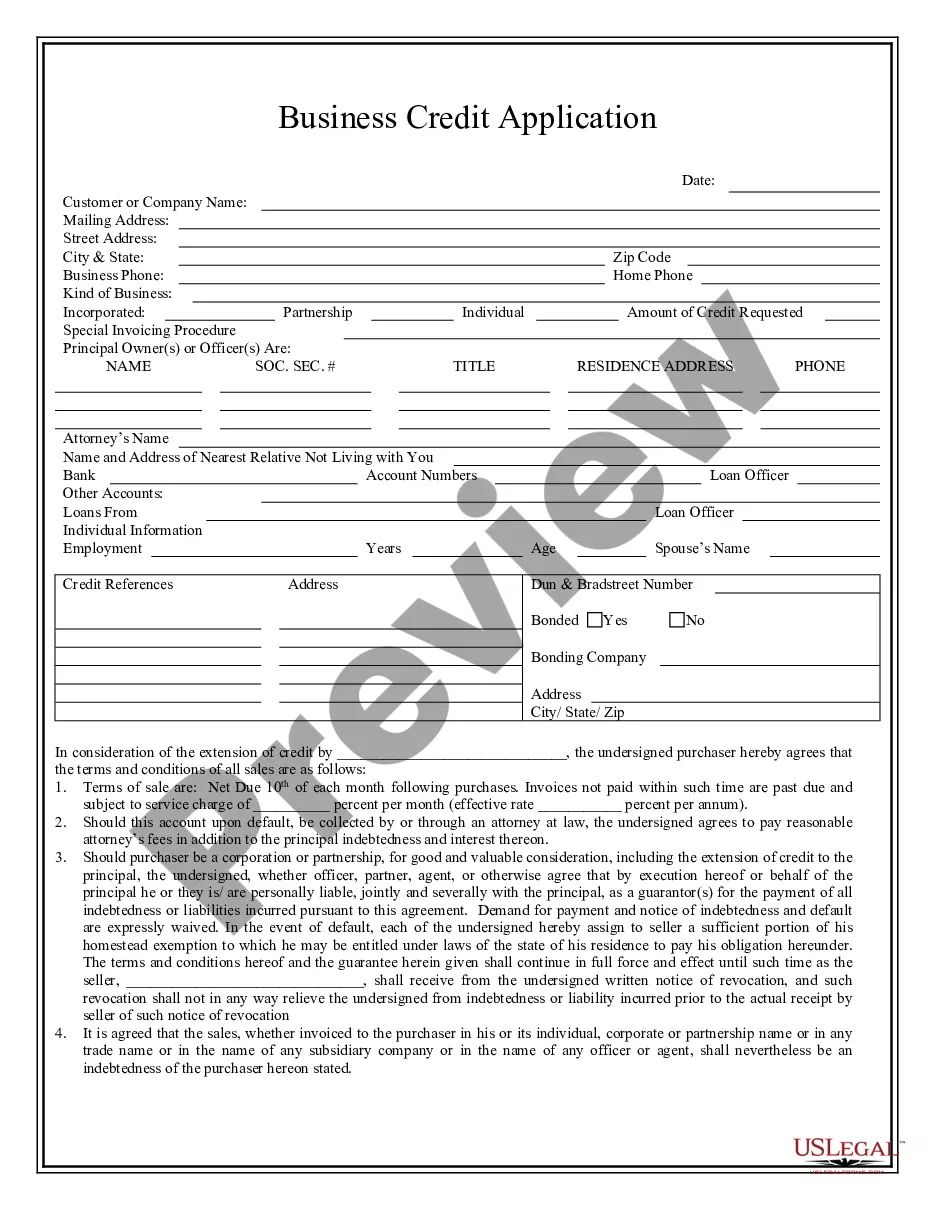

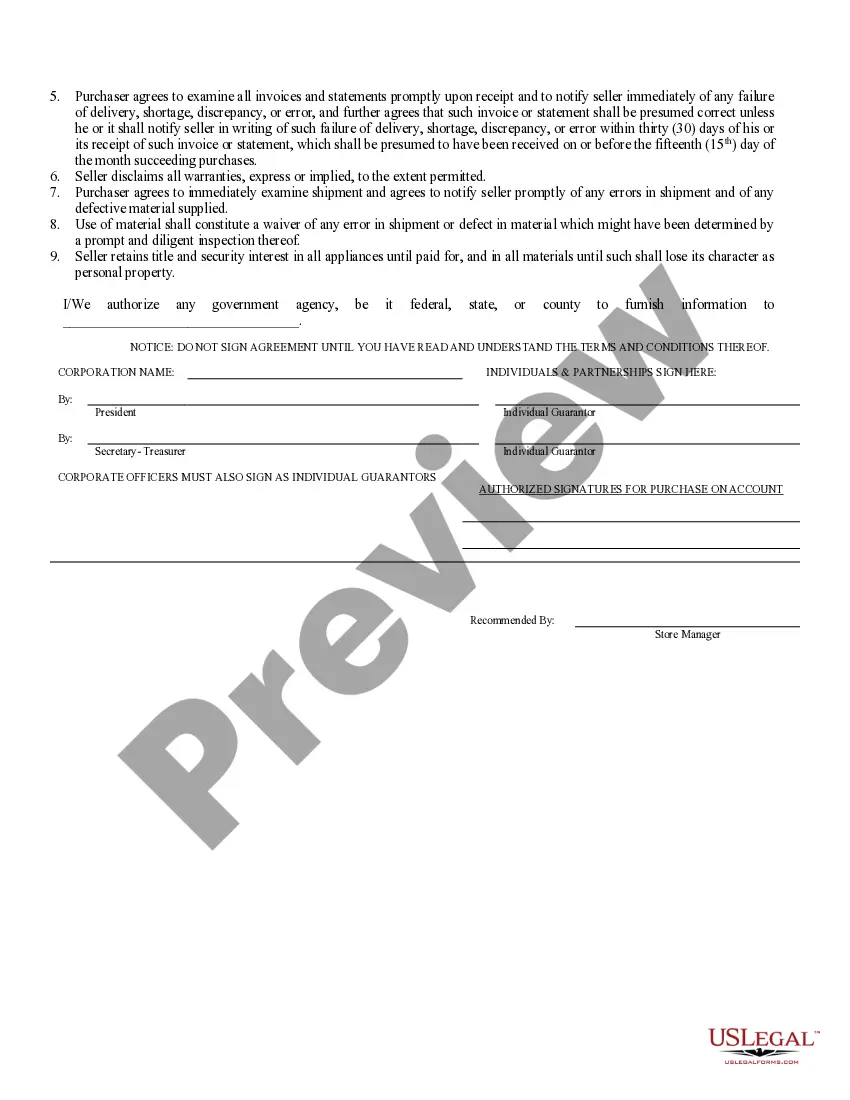

Manchester New Hampshire Business Credit Application

Description

How to fill out New Hampshire Business Credit Application?

If you have previously utilized our service, sign in to your account and download the Manchester New Hampshire Business Credit Application onto your device by clicking the Download button. Verify that your subscription is active. If not, renew it as per your payment plan.

If this is your initial engagement with our service, adhere to these straightforward instructions to acquire your document.

You have constant access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to conveniently discover and save any template for your personal or professional requirements!

- Ensure you’ve identified an appropriate document. Browse the description and use the Preview feature, if available, to verify if it fits your needs. If it does not meet your criteria, use the Search tab above to find the correct one.

- Purchase the template. Hit the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and finalize your payment. Input your credit card information or use the PayPal option to complete your purchase.

- Retrieve your Manchester New Hampshire Business Credit Application. Select the file format for your document and download it to your device.

- Complete your template. Print it out or use professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

New Hampshire does not have a general business license requirement. However, certain professions and businesses may require specific licenses or permits. It's essential to check local regulations and the requirements relevant to your field. Once you're ready, consider applying for a Manchester New Hampshire Business Credit Application to kickstart your activities.

To register yourself as a small business, you first need to choose a unique business name and decide on the type of business structure. After that, complete the necessary forms provided by the state and file them accordingly. Don't forget to explore the Manchester New Hampshire Business Credit Application to secure the financing you may need for growth.

The process of registering a business in New Hampshire can take anywhere from a few days to a couple of weeks. It largely depends on the business structure you choose and how quickly you submit your required documents. Once registered, you can proceed with your Manchester New Hampshire Business Credit Application, which may further streamline your business setup.

