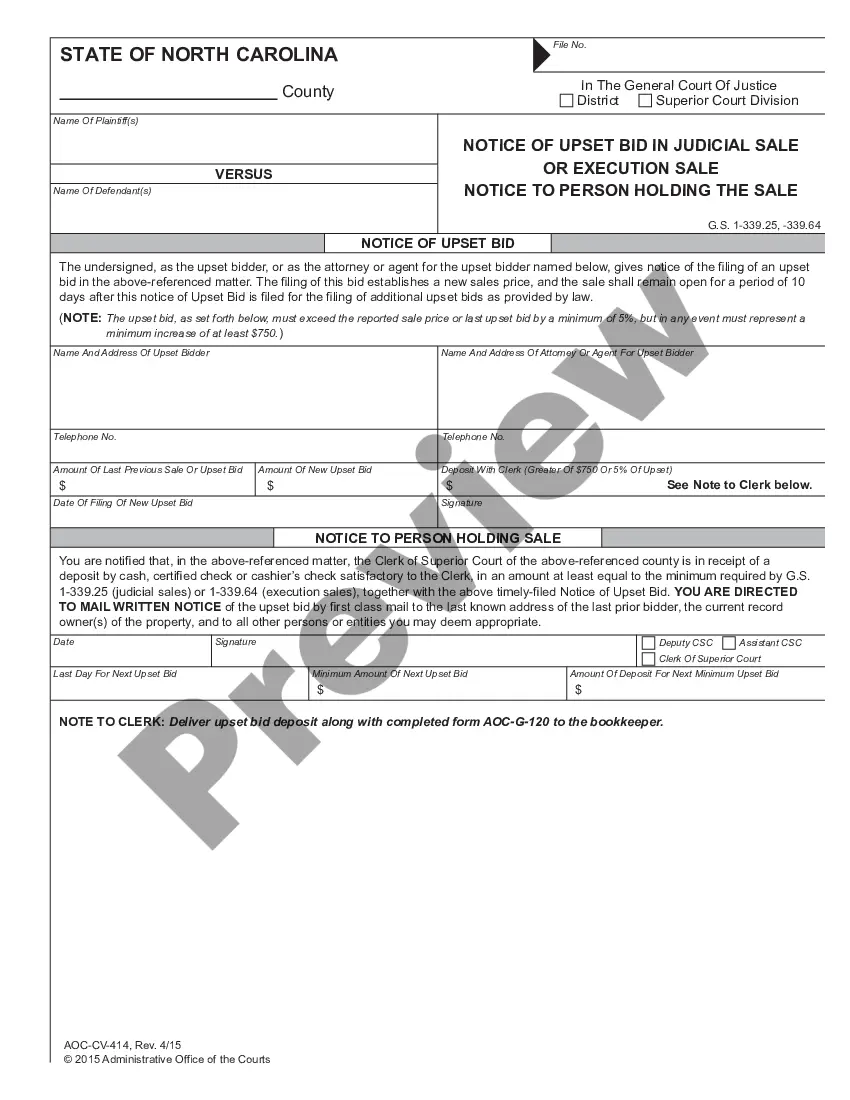

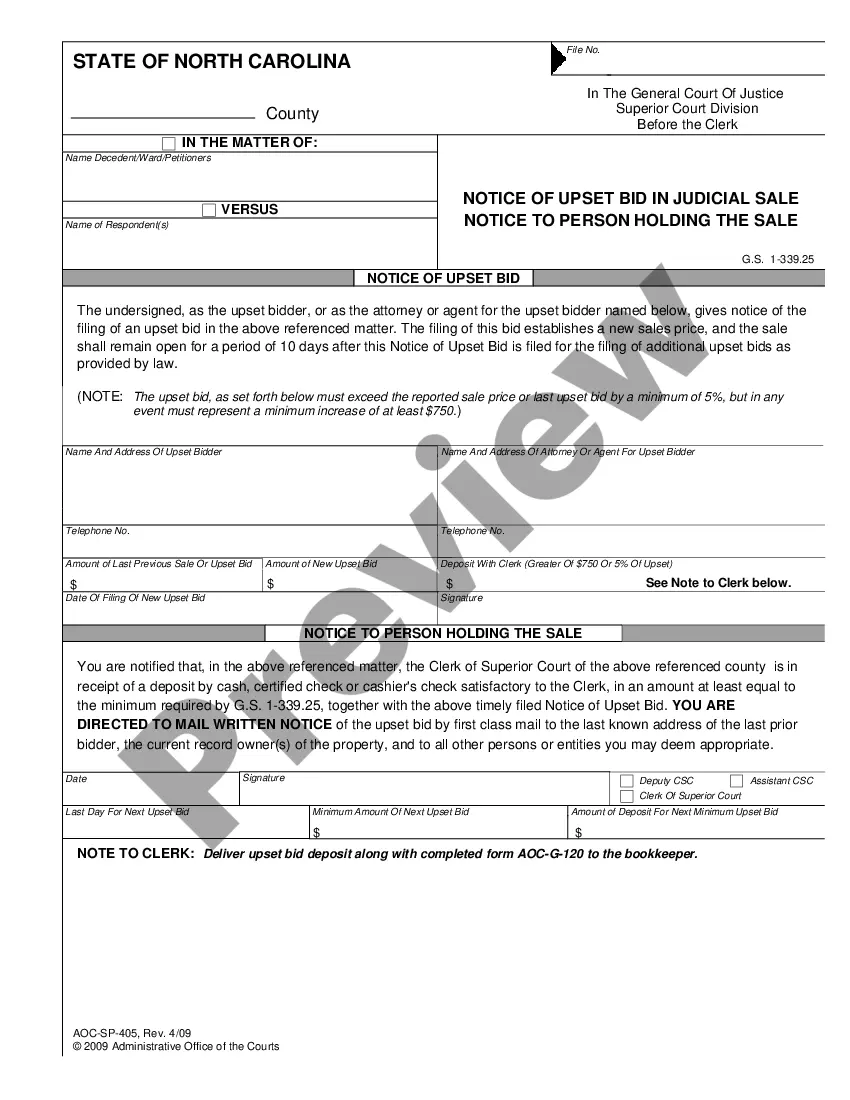

Notice of Upset Bid Notice to Trustee or Mortagee: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee

Description

How to fill out North Carolina Notice Of Upset Bid Notice To Trustee Or Mortgagee?

If you are searching for a legitimate document, it’s unattainable to discover a more suitable platform than the US Legal Forms site – perhaps the most extensive collections on the internet.

With this repository, you can acquire a vast array of form samples for commercial and personal applications categorized by type and jurisdiction, or keywords.

With the superior search functionality, locating the most current Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee is as straightforward as 1-2-3.

Confirm your choice. Select the Buy now button. Subsequently, choose the desired pricing plan and provide details to register for an account.

Complete the financial transaction. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the appropriateness of each document is confirmed by a team of proficient attorneys who routinely assess the templates on our platform and revise them according to the latest state and county standards.

- If you are already familiar with our system and possess an account, all you need to obtain the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure you have opened the sample you need. Review its details and use the Preview option (if available) to view its content.

- If it doesn’t satisfy your requirements, utilize the Search option located near the top of the screen to locate the necessary file.

Form popularity

FAQ

In a foreclosure sale in North Carolina, the minimum bid often starts at the amount owed under the mortgage, including interest and fees. This starting bid is determined by the lender and is designed to recover the outstanding debt. It is crucial for potential bidders to understand the implications of this figure and how it relates to the property’s market value. For detailed information, refer to the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee.

The timeline for foreclosure in North Carolina generally spans several months, beginning with the default on the mortgage and advancing through various legal procedures. Depending on the complexity of the case and potential delays, the entire foreclosure process can take anywhere from 2 to 6 months. Important stages include the issuance of a notice of default and the scheduling of a foreclosure sale. Utilizing the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee can help you stay informed during this critical period.

