This form is a Grant Deed where the Grantors are Husband and Wife / Two Individuals and the Grantees are Husband and Wife / Two Individuals This deed complies with all state statutory laws.

Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals

Description

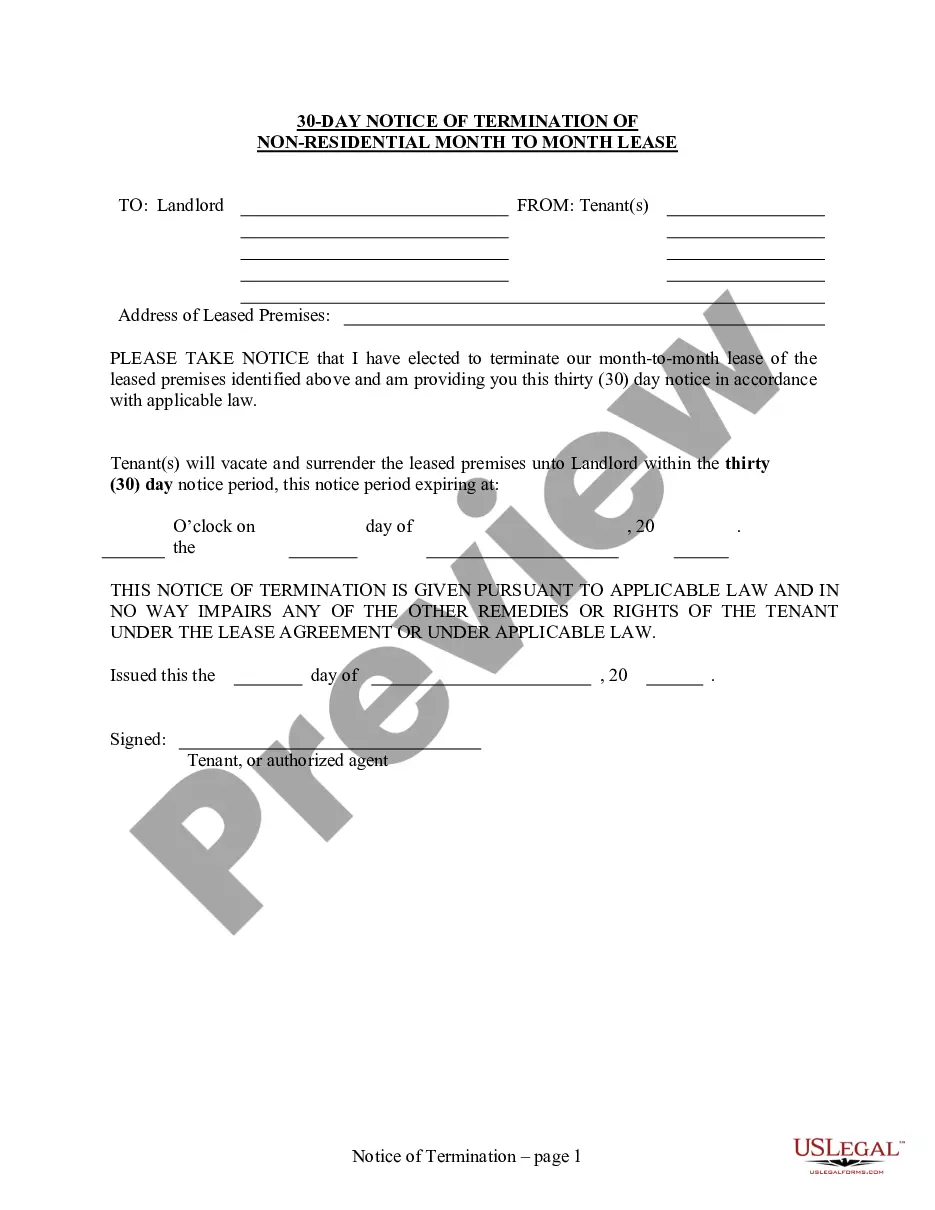

How to fill out New Jersey Grant Deed From Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms archive.

This is an online repository containing over 85,000 legal documents for both personal and professional requirements across various real-life situations.

All forms are appropriately categorized by usage areas and jurisdictions, making it as simple as pie to search for the Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals.

Maintaining documentation organized and in line with legal standards is crucial. Utilize the US Legal Forms library to always have access to vital document templates for any requirement right at your fingertips!

- Refer to the Preview mode and form details.

- Ensure you’ve selected the correct form that fulfills your requirements and complies with your regional jurisdiction regulations.

- Search for another template, if necessary.

- If you spot any discrepancies, use the Search tab above to find the correct one.

- Proceed to the next stage if it meets your needs.

