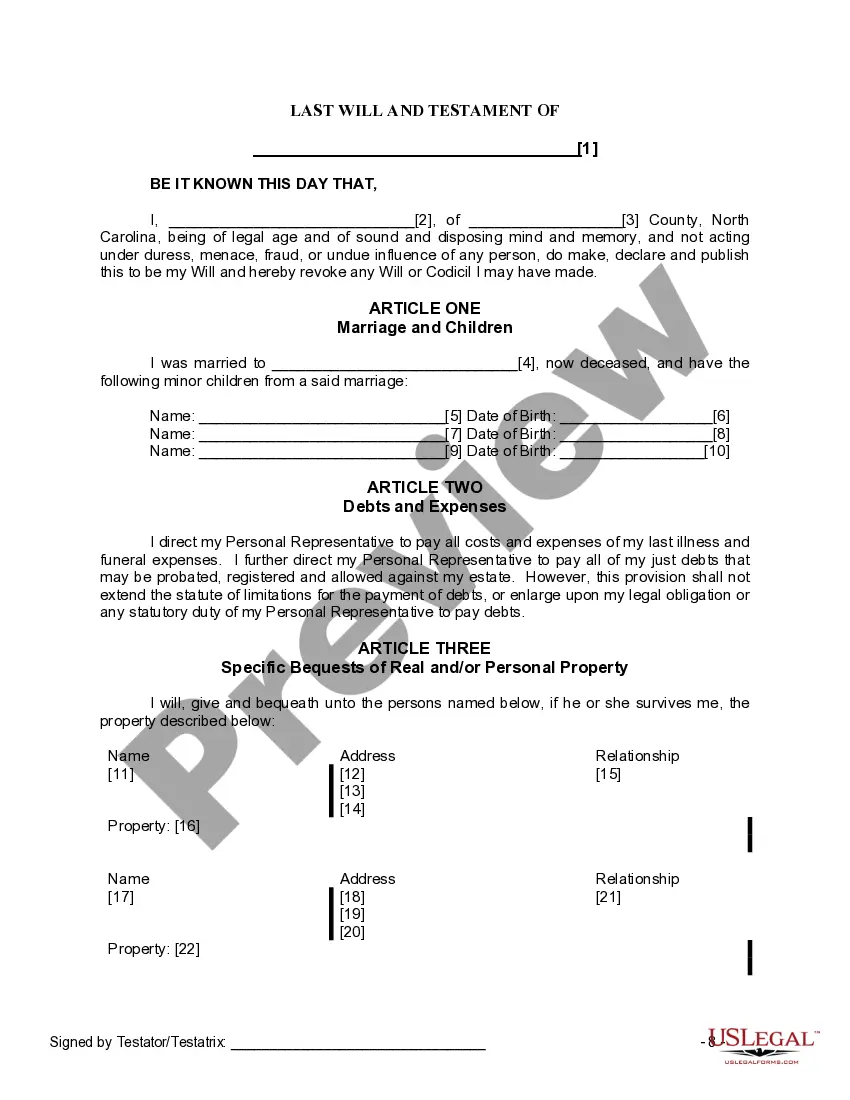

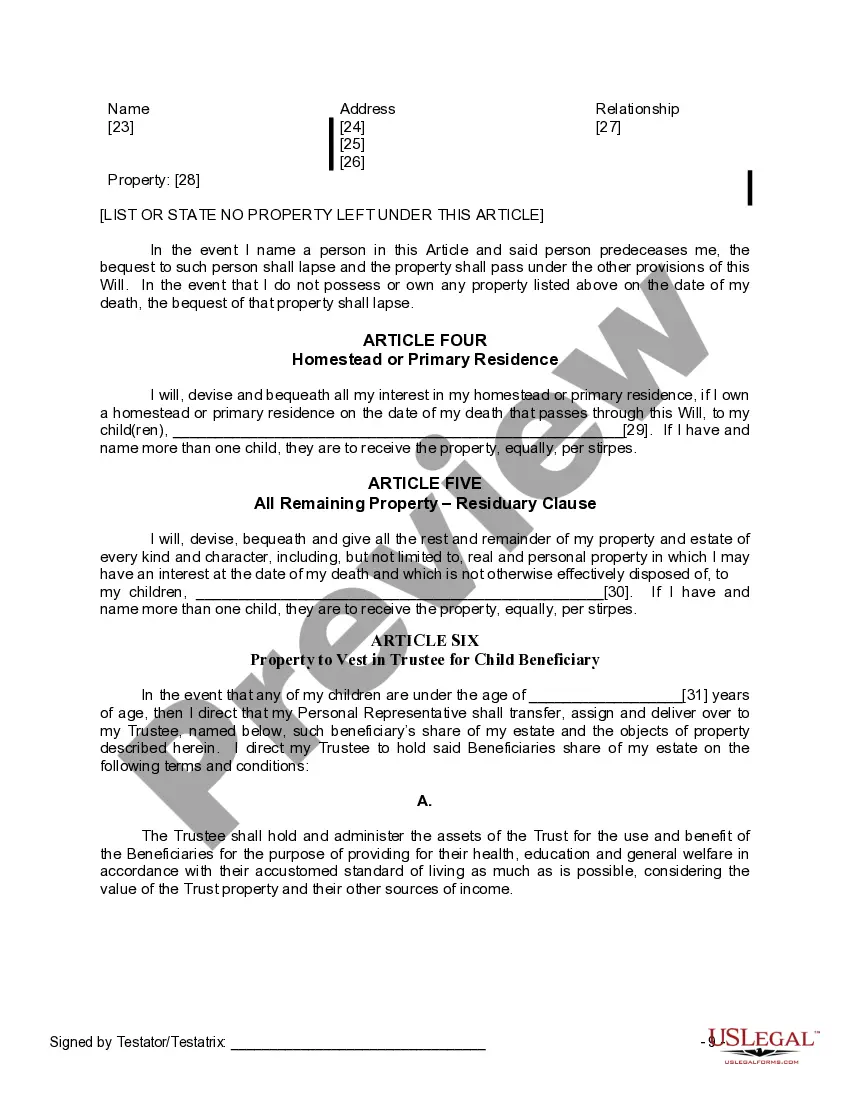