The upset bid period in North Carolina is a designated timeframe that allows potential buyers to submit higher bids for a property that is already up for auction. Typically, this period lasts for 10 days following the initial sale, during which any party can place a new bid. If a valid upset bid is received, the auction process resets, granting more time for additional bids. Understanding the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee can help you navigate this process effectively.

The upset bid period in North Carolina foreclosure is a designated timeframe, typically ten days, where individuals can place an upset bid on a property. This period starts after an initial sale has occurred, and any bid that exceeds the previous amount must be submitted during this time. The Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee provides critical information that buyers must consider when engaging in foreclosures. It’s essential for potential bidders to understand this process to make informed decisions.

To place an upset bid in North Carolina, you must submit your bid in writing, including your personal information and the desired bid amount. Make sure to follow the instructions provided in the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee. Additionally, utilizing the resources available on our platform can streamline your submission process and help avoid potential errors.

To decline a bid respectfully, you should communicate your decision clearly and professionally, referencing the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee for context. A concise written notice expressing your thanks for the offer, while explaining your reasons, is a courteous approach. Proper documentation helps maintain a positive relationship with potential bidders.

In North Carolina, a 10 day upset bid refers to a period during which an interested party can place a higher bid after an initial bid has been accepted. This time frame allows individuals to challenge the existing bid, promoting fairness. The Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee provides essential details about this process.

