Greensboro North Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children

Description

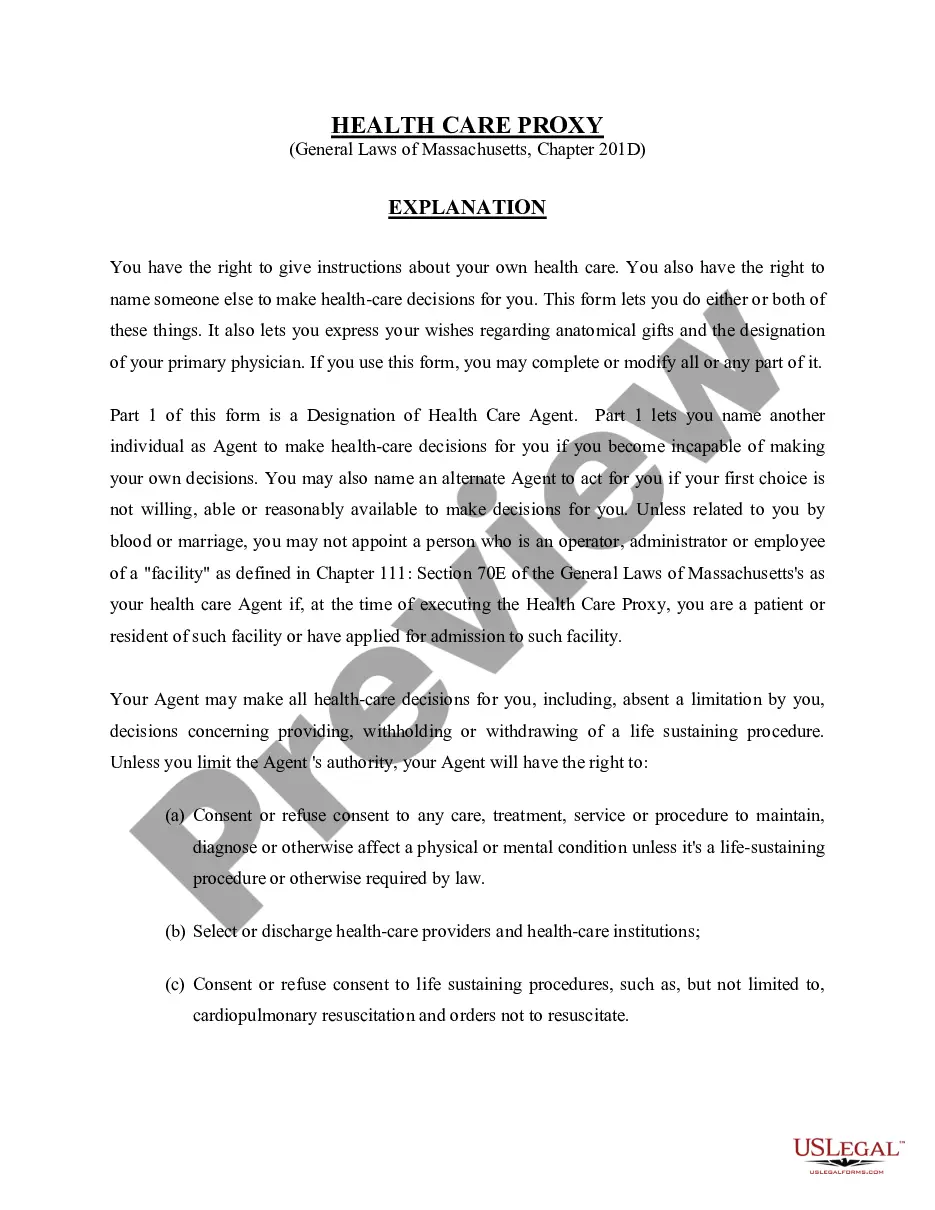

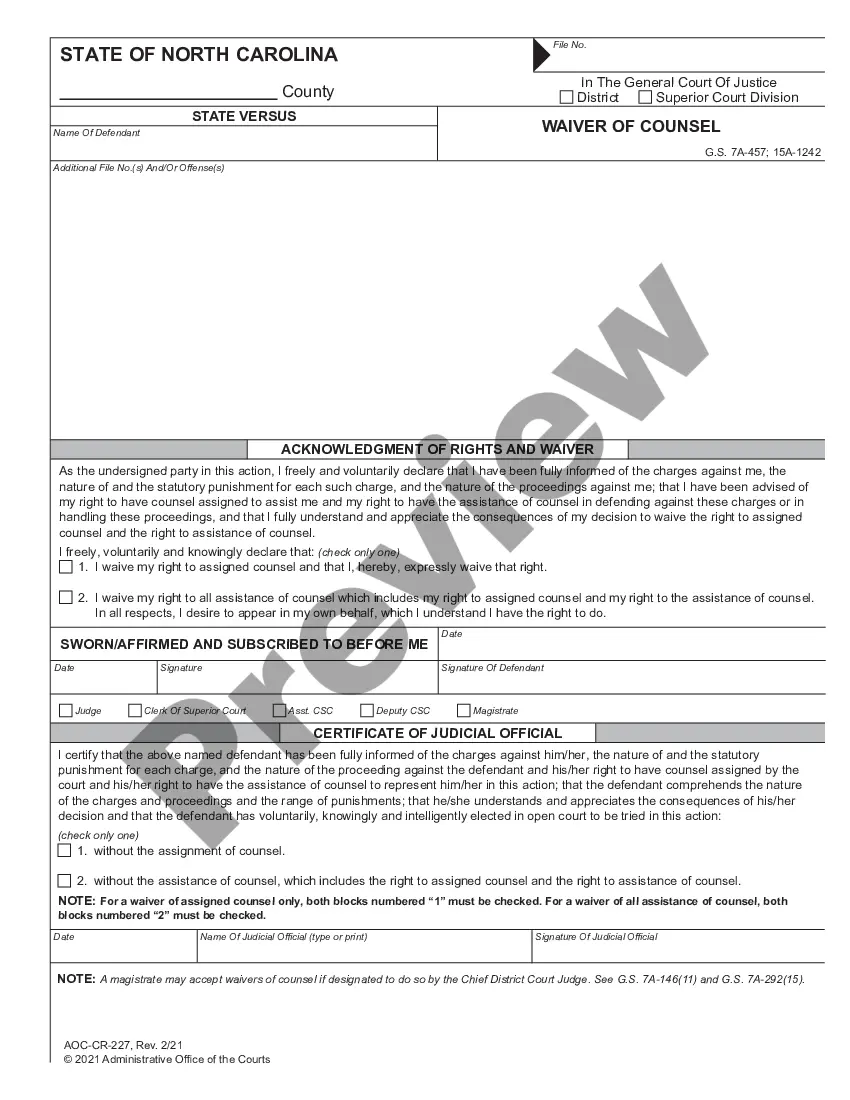

How to fill out North Carolina Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children?

If you are looking for an appropriate document, it’s hard to discover a superior service than the US Legal Forms website – one of the largest online repositories.

Here you can find an extensive assortment of templates for business and personal purposes categorized by types and regions, or keywords.

With the enhanced search functionality, locating the latest Greensboro North Carolina Living Trust for Individuals Who are Single, Divorced, or a Widow or Widower without Children is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Choose your desired format and download it to your device. Edit the document. Complete, alter, print, and sign the acquired Greensboro North Carolina Living Trust for Individuals Who are Single, Divorced, or a Widow or Widower without Children.

- Additionally, the relevance of each document is validated by a team of professional attorneys who consistently evaluate the templates on our site and refresh them according to the most up-to-date state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Greensboro North Carolina Living Trust for an Individual Who is Single, Divorced, or a Widow or Widower with No Children is to Log In to your account and click the Download button.

- If you utilize US Legal Forms for the first time, follow the guidelines below.

- Ensure you have located the form you desire. Review its details and use the Preview feature (if available) to check its content. If it doesn’t meet your requirements, use the Search option located at the top of the page to find the necessary document.

- Confirm your choice. Click the Buy now button. Next, select your preferred subscription plan and submit your details to create an account.

Form popularity

FAQ

While a Greensboro North Carolina Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children can offer many benefits, there are some disadvantages to consider. First, establishing a trust involves initial costs, including attorney fees and court fees, which can add up. Additionally, you may face ongoing administrative tasks, such as record-keeping and tax filings, that require time and attention. Lastly, if not properly managed, a trust could lead to complications and misunderstandings among family members or beneficiaries.