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children

Description

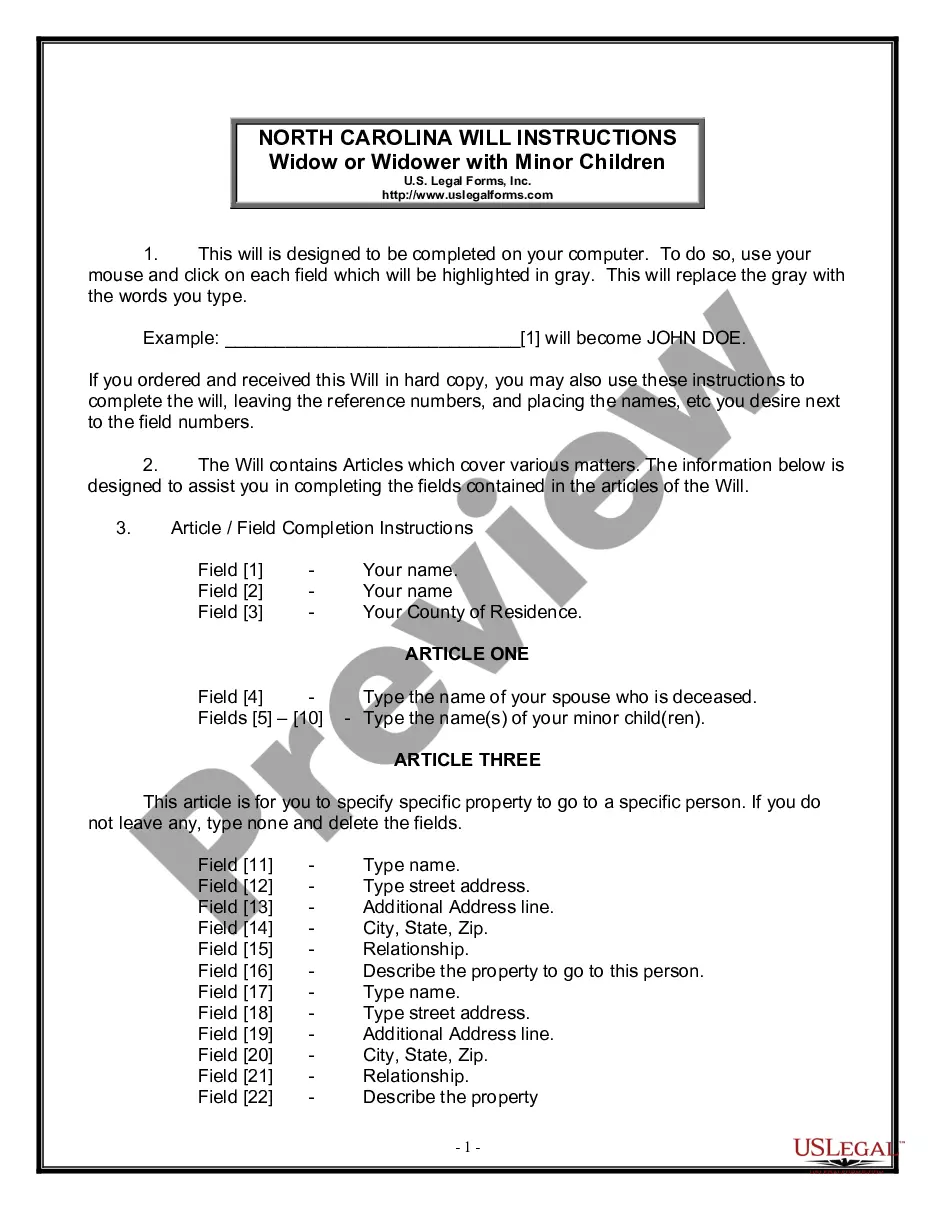

