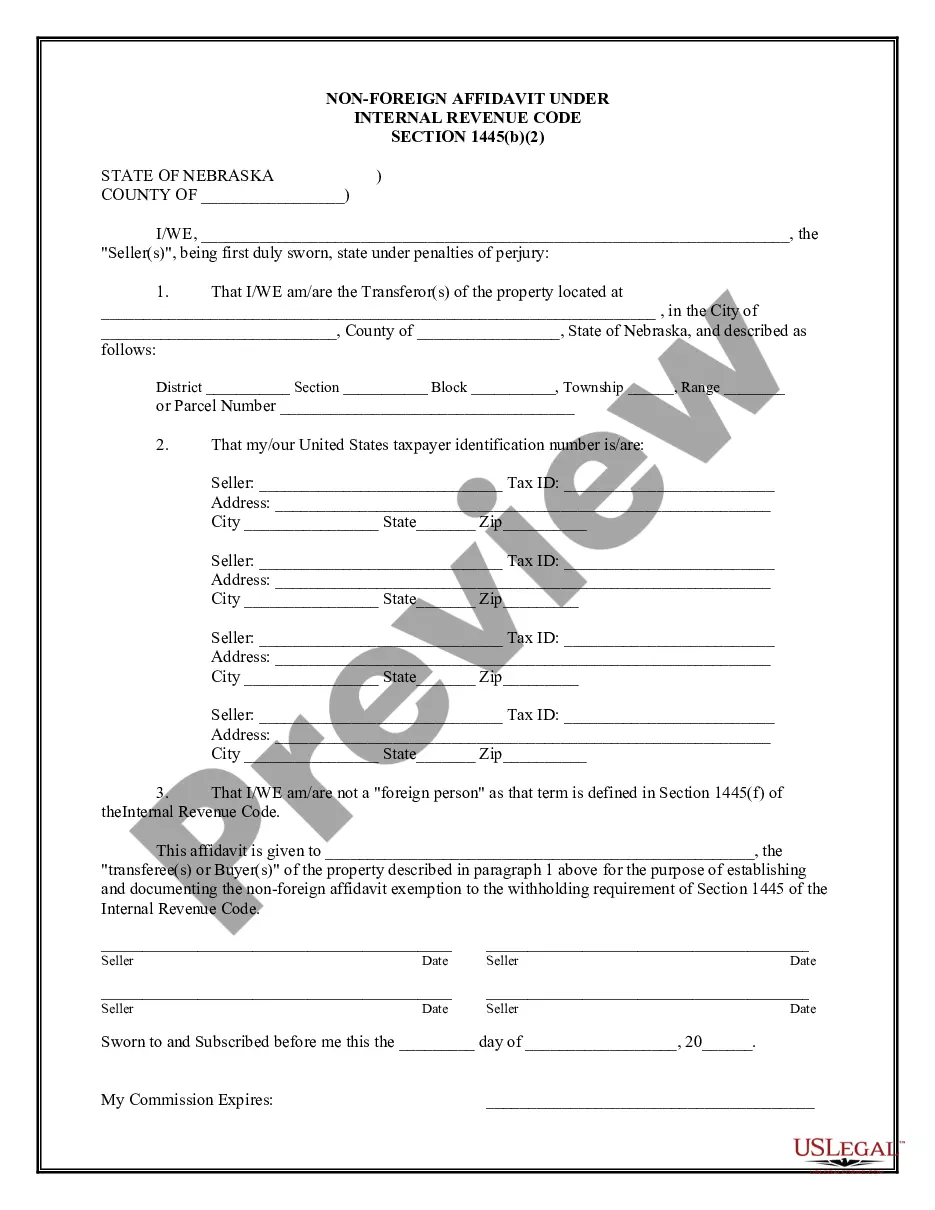

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Omaha Nebraska Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Omaha Nebraska Non-Foreign Affidavit Under IRC 1445?

If you are looking for an appropriate form template, it’s very challenging to find a superior platform than the US Legal Forms website – one of the most comprehensive collections available online.

Here, you can access thousands of form examples for both business and personal needs categorized by types and regions or keywords.

With our efficient search feature, locating the most current Omaha Nebraska Non-Foreign Affidavit Under IRC 1445 is as simple as 1-2-3.

Complete the payment. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose the file format and download it onto your device.

- Moreover, the accuracy of each document is verified by a team of experienced attorneys who routinely review the templates on our site and refresh them in line with the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Omaha Nebraska Non-Foreign Affidavit Under IRC 1445 is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have accessed the form you require. Review its description and use the Preview option to examine its content. If it does not satisfy your needs, use the Search bar at the top of the page to find the correct document.

- Confirm your choice. Hit the Buy now button. Then select your desired subscription plan and provide details to register an account.

Form popularity

FAQ

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an authorized officer of Borrower, stating (a) that Borrower is not a ?foreign corporation,? ?foreign partnership,? ?foreign trust,? or ?foreign estate,? as those terms are defined in the Code and the regulations promulgated

CERTIFICATION OF FOREIGN STATUS UNDER FIRPTA The purpose of this Certification is to notify Buyer of Seller's/Sellers' status under FIRPTA (Section 1445 of the Internal Revenue Code) with regard to a prospective real estate transaction involving the Property identified below.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

Certification of Non-Foreign Status means an affidavit, signed under penalty of perjury by an individual General Partner of the Company, by a responsible officer of a corporate General Partner of the Company (or of the Company, if the Company is a corporation), or by the trustee, executor, or equivalent fiduciary of

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

If you're buying property, you should make sure the seller signs a FIRPTA Affidavit to protect yourself. You shouldn't take the seller's word for it ? or you could face serious penalties for not abiding by FIRPTA rules if they apply. A buyer can be penalized for not determining or disclosing a foreign seller.