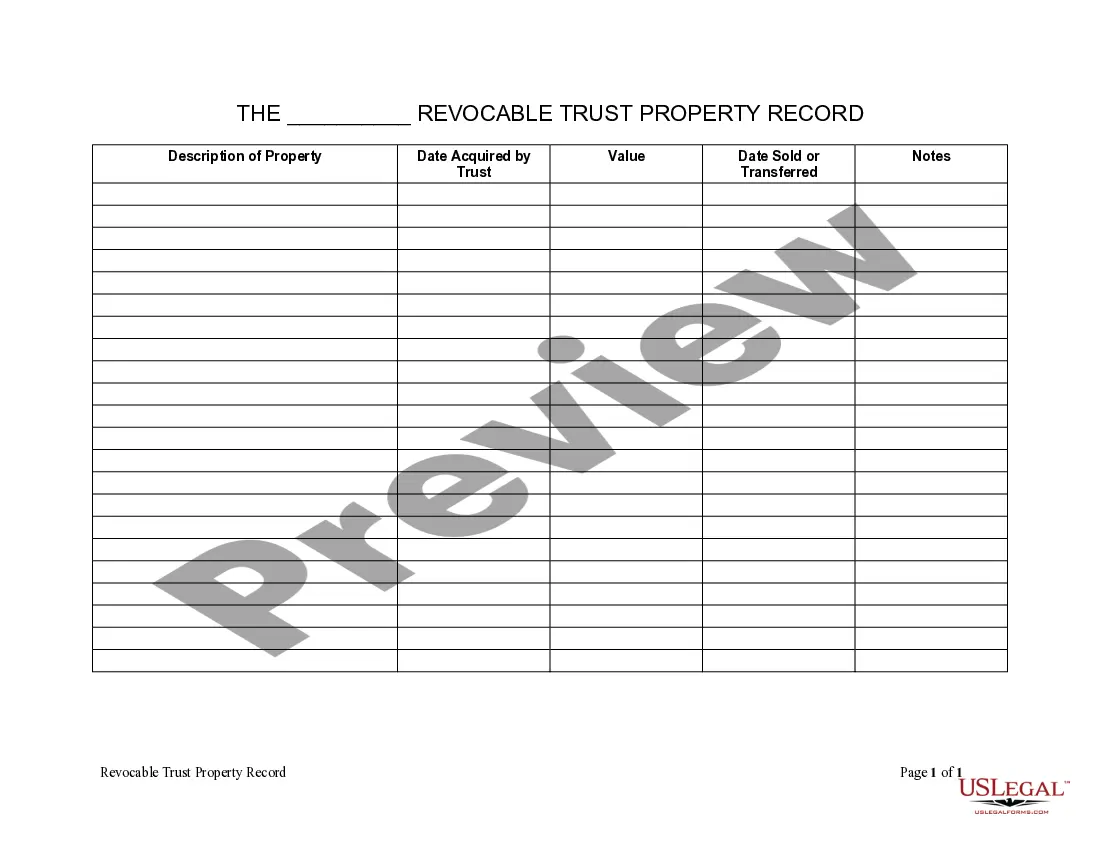

Fayetteville North Carolina Living Trust Property Record

Description

How to fill out North Carolina Living Trust Property Record?

Finding authentic templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional requirements and various real-life scenarios.

All the paperwork is appropriately organized by usage category and jurisdictional areas, making the search for the Fayetteville North Carolina Living Trust Property Record as straightforward as pie.

Providing your credit card information or using your PayPal account to settle the transaction.

- Review the Preview mode and document description.

- Ensure you’ve selected the right one that fulfills your requirements and fully aligns with your local jurisdiction guidelines.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To put a house in a trust in North Carolina, first, establish the trust by drafting a legal document. Next, execute a deed transferring your property into the trust, which must be signed and potentially notarized. Finally, record the new deed with your local county office to update your Fayetteville North Carolina Living Trust Property Record accurately.

In North Carolina, a trust does not necessarily have to be notarized to be valid. However, notarizing certain documents, such as the deed transferring property to the trust, can provide an added layer of legitimacy and help maintain an accurate Fayetteville North Carolina Living Trust Property Record. It's wise to follow proper legal procedures to avoid potential issues.

Trust agreements themselves are not typically recorded in North Carolina. However, real estate held in a trust must be recorded to show ownership. This means you will need to ensure your Fayetteville North Carolina Living Trust Property Record reflects any property held in a trust for clarity and legal purposes.

While trusts offer many benefits, there are also some disadvantages to consider in North Carolina. Creating a trust can involve upfront costs, including legal fees, and may require ongoing maintenance. Additionally, trusts do not shield assets from creditors as effectively as some may think, which can impact your Fayetteville North Carolina Living Trust Property Record.

To place your house in a trust in North Carolina, you need to create the trust document and then transfer the title of the property to the trust. This process involves drafting the trust agreement and executing a new deed that specifies the trust as the legal owner. It’s important to ensure that this transfer is properly recorded to maintain accurate Fayetteville North Carolina Living Trust Property Record.

The best trust for your home typically depends on your specific goals. A revocable living trust is a popular option as it allows flexibility during your lifetime. This type of trust can help you manage your Fayetteville North Carolina Living Trust Property Record easily and avoid probate. Always consider consulting an estate planning attorney to find the best choice tailored for you.

To get a copy of a living will or trust, you should contact the attorney who drafted the document, as they typically retain copies for their clients. If you are unable to locate the attorney, check personal records, as individuals often keep important documents filed securely. For further assistance regarding Fayetteville North Carolina Living Trust Property Record, the US Legal Forms platform offers templates and guides that may ease your search process.

To obtain a copy of your property survey in North Carolina, start by contacting your county’s Register of Deeds office. Many surveys are filed there, especially if they pertain to subdivisions or developed properties. You can also reach out to local surveyors who might retain records or offer services related to Fayetteville North Carolina Living Trust Property Record.

To look up property records in North Carolina, you can visit the North Carolina County Register of Deeds website. Most counties provide online access to property records, which allows you to search by name, address, or parcel number. For Fayetteville North Carolina Living Trust Property Record specifically, you may also explore local legal resources for more detailed information.

In North Carolina, private property includes any land or structure that is owned by individuals or entities rather than the government. This includes residential homes, commercial buildings, and vacant land. Understanding how private property is documented in your Fayetteville North Carolina Living Trust Property Record is important for estate planning and property rights.