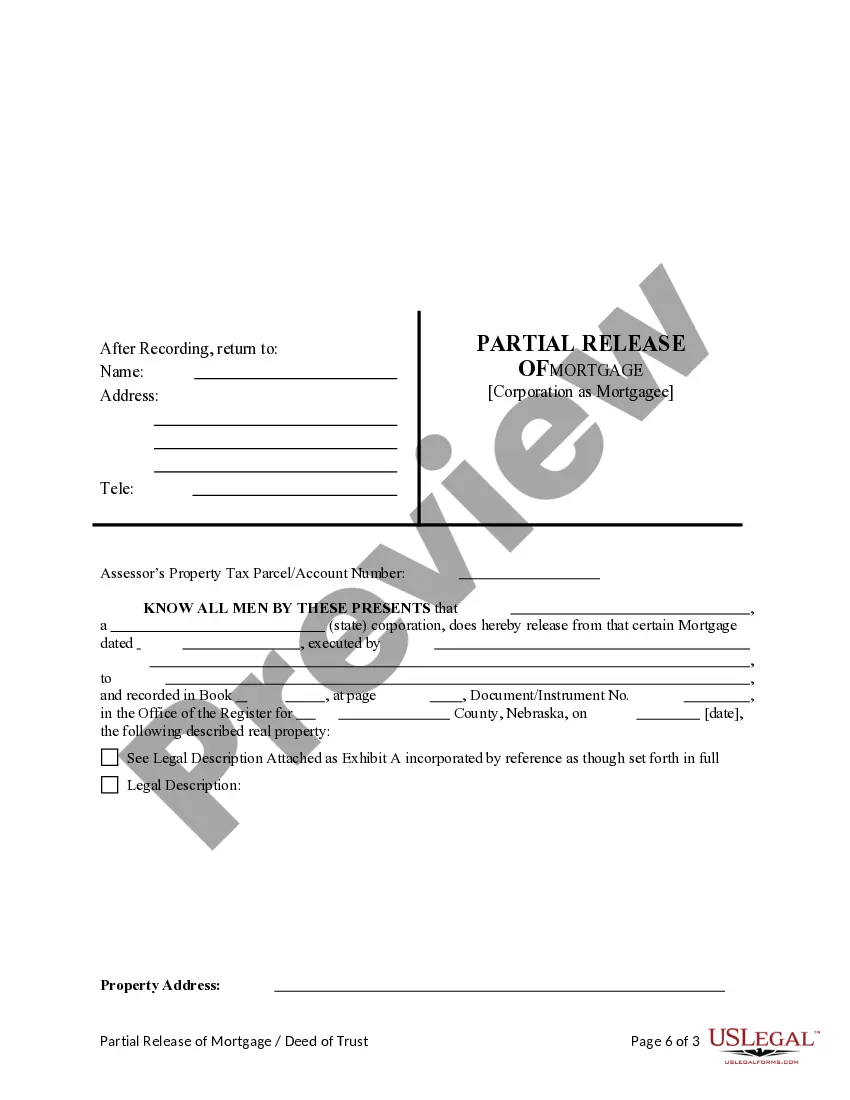

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Omaha Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation

Description

How to fill out Nebraska Partial Release Of Property From Deed Of Trust Or Mortgage For Corporation?

Regardless of one’s social or career position, completing legal documents is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for individuals without any legal expertise to generate such documents independently, primarily because of the intricate terminology and legal nuances they entail.

This is where US Legal Forms can be a lifesaver.

Verify that the template you selected is appropriate for your jurisdiction, as the regulations of one state or county may not apply to another.

Examine the document and read a brief description (if available) of situations in which the document can be utilized.

- Our service provides a vast array with over 85,000 ready-to-use state-specific templates that are suitable for nearly any legal scenario.

- US Legal Forms is also an excellent source for associates or legal advisors who wish to save time utilizing our DIY papers.

- Whether you need the Omaha Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation or any other document valid in your locality, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Omaha Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation in just a few minutes using our reliable service.

- If you are already a subscriber, you may proceed to Log In to your account to access the needed form.

- If you’re new to our platform, ensure you follow these instructions before downloading the Omaha Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation.