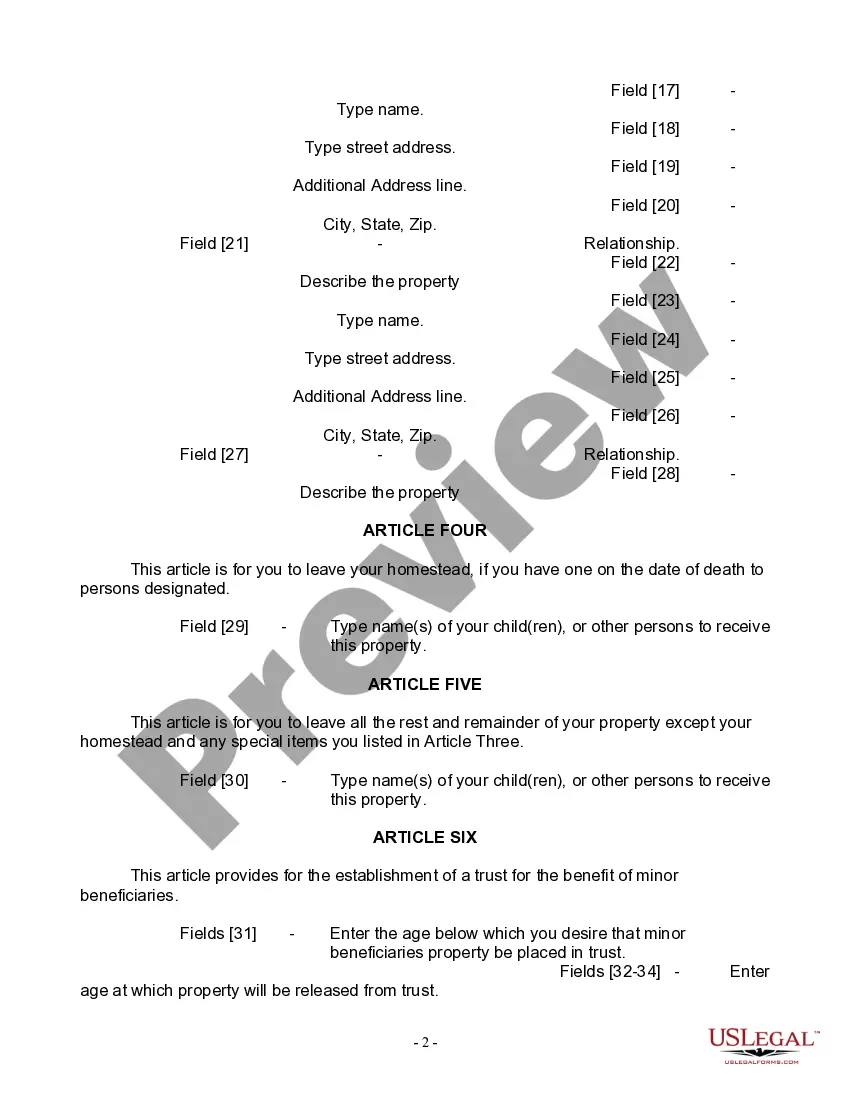

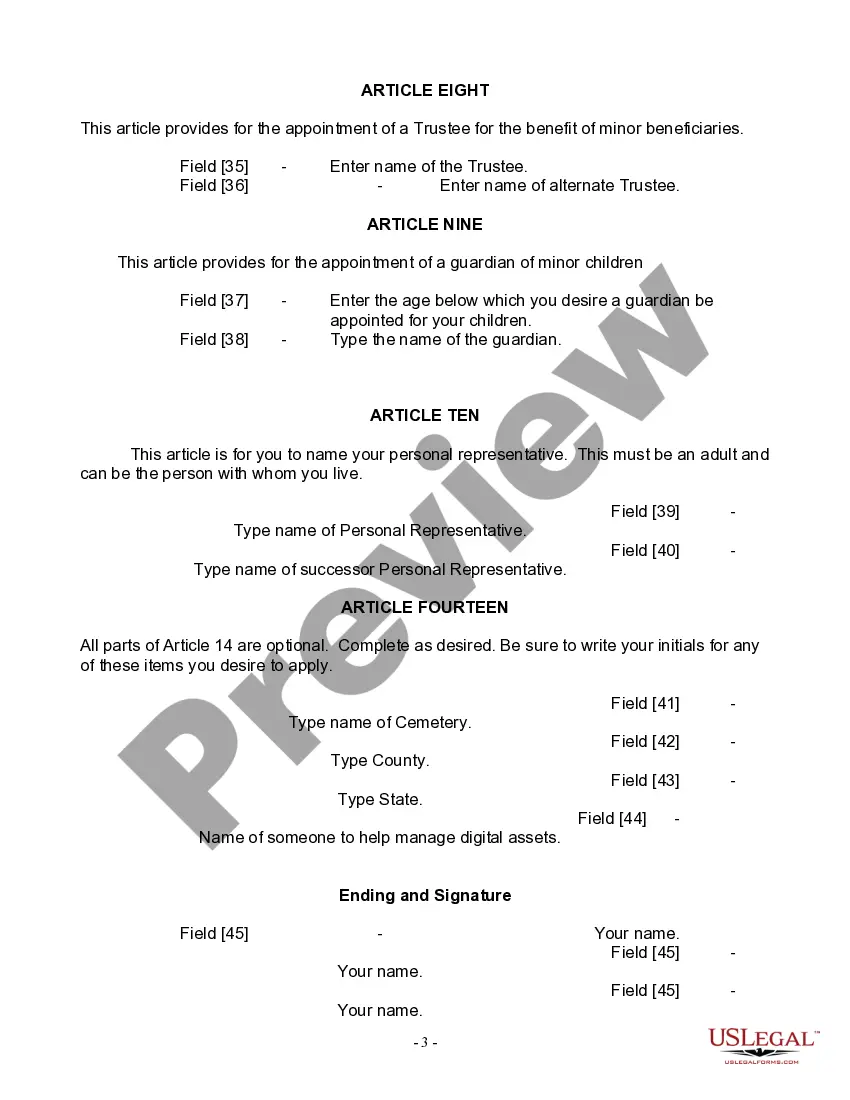

How to fill out North Carolina Last Will And Testament For Widow Or Widower With Minor Children?

