Newark New Jersey Living Trust for Husband and Wife with No Children

Description

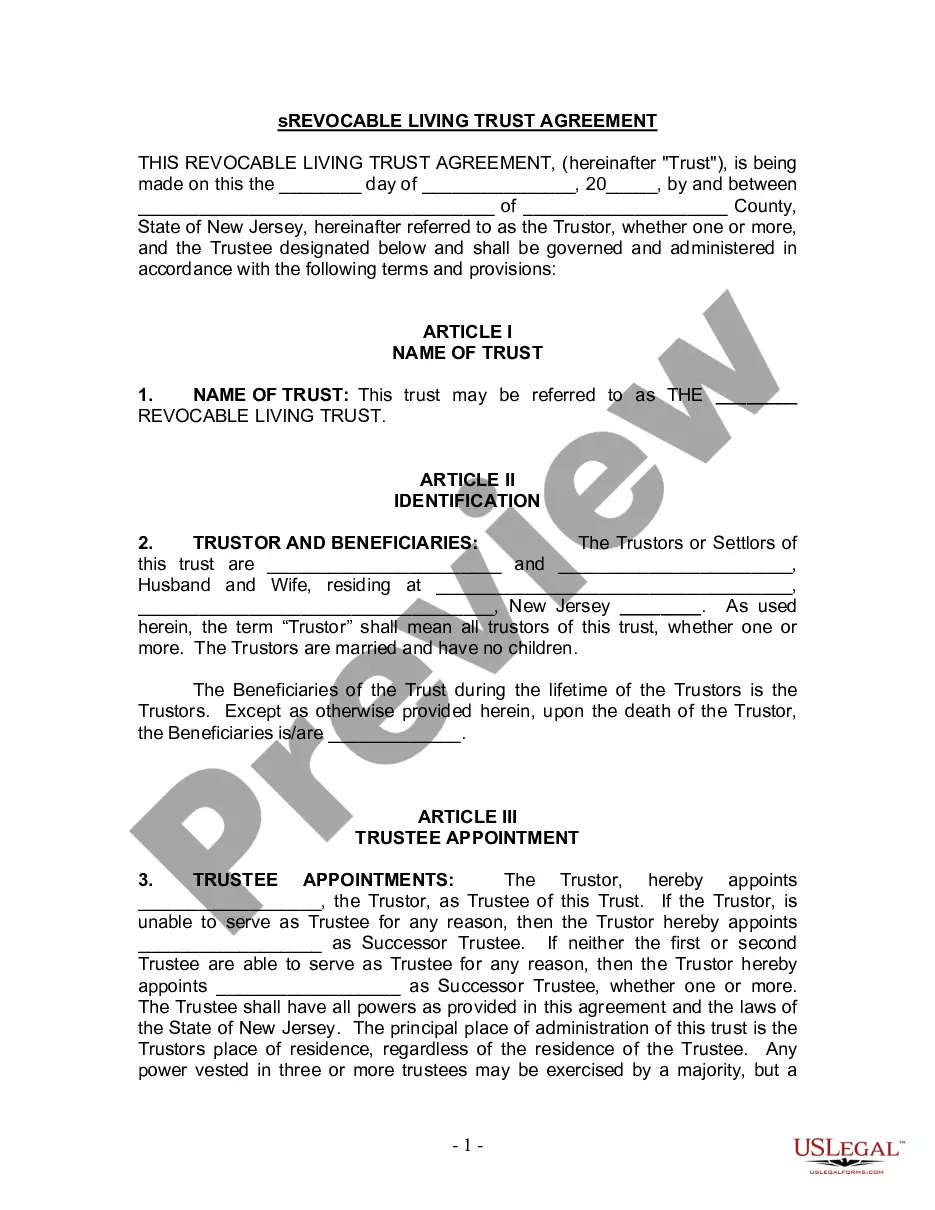

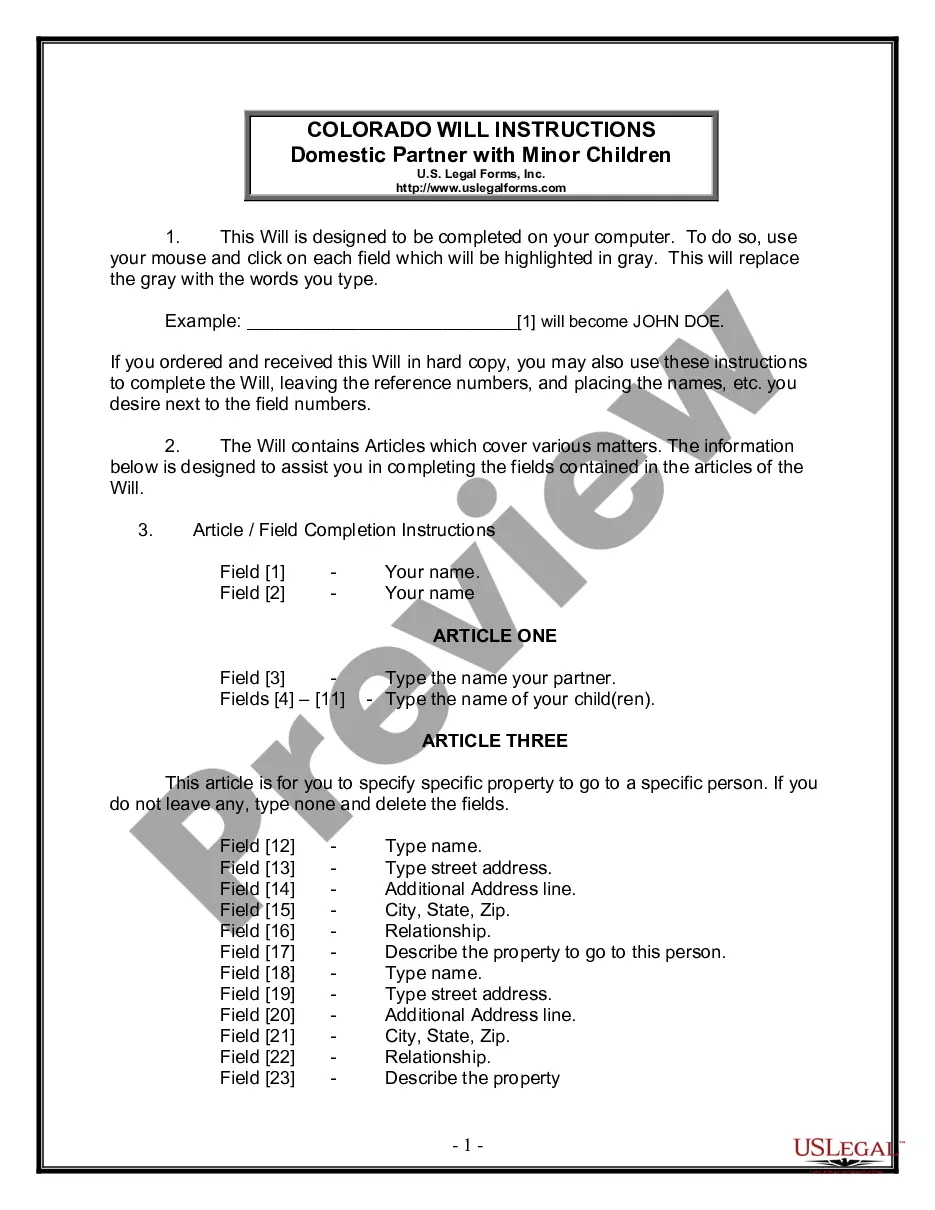

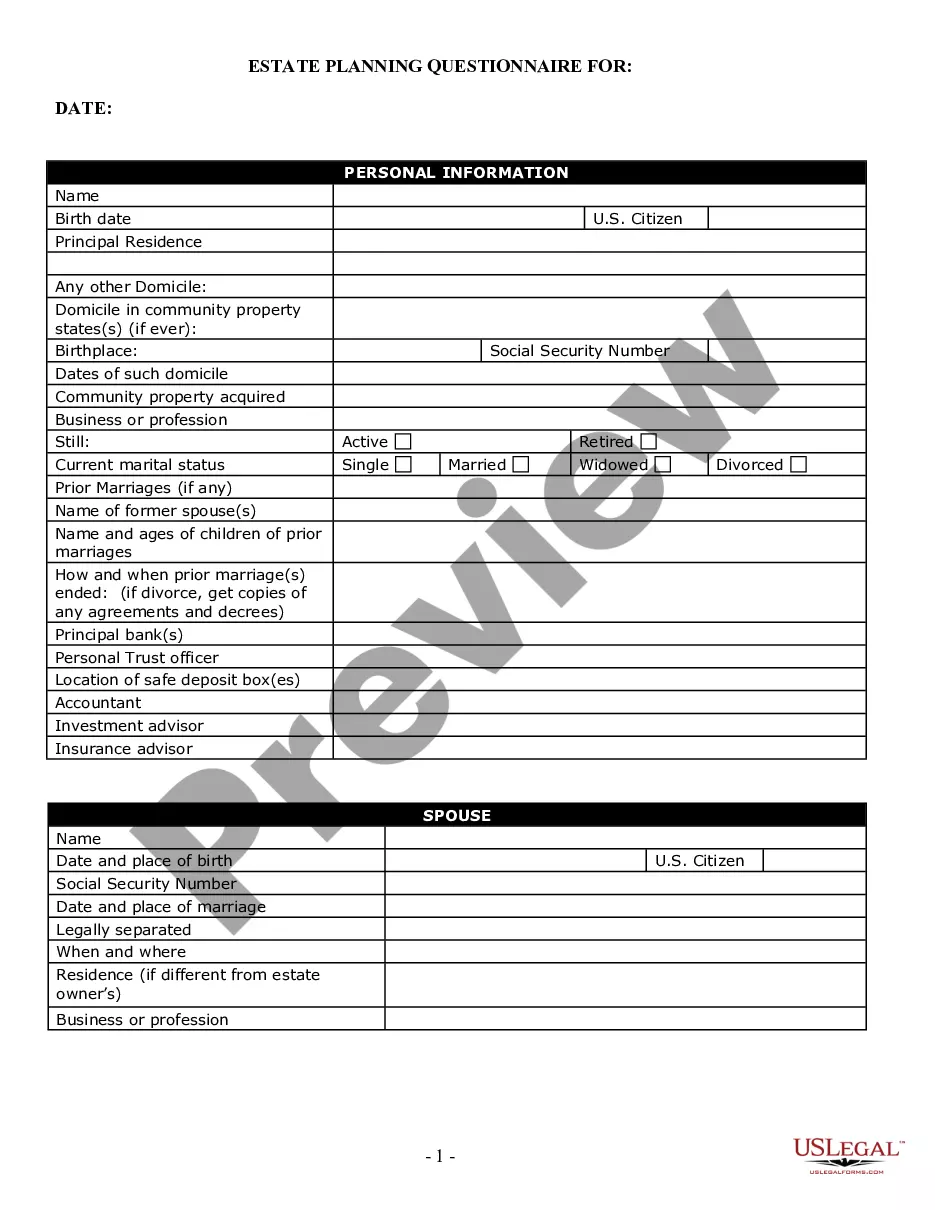

How to fill out New Jersey Living Trust For Husband And Wife With No Children?

If you are looking for a suitable form template, it’s hard to find a better location than the US Legal Forms site – one of the most extensive collections available online.

Here you can discover countless form examples for both business and personal use categorized by types and states, or keywords.

With our top-notch search feature, obtaining the latest Newark New Jersey Living Trust for Husband and Wife with No Children is as straightforward as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Retrieve the form. Specify the file format and download it onto your device.

- Moreover, the relevance of every single document is validated by a group of experienced attorneys who routinely assess the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our platform and have an account, all you need to do to access the Newark New Jersey Living Trust for Husband and Wife with No Children is to Log In to your account and hit the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have located the necessary form. Review its description and utilize the Preview feature to examine its contents. If it doesn’t fit your requirements, use the Search function at the top of the page to find the desired document.

- Confirm your selection. Click the Buy now button. Next, select the desired pricing option and enter your information to register for an account.

Form popularity

