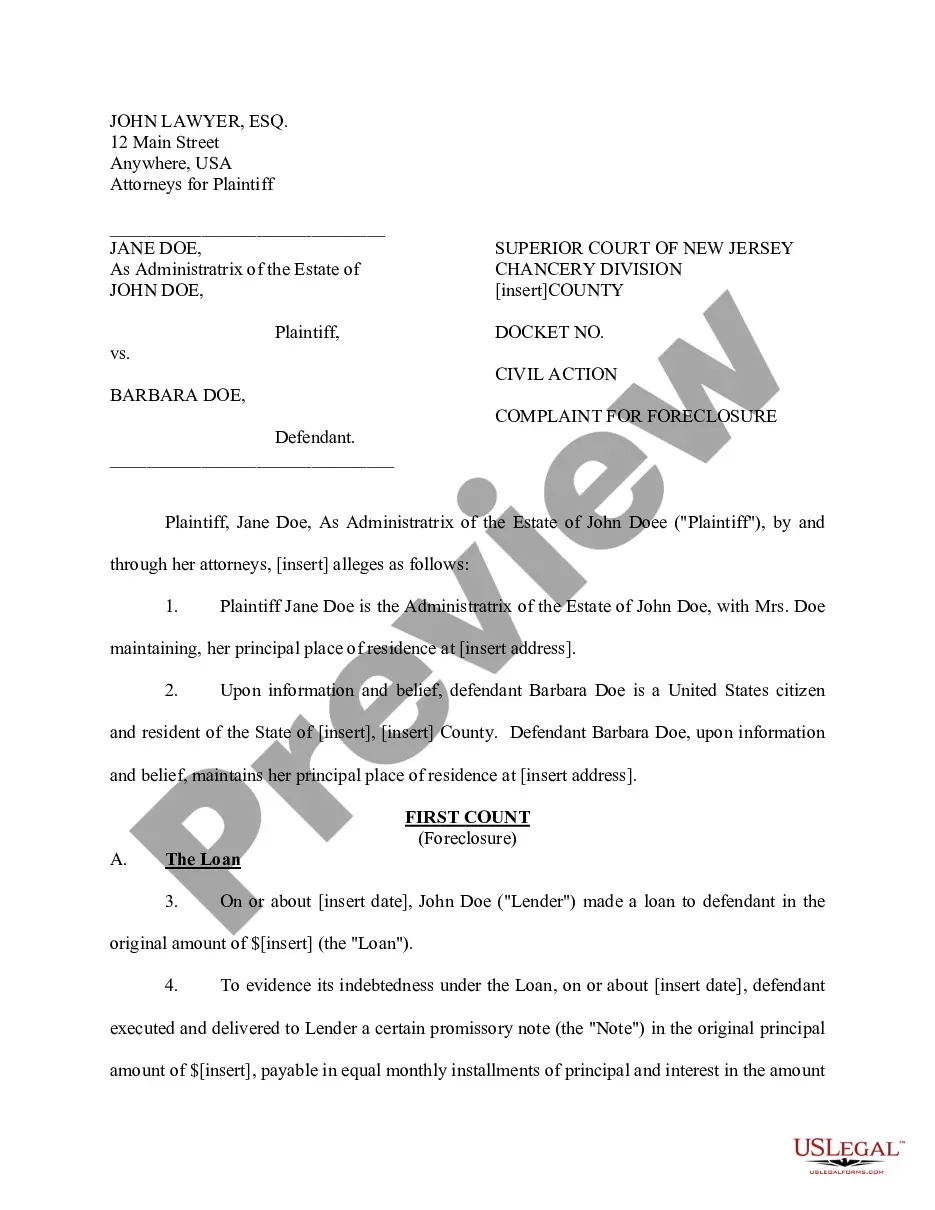

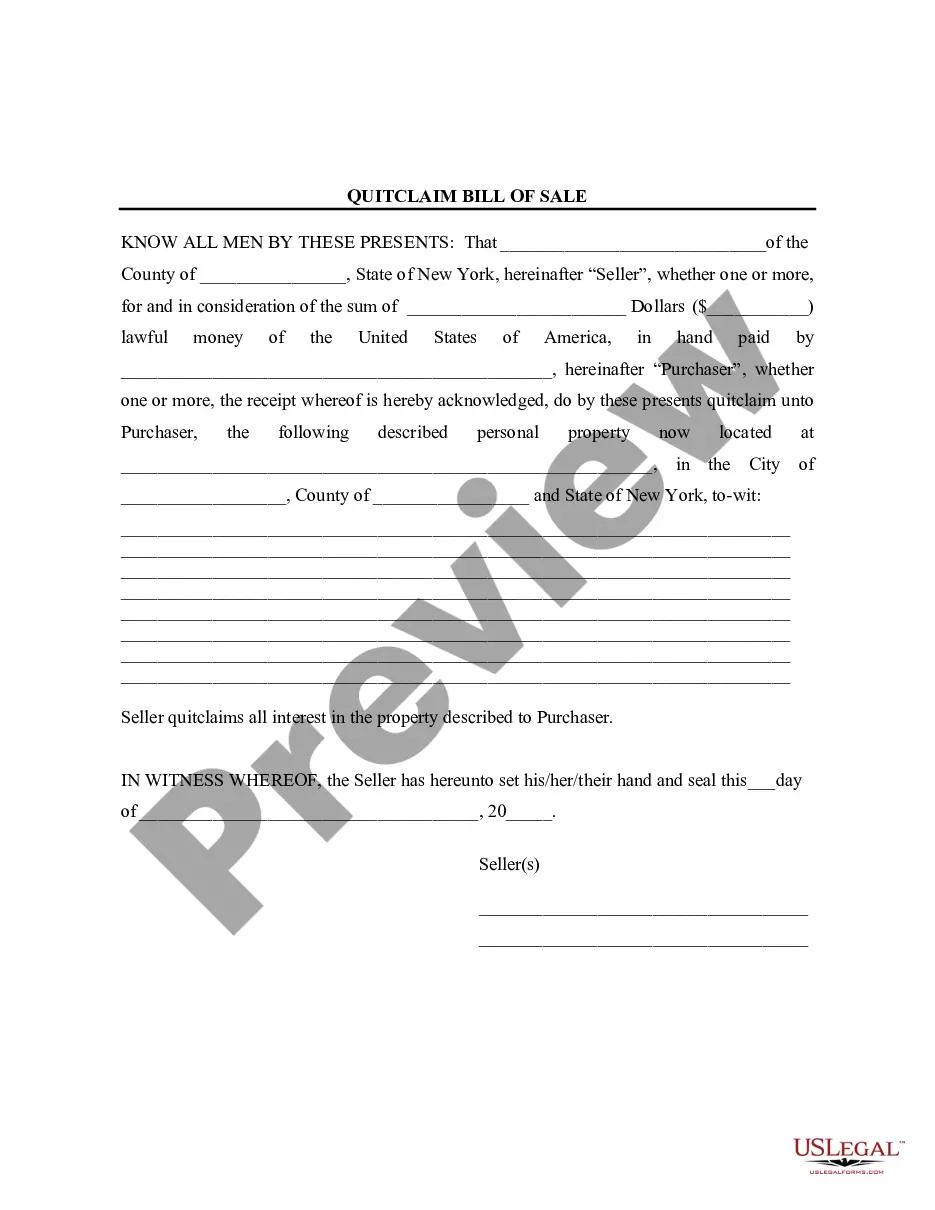

This form is a Complaint to Foreclose on a Residential Mortgage for use in foreclosure proceedings within the state of New Jersey.

Elizabeth New Jersey Complaint to Foreclose Residential Mortgage

Description

How to fill out New Jersey Complaint To Foreclose Residential Mortgage?

If you’ve previously utilized our service, sign in to your account and download the Elizabeth New Jersey Complaint to Foreclose Residential Mortgage onto your device by clicking the Download button. Ensure your subscription remains active. If it has expired, renew it based on your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your file.

You have ongoing access to all documents you’ve purchased: you can find them in your profile within the My documents menu whenever you need to access them again. Utilize the US Legal Forms service to conveniently find and save any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Review the description and utilize the Preview option, if available, to verify it aligns with your needs. If it doesn’t fit your criteria, use the Search tab above to locate the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Receive your Elizabeth New Jersey Complaint to Foreclose Residential Mortgage. Select the file type for your document and save it to your device.

- Finish your sample. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Filing a foreclosure in New Jersey involves several steps. First, you must prepare an Elizabeth New Jersey Complaint to Foreclose Residential Mortgage, which outlines your case and the reasons for the foreclosure. After you file this complaint with the court, you should serve a copy to the borrower. To navigate this process smoothly, consider using platforms like US Legal Forms, which provide templates and guidance to help you complete the necessary paperwork accurately.

