Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out North Carolina Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s a digital compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the forms are suitably categorized by area of application and jurisdiction, making the process of finding the Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate as simple and quick as possible.

Submitting your credit card information or utilizing your PayPal account to make the payment allows you to proceed with your purchase.

- Examine the Preview mode and form description.

- Ensure that you’ve selected the correct one that fulfills your needs and aligns with your local jurisdictional criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your requirements, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

You can obtain a promissory note for your mortgage through banks, credit unions, or online platforms that specialize in legal documents. Websites like uslegalforms offer customizable templates tailored for Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate. This makes the process straightforward and efficient, ensuring you have the documents needed for your mortgage.

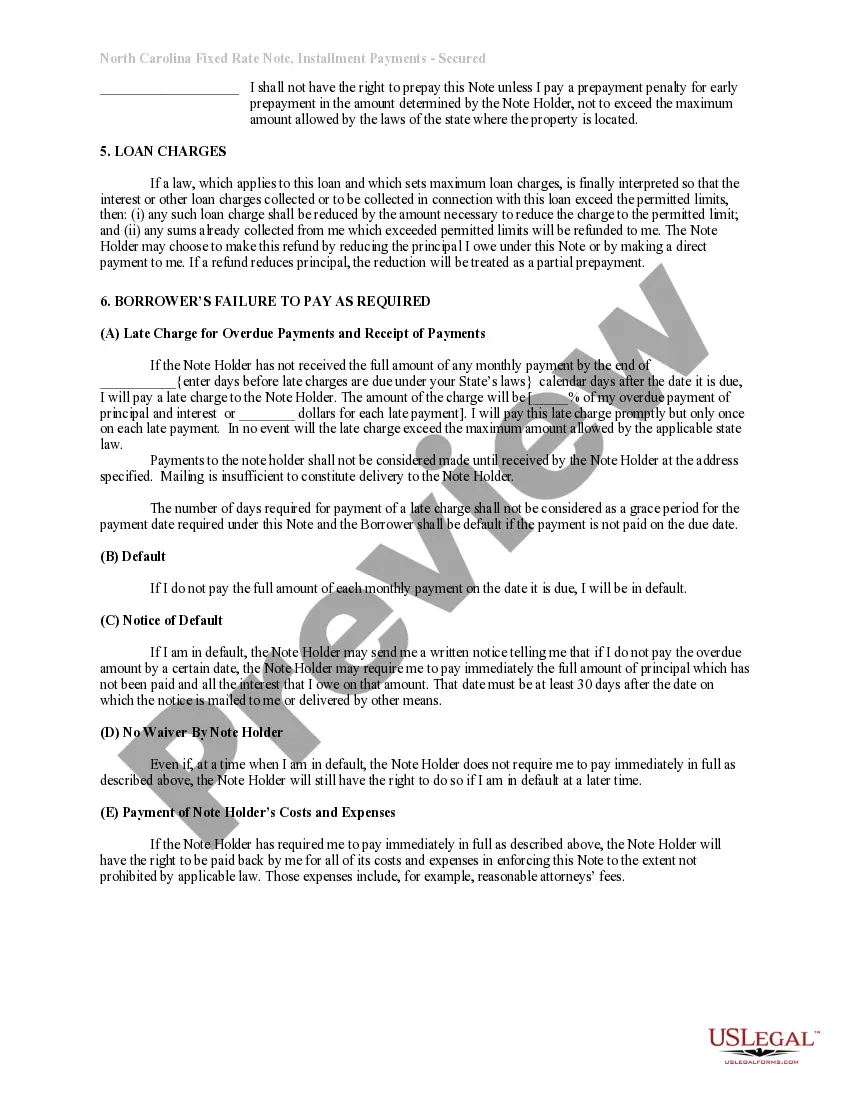

The criteria for a promissory note include a clearly defined borrower and lender, the principal amount, interest rate, payment schedule, and the signatures of all parties involved. It also should outline what happens in case of default. To ensure you meet these criteria related to Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, using resources like uslegalforms can help.

For a promissory note to be valid, it typically must include the amount loaned, the interest rate, and the repayment schedule. It should clearly identify the parties involved and must be signed by the borrower. Adhering to the guidelines related to Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate can ensure that your note complies with state laws.

Yes, banks can sell promissory notes, especially those related to mortgages, such as Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate. These notes are often sold in the secondary market to investors. By understanding the availability and terms, you can find opportunities that meet your financial needs.