If you’ve previously utilized our service, Log In to your account and store the Wilmington North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children on your device by clicking the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your file.

You have perpetual access to every document you have purchased: you can find it in your profile under the My documents menu whenever you wish to access it again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Review the description and use the Preview option, if available, to verify if it aligns with your requirements. If it does not meet your preferences, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and complete a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Wilmington North Carolina Legal Last Will and Testament Form for Widow or Widower with Minor Children. Select the file format for your document and save it to your device.

- Complete your sample. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

In North Carolina, a will that is not notarized can still be deemed valid as long as it meets specific legal requirements, such as being signed by two witnesses. However, notarization can simplify the probate process, especially for a Wilmington North Carolina Last Will and Testament for a Widow or Widower with Minor Children. Notarization helps establish the authenticity of the document and minimizes potential disputes among heirs.

To create a last will and testament in North Carolina, begin by clearly stating your wishes regarding asset distribution, guardianship for minor children, and any specific bequests. Use a straightforward format and include necessary details such as your name, date, and signature. For assistance, you can utilize platforms like UsLegalForms, which offer resources tailored for devising a Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children.

In North Carolina, a will must be filed with the court after the person who created it passes away. This step is crucial to initiate the probate process, ensuring that the intentions of the deceased, especially in a Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children, are honored. Filing the will protects the rights of minor children and ensures a smooth transition of assets.

The form AOC-E 201 is a specific document related to the probate process in North Carolina. It is used to make a request for probate proceedings and includes information about the deceased's assets and beneficiaries. If you are creating a Wilmington North Carolina Last Will and Testament for a Widow or Widower with Minor Children, it may be essential to understand this form and its impact on your estate planning.

Yes, you can create a Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children without a lawyer. North Carolina allows individuals to draft their own wills, provided that they meet certain legal requirements. However, using a service like USLegalForms can simplify the process and ensure that your will meets all legal standards. This is especially important when you want to protect your minor children and secure their future.

For a will to be valid in North Carolina, it must meet several criteria: it should be in writing, signed by the testator, and witnessed by at least two people who are present at the same time. Additionally, the testator must be at least 18 years old and of sound mind. When creating your Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children, understanding these requirements ensures that your wishes are honored. USLegalForms can assist you in drafting a will that meets these legal standards.

A last will and testament does not need to be notarized in North Carolina. While notarization can verify the identity of the testator and help prevent disputes, it is not a legal requirement for the will to be valid. It is essential, however, to ensure that your Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children adheres to other state requirements. Consider using USLegalForms for a user-friendly way to create your will.

You can create a will in North Carolina without a lawyer by following specific guidelines. Start by drafting your Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children, ensuring it includes your intentions, an executor, and witness signatures. You can consult resources online, such as USLegalForms, to find templates and instructions that will simplify the process for you.

In North Carolina, the surviving spouse typically inherits everything if there are no surviving children. If there are children, the spouse shares the estate with them. It is important to clearly outline your wishes in your Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children to avoid confusion. Utilizing USLegalForms can help you ensure that your will reflects your intentions accurately.

Yes, you can write your own will in North Carolina. You must ensure it meets the state’s legal requirements, which include being of sound mind, at least 18 years old, and having the proper format. Creating a Wilmington North Carolina Last Will and Testament for Widow or Widower with Minor Children on your own can be straightforward if you follow these guidelines. USLegalForms offers helpful resources if you need templates or additional support during the process.