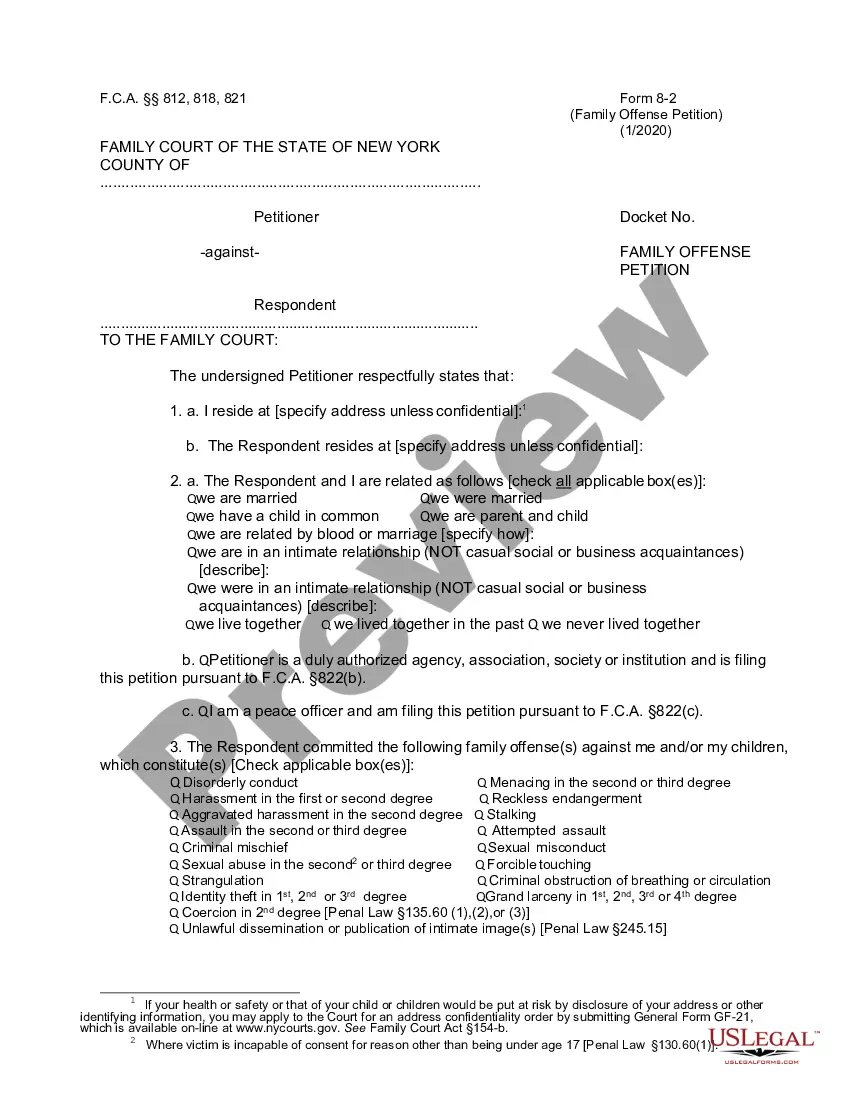

Serving a complaint in New Jersey involves delivering the legal documents to the individual named in the complaint, following specific state procedures. You can serve the complaint through a process server, a sheriff's officer, or certified mail, depending on your situation. It is crucial to prove that service was completed to ensure the case can proceed. For more guidance on serving complaints related to an Elizabeth New Jersey Complaint to Foreclose Residential Mortgage, consider resources from US Legal Forms.

A notice of intention to foreclose in New Jersey is a legal document that informs borrowers about the lender's intent to initiate foreclosure proceedings. This notice is typically required to be sent at least 30 days before a foreclosure action begins. It provides homeowners with a chance to rectify their situation or seek assistance. Understanding this notice is vital when facing an Elizabeth New Jersey Complaint to Foreclose Residential Mortgage.

In New Jersey, foreclosure rules include strict compliance with state laws, which aim to ensure fairness during the process. Lenders must provide notice prior to initiating foreclosure proceedings, allowing homeowners the opportunity to respond. Additionally, the court oversees the process to validate all claims and defenses. Familiarizing yourself with these regulations can be crucial when dealing with an Elizabeth New Jersey Complaint to Foreclose Residential Mortgage.

To file a foreclosure complaint answer in Elizabeth, New Jersey, you will need to draft a formal response to the complaint filed against you. This includes outlining your defense and any counterclaims. It is essential to file your answer within the stipulated time frame to avoid a default judgment. Consider using US Legal Forms to access templates and guides tailored for an Elizabeth New Jersey Complaint to Foreclose Residential Mortgage.

