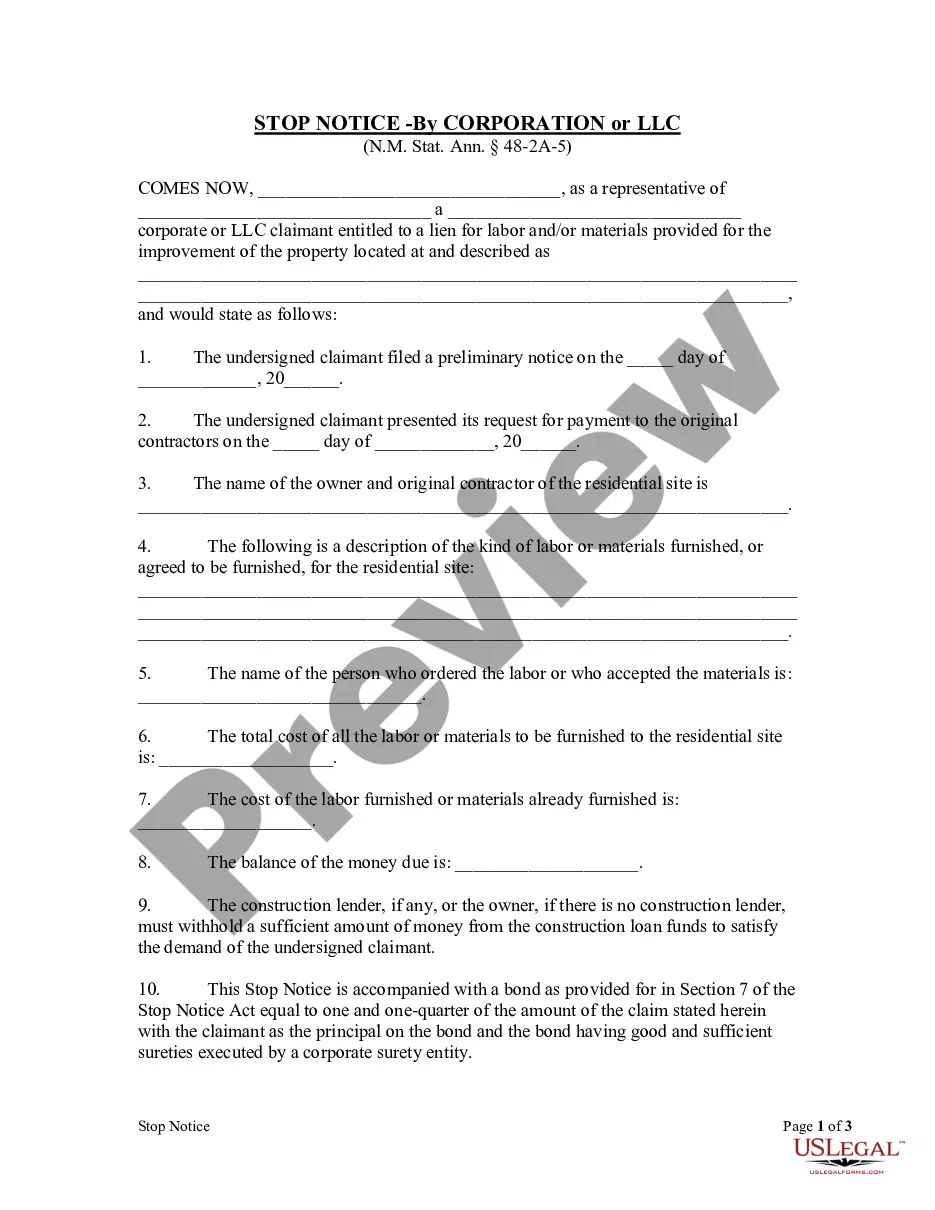

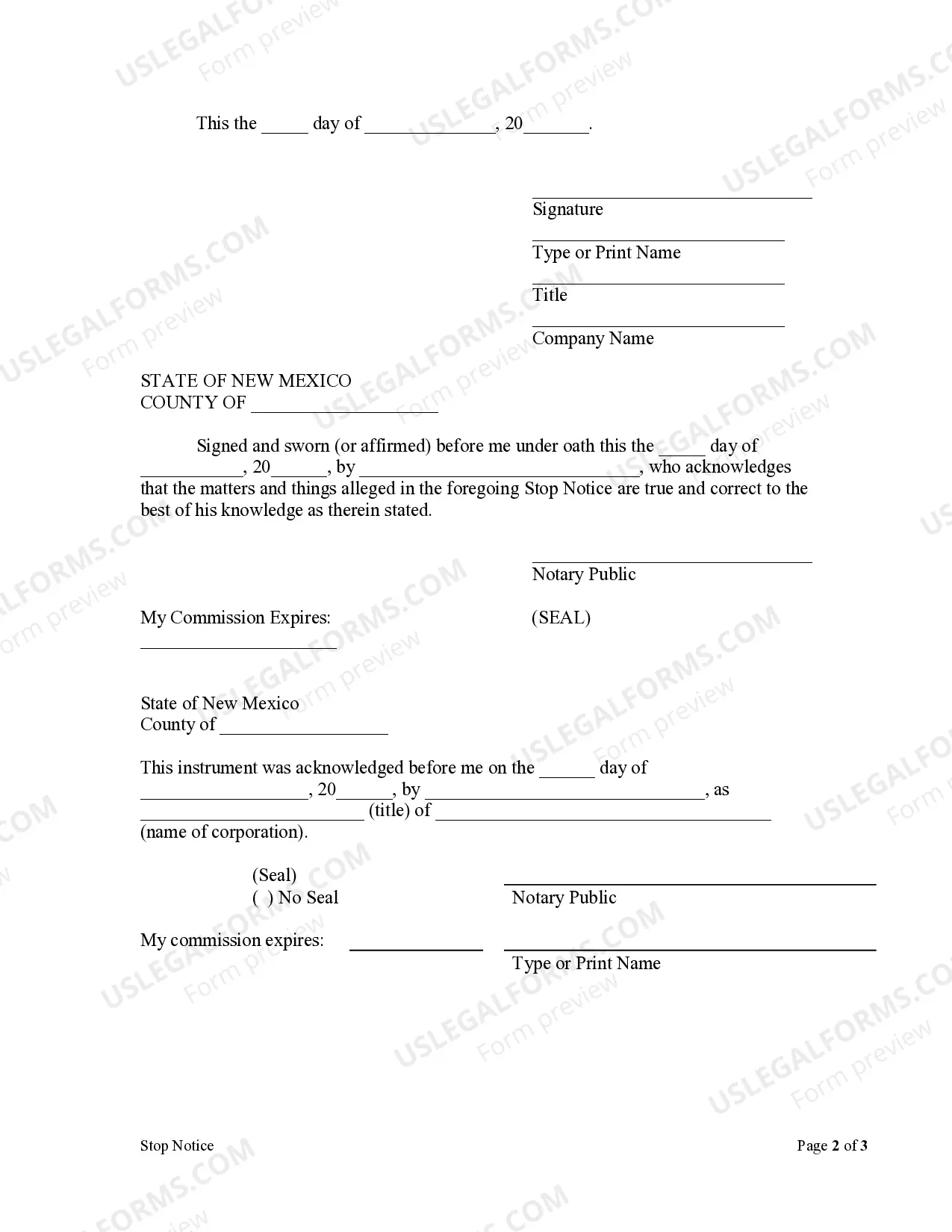

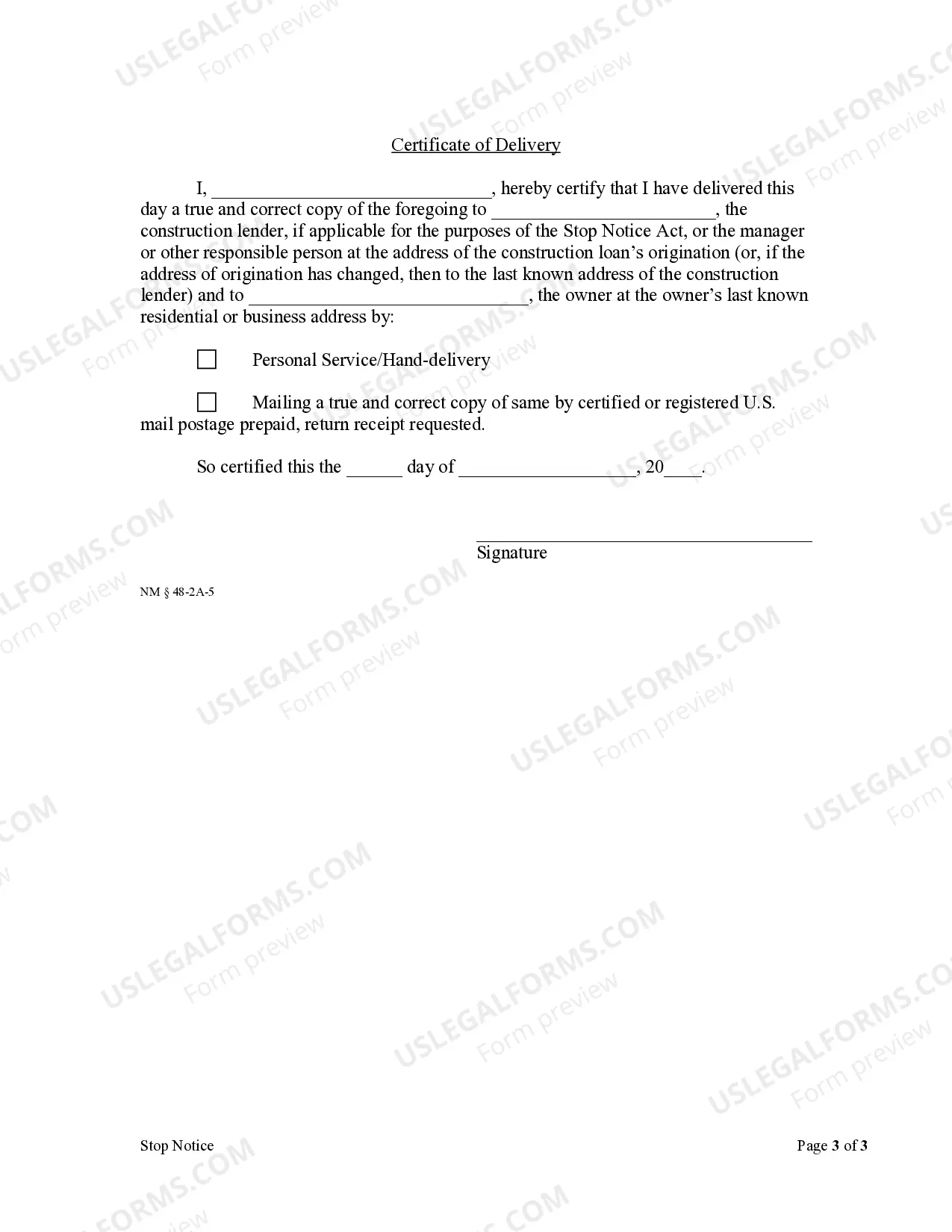

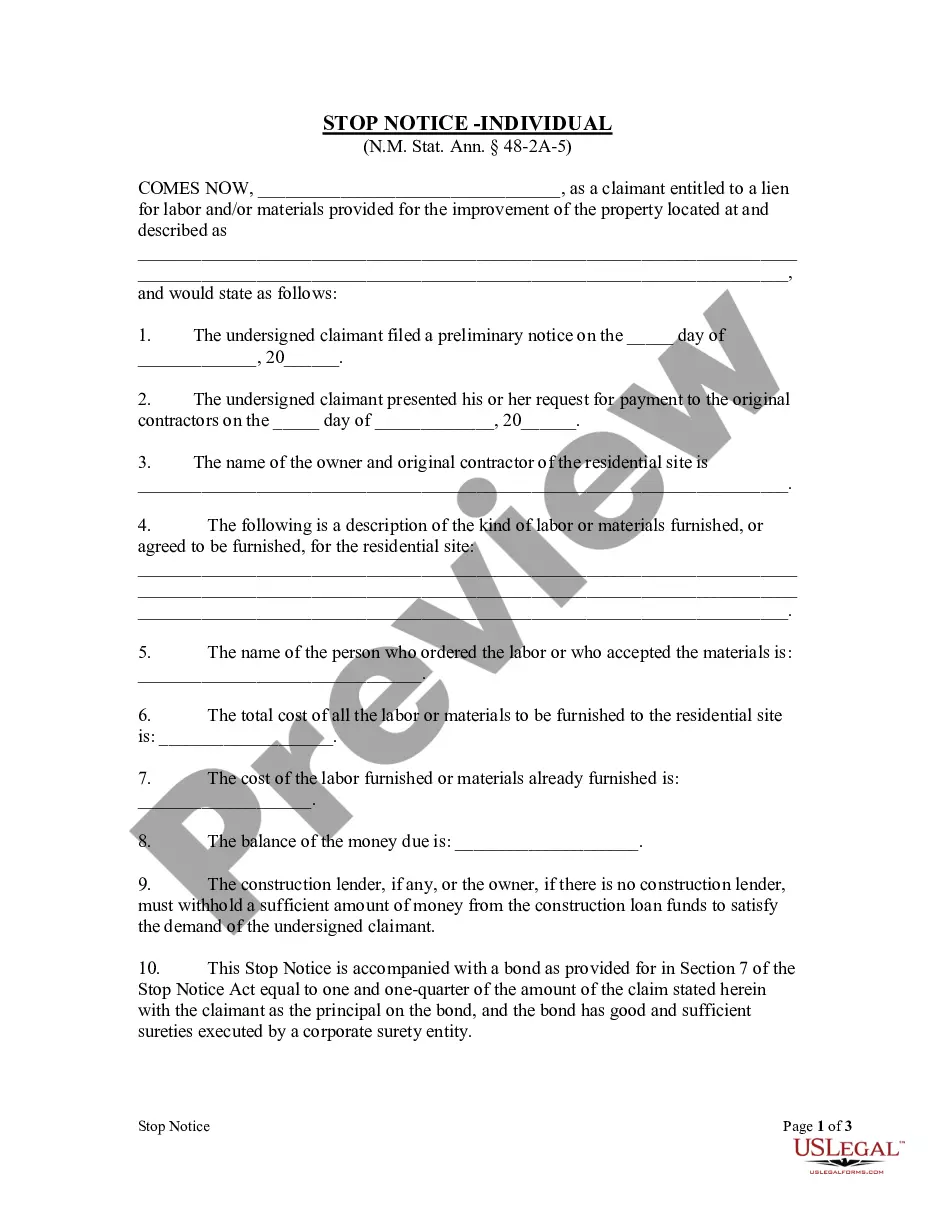

This Stop Notice form is for use by a corporate lien claimant entitled to a lien for labor and/or materials provided for the improvement of property to provide notice of the date the claimant filed a preliminary notice, the date the claimant presented its request for payment to the original contractors, the name of the owner and original contractor of the residential site, a description of the kind of labor or materials furnished, or agreed to be furnished, for the residential site, the name of the person who ordered the labor or who accepted the materials, the total cost of all the labor or materials to be furnished to the residential site, the cost of the labor furnished or materials already furnished, the balance of the money due, and a statement that the construction lender, if any, or the owner, if there is no construction lender, must withhold a sufficient amount of money from the construction loan funds to satisfy the demand of the undersigned claimant.

Albuquerque New Mexico Stop Notice - Corporation

Description

