Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out New Mexico Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

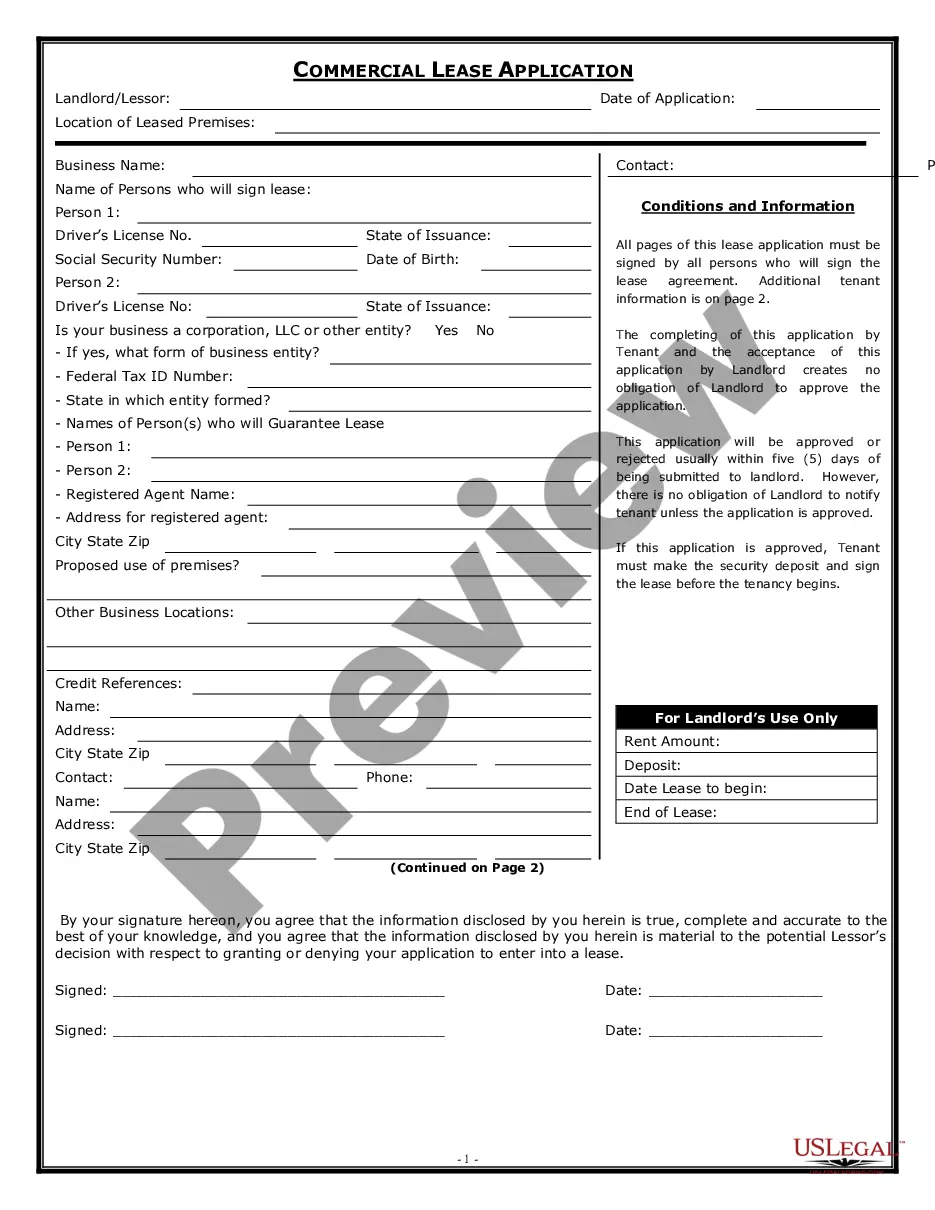

Finding authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents to cater to both personal and professional requirements as well as various real-world situations.

All the files are properly organized by usage category and jurisdiction, making it as quick and straightforward as possible to find the Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Download the Albuquerque New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Save the template on your device to work on it and access it later in the My documents section of your profile whenever needed. Maintaining organized paperwork in compliance with legal standards is crucial. Leverage the US Legal Forms library to always have crucial document templates readily available!