A common mistake individuals make is failing to accurately define the terms and beneficiaries of the trust. This can lead to confusion and conflict in the future. When creating a trust, it is crucial to have clear instructions and to consider all possible scenarios. Using resources like USLegalForms can help establish a well-structured Greensboro North Carolina Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with No Children.

Yes, you can create your own living trust in North Carolina. However, it is essential to understand the legal requirements to ensure your trust meets state laws. Engaging with a reputable service like USLegalForms can simplify this process. They provide templates and guidance tailored specifically for a Greensboro North Carolina Living Trust for Individuals Who are Single, Divorced, or Widow or Widower with No Children.

How Do I Make a Living Trust in North Carolina? Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

Common Types of Trusts Inter vivos trusts or living trusts: created and active during the lifetime of the grantor. Testamentary trusts: trusts formed after the death of the grantor. Revocable trusts: can be changed or revoked entirely by the grantor.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

When one spouse dies, the survivor inherits the deceased spouse's share automatically. Additionally, you may have insurance policies or retirement plans on which you have appointed beneficiaries. Those assets will pass to their intended beneficiaries regardless of these rules.

Your spouse only, no children or parents living: Your spouse will receive all property that could pass under a will. 4. Your spouse and one child: Your spouse will receive the first $60,000.00 of personal property, one-half (1/2) of the remaining personal property, and one-half (1/2) all real estate.

Your entire estate will pass to and be divided equally among your parents. If there is only one parent, he or she receives everything. All property and possessions are divided evenly among the children. If there is only one child, he or she receives everything.