Charlotte North Carolina Living Trust for Husband and Wife with One Child

Description

How to fill out North Carolina Living Trust For Husband And Wife With One Child?

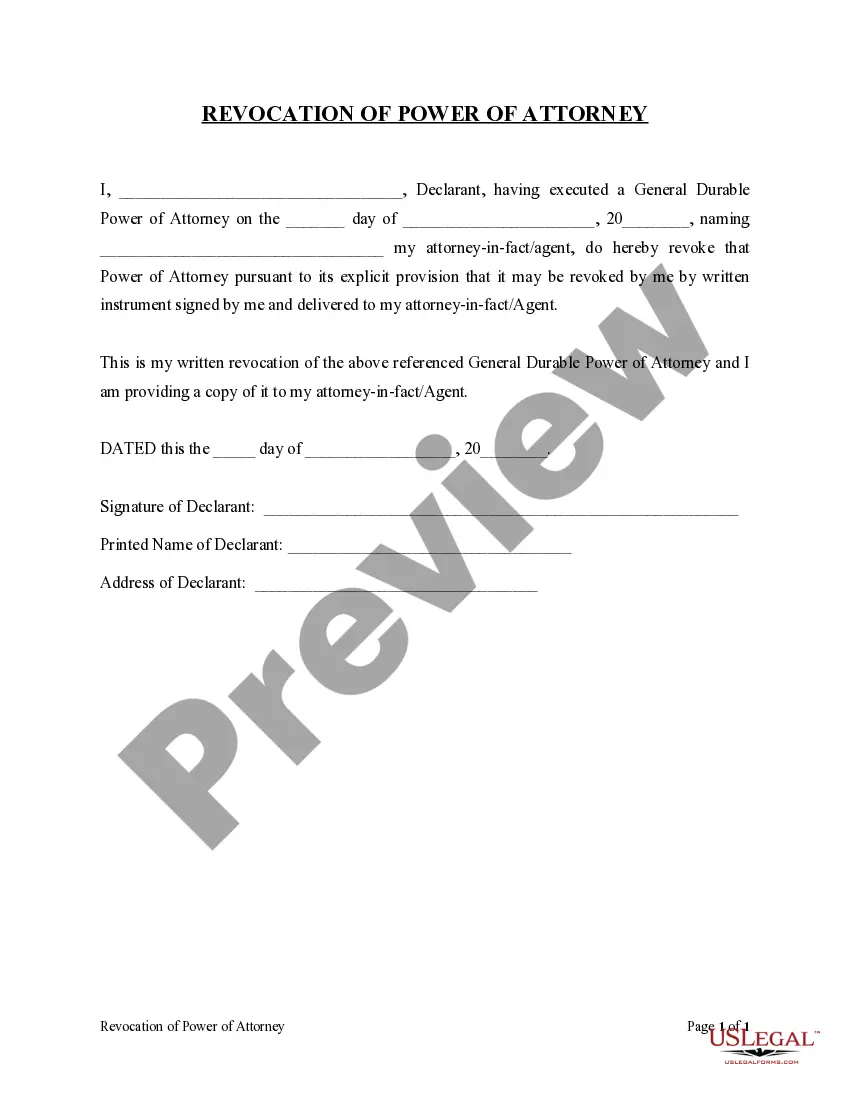

Regardless of one's societal or occupational position, completing legal documents is an unfortunate requirement in the contemporary landscape.

Frequently, it’s almost unfeasible for an individual lacking any legal knowledge to formulate such documents from the ground up, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms proves to be beneficial.

