Fayetteville North Carolina UCC1 Financing Statement

Description

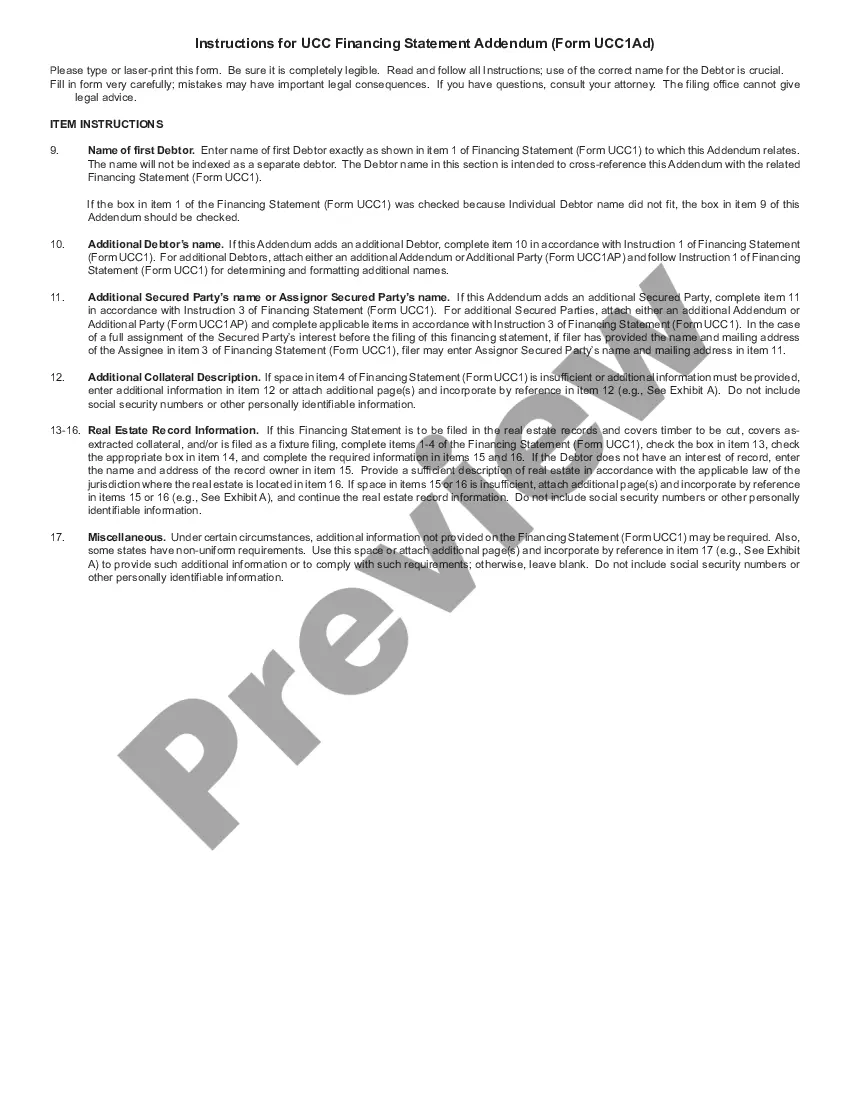

How to fill out North Carolina UCC1 Financing Statement?

Regardless of personal or professional standing, completing legal paperwork is a regrettable requirement in today’s business landscape.

Frequently, it’s nearly impossible for an individual lacking legal education to generate such forms from scratch, primarily due to the intricate jargon and legal subtleties they entail.

This is where US Legal Forms proves to be beneficial.

Make sure the document you’ve selected is suitable for your jurisdiction, as the regulations of one state or county may not apply to another.

Review the document and read a brief overview (if available) of situations in which the document can be utilized.

- Our platform offers an extensive database with over 85,000 ready-to-utilize state-specific documents that cater to nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors aiming to enhance their efficiency by using our DIY forms.

- Whether you need the Fayetteville North Carolina UCC1 Financing Statement or any other paperwork recognized in your state or county, US Legal Forms has everything readily available.

- Here’s how to swiftly obtain the Fayetteville North Carolina UCC1 Financing Statement using our reliable platform.

- If you're already a current customer, you can proceed to Log In to your account to access the necessary form.

- However, if you are new to our collection, ensure you follow these instructions before downloading the Fayetteville North Carolina UCC1 Financing Statement.

Form popularity

FAQ

A North Carolina UCC statement form is a document that a secured party files to notify others of their interest in a debtor's assets. This form is essential for establishing priority in claims against collateral. If you’re dealing with a Fayetteville North Carolina UCC1 Financing Statement, it is crucial to understand how this document could impact your transactions. US Legal Forms offers various templates and resources to help you complete this form accurately.

You file a UCC-1 financing statement with the Secretary of State in the state where the debtor is located. For Fayetteville, North Carolina, you would typically submit this filing to the North Carolina Secretary of State's office. You can file either in person or electronically, depending on your needs. US Legal Forms can guide you through the submission process, ensuring your filing adheres to all requirements.

Receiving a UCC financing statement usually indicates that a creditor has filed to secure their interest in your assets. This filing protects the creditor's right to payment in case of default. If you have a Fayetteville North Carolina UCC1 Financing Statement, it's essential to understand its implications on your business and finances. You may want to consult resources like US Legal Forms to navigate the next steps.

To look up a UCC filing, you can use the online database provided by your state's Secretary of State. You will typically need information such as the debtor's name or the UCC file number. This process allows you to review the details of any Fayetteville North Carolina UCC1 Financing Statement that affects you or your business. US Legal Forms also offers tools to simplify this lookup process for your convenience.

In Massachusetts, you can file a UCC financing statement at the Secretary of the Commonwealth's office. Your filing can be done online or in person, depending on your preference. Keep in mind that your Fayetteville North Carolina UCC1 Financing Statement must meet specific guidelines to ensure it is processed correctly. For a streamlined experience, consider using US Legal Forms to assist with the filing process.

A NC UCC statement refers to the document filed to perfect a security interest in personal property. Specifically, the UCC1 Financing Statement outlines the details of the asset and the debtor. If you are operating in Fayetteville, North Carolina, using this statement can help safeguard your investments. Platforms like uslegalforms can facilitate the preparation and filing of UCC statements, ensuring you stay compliant and protected.

A North Carolina UCC1 lien is a legal claim placed on property to secure a debt. This type of lien involves filing a UCC1 Financing Statement, which informs other parties of the lender's interest in the debtor’s property. By filing this statement in Fayetteville, North Carolina, you establish your rights in case of default. It serves as a proactive measure to protect your financial interests.

UCC stands for Uniform Commercial Code. It is a comprehensive set of laws that govern commercial transactions across the United States. In Fayetteville, North Carolina, UCC1 Financing Statements fall under this legal framework, providing clarity and consistency in securing interests. Understanding this acronym can be crucial for anyone involved in business or financing.

In North Carolina, a UCC1 Financing Statement is valid for five years. After this period, it can be renewed to maintain the security interest. If you are dealing with transactions in Fayetteville, North Carolina, it’s essential to keep track of expiration dates to ensure continued protection. This renewal process helps secure your interests against creditors and competing claims.

Yes, North Carolina adheres to the Uniform Commercial Code (UCC). This set of laws simplifies the process of securing loans through personal property. In Fayetteville, North Carolina, UCC1 Financing Statements help lenders register their security interests. By following the UCC, the state creates a clear legal framework for businesses and individuals engaging in financial transactions.