High Point North Carolina Financial Account Transfer to Living Trust

Description

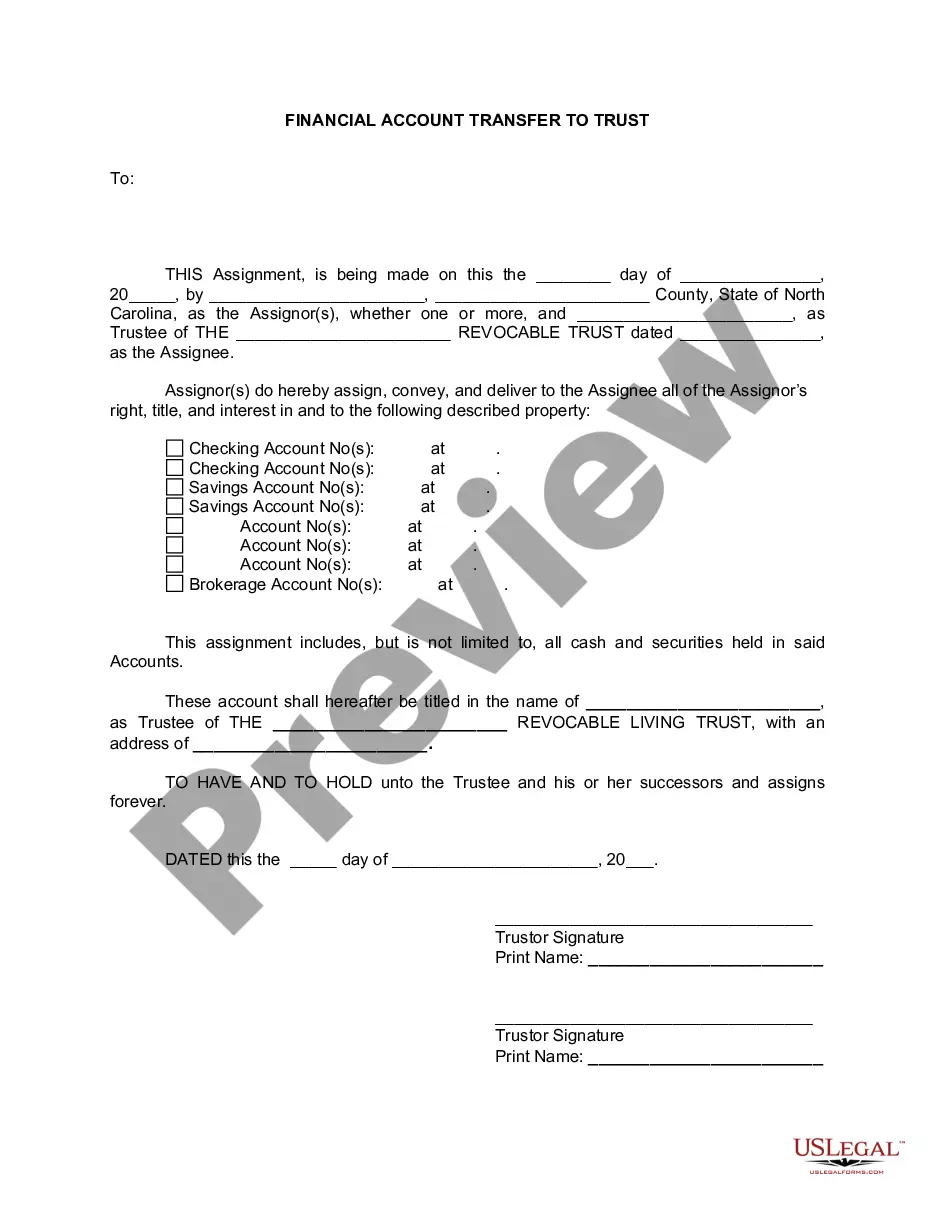

How to fill out North Carolina Financial Account Transfer To Living Trust?

If you have previously availed yourself of our service, Log In to your account and download the High Point North Carolina Financial Account Transfer to Living Trust onto your device by clicking the Download button. Ensure your subscription is current. If not, renew it according to your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You retain permanent access to every document you have bought: you can locate it in your profile within the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Ensure you’ve located the correct document. Review the description and use the Preview feature, if available, to verify that it meets your requirements. If it doesn't fulfill your needs, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Retrieve your High Point North Carolina Financial Account Transfer to Living Trust. Choose the desired file format for your document and save it to your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

One significant downside of transferring assets into a trust is the loss of direct ownership. This transition may limit your family's immediate control over those assets, and there could be tax implications as well. As you explore the High Point North Carolina Financial Account Transfer to Living Trust, it’s wise to consult with professionals to navigate these potential challenges effectively.

Family trusts, while beneficial, have their drawbacks as well. They can restrict access to funds, meaning family members may face limitations if funds are tied up in the trust. When considering a High Point North Carolina Financial Account Transfer to Living Trust, it's crucial to weigh these factors against the potential benefits, ensuring that it aligns with your family's goals.

Placing assets in a trust can provide several advantages. It allows for a smooth transition of ownership, often avoiding the lengthy probate process. If your parents are considering a High Point North Carolina Financial Account Transfer to Living Trust, they can protect their assets and ensure their wishes are respected. This approach also offers flexibility in managing their estate.

To transfer your checking account to your living trust, you need to contact your bank and request their process for this transfer. Most banks require you to provide a copy of your trust document. After completing the necessary paperwork, your checking account will be successfully linked to your living trust. Utilizing a platform like uslegalforms can simplify this process and provide clear guidance on a High Point North Carolina Financial Account Transfer to Living Trust, making the transition more straightforward.

Yes, you can put your checking account in a trust. This process allows you to manage your financial assets more effectively. By completing a High Point North Carolina Financial Account Transfer to Living Trust, you ensure that your funds are distributed according to your wishes. It simplifies the process for your beneficiaries and can help avoid probate.

One common mistake parents make when setting up a trust fund is failing to fund it properly after its creation. They may establish the trust but neglect to transfer assets into it, leaving their intentions unfulfilled. This oversight can lead to complications for heirs and negate the benefits of setting up the trust. To avoid this mistake, ensure that all relevant assets, including your financial accounts, undergo a High Point North Carolina Financial Account Transfer to Living Trust to provide clear guidance for your beneficiaries.

Transferring funds to a trust involves a few straightforward steps. First, verify that your trust is properly established and funded. Then, you can initiate transfers from your bank account or investment accounts directly into your trust by changing the account titles to reflect the trust's name. By doing so, you facilitate a smooth High Point North Carolina Financial Account Transfer to Living Trust, making management and distribution easier for your beneficiaries.

To transfer your bank account to your living trust, begin by contacting your bank to understand their specific procedures. Generally, you will need to provide a copy of the trust document, complete the required forms, and designate the trust as the account holder. This process ensures that upon your passing, the funds in your account automatically transfer to your trust, simplifying your estate planning. For assistance, consider utilizing the US Legal Forms platform for guidance on completing this High Point North Carolina Financial Account Transfer to Living Trust effectively.

To transfer property to a trust in North Carolina, you need to create and execute a deed that names the trust as the new owner. This deed should be recorded with the county register of deeds. It's important to ensure that all legal formalities are followed to avoid complications later. For assistance, consider using USLegalForms, which provides resources to help you navigate this process smoothly.

The 5-year rule refers to the period during which transferred assets may be subject to taxes if the grantor applies for Medicaid. In High Point, North Carolina, if you transfer financial accounts to a living trust and apply for assistance within five years, those assets might still count against eligibility. It's important to plan carefully around this rule to protect your assets and ensure your trust operates as intended.