Wilmington North Carolina UCC1 Financing Statement

Description

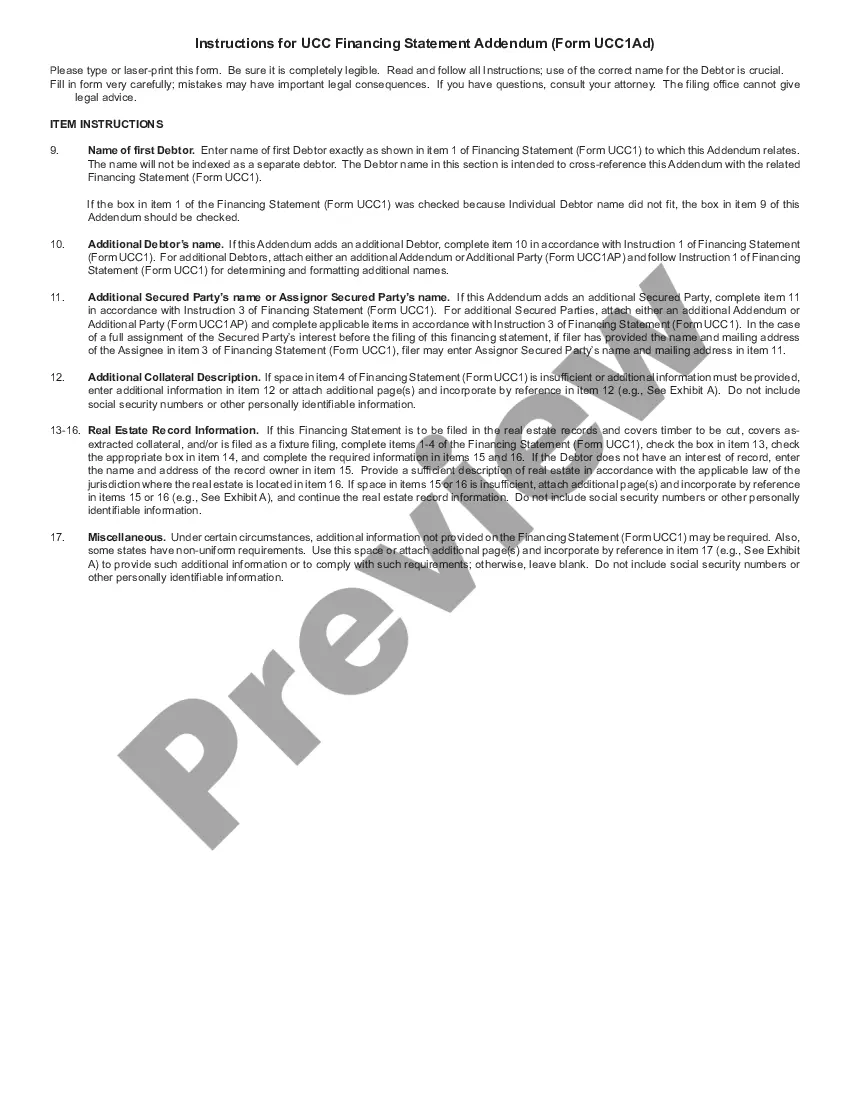

How to fill out North Carolina UCC1 Financing Statement?

Irrespective of social or occupational standing, completing legal documentation is an unfortunate requirement in the current professional landscape.

Frequently, it’s nearly impossible for an individual lacking any legal background to create this type of paperwork from scratch, primarily because of the complex terminology and legal nuances they involve.

This is where US Legal Forms can come to the rescue.

Verify that the template you have selected is applicable for your region, as the regulations of one state or county may not be effective for another.

Look over the form and review a brief summary (if available) of scenarios the document can be utilized for.

- Our platform offers an extensive library containing over 85,000 ready-to-use state-specific documents applicable to virtually any legal matter.

- US Legal Forms is also a fantastic resource for associates or legal advisors looking to save time utilizing our DIY documents.

- Whether you require the Wilmington North Carolina UCC1 Financing Statement or any other form appropriate for your state or county, with US Legal Forms, everything is at your disposal.

- Here’s how to quickly acquire the Wilmington North Carolina UCC1 Financing Statement using our reliable platform.

- If you are already a registered user, you can simply Log In to your account to download the correct document.

- However, if you are new to our platform, please follow these steps before obtaining the Wilmington North Carolina UCC1 Financing Statement.

Form popularity

FAQ

A UCC must be filed with the appropriate state authority where the debtor is located. In the case of Wilmington North Carolina UCC1 Financing Statements, this is the Secretary of State's office. This filing ensures your security interest is perfected according to state law. To make the process smoother, you can use resources from uslegalforms for guidance on necessary documentation and filing procedures.

You will file your Wilmington North Carolina UCC1 Financing Statement at the Secretary of State's office. This location handles all UCC filings for the state, ensuring your interests are protected under North Carolina law. Filing can be done online, making the process efficient and user-friendly. Remember, timely filing is crucial to securing your financing interests.

To file a lien for unpaid work in North Carolina, you typically start by preparing a Notice of Claim of Lien. This document should include specific details about the work performed and the amounts owed. Submit the lien to the county register of deeds in the area where the work took place. For additional guidance, consider leveraging platforms like uslegalforms, which can provide templates and instructions tailored to your needs.

In North Carolina, you should file your UCC documents with the Secretary of State's office. This office handles all UCC filings, including the Wilmington North Carolina UCC1 Financing Statement. You can choose to file electronically for faster processing or mail in physical documents. This centralized filing system simplifies the process for everyone involved.

You can file your Wilmington North Carolina UCC1 Financing Statement with the North Carolina Secretary of State's office. This filing is essential for perfecting a security interest in personal property. You can file online or submit a paper form depending on your preference. Ensuring your UCC-1 is filed correctly protects your interests as a creditor.

A UCC filing can have both positive and negative implications, depending on your perspective. For creditors, it provides security for loans, while for debtors, it may indicate financial obligations that could affect credit ratings. Understanding how a Wilmington North Carolina UCC1 Financing Statement impacts your situation is essential for making informed financial decisions.

The IRS may file a UCC to secure its interest in a taxpayer's assets when unpaid taxes are owed. This filing acts similarly to a lien, putting creditors on notice about the IRS's claim. Understanding the implications of a UCC filing from the IRS can help you manage your finances and avoid complications in Wilmington North Carolina.

To remove a UCC filing in North Carolina, you will need to file a termination statement with the Secretary of State's office. This document officially releases the lien and indicates that the secured obligation has been satisfied. Utilizing the resources at uslegalforms can help you navigate this process efficiently, ensuring compliance with all regulations.

You can file a UCC-1 financing statement in North Carolina at the Secretary of State's office, or online through designated portals. This ensures that your filing is recorded publicly and serves as notice to other creditors. Using uslegalforms can simplify the filing process and ensure accuracy, saving you time and effort.

NC UCC statement service refers to the process of filing UCC statements in North Carolina and managing related inquiries. Services like uslegalforms can streamline this process, making it easier for businesses and individual creditors to file and search UCC records. Efficient handling of these documents helps maintain clarity in financial relationships.