from US Legal Forms can guide you through Clark Nevada Renunciation And Disclaimer Property - Intestate Succession.

When a person dies without a will in the USA, the estate is distributed according to state intestate succession laws. Typically, the property goes to the closest relatives, which may include a spouse, children, or other kin. In each state, these laws vary, making it essential to consult legal resources for specifics, especially concerning Clark Nevada Renunciation And Disclaimer Property - Intestate Succession.

Intestate succession law in Nevada governs how property is distributed when someone dies without a will. Under these laws, the deceased's estate is divided among surviving relatives based on their relationship. For instance, spouses, children, and in some cases, parents inherit first. Understanding these laws can be vital for those dealing with Clark Nevada Renunciation And Disclaimer Property - Intestate Succession.

In Nevada, heirs typically have a limited time to claim property after a person's death. The state generally allows a period of six months for heirs to assert their rights to an inheritance. This timeline is crucial for ensuring a smooth resolution of the estate. Utilizing resources like US Legal Forms can help clarify processes related to Clark Nevada Renunciation And Disclaimer Property - Intestate Succession.

Yes, a disclaimer of inheritance in Clark Nevada generally needs to be notarized to be considered valid. This notarization provides an additional layer of authenticity to your intent to renounce the inheritance. Filing this document with the appropriate probate court solidifies your legal standing under intestate succession laws. For further assistance, you can turn to platforms like USLegalForms for the necessary documentation.

When one spouse dies in Nevada, community property typically passes directly to the surviving spouse. This process occurs without going through probate, which simplifies the transfer of assets. However, if there are specific concerns or disputes, understanding the Clark Nevada Renunciation And Disclaimer Property - Intestate Succession can provide clarity. Always seek professional guidance to navigate these laws correctly.