How to fill out New Mexico Stop Notice - Corporation?

Obtaining verified templates tailored to your local regulations can be challenging unless you access the US Legal Forms library.

This is an online repository of over 85,000 legal documents for both personal and business purposes, covering various real-life situations.

All documents are accurately sorted by usage area and jurisdiction, making it quick and straightforward to find the Albuquerque New Mexico Stop Notice - Corporation or LLC.

Maintaining organized paperwork that complies with legal standards is of utmost importance. Utilize the US Legal Forms library to always have essential document templates readily available for any requirements!

- For those already familiar with our catalog and have utilized it before, acquiring the Albuquerque New Mexico Stop Notice - Corporation or LLC takes only a few clicks.

- Simply Log In to your account, select the document, and click Download to save it to your device.

- This procedure will involve a few more steps for new users.

- Follow the instructions below to begin using the most comprehensive online form library.

- Review the Preview mode and form description. Ensure you have selected the correct form that aligns with your needs and fully meets your local jurisdiction specifications.

Form popularity

FAQ

Burying Your Identity in Your LLC Set up a series of companies. This is the most typical way of protecting your privacy. The company you legally own would own your LLC, making it harder for people to trace ownership of the LLC to your name. Create a blind trust, naming yourself as the beneficiary.

To file a New Mexico anonymous LLC, the owner must submit the business's Articles of Organization to the state. Typical Articles of Organization should include: The name of the company. The duration of the business.

You can apply for a Combined Reporting System (CRS) number online using the Departments website,Taxpayer Access Point (TAP) . From the TAP homepage, under Businesses select Apply for a CRS ID. Follow the steps to complete the business registration.

Which Are the Best States for an Anonymous LLC? Delaware and New Mexico are the most popular states for registering anonymous LLCs. Delaware has a streamlined court dedicated to business matters and offers personal liability protections that other states do not.

corporations, limited liability companies and other passthrough entities doing business in the state must file a New Mexico income tax return.

To change your registered agent in New Mexico, you must complete and file a Statement of Change of Registered Agent form with the New Mexico Secretary of State. The New Mexico Statement of Change of Registered Agent must be submitted by mail or in person and costs $25 for corporations and $20 for LLCs to file.

Common Myths of Anonymous Corporations or LLC's This is a myth. Some companies just want to avoid frivolous lawsuits that could potentially bankrupt their business and their personal assets. Business owners cannot remain anonymous.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

File Your New Mexico LLC Forms The price for in-state LLCs is $50. Foreign (out-of-state) entities cannot file online. Instead, they must mail their Certificate of Registration forms to the Secretary of State.

If you are dissolving or withdrawing a corporation from the State of New Mexico, you must request a Corporate Certificate of No Tax Due from the New Mexico Taxation and Revenue Department. You may also contact the Secretary of State (SOS) for information regarding any further requirements administered by that agency.