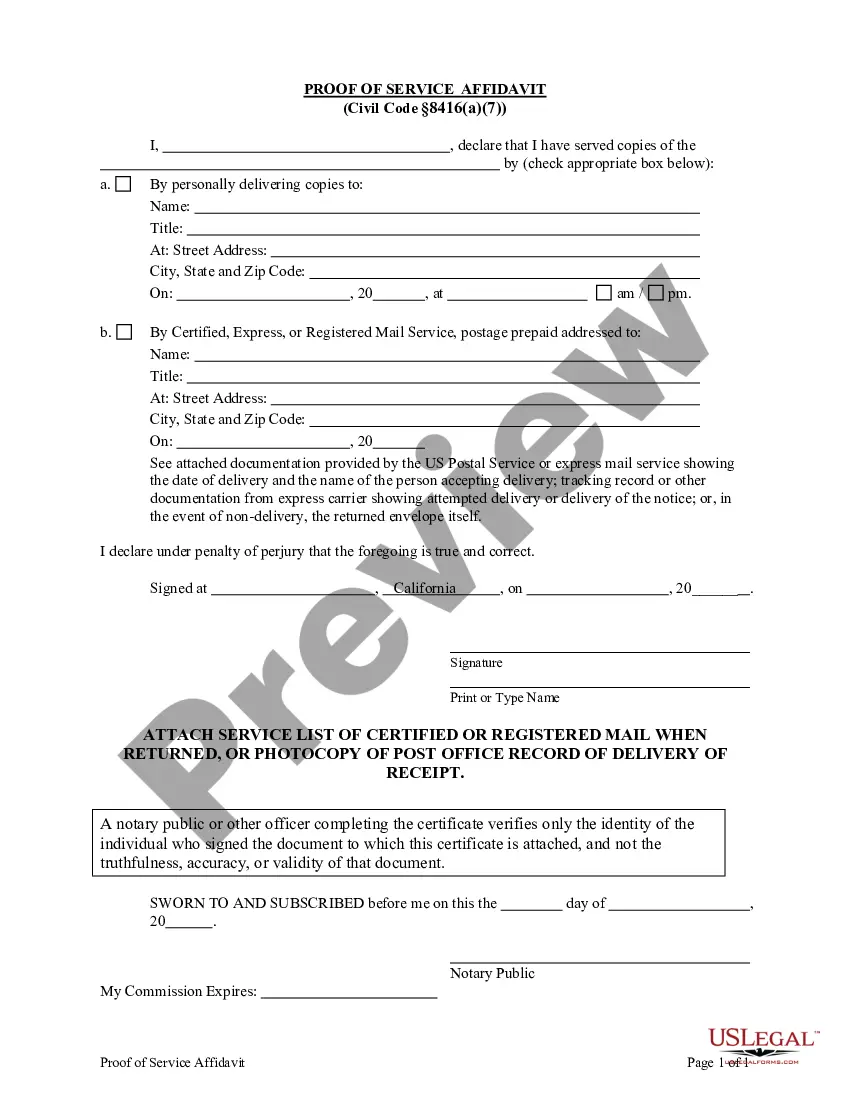

- Review the Preview mode and form description.

- Ensure you have selected the correct document that aligns with your needs and fully complies with your local jurisdiction criteria.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your specifications, proceed to the following step.

