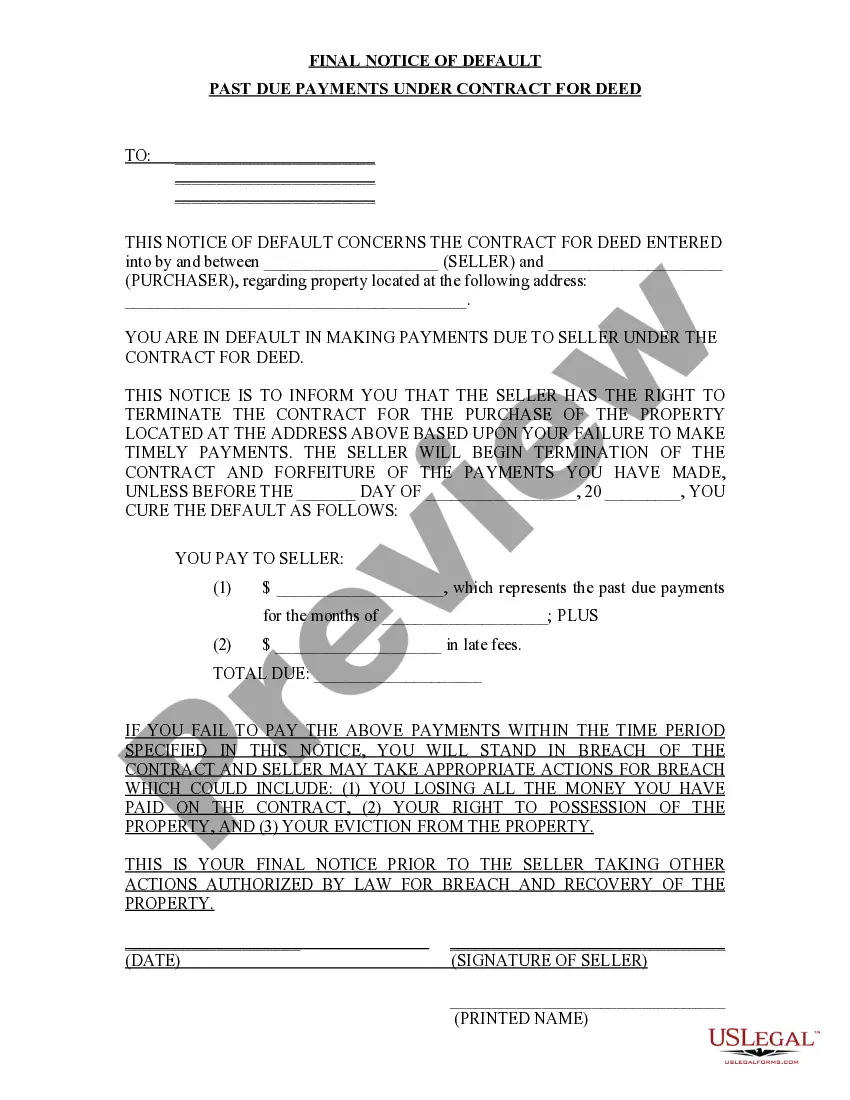

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out New Hampshire Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you are in search of a pertinent form, it’s challenging to find a superior platform than the US Legal Forms site – one of the largest collections on the web.

With this collection, you can access a vast array of form specimens for both business and personal uses categorized by types and jurisdictions, or keywords.

Utilizing our premium search feature, obtaining the latest Manchester New Hampshire Final Notice of Default for Past Due Payments relating to Contract for Deed is as straightforward as 1-2-3.

Complete the payment process. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the file format and download it to your device. Edit as needed. Fill in, modify, print, and sign the acquired Manchester New Hampshire Final Notice of Default for Past Due Payments related to Contract for Deed.

- Additionally, the validity of each document is verified by a team of professional attorneys who routinely assess the templates on our site and update them according to the latest state and county criteria.

- If you are already familiar with our system and possess a registered account, all you need to do to acquire the Manchester New Hampshire Final Notice of Default for Past Due Payments concerning Contract for Deed is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have located the sample you seek. Review its details and utilize the Preview feature (if available) to examine its contents. If it doesn’t satisfy your needs, employ the Search option at the top of the screen to discover the appropriate record.

- Verify your choice. Click the Buy now button. Then, select the desired pricing plan and provide the information to register for an account.

Form popularity

FAQ

Yes, negotiating after a default judgment is possible, but it can be more challenging. If you have received a Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed, you should act swiftly to discuss your case with legal counsel. They can assist you in negotiating terms that may allow you to retain your property or satisfy outstanding debts. Engaging with professionals through services like uslegalforms can empower you with the knowledge needed to pursue your options effectively.

Dealing with a default notice requires quick and informed decisions. Start by examining your finances and determine how you can catch up on any past due payments related to the Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed. You can reach out to your lender to discuss potential repayment options or modifications to your existing agreements. Exploring consumer assistance platforms such as uslegalforms can give you additional resources to navigate this challenging time.

When you receive a default notice, the first step is to review the notice carefully and verify the details. You need to respond promptly to the Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed, as this shows your intention to address the situation. You may want to outline your plans to make up missed payments or seek an extension. Contacting a legal professional or a platform like uslegalforms can also provide necessary guidance tailored to your case.

Receiving a Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed indicates that your payments have fallen behind. This notice is typically a last warning before a foreclosure process begins. It signals to you that immediate action is necessary to avoid further consequences, including potential loss of the property. Understanding your options is crucial at this stage, and seeking assistance can help you navigate the situation.

A final payment notice is a document you receive when your payments on a Contract for Deed have been significantly overdue. This notice emphasizes the urgency of settling your outstanding balance to avoid escalating measures, such as foreclosure. In Manchester, New Hampshire, the Final Notice of Default for Past Due Payments highlights the implications of not taking action. It is advisable to consult legal resources or platforms like US Legal Forms for guidance on how to respond effectively to this situation.

Receiving a default notice indicates that you are behind on your payments related to your Contract for Deed. This notice serves as a formal warning that your rights to the property may be at risk if the overdue payments are not addressed promptly. In Manchester, New Hampshire, a Final Notice of Default for Past Due Payments provides critical information about the steps you need to take to avoid further legal action. It is essential to review this notice carefully and consider seeking assistance to navigate any potential consequences.

A notice of default typically appears as a formal letter or document that includes essential information about the defaulting party and the contract. For the Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed, you can expect to see the property details, amount owed, and specific breaches listed. The formatting may vary, but it should maintain a professional appearance reflecting its seriousness.

Responding to a default notice requires careful attention to the details outlined in the document. When facing a Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed, acknowledge receipt of the notice and outline your intentions regarding payment or resolution. It’s advisable to communicate promptly and, if needed, seek legal advice to ensure your rights are protected.

A request for notice of default signals that a party, typically a lender or seller, seeks formal notification of any default related to the contract. In the context of the Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed, this means the requester wishes to be informed when payments are not made as agreed. This request helps protect their interests and allows for quicker action if necessary.

To write a notice of default, be clear and concise while providing necessary details. Your notice for the Manchester New Hampshire Final Notice of Default for Past Due Payments in connection with Contract for Deed should identify the parties involved, describe the breach of contract, and specify the timeline for rectifying the situation. It’s essential to follow local legal requirements to ensure the notice is valid.