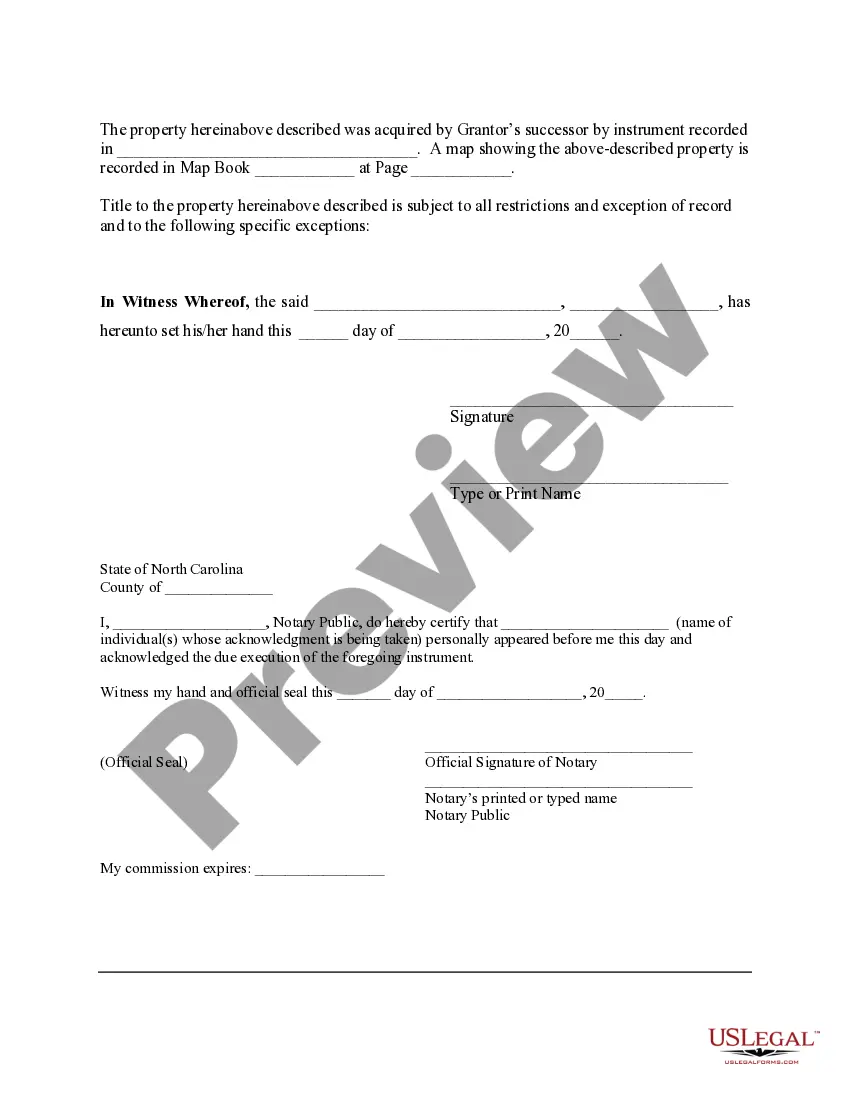

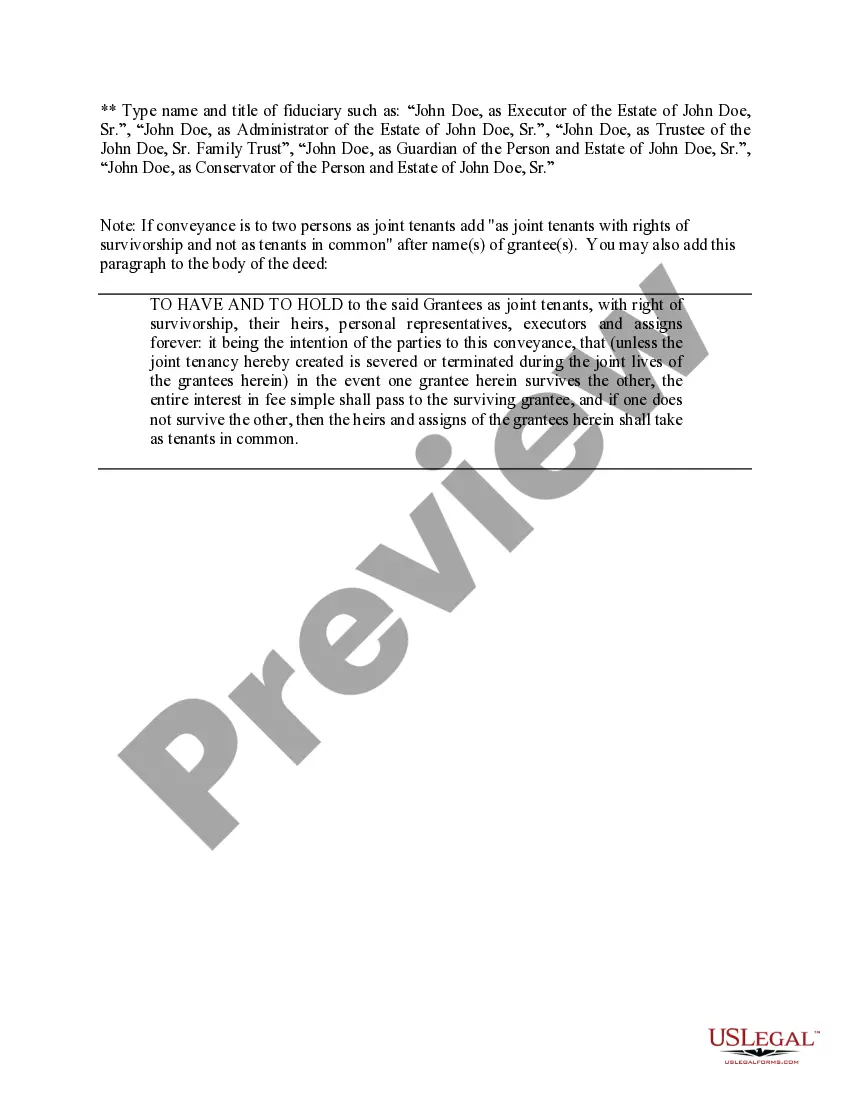

Raleigh North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

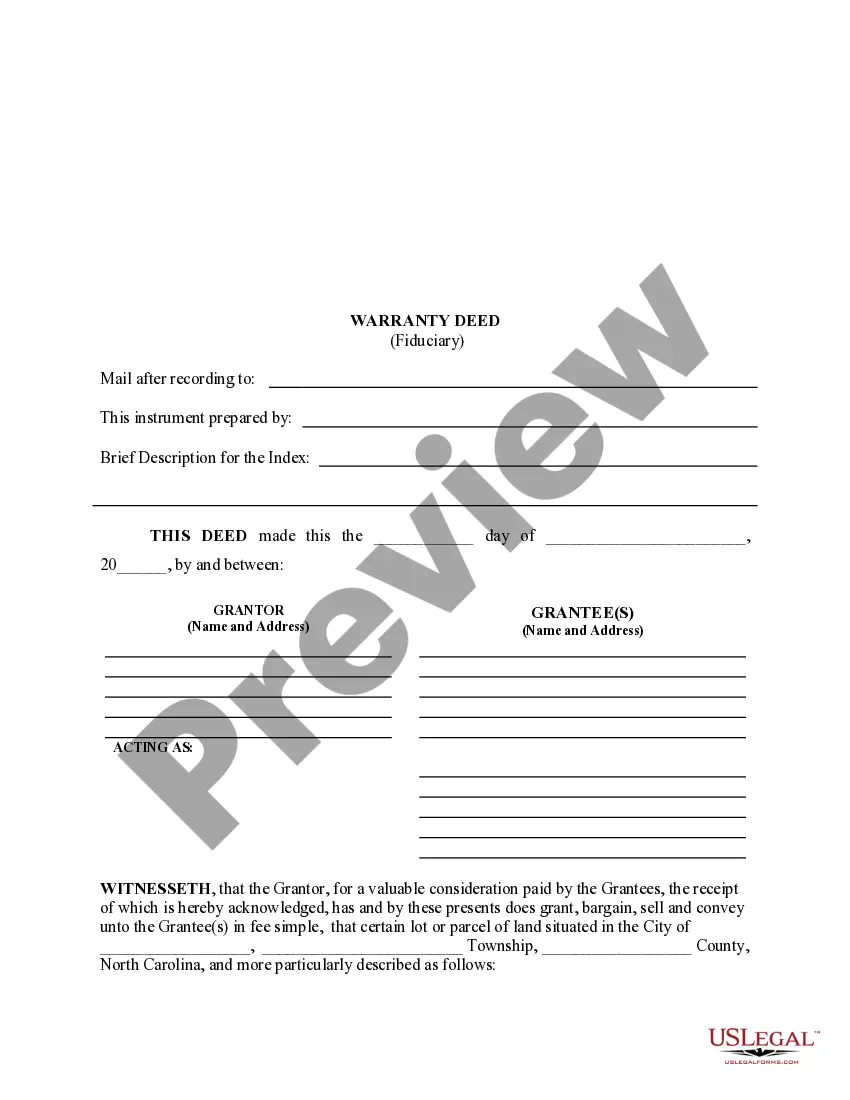

How to fill out North Carolina Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Take advantage of the US Legal Forms and gain immediate access to any document you need.

Our advantageous platform with a vast collection of templates enables you to locate and acquire almost any sample document you might require.

You can save, complete, and validate the Raleigh North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries in just a few minutes instead of searching the internet for countless hours in search of a suitable template.

Using our library is an excellent method to enhance the security of your form submission. Our experienced attorneys routinely examine all the documents to ensure that the templates are applicable for a specific state and adhere to current laws and regulations.

If you have not set up a profile yet, follow the instructions below.

Locate the template you seek. Ensure it is the one you need: confirm its title and description, and use the Preview feature when available. Otherwise, use the Search box to find the right one.