Starting a small business in New Hampshire involves several steps. First, you should determine your business structure, whether it's a sole proprietorship, partnership, or corporation. Next, you need to choose a business name and register it with the state. Finally, consider applying for a Manchester New Hampshire Business Credit Application to help fund your new venture.

Generally, a personal credit score of 680 or above is recommended for qualifying for business credit. However, some lenders may approve lower scores depending on your overall business profile. When applying through a Manchester New Hampshire Business Credit Application, keeping your personal credit in good standing plays a vital role in influencing lenders' decisions about your business's creditworthiness.

To achieve approval for a business credit line, you should first maintain a good personal and business credit history. Begin by submitting a comprehensive Manchester New Hampshire Business Credit Application, providing all required financial documentation accurately. Additionally, establish a solid business plan demonstrating how you intend to use the credit wisely and repay it promptly.

A business credit application is designed to assess the creditworthiness of a business and to determine its eligibility for credit lines or loans. By filling out a Manchester New Hampshire Business Credit Application, you provide lenders with essential information about your business finances, which helps them evaluate your ability to repay borrowed funds. This application is crucial for securing capital necessary for growth and operational needs.

Typically, an LLC starts with no credit score. Instead, its creditworthiness builds over time as it establishes financial activity and relationships with creditors. If you apply for a Manchester New Hampshire Business Credit Application, the credit activities you undertake can significantly affect your LLC's credit score. It's essential to monitor this process to ensure your business credit profile develops positively.

To reserve a business name in New Hampshire, you need to complete a reservation application and submit it to the Secretary of State for approval. This reservation holds the name for 120 days, giving you time to finalize your business plans. Using uslegalforms can assist you in preparing the application for your Manchester New Hampshire Business Credit Application.

Approval for an LLC in New Hampshire typically occurs within one to three weeks, depending on the filing method and workload at the state's office. If you file online, you may receive faster results. For an efficient experience, consider uslegalforms while preparing your Manchester New Hampshire Business Credit Application.