Jersey City New Jersey Quitclaim Deed from Corporation to LLC

Description

How to fill out New Jersey Quitclaim Deed From Corporation To LLC?

If you are in search of a pertinent form template, it’s hard to find a superior service than the US Legal Forms website – one of the largest online repositories.

With this repository, you can access numerous templates for business and personal needs categorized by types and states, or key phrases.

With our high-quality search feature, acquiring the latest Jersey City New Jersey Quitclaim Deed from Corporation to LLC is as straightforward as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Receive the template. Select the file format and store it on your device.

- Additionally, the relevance of each document is validated by a team of professional attorneys who routinely review the templates on our platform and update them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and hold a registered account, all you need to do to obtain the Jersey City New Jersey Quitclaim Deed from Corporation to LLC is to Log In to your account and select the Download option.

- If you are using US Legal Forms for the first time, just follow the steps below.

- Ensure you have opened the sample you require. Review its description and utilize the Preview option to examine its content. If it does not fulfill your requirements, use the Search option located at the top of the screen to find the appropriate document.

- Confirm your choice. Press the Buy now option. Next, choose your desired pricing plan and provide credentials to create an account.

Form popularity

FAQ

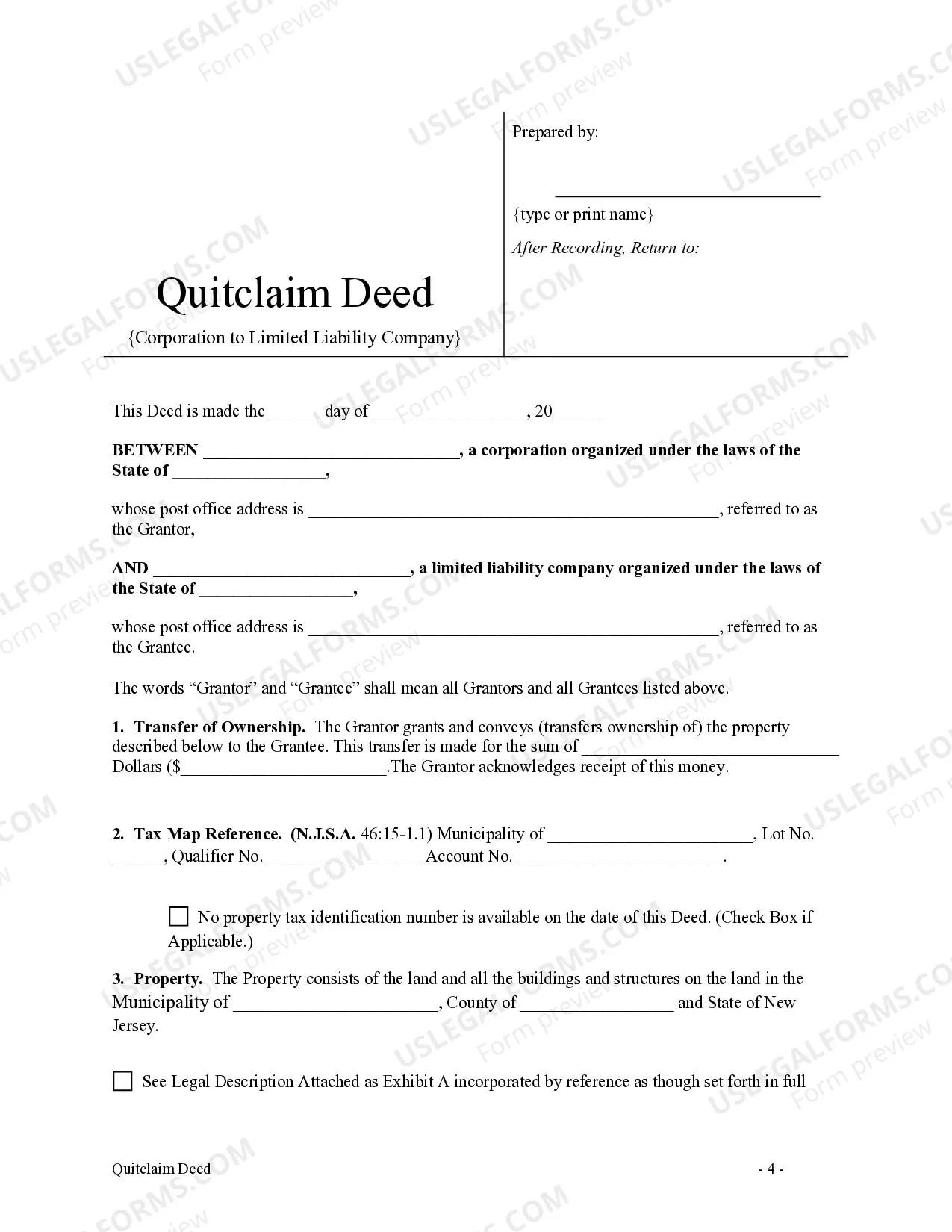

Transferring a deed in New Jersey involves several steps. Start by drafting a Jersey City New Jersey Quitclaim Deed, which requires accurate property descriptions and signatures. After the document is complete, submit it to the county clerk for recording. It is also beneficial to check for any local regulations or requirements to ensure compliance throughout the process.

To transfer the deed of a house to an LLC, you will need to execute a Jersey City New Jersey Quitclaim Deed from Corporation to LLC. First, prepare the deed with the correct legal description of the property. Next, have the appropriate signatures, including those from both the corporation and the LLC. Finally, file the deed with the local county recorder to finalize the transfer.

To file a quitclaim deed in New Jersey, start by completing a Jersey City New Jersey Quitclaim Deed from Corporation to LLC with accurate property and party details. Next, ensure the deed is signed and notarized by the necessary parties. Finally, submit the deed to the county clerk’s office where the property is located to officially record the transfer. Platforms like uslegalforms can help you with the right forms to make this process easier.