- How can you obtain the Raleigh North Carolina Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

- If you already possess an account, simply Log In to your profile. The Download button will show up on all the samples you access.

- Additionally, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

According to tariff, the executor is entitled to 3.5% on the gross value of assets in an estate and 6% on income accrued and collected after the death of the deceased. It is best to discuss the fees with your family upfront so that they are aware of how the fees will be calculated.

If one of these individuals is interested in being an executor, they must apply to the Clerk of Superior Court through a form from the court's office. This form includes a preliminary inventory of the decedent's assets.

The Executor The deceased nominates an executor in his or her will and the Master appoints such executor subject to certain requirements. If the deceased did not nominate an executor, the beneficiaries may nominate an executor for the Master to appoint.

Prior to being legally recognized as Executor or Trustee, you do not yet have the legal authority to act on behalf of the Estate or Trust or to sign documents on behalf of the Estate or Trust. For an Estate without a Last Will and Testament, you would petition the Court to be appointed as Administrator of the Estate.

If one of these individuals is interested in being an executor, they must apply to the Clerk of Superior Court through a form from the court's office. This form includes a preliminary inventory of the decedent's assets.

State law allows for two years for the will to be entered into the court records. However, an heir may file sooner if the executor fails to file within 60 days of the death of the person.

An executor cannot claim for the time they have incurred; however they are entitled to be reimbursed for the reasonable costs of the administration.

Original / certified copy of the death certificate. Original / certified copy of the marriage certificate. Original will. Completed death notice. Completed next-of-kin affidavit. Completed inventory showing all the assets of the deceased.

Unless the Will provides otherwise, under North Carolina law, Executors or Administrators may claim a commission of up to 5% of the Estate assets and receipts, as approved by the Clerk of Court.