Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out New Mexico Dissolution Package To Dissolve Limited Liability Company LLC?

If you are searching for a legitimate form, it’s incredibly challenging to discover a superior service than the US Legal Forms website – likely the most comprehensive collections available on the web.

Here you can acquire a vast quantity of form samples for both business and personal use categorized by type and state, or search terms.

With the advanced search capability, obtaining the latest Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the format and download it to your device.

- Furthermore, the validity of each document is confirmed by a group of experienced attorneys who routinely assess the templates on our platform and refresh them according to the latest state and county laws.

- If you are already familiar with our service and possess a registered account, all you need to obtain the Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, just follow the instructions below.

- Ensure you have selected the form you desire. Review its details and use the Preview feature to investigate its content. If it does not satisfy your needs, utilize the Search box at the top of the screen to find the suitable document.

- Verify your selection. Hit the Buy now button. Then, choose your preferred pricing plan and provide details to create an account.

Form popularity

FAQ

Dissolution and termination of an LLC refer to related but distinct processes. Dissolution is the official act of closing the company, whereas termination is the final step that formally ends the legal existence of the LLC. With the Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC, you can efficiently handle both processes. This approach ensures clarity and compliance, letting you finish your business affairs with confidence.

When considering whether to dissolve your LLC or leave it inactive, think about your long-term plans. An inactive LLC may still incur annual fees and compliance requirements, potentially leading to complications later. By utilizing the Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC, you can simplify the process and eliminate unnecessary costs. This package provides the guidance you need to make a clear decision.