One major disadvantage of placing your house in an LLC is the potential difficulty in obtaining a mortgage, as lenders often prefer personal guarantees. Additionally, transferring your property may incur transfer taxes and fees, impacting financial aspects. It's important to weigh these challenges against the benefits of liability protection. To streamline the process, consider using uslegalforms for clear guidance.

Many individuals choose to place their property in an LLC to protect personal assets from liabilities associated with property ownership. This structure can provide tax benefits and simplify estate planning, making it a popular option for property investors. By utilizing a Jersey City New Jersey Quitclaim Deed from Corporation to LLC, property owners can effectively formalize this transition. Always consider your unique situation and consult a professional if needed.

Transferring a house deed to an LLC involves drafting a Jersey City New Jersey Quitclaim Deed from Corporation to LLC. This deed must include the names of the grantor and grantee, along with a legal description of the property. Once the deed is signed and notarized, file it with your local county office to complete the transfer. Online services like uslegalforms can guide you through the process efficiently.

To place your property in an LLC, you first need to create the LLC in accordance with state laws. After that, execute a Jersey City New Jersey Quitclaim Deed from Corporation to LLC to transfer the property. Make sure to file the deed with the county clerk's office. Additionally, consider consulting legal professionals or using platforms like uslegalforms for accurate document preparation.

One potential disadvantage of placing a property in an LLC is the costs associated with maintaining the entity. You may face fees for registration, annual reports, and tax obligations. Additionally, transferring a property into an LLC may trigger property taxes based on the transfer value. It’s wise to consider these factors before utilizing the Jersey City New Jersey Quitclaim Deed from Corporation to LLC.

To transfer property to an LLC in New Jersey, complete a quitclaim deed designating the LLC as the new owner. Fill in the grantor's and grantee's information, as well as a thorough description of the property. After signing the deed, have it notarized for it to be legally binding. This step is particularly relevant when engaging with the Jersey City New Jersey Quitclaim Deed from Corporation to LLC.

Transferring property from personal ownership to an LLC requires filling out a quitclaim deed. Begin by completing the deed, naming yourself as the grantor and the LLC as the grantee. It is crucial to provide complete and accurate property details. Finally, sign and notarize the deed to complete the process, facilitating the Jersey City New Jersey Quitclaim Deed from Corporation to LLC.