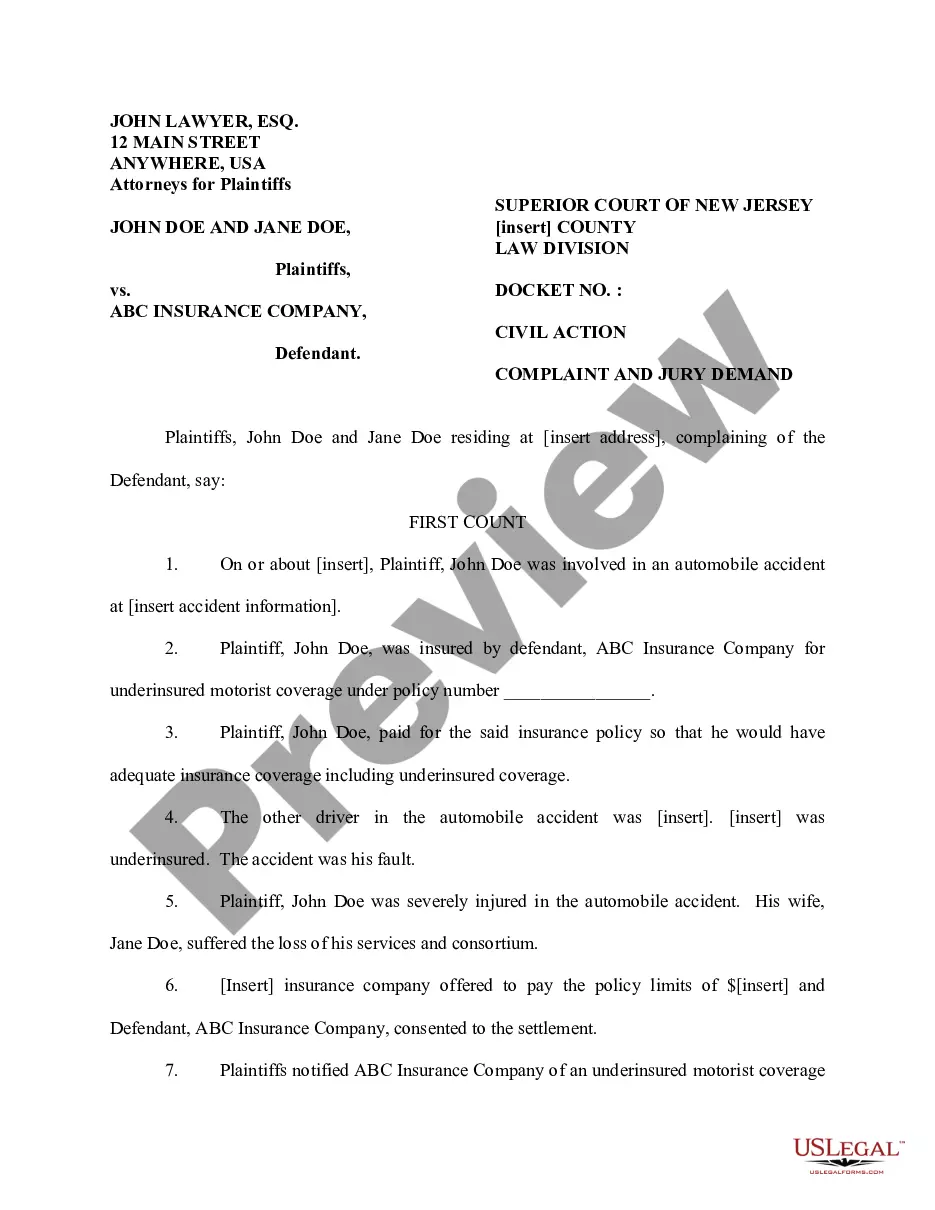

This form is a Complaint Seeking Underinsured Motorist Coverage for use in civil proceedings within the state of New Jersey.

Newark New Jersey Complaint Seeking Underinsured Motorist Coverage

Description

How to fill out New Jersey Complaint Seeking Underinsured Motorist Coverage?

We consistently strive to minimize or avert legal complications when handling intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically very expensive.

However, not every legal concern is as intricately complicated.

Many of them can be resolved independently.

Take advantage of US Legal Forms whenever you need to obtain and download the Newark New Jersey Complaint Seeking Underinsured Motorist Coverage or any other document swiftly and safely.

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection allows you to manage your matters autonomously without relying on legal advice.

- We offer access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

New Jersey Statute -129 pertains to the operation of motor vehicles in relation to right-of-way rules. Understanding this law is essential for establishing liability in an accident, which may connect to your Newark New Jersey Complaint Seeking Underinsured Motorist Coverage. For clarity on how this statute impacts your case, exploring resources offered by uslegalforms can be beneficial.

In New Jersey, the statute of limitations for a contract claim is typically six years. This means you have six years from the breach of contract to take action, including any agreements related to UIM benefits. Consulting with a legal expert can help clarify how this relates to your Newark New Jersey Complaint Seeking Underinsured Motorist Coverage.

For UIM claims in New Jersey, the statute of limitations mirrors that of personal injury claims, allowing for two years from the accident date to file. If you fail to act within this time, your Newark New Jersey Complaint Seeking Underinsured Motorist Coverage may be dismissed. To ensure you meet all deadlines, consider seeking legal assistance early in the process.

In New Jersey, the statute of limitations for filing a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage is generally two years from the date of the accident. This timeframe is crucial as it impacts your right to pursue a claim. Always make sure to file within this period to avoid losing the opportunity to seek compensation.

Many people worry that filing a claim for underinsured motorist coverage will increase their insurance rates. In New Jersey, insurance companies typically evaluate each claim on a case-by-case basis. If you file a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage, your rates may not necessarily rise, especially if you were not at fault. Checking with your insurer for specifics is always a good idea, as each policy and situation can differ significantly.

Underinsured Motorist (UIM) coverage in New Jersey protects you when the driver at fault has insufficient insurance to cover your damages. If you're involved in an accident with an underinsured driver, you can file a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage to access additional funds from your own policy. This coverage allows you to claim the difference between what the at-fault driver’s insurance covers and your actual losses. It’s vital to understand your policy limits and how UIM coverage can secure your financial future.

Underinsured motorist coverage is not mandatory in New Jersey, but it is highly recommended. It protects you against losses in the event that another driver lacks sufficient coverage. For clarity around your insurance needs, a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage can provide detailed information.

Underinsured Motorist coverage (UIM) in New Jersey helps cover your expenses when the at-fault driver has insufficient insurance to cover your damages. If your costs exceed their policy limits, UIM kicks in to help fill that gap. Understanding how to file your UIM claim can be simplified with a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage.

The statute of limitations for filing a UM/UIM claim in New Jersey is two years, starting from the date of the accident. This means you must take action within this period to protect your rights. For detailed guidance, try referencing a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage to help streamline your claim process.

In New Jersey, to qualify for Uninsured and Underinsured Motorist coverage (UM/UIM), you must have auto insurance explicitly providing this coverage option. Additionally, you need to inform your insurer about the limits of UM/UIM you're selecting. To fully understand these requirements, a Newark New Jersey Complaint Seeking Underinsured Motorist Coverage can serve as a valuable resource.