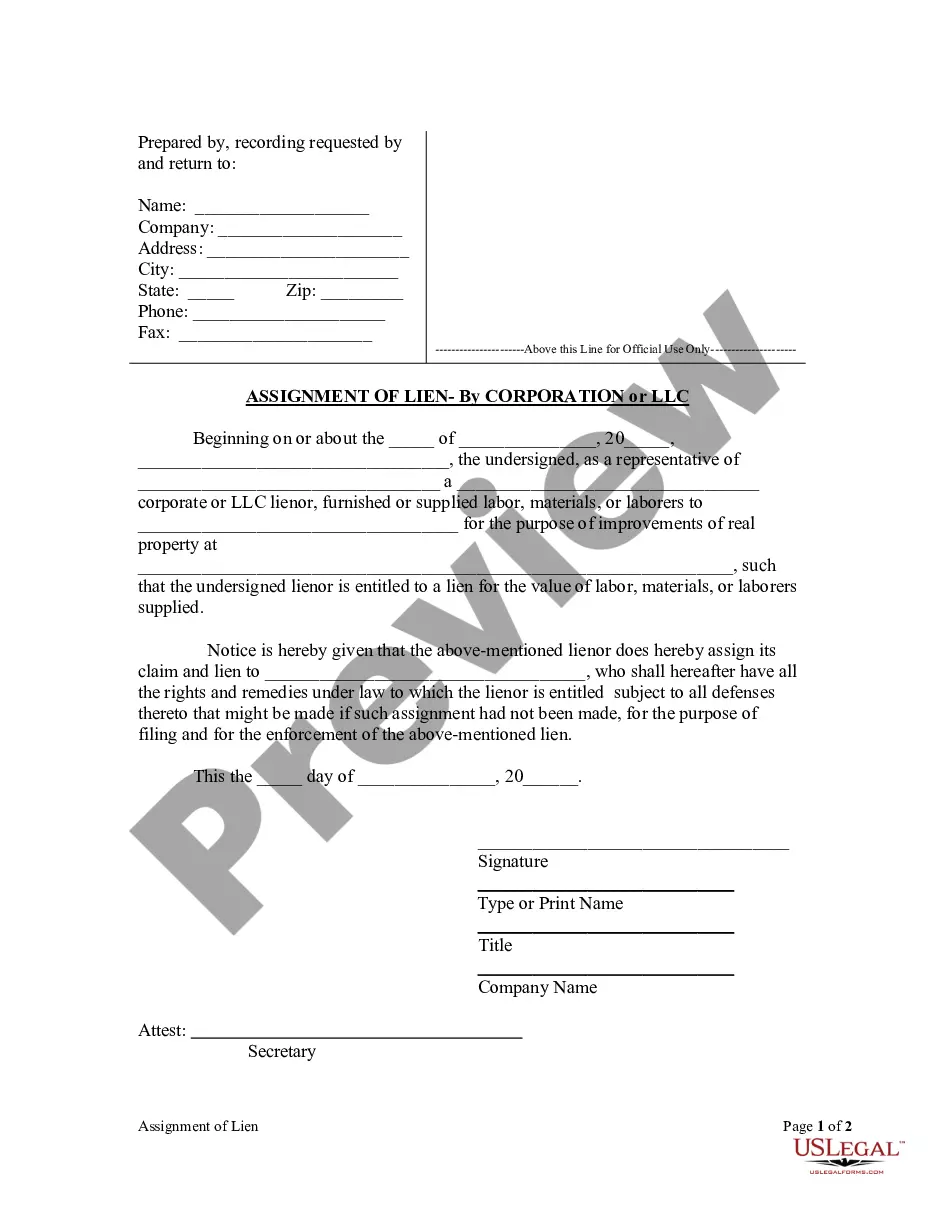

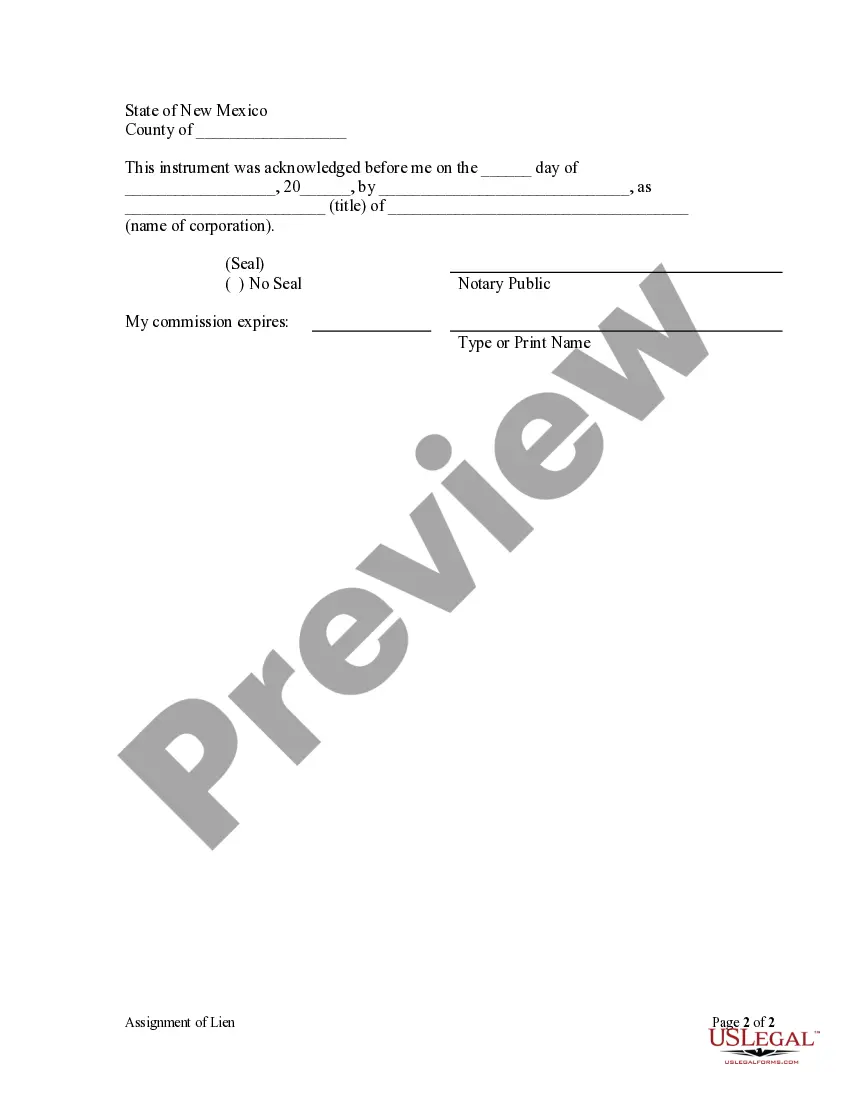

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied, to provide notice that the lienor assigns the lienor's claim and lien to an individual who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Albuquerque New Mexico Assignment of Lien - Corporation

Description

How to fill out New Mexico Assignment Of Lien - Corporation?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our practical platform with a vast array of documents enables you to locate and secure nearly any document sample you desire.

You can download, fill out, and sign the Albuquerque New Mexico Assignment of Lien - Corporation or LLC in only a few minutes instead of spending hours online in search of a suitable template.

Using our directory is an excellent method to enhance the security of your record submissions. Our skilled legal experts routinely verify all the documents to ensure that the templates are suitable for a specific state and adhere to current laws and regulations.

US Legal Forms is one of the largest and most dependable template libraries available online. Our organization is always prepared to assist you with any legal procedure, even if it is simply downloading the Albuquerque New Mexico Assignment of Lien - Corporation or LLC.

Feel free to fully leverage our platform and make your document experience as seamless as possible!

- Discover the template you require.

- Ensure it is the document you intended to find: confirm its title and summary, and utilize the Preview option when available. Otherwise, employ the Search field to locate the one you need.

- Initiate the saving process.

- Choose Buy Now and select your preferred pricing plan. Afterward, create an account and complete your order using a credit card or PayPal.

- Store the document.

- Indicate the desired format to receive the Albuquerque New Mexico Assignment of Lien - Corporation or LLC and review and complete, or sign it according to your specifications.

Form popularity

FAQ

