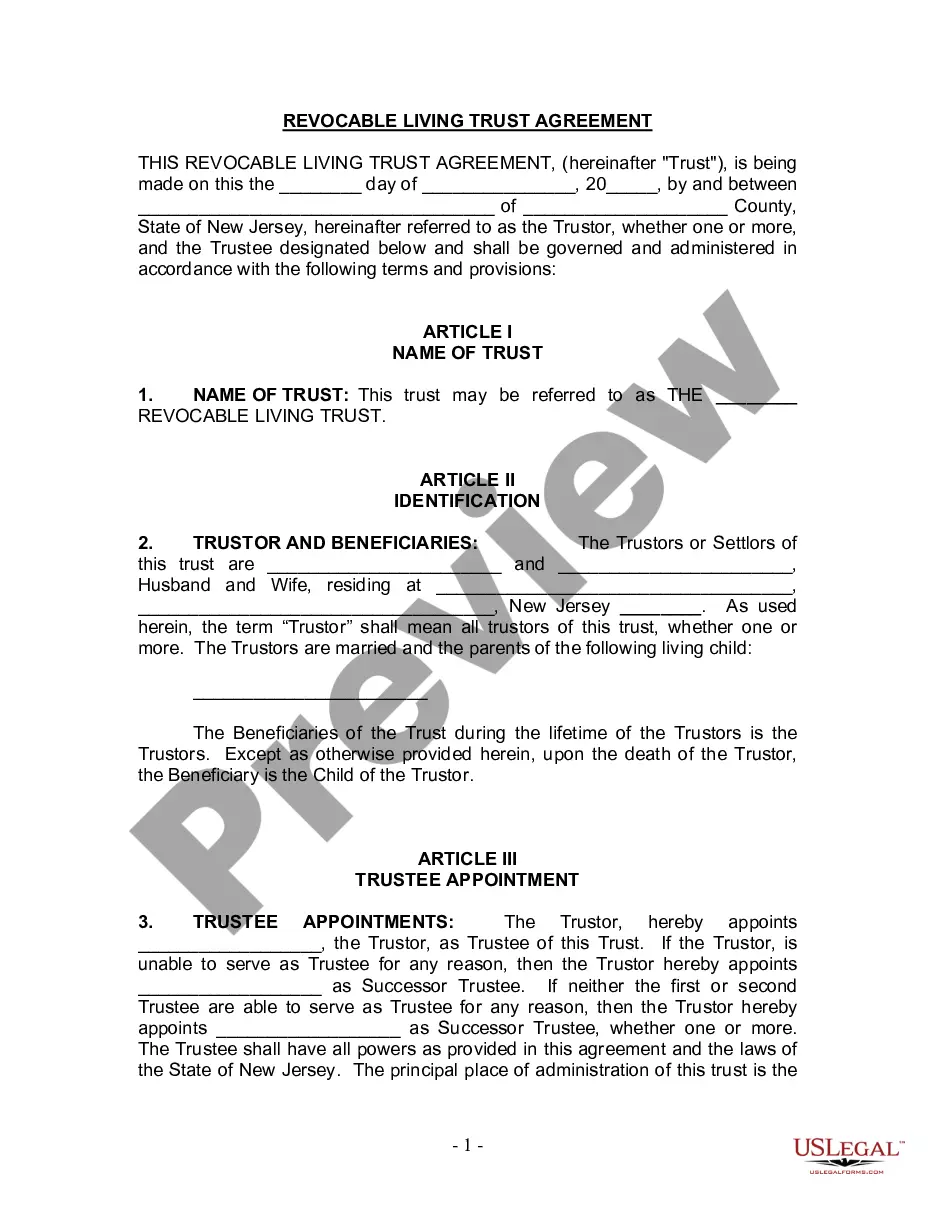

Newark New Jersey Living Trust for Husband and Wife with One Child

Description

How to fill out New Jersey Living Trust For Husband And Wife With One Child?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both private and professional requirements and various real-life situations.

All the files are meticulously organized by area of use and jurisdiction, making the search for the Newark New Jersey Living Trust for Husband and Wife with One Child as quick and straightforward as counting to three.

Maintaining documents organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to have vital document templates accessible for any requirements right at your fingertips!

- Verify the Preview mode and document description.

- Ensure you’ve selected the correct one that meets your preferences and fully adheres to your local jurisdiction standards.

- Search for an alternative template if necessary.

- If you observe any discrepancies, use the Search tab above to locate the suitable one. If it fits your needs, proceed to the next step.

- Complete your purchase.

Form popularity

FAQ

The best type of trust for a married couple is often a Newark New Jersey Living Trust for Husband and Wife with One Child. This trust allows both partners to enjoy flexibility in managing assets while providing effective estate planning. It can help streamline property transfer upon death and offer protection from creditors, making it a wise choice for many couples.

While establishing a Newark New Jersey Living Trust for Husband and Wife with One Child offers advantages, there are also some drawbacks you should consider. Transferring your property into a trust may involve upfront costs and administrative tasks. Additionally, you lose complete control over the asset, which might not suit everyone’s needs.

In Newark, New Jersey, if you place your home in a Newark New Jersey Living Trust for Husband and Wife with One Child, it can often be protected from nursing home claims. However, the trust must be irrevocable, meaning you cannot change it once set up, to ensure this protection. It is wise to consult with a legal professional to explore if this option best fits your situation.

Couples may choose separate trusts to address unique financial situations, such as different asset types or obligations to previous marriages. A Newark New Jersey Living Trust for Husband and Wife with One Child offers simplicity, but separate trusts can help tailor management to suit individual needs. They can also provide protection from creditors or unwanted claims against shared assets. Evaluate both options carefully to find what works best for you, and our platform can assist in this decision-making process.

One common mistake parents make is failing to properly fund their trust. Establishing a Newark New Jersey Living Trust for Husband and Wife with One Child is just the first step; transferring assets into the trust is crucial for it to function correctly. Without funding, the trust cannot fulfill its purpose, leaving assets exposed to probate. Ensure all your assets are accounted for, and consider using our platform to streamline this process.

The best option for a married couple typically involves a joint Newark New Jersey Living Trust for Husband and Wife with One Child. This type of trust simplifies the management of your collective assets while ensuring they pass seamlessly to your child. Additionally, it allows you to coordinate decision-making and asset distribution while minimizing potential legal disputes. Our platform can guide you step-by-step to establish the most effective trust for your situation.

Having separate living trusts may make sense in specific situations, especially if you and your spouse have distinct financial interests or children from previous relationships. However, a joint Newark New Jersey Living Trust for Husband and Wife with One Child often simplifies management and reduces paperwork. You can customize each trust according to your unique needs, but consider the benefits of a unified approach to streamline estate planning. We can help you explore both options with our easy-to-use platform.

Putting your house in a Newark New Jersey Living Trust for Husband and Wife with One Child can provide significant benefits. This strategy helps avoid probate, ensuring a smoother transfer of assets to your child after passing. A trust also offers greater control over how your home is managed and distributed, which can ease stress during difficult times. Plus, it adds an extra layer of privacy to your estate.