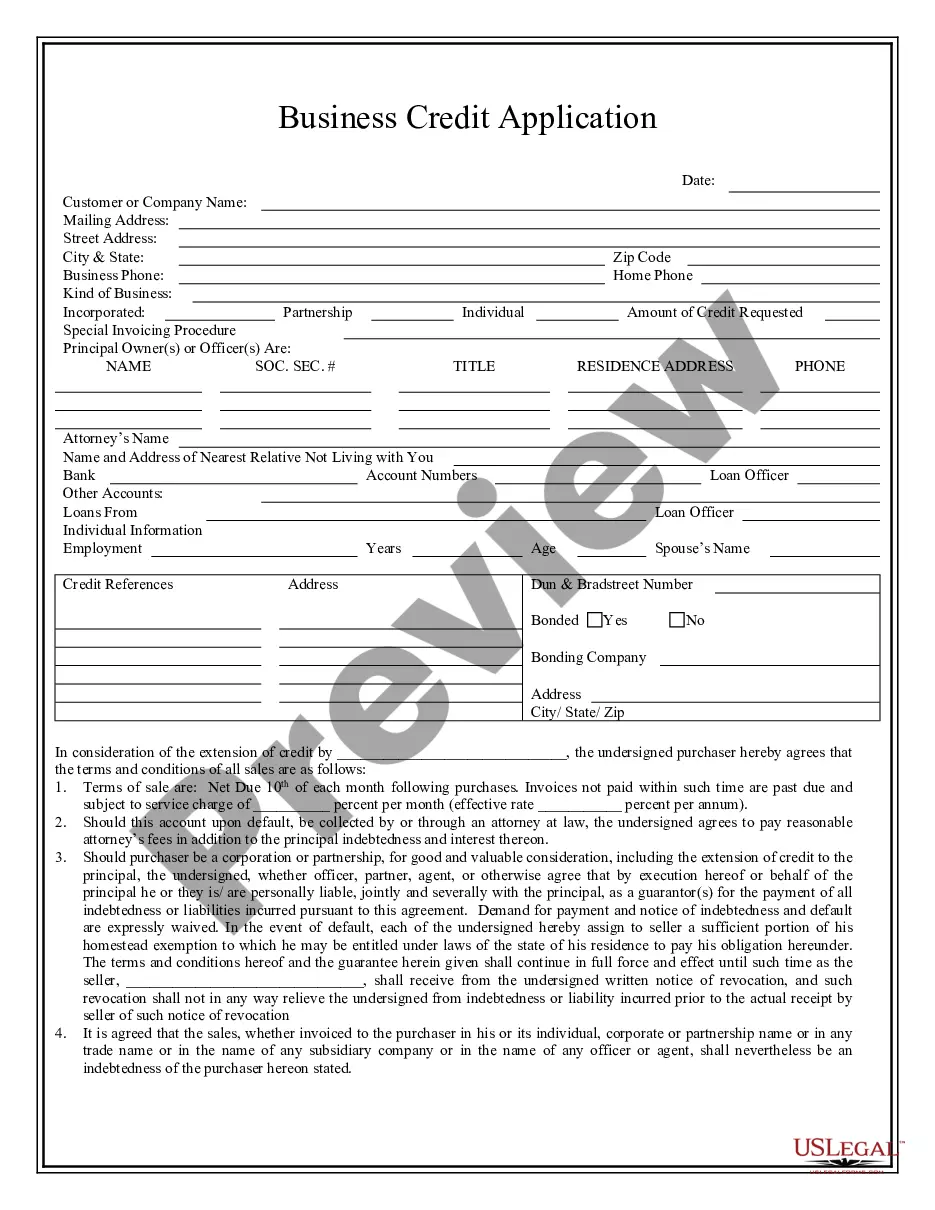

- Complete the transaction.

- Click on the Buy Now button and select your desired subscription plan. You will need to create an account to access the resources in the library.

Form popularity

FAQ

The Dishonored Check Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

If You Bounce a Check Usually, this is because there is not enough money in your account to complete the transaction. State laws generally spell out what happens next: Typically, you are liable for paying the merchant and the returned-check fee.

Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items. Depository banks attempt to deposit checks twice before being considered dishonored.

For example, a check might be drawn on a non-existent bank account, or the account on which the check is drawn does not contain sufficient funds, or the check was not signed, or the check was not endorsed.

Every legitimate check contains a number that appears in two places: in the upper-right corner and in the magnetic ink character recognition (MICR) line at the bottom. If the numbers don't match, it's a bogus check. And be wary of low numbers, such as 101-400 on a personal check or 1,000-1,500 on a business check.

Why are cheques dishonoured by bank? Cheques are dishonoured by the bank if there are insufficient funds, a signature mismatch, overwriting or a stale date.

DISHONORED CHECKS - 8043 Dishonored checks are items deposited at a depository bank, but are returned to the State due to non-sufficient funds or other reasons preventing the bank from cashing the items.

What is Dishonour of Cheque? A cheque is said to be honoured if the banks give the amount to the payee. While, if the bank refuses to pay the amount to the payee, the cheque is said to be dishonoured. In other words, dishonour of cheque is a condition in which the bank refuses to pay the amount of cheque to the payee.

If a cheque is dishonoured for any reason, the bank on which it is drawn must promptly return the cheque to the depositor's (payee's) bank, which will ultimately return it to the depositor.

A bad check refers to a check that cannot be negotiated because it is drawn on a nonexistent account or one that has insufficient funds. Writing a bad check, also known as a hot check, is illegal.