FAQ

When considering a Newark New Jersey Living Trust for Husband and Wife with No Children, it's important to understand the implications of having separate trusts. In many cases, couples benefit from creating a joint trust, which simplifies the management and distribution of assets. However, separate trusts might provide more control over individual assets and specific wishes. Ultimately, deciding between joint or separate trusts depends on individual circumstances, and US Legal Forms can help you navigate the options effectively.

One common mistake parents make when setting up a trust, especially a Newark New Jersey Living Trust for Husband and Wife with No Children, is failing to clearly define the purpose and beneficiaries of the trust. Without clarity, your loved ones may face confusion and disputes after your passing. Additionally, not regularly updating the trust to reflect changes in your financial situation or family dynamics can lead to complications. Utilizing tools like USLegalForms can help ensure that your trust is set up correctly and managed effectively.

In Newark, New Jersey, choosing between a will and a trust often depends on your personal circumstances, but for a husband and wife with no children, a Newark New Jersey Living Trust for Husband and Wife with No Children can offer more advantages. Unlike a will, a trust can help avoid the probate process, allowing for quicker access to assets and greater privacy. Furthermore, a living trust provides management of your assets during your lifetime and can reduce estate taxes. Utilizing uslegalforms can help you navigate this decision effectively.

The best living trust for a married couple, especially in the case of a Newark New Jersey Living Trust for Husband and Wife with No Children, typically involves a joint trust that allows both partners to manage and control shared assets. This setup offers flexibility and can provide significant tax benefits while ensuring that both partners’ wishes are honored. A joint living trust can simplify the transfer of assets upon one partner’s passing, making it an efficient estate planning tool. To create a tailored living trust that fits your needs, consider using uslegalforms for guidance.

One option is to use an online program to write the trust document yourself. This will likely cost you around a few hundred dollars. You can also choose to hire an attorney. This option will probably cost you more than $1,000, though the exact cost will depend on the attorney's fees and the complexity of your estate.

The average cost for this document is about $3,500.00 plus a new deed and other documents necessary to transfer assets into the Trust.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

Revocable Living Trusts Should be Considered for Your Estate Plan. Although having a Revocable Living Trust as part of your estate plan may not be as essential in New Jersey as it is in some other states, it has some benefits as compared to the extended probate process.

The law of intestate succession in New Jersey states that: If you die leaving a spouse, a registered domestic partner, or civil union partner and children who are also the children of the spouse or legal partner, the spouse/legal partner receives 100% of the estate and no bond is required to be posted.