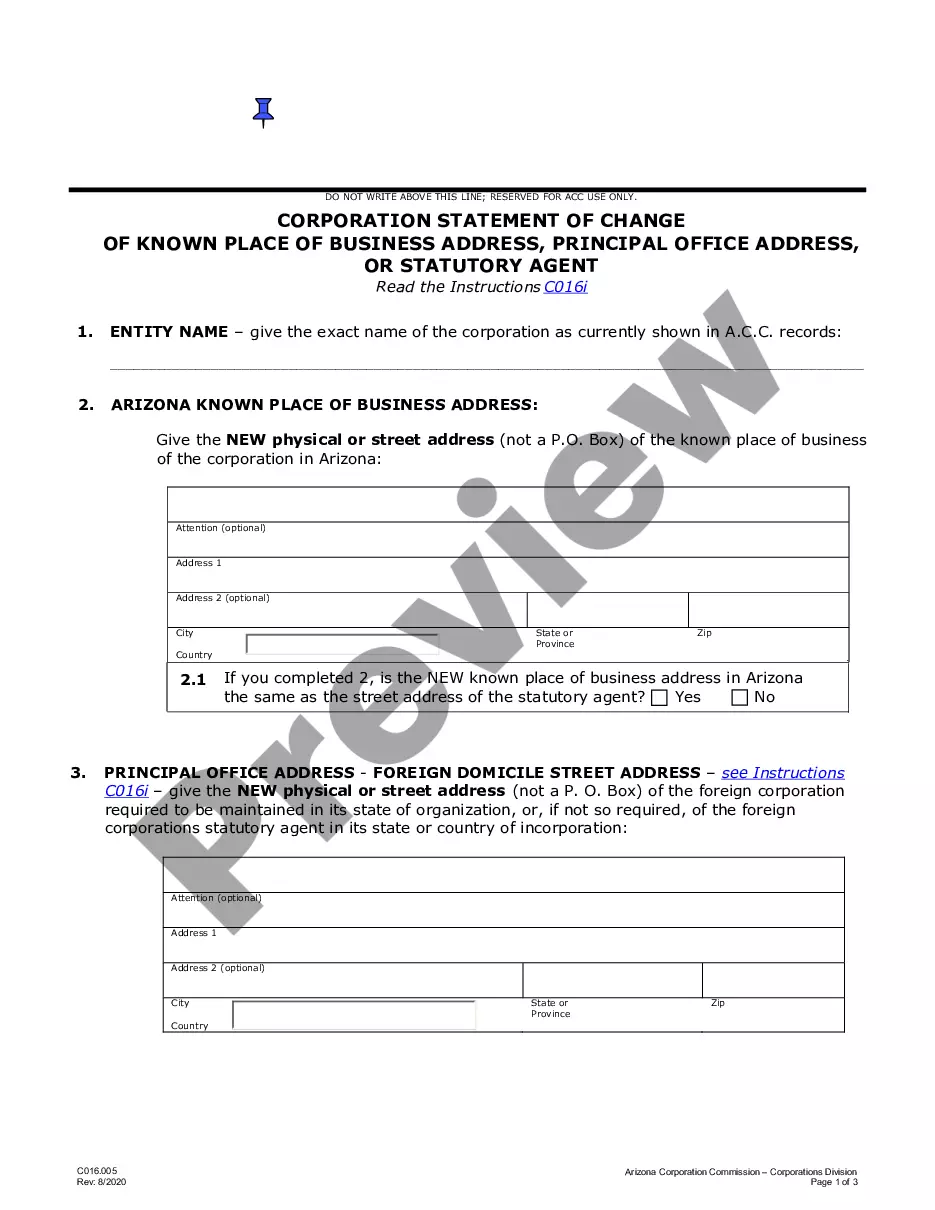

Ensure the document you’ve located is suitable for your region as the laws of one state or county may not apply to another.

Review the document and read a short summary (if available) of the situations for which the form can be utilized.