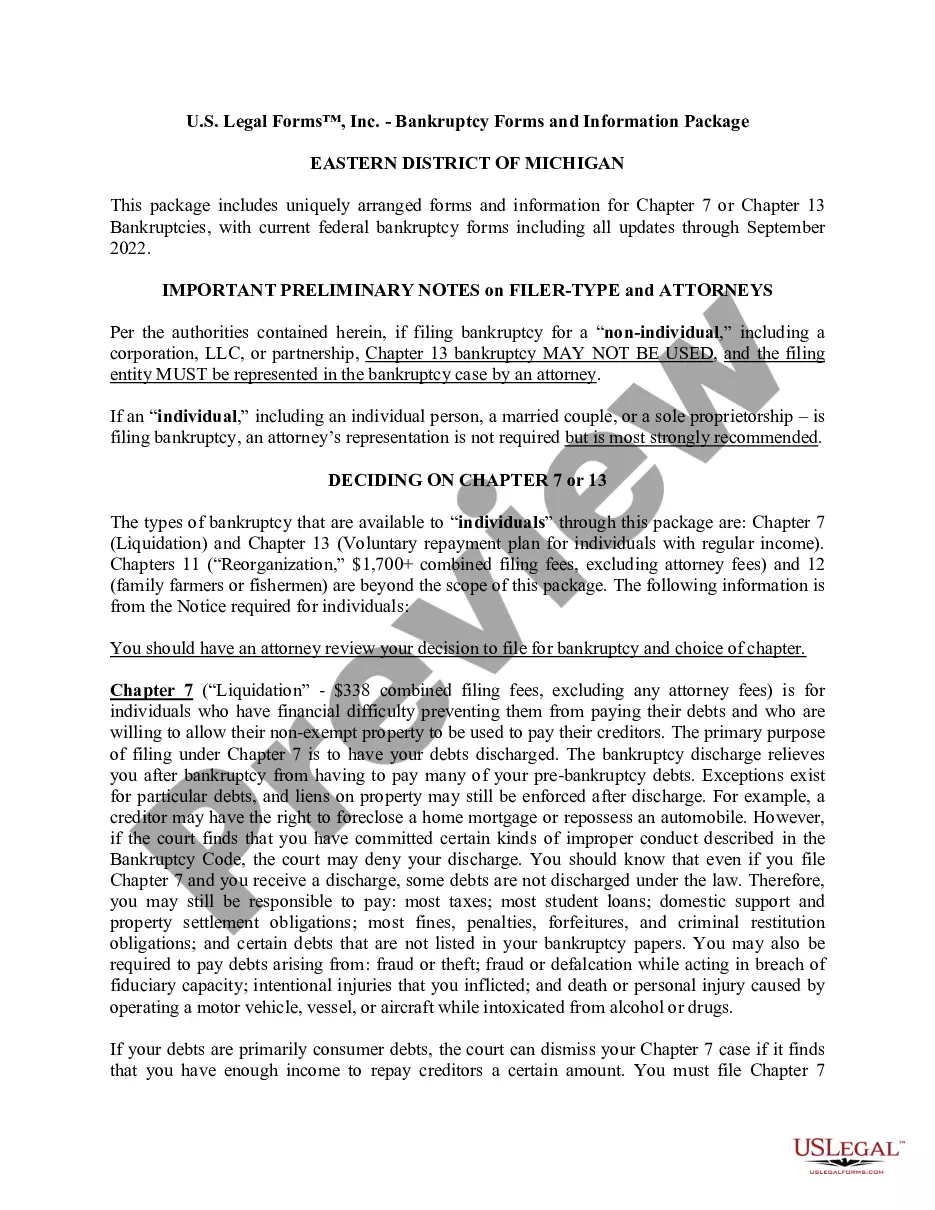

The timeline for foreclosing on a house in New Jersey can vary, but it generally takes several months to over a year. Factors such as court schedules, the borrower's response, and whether the case proceeds to trial can impact this duration. Homeowners in Elizabeth faced with a Complaint to Foreclose Residential Mortgage should be prepared for a lengthy process and consider engaging with platforms like USLegalForms for resources and guidance. Taking proactive steps can make a significant difference in your situation.

The new foreclosure law in New Jersey emphasizes borrower protection and aims to streamline the foreclosure process. Under this law, lenders must adhere to stricter guidelines and communicate more effectively with homeowners about available assistance. As residents of Elizabeth navigate potential Complaints to Foreclose Residential Mortgage, understanding these changes can provide critical insights and options to avoid foreclosure. Knowledge of the law can help homeowners protect their rights.

A complaint in mortgage foreclosure is a legal document that a lender files to initiate the foreclosure process. This document outlines the lender's claim against the borrower, detailing the reasons for foreclosure, such as missed payments. In Elizabeth, New Jersey, filing a Complaint to Foreclose Residential Mortgage sets the legal proceedings in motion, leading to potential loss of the property. Understanding this process is vital for homeowners facing financial difficulty.