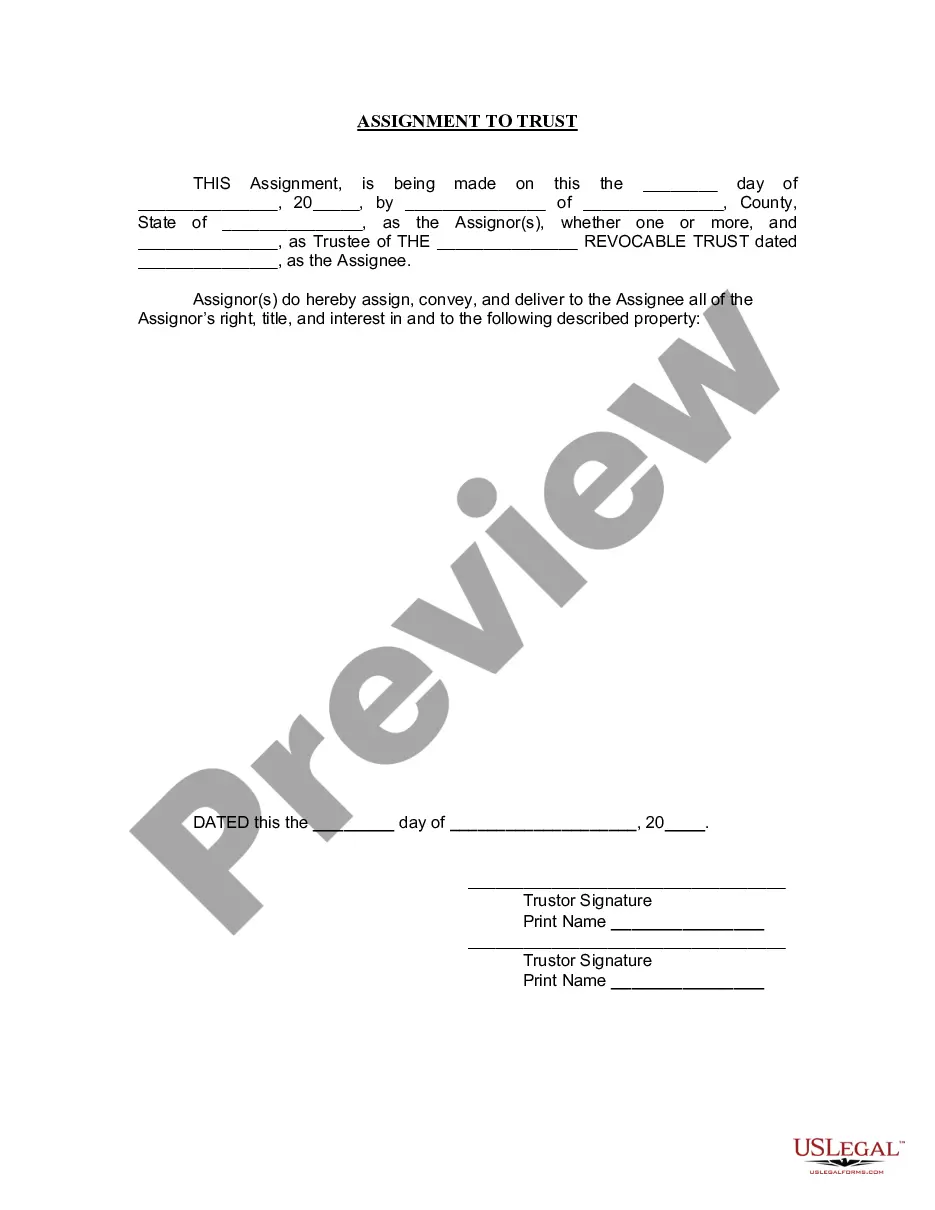

Albuquerque New Mexico Assignment to Living Trust

Description

How to fill out New Mexico Assignment To Living Trust?

If you’ve previously utilized our service, Log In to your account and retrieve the Albuquerque New Mexico Assignment to Living Trust on your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial experience with our service, follow these easy steps to acquire your document.

You have uninterrupted access to all the documentation you have acquired: you can find it in your profile under the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to efficiently find and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and use the Preview option, if available, to ensure it satisfies your needs. If it doesn't suit you, utilize the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Albuquerque New Mexico Assignment to Living Trust. Choose the file format for your document and store it on your device.

- Finalize your sample. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay in the range of $1,500 to $2,500, depending on whether you are single or married, how complex the trust needs to be and what state you are in.

One big difference between the two is in how and when they take effect. Wills don't go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it.

A will does not go into effect until after you die, whereas a living trust is active once it is created and funded. This means that a trust can provide protection and direct your assets if you become mentally incapacitated, something a will is unable to do.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

A New Mexico living trust protects and maintains your assets for your exclusive use during your life and passes them to your beneficiaries after your death. A revocable living trust (inter vivos trust) can be an important part of your estate planning process.

A living trust, sometimes referred to as a revocable trust or inter vivos trust, is established and takes effect during your lifetime by a written document known as a trust agreement. A will is written during your lifetime, but does not take effect until after your death.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

How to Create a Living Trust in New Mexico Figure out which type of trust is best for you. If you're single, a single trust is probably what you'll want.Take inventory of your assets.Choose your trustee.Write a trust document.Sign the trust in front of a notary. Fund the trust by moving property into it.