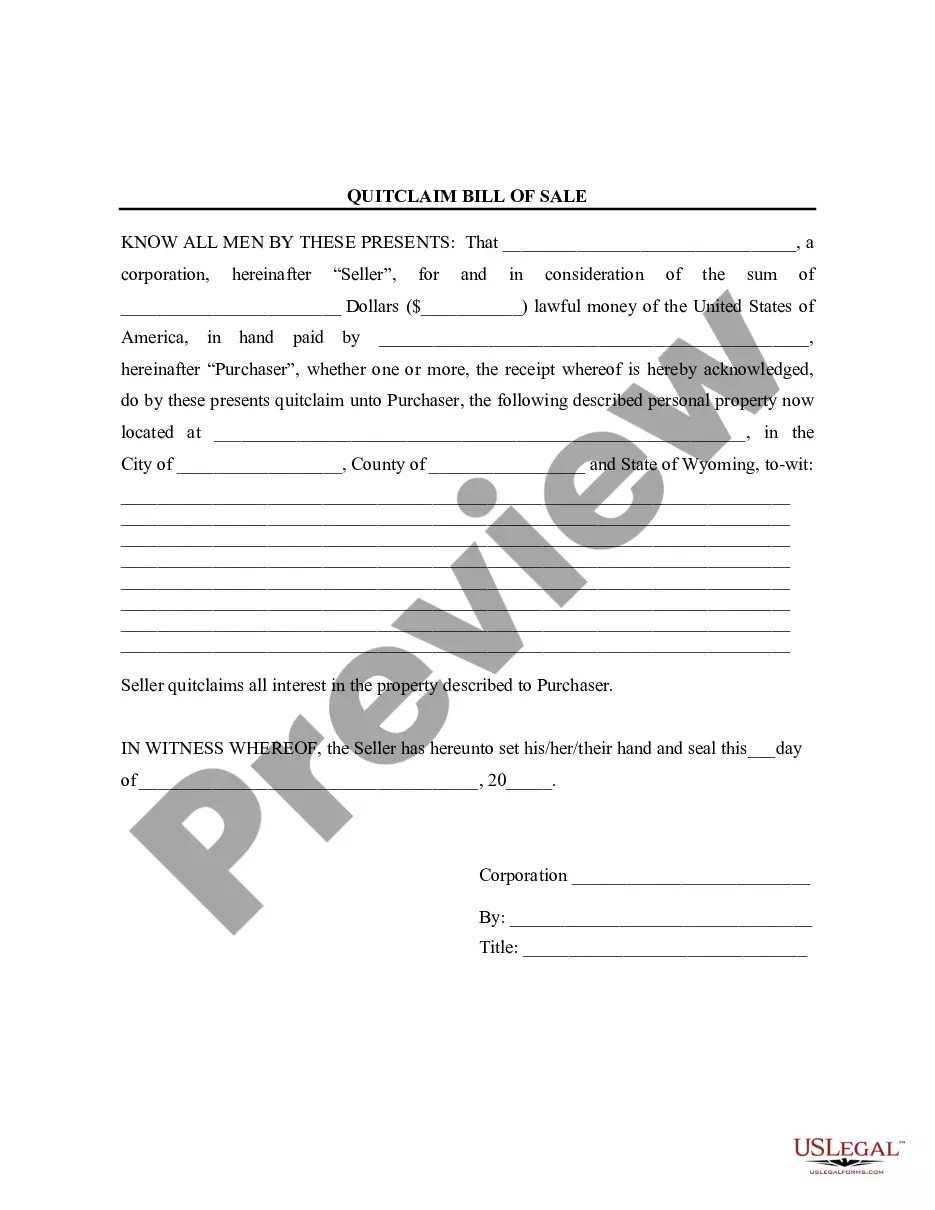

- Our platform provides an extensive repository with over 85,000 ready-to-use state-specific forms that accommodate almost any legal circumstance.

- US Legal Forms also acts as a valuable resource for associates or legal advisors who wish to enhance their efficiency in terms of time by utilizing our DIY papers.

- Regardless of whether you need the Charlotte North Carolina Living Trust for Husband and Wife with One Child or any other document that will be recognized in your state or county, everything is accessible with US Legal Forms.

- Here’s how to quickly obtain the Charlotte North Carolina Living Trust for Husband and Wife with One Child using our dependable platform.

- If you are already an existing client, you can go ahead and Log In to your account to procure the required form.

- If you are unfamiliar with our library, make sure to follow these steps prior to acquiring the Charlotte North Carolina Living Trust for Husband and Wife with One Child.