To obtain a promissory note for a mortgage, you should first consult with a lender who specializes in Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate. You can explore options through a bank or a private lender. Additionally, using platforms like uslegalforms can simplify the process, providing you with templates and guidance to create a legally sound promissory note.

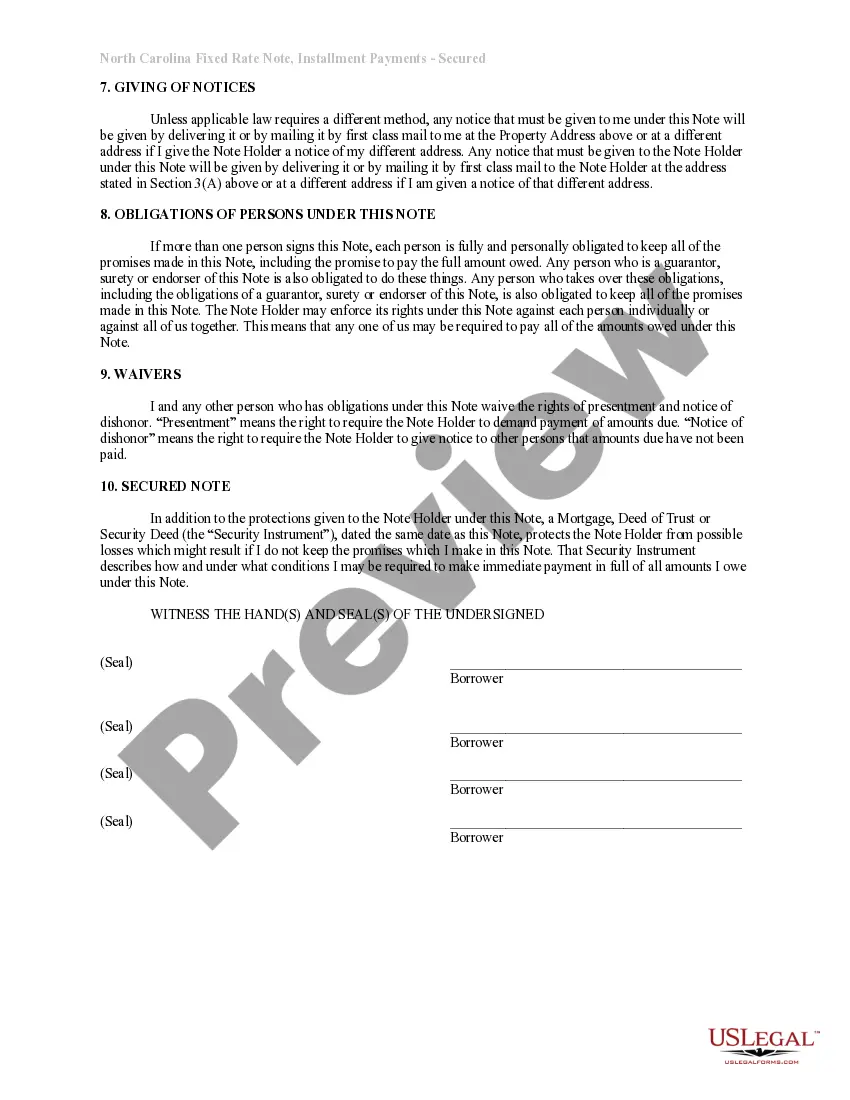

A personal promissory note typically does not need to be notarized to be valid; however, notarization can provide an added layer of security and authenticity. Including notarization can reduce potential disputes by proving the identity of the signatories. If you are drafting a Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consider including notarization for additional protection.

A reasonable interest rate for a promissory note often varies based on current market conditions, but it typically ranges from 4% to 10%. For the Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consider other factors such as the creditworthiness of the borrower and comparable rates in your area. Researching local interest norms can help you determine a fair rate.

Yes, promissory notes can indeed be backed by collateral to increase security for lenders. In the case of the Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the collateral can be a property that the borrower owns. This arrangement safeguards the lender's investment and provides peace of mind in financial transactions.

In North Carolina, a promissory note typically remains valid for a period of ten years. After this duration, the note could be considered unenforceable unless renewed. Therefore, it is important to track the validity of your Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Keeping records helps ensure you remain compliant with state laws.

The document that secures the Wilmington North Carolina Installments Fixed Rate Promissory Note Secured by Residential Real Estate is known as a mortgage or deed of trust. This document details the rights and responsibilities of both the borrower and lender, ensuring that the lender can take possession of the property if necessary. Understanding this key document is essential for both parties involved in the transaction to ensure clarity and compliance.