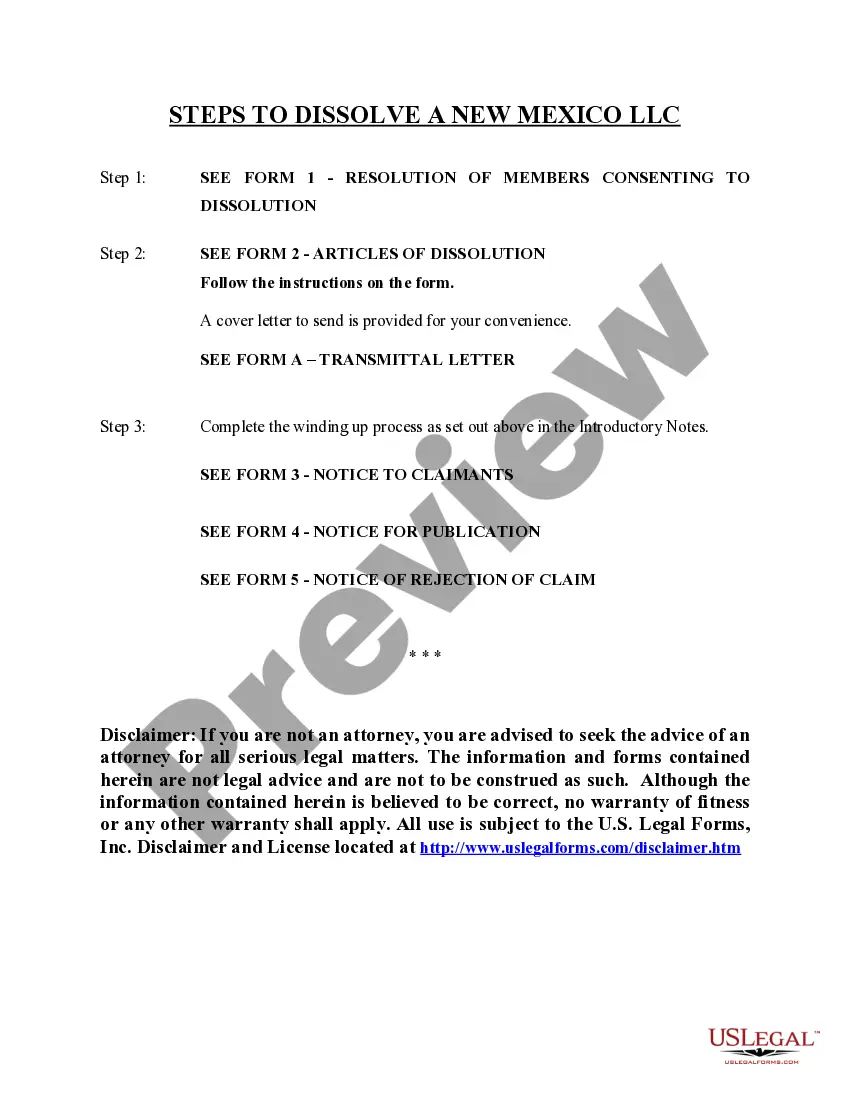

To officially close an LLC, you need to follow a series of steps, including filing the necessary dissolution forms with the state and addressing any outstanding business obligations. It’s essential to properly dissolve the company to avoid ongoing taxes and legal issues. Using our Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC simplifies this process, ensuring you complete each step correctly.

Dissolving an LLC means you are officially ending its operations and dissolving its legal existence. On the other hand, terminating refers to the complete cessation of business activities without going through the formal dissolution process. If you're considering the steps to take in Las Cruces, New Mexico, our Dissolution Package to Dissolve Limited Liability Company LLC can guide you through these distinctions effectively.

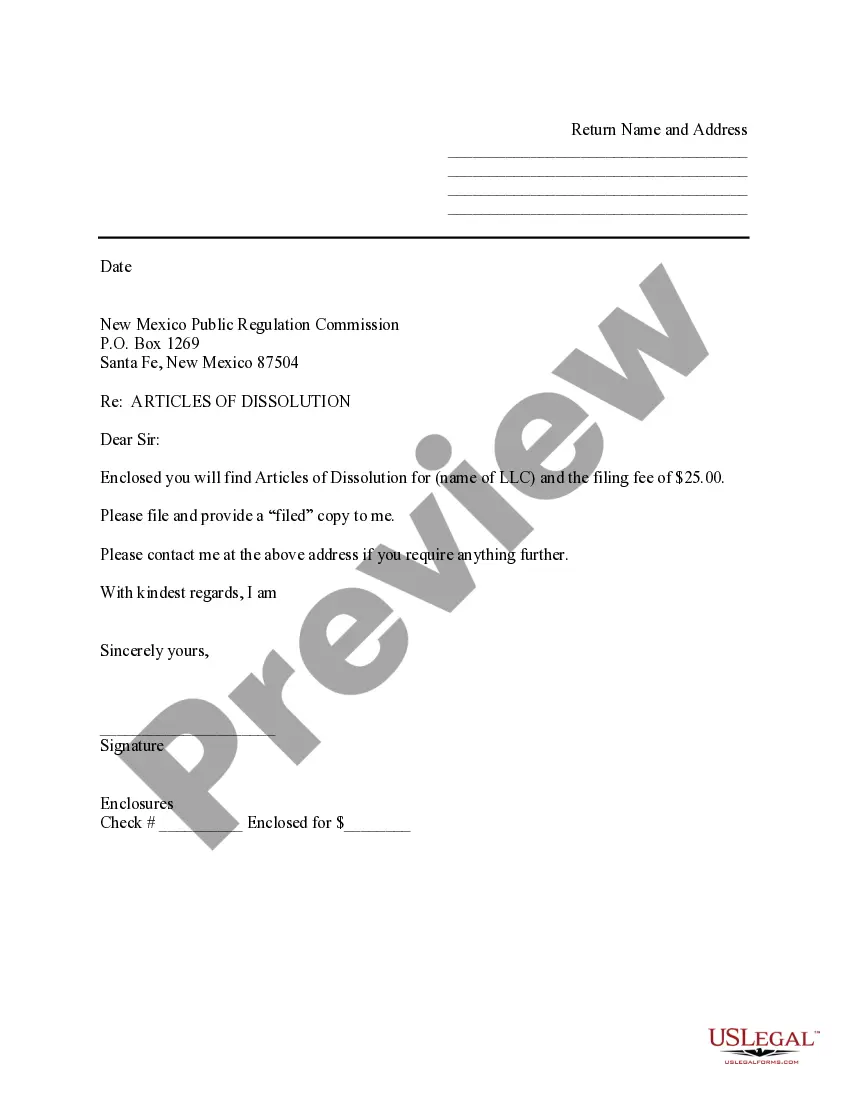

To cancel your LLC in New Mexico, you need to file the appropriate paperwork with the New Mexico Secretary of State. The process involves submitting a dissolution form, which is part of the Las Cruces New Mexico Dissolution Package to Dissolve Limited Liability Company LLC. Ensure you notify any creditors and settle any debts your LLC may have. Using the uslegalforms platform can streamline this process, making it easier for you to manage your LLC dissolution efficiently.