Form popularity

FAQ

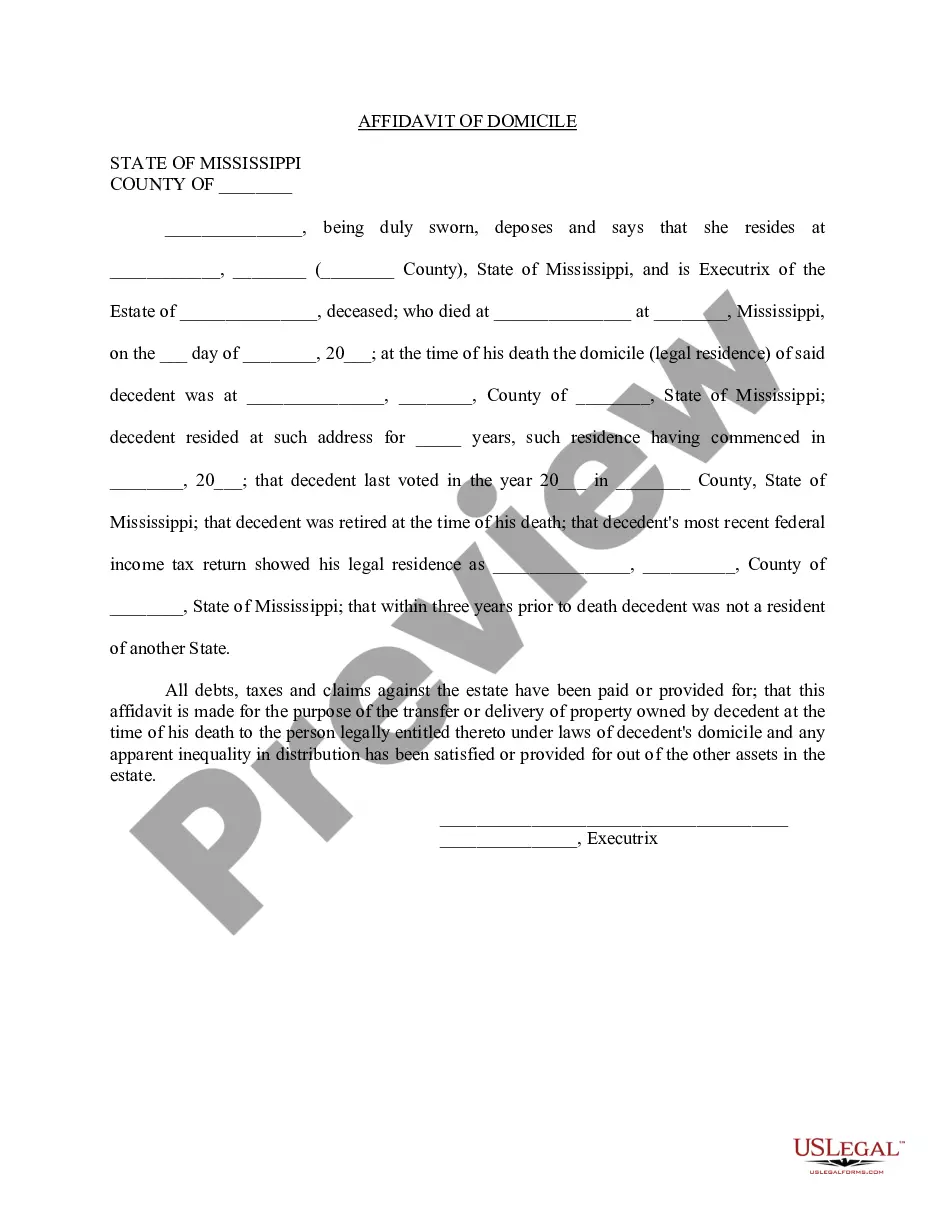

A living trust can avoid probate and help maintain privacy while preserving your assets by avoiding unnecessary fees. A trust gives you control, even after you pass away. A will gives you control of who you leave your assets to, but not how or when they get those assets.

Joint trusts are easier to manage during a couple's lifetime. Since all assets are held in one trust, ownership mimics how many couples hold their assets - jointly. Both spouses having equal control of the management of joint assets held by the trust.

A will distributes assets immediately after probate ends. A trust lets you keep assets in the trust if you wish and pass them on at later dates, such as beneficiaries' significant birthdays. Your revocable living trust protects you should you become mentally incapacitated.

The Joint Trust. Typically, when a married couple utilizes a Revocable Living Trust-based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

One advantage for using a trust is that trusts can be used to begin distributing property before death, at death or even sometime afterwards. That isn't helpful or important in all cases, but it provides a level of flexibility that a will simply can't.

If you use an online program to draw up the trust document yourself, you will pay a few hundred dollars or less. You can also choose to hire an attorney, which could end up costing more than $1,000. The exact amount you'll pay for a lawyer will depend on the fees the lawyer charges.

Drawbacks of a living trust The most significant disadvantages of trusts include costs of set and administration. Trusts have a complex structure and intricate formation and termination procedures. The trustor hands over control of their assets to trustees.

A joint revocable trust is probably the easiest form of living revocable trusts for a married couple to use. A joint revocable trust merges the estate planning of a couple using a single trust document. Joint trusts and individual trusts each have advantages and disadvantages.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

Drawbacks of a Living Trust Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.