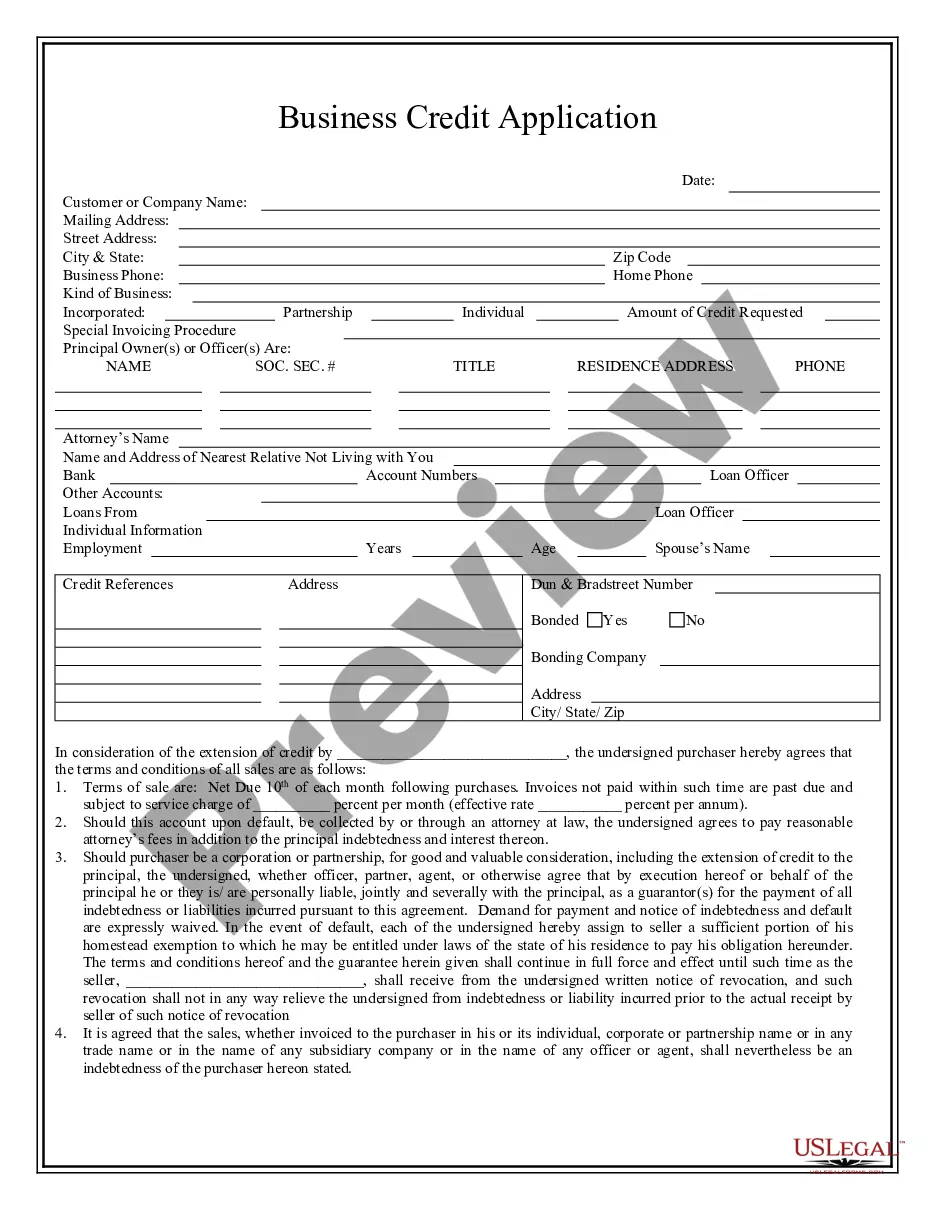

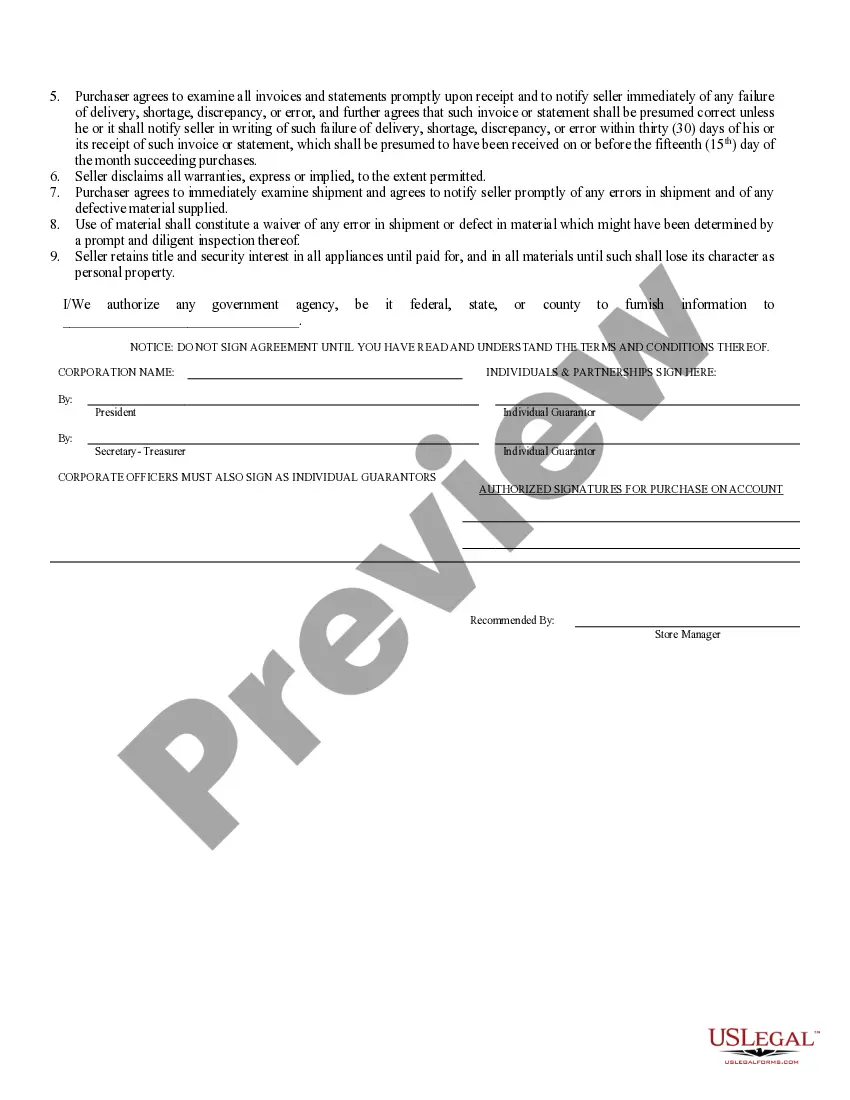

South Carolina Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Business Credit Application?

The work with documents isn't the most uncomplicated job, especially for those who almost never deal with legal paperwork. That's why we advise using correct South Carolina Business Credit Application templates created by professional lawyers. It allows you to eliminate troubles when in court or dealing with official institutions. Find the files you need on our site for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the template page. Soon after downloading the sample, it will be stored in the My Forms menu.

Customers with no an activated subscription can easily create an account. Look at this short step-by-step help guide to get the South Carolina Business Credit Application:

- Make certain that the sample you found is eligible for use in the state it is necessary in.

- Confirm the document. Make use of the Preview feature or read its description (if offered).

- Buy Now if this template is the thing you need or use the Search field to find a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these easy steps, you are able to complete the sample in a preferred editor. Check the filled in info and consider asking an attorney to review your South Carolina Business Credit Application for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

640 to 700: Business loan providers generally consider a credit score that falls somewhere between 640 and 700 to be goodbut not excellent. Generally, the minimum credit score for SBA and term loans is around 680.

At a minimum, you will need to provide income tax returns, your credit score, bank account information, a business financial statement, and personal identification such as a driver's license. For more information about loan paperwork, go to Business Loan Documents to Provide.