Nevada requires an articles of dissolution form be filed with the Secretary of State by mail, fax or email. This form is available online, along with instructions. There is a fee for filing and it is usually processed within 5 business days. Expedited processing is available for an additional fee.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.

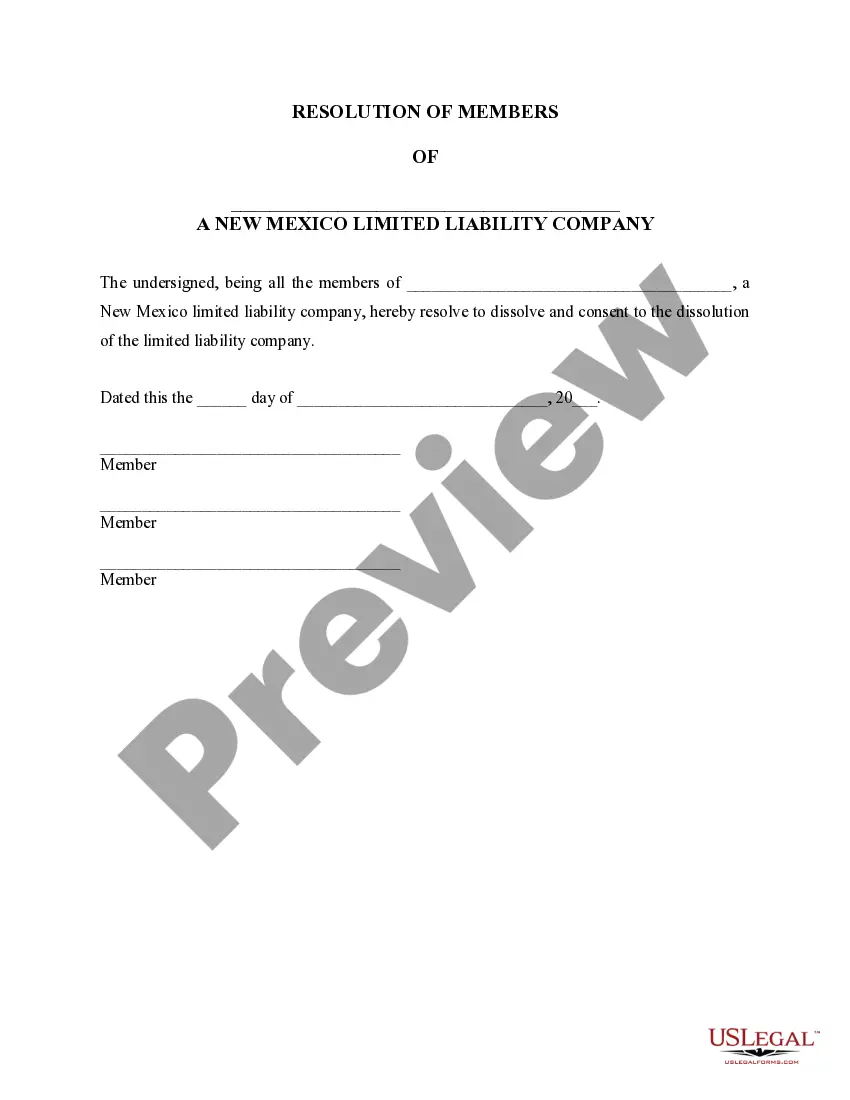

Generally called articles of dissolution, it usually states the LLC's name, the date it was formed, the fact the LLC is dissolving, and the event triggering the dissolution. Upon the effective date of this document, the LLC is considered dissolved and must stop doing its regular business and start winding up.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.