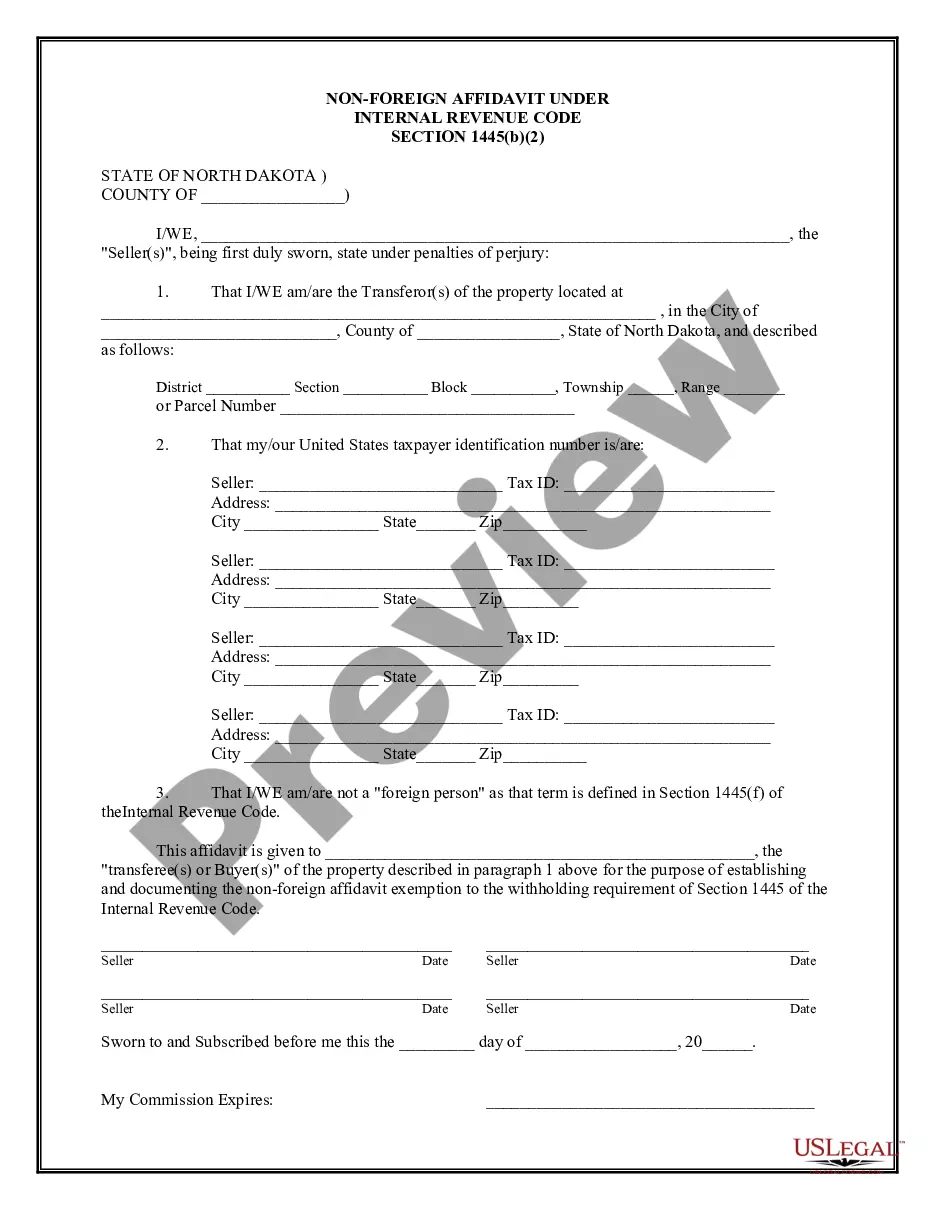

Fargo North Dakota Non-Foreign Affidavit Under IRC 1445

Description

How to fill out North Dakota Non-Foreign Affidavit Under IRC 1445?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our user-friendly platform with thousands of form templates streamlines the process of locating and acquiring nearly any document sample you require.