To manage bids effectively, it is important to follow the guidelines set forth in the Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee. Each bid must be submitted in writing and should clearly state the amount. Our platform offers resources to simplify the process, ensuring you meet all legal requirements and deadlines.

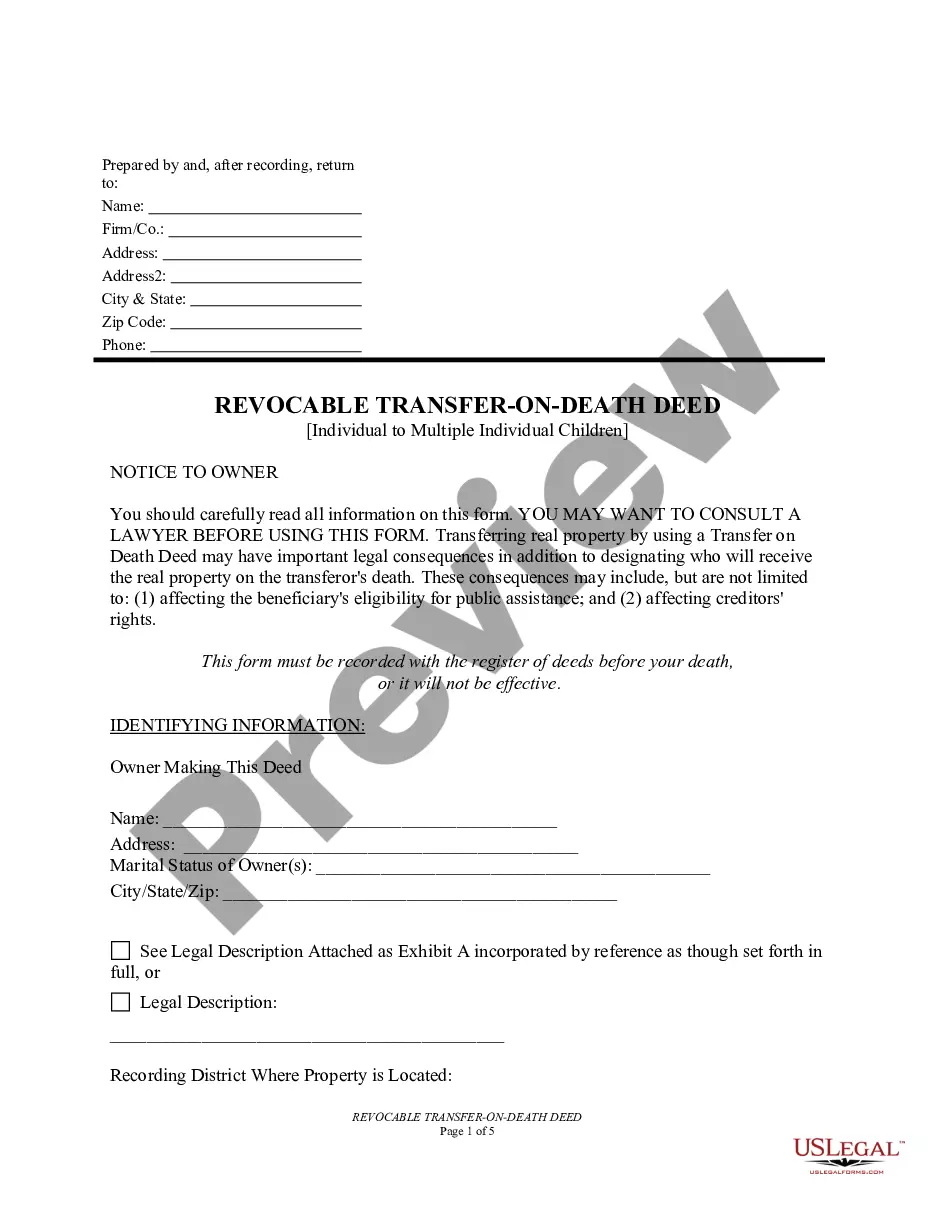

Yes, in North Carolina, one heir can petition the court to force the sale of inherited property, especially if there is no agreement among heirs. This action typically requires legal formalities and can be essential in settling an estate. If a Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee is connected with such a sale, having a clear understanding of the laws involved is vital. Seeking guidance through platforms like US Legal Forms can help outline necessary steps.

The foreclosure process in North Carolina typically takes between 120 to 180 days, depending on various factors. After the filing of the complaint, homeowners have a set period to respond before proceeding to court. If you are dealing with a Fayetteville North Carolina Notice of Upset Bid Notice to Trustee or Mortgagee, understanding the timeline helps you prepare for possible outcomes. Utilizing resources such as US Legal Forms can enhance your approach.