Form popularity

FAQ

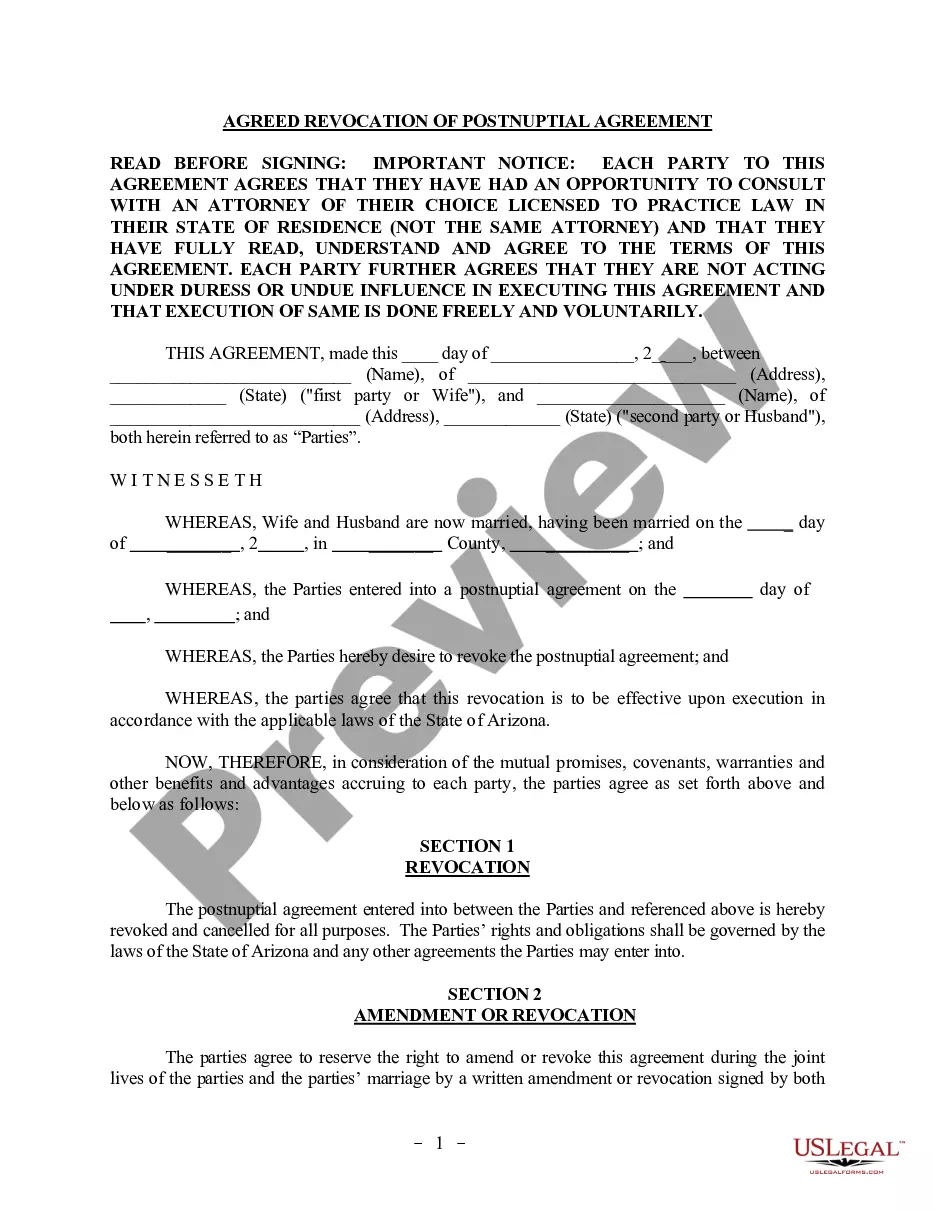

To change the deed on your house after your spouse passes away in Newark, New Jersey, you will need to prepare a new Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, reflecting your ownership status. The process usually involves providing a copy of the death certificate and possibly other legal documentation. Resources like uslegalforms can offer the necessary forms and guidance for accurately processing this change.

When you add someone to your property deed in Newark, New Jersey, it may impact local property taxes and transfer taxes. Depending on the situation, this change could be considered a gift, which may have tax implications for both parties. It’s wise to consult a tax professional who is familiar with real estate in New Jersey to understand any potential challenges. Utilizing resources like uslegalforms can help clarify the specific forms and processes necessary for your situation.

While it is not mandatory to hire a lawyer to add a name to a deed in Newark, New Jersey, seeking legal assistance can simplify the process. A lawyer can ensure the Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is drafted correctly and complies with state regulations. Nonetheless, platforms like uslegalforms can provide templates and guidance if you choose to handle it independently.

Adding your spouse to the deed in Newark, New Jersey is a straightforward process. You can create a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, listing both names on the deed. Once the new deed is drafted, it must be signed and then filed with the County Clerk to update the property records officially.

To transfer a property title to a family member in Newark, New Jersey, you typically need to prepare a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals. You should include the names and details of both parties in the deed. After preparing the deed, file it at the local county office to ensure the transfer is officially recorded.

To add a spouse to a house deed in NJ, you need to create a new deed that includes both names and record it with your county clerk’s office. This usually involves drafting a quitclaim deed or a grant deed. If you are considering a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals, you can simplify this process with tools available on platforms like uslegalforms.

One disadvantage of a grant deed is that while it provides a measure of protection regarding the title, it does not guarantee clear title as a warranty deed would. If title issues arise after the transfer, the new owners may face legal complications. It's crucial to consider this when entering into a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals.

The main purpose of a grant deed is to legally transfer property ownership from one party to another. This deed protects the interests of both the seller and buyer by confirming the status of the property’s title. Utilizing a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals can provide a clear record of ownership.

The right of survivorship allows the surviving owner to claim full ownership of the property upon the death of the other owner. This feature is commonly included in deeds held by husbands and wives or two individuals in New Jersey. This ensures that the property does not pass to heirs but remains with the surviving owner, providing stability in property ownership.

A grant deed in New Jersey is a legal document used to transfer ownership of property. This deed assures the buyer that the seller has the right to transfer the property and that there are no undisclosed encumbrances. Using a Newark New Jersey Grant Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals ensures a smooth transition of ownership.