You can download, complete, and validate the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445 in just a few minutes instead of spending hours online searching for a suitable template.

Utilizing our library is an excellent method to enhance the security of your form submissions. Our experienced attorneys routinely review all documents to ensure that the forms are applicable to a specific area and adhere to the latest regulations and policies.

US Legal Forms is one of the largest and most dependable template libraries online. Our team is always ready to help you with any legal process, even if it is merely downloading the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445.

Don't hesitate to leverage our form catalog and optimize your document experience to be as effective as possible!

- How can you obtain the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445? If you have a subscription, simply Log In to your account. The Download button will be activated for all documents you view.

- Additionally, you can access all previously saved documents through the My documents menu.

- If you do not have an account yet, follow the instructions below.

- Locate the template you need. Verify that it is the template you were searching for: check its title and description, and use the Preview option if it's available. Otherwise, utilize the Search field to find the correct one.

- Initiate the downloading process. Click Buy Now and choose your preferred pricing plan. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Select the format to receive the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445 and edit and fill it, or sign it according to your requirements.

Form popularity

FAQ

IRS notice 1445 provides guidance on the reporting and withholding requirements under FIRPTA for real estate transactions involving foreign sellers. It emphasizes the importance of obtaining the correct documentation, such as a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445, to ensure compliance with tax obligations. Understanding this notice can significantly streamline the sales process and mitigate any potential tax liabilities.

A FIRPTA certificate serves to verify the status of a seller as foreign or non-foreign. When a seller provides a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445, they essentially issue a FIRPTA certificate, which protects buyers from unnecessary tax withholding. This certificate simplifies the settlement process and enhances confidence in the transaction.

Section 1445 of the IRS Code addresses the tax obligations related to foreign persons selling U.S. real estate. This section outlines the withholding requirements that apply unless the seller qualifies for an exemption, such as through a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445. Understanding this section is critical for ensuring compliance with IRS regulations during property transactions.

A FIRPTA affidavit is typically provided by the seller of the property involved in the transaction. When a seller wishes to assert their non-foreign status, they complete the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445. It is advisable for both parties to consult legal or real estate professionals to ensure the affidavit meets all necessary requirements.

The 1445 form is an important document that certifies a seller's foreign status when selling U.S. property. Specifically, the Fargo North Dakota Non-Foreign Affidavit Under IRC 1445 serves as proof that the seller is not subject to FIRPTA withholding. Completing this form can be beneficial for both buyers and sellers, as it provides clarity on tax obligations associated with the transaction.

To navigate around FIRPTA when dealing with property sales, it is crucial to understand the guidelines on foreign ownership. One effective approach is to utilize a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445. This affidavit can provide the necessary proof of non-foreign status, thus allowing you to avoid withholding requirements and simplifying the transaction process.

IRC section 1031 allows property owners to defer tax on the exchange of like-kind properties under specific conditions. This provision can be beneficial if you are looking to reinvest without immediate tax implications. Incorporating a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445 in your strategy can help you navigate these tax laws effectively.

IRC Code section 1445 addresses the withholding tax responsibilities for foreign sellers of U.S. property. This code mandates that buyers withhold a percentage of the sale proceeds in certain transactions involving foreign sellers. Understanding this section is crucial, as it directly impacts how you approach a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445 to prevent unexpected tax liabilities.

To avoid paying FIRPTA withholding, you can provide a credible affidavit declaring your non-foreign status at the time of closing. It’s essential to submit a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445, which demonstrates that you meet the requirements to avoid withholding. Engaging a tax professional can also help clarify your obligations and alternative strategies.

A Section 1445 affidavit is a declaration made by a foreign seller asserting that they are not subject to withholding under the Foreign Investment in Real Property Tax Act (FIRPTA). This affidavit is crucial for buyers, who want to avoid unnecessary withholding taxes. When you prepare a Fargo North Dakota Non-Foreign Affidavit Under IRC 1445, you safeguard your interests during real estate transactions.