To qualify for the earned income credit: You must file as single or married filing jointly.You cannot earn over a certain amount of investment income for the year. For 2019 this amount is $3,600, for 2020 the amount is $3,650.

With a credit score between 550 and 620, you could qualify for a short-term loan or even a medium-term loan if your business is doing well. Owners with a credit score over 600. If your credit score is 620 or above, you may qualify for a medium-term loan.

Generally, you should be able to find a startup loan as long as you have at least a few months in business and your credit score is at least 500. You'll also need to show that you have sufficient income (personal or business, depending on the lender's requirements) to repay the loan.

Basic Qualifying Rules Have investment income below $3,650 in the tax year you claim the credit. Have a valid Social Security number. Claim a certain filing status. Be a U.S. citizen or a resident alien all year.

It is difficult to qualify for a small business loan with a credit score lower than 700.Additionally, you should build a strong personal credit score and drive down any debt prior to applying for a business loan.

South Carolina's version of the federal EITC was adopted in 2018 and is being phased in over six years. For tax year 2019, eligible taxpayers could claim up to 41.67% of the federal credit.By tax year 2023, South Carolina taxpayers will be able to claim 125% of the federal EITC.

The credit is calculated on South Carolina Form I-385, Motor Fuel Income Tax Credit. This form must be included with the resident taxpayer's income tax return. The credit is available for up to two private passenger motor vehicles or motorcycles per taxpayer.