To confirm a company's LLC status, call the secretary of state's office or visit the website. In states like Arizona, out-of-state companies must register with the state before they can do business there. If your state doesn't have a mandatory registration, contact the company's home state for more information.

Although fees vary by state when it comes to forming an LLC and keeping it in compliance, New Mexico is considered one of the best states to form an LLC in. This is because there is no annual fee.

Kentucky has the lowest LLC formation cost at $40 per LLC while Massachusetts is the most expensive at $500 per LLC.

You can obtain your New Mexico certificate of good standing by requesting it from the Secretary of State. What is a certificate of good standing? A certificate of good standing is a state document that verifies your business was legally formed and has been properly maintained.

It's strongly recommended. Even though single-member LLCs can be relatively simple entities, operating agreements help the business with credibility and help ensure LLC status.

Unlike most other states, New Mexico does not require LLCs to file annual reports. However, New Mexico does require LLCs to file an Income and Information Return for Pass-Through Entities (PTE). You can download a copy of the required form from the website for New Mexico Taxation and Revenue Department (TRD).

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

An LLC operating agreement is not required in New Mexico, but is highly advisable. This is an internal document that establishes how your LLC will be run. It sets out the rights and responsibilities of the members and managers, including how the LLC will be managed.

The cost to start an LLC (limited liability company) online in New Mexico is $50. This fee is paid to the New Mexico Secretary of State when filing the LLC's Articles of Organization.

New Mexico does not require LLCs to file an annual report. New Mexico imposes a franchise tax on LLCs if they paid federal income tax. The franchise tax is filed along with the state income tax, and is due by the 15th day of the third month following the close of the tax year.