Form popularity

FAQ

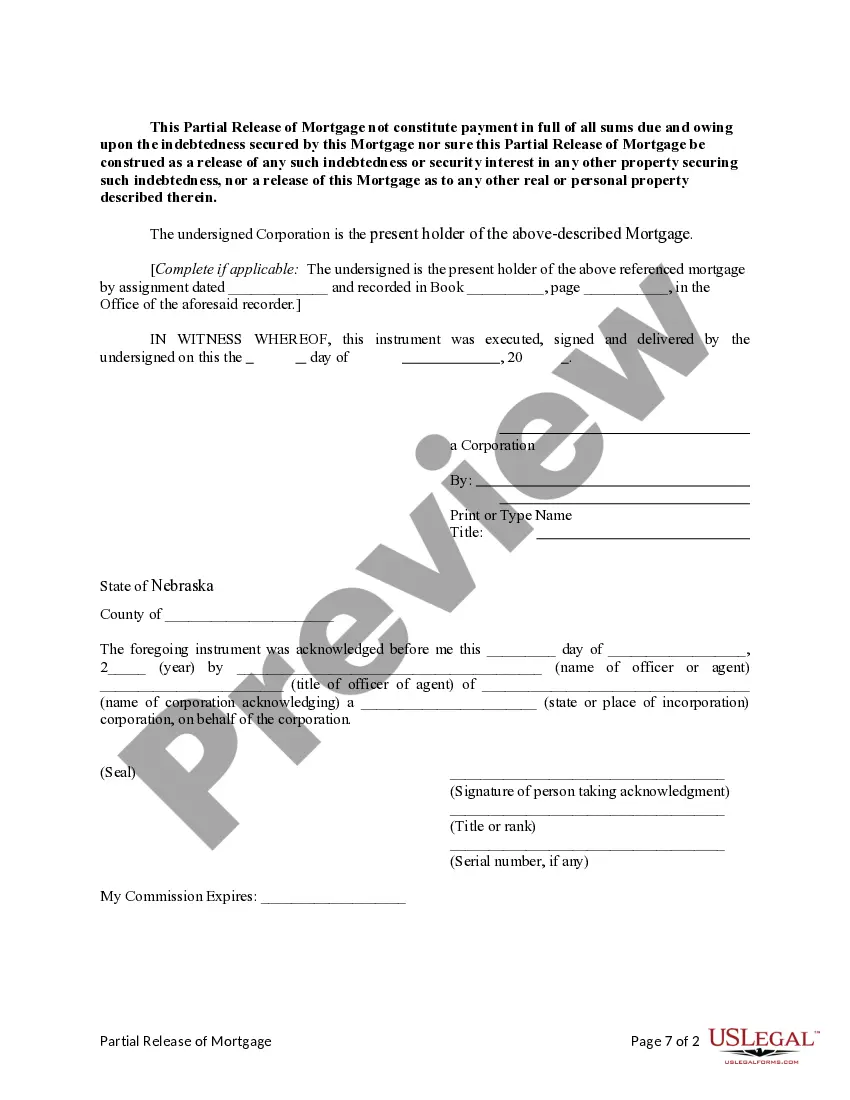

This release of mortgage is recorded or filed and gives notice to the world that the lien is no more. On the other hand, when you have a trust deed or deed of trust, the lender files a release deed. With a deed of trust, you temporarily give control of the title to your property to the lender for security purposes.

A deed of reconveyance is a legal document that indicates the transfer of a property's title from lender to borrower. The deed of reconveyance is typically issued after the borrower has paid off their mortgage in full. Some states do not use mortgages but use deeds of trust.

A release deed is a deed whereby the signor releases to the other party any interest if any, they had in the property.

Nebraska Deed of Full Reconveyance for Deed of Trust Information. When a Deed of Trust has been paid in full the beneficiary/lender is responsible to deliver (a reconveyance in recordable form duly executed by the trustee) to the trustor/borrower. (

An attorney licensed to practice law in Ohio must prepare deeds, powers of attorney, and other instruments that are to be recorded. One exception is that a party to the transaction may prepare an instrument in which they are a party.

Once you've met all the mortgage payment terms or fully repaid your loan, your lender's legal team draws up the deed of release form and in it reports that: you've repaid the loan in full under the terms required; and. the lender has removed its charge or 'lien' and has transferred full title to you.

In that context, reconveyance refers to the transfer of title to real estate from a creditor to the debtor when a loan secured by the property?i.e. mostly likely a mortgage with the property as collateral?is paid off.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount. In this case ? like the great majority of cases ? we are not dealing with a subdivided parcel of land, so the customer won't be able to split up the land subject to the deed of trust.

Once a settlement is reached, it is important to draft a deed of release to ensure that the other party cannot issue legal proceedings against the other parties. Therefore, a deed of release provides conclusive evidence following the end of a dispute or agreement. However, a release deed can limit legal actions.

To execute a release of Deed of Trust, it is necessary to submit the following to the Public Trustee's Office: Request for Release of Deed of Trust Form signed by all holders of the Evidence of Debt (normally a Promissory Note) or their attorney or agent. Lenders' signatures must be